Happy July 4th and it looks like gold could go off like fire works too!

In the last few days a Morning Doji Star reversal pattern was formed. These are strong reversal patterns and very significant rallies followed the last two times this pattern formed. We also have the monthly trading pattern in our favour. I have pointed this out a number of times in the past. Gold typically is pushed down around month end, probably so traders can settle options in their favour. And then rallies at the start of the new month. These rallies can be small or quite large as I indicate with the black arrows. And finally the Commodity Channel Index showed an over sold condition at -138. This indicator was not much use in May, but perhaps this time we see a move in the indicator to blue.

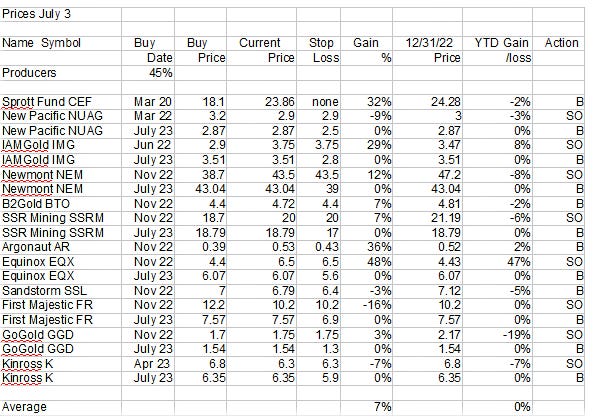

On our gold stock list we could see good rallies with B2Gold, Kinross, Equinox, Argonaut, SSR Mining and others. I have them all listed as buys now. We got stopped out of a lot of them in this recent correction and are now buying a lot back just a little lower with a few a fair bit lower. We got stopped out of First Majestic early in the year and now is time to buy back at a good discount.

The prices listed are yesterday's close and most of these are up a little today. US markets close early today at 1PM. Basically we have gotten no where with the senior gold stock as they have been going sideways, gyrating up and down in a range. I believe we are at the bottom of the range now, but a rally this month could end up with weakness again in August. I am very bullish for the later part of the year as the s_ _ _ is going to hit the fan.

Markets and the economy have been hanging together but it will not last. I believe consumers are on borrowed time and money. They have run up debt believing interest rates would come down. According to the Federal Reserve Bank of New York, consumers now owe a record $988B on their cards, up 17% from a year earlier, or about $5,700 per person. There is a large range of items that are going to hurt consumers and small business.

In a 6-3 vote, the Supreme Court killed Biden’s plan to cancel student loan debt. At ~$430 billion, the plan would have been among the most expensive executive acts in US history.

According to Morgan Stanley, only 29% of roughly 40 million Americans holding student loan debt totalling $1.8 trillion debt are confident they can start making payments without adjusting in other areas. Some 34% say they can’t make payments at all. This is going to affect consumer spending.

According to Barclays, the restart of payments could lead to a monthly decrease of $15.8 billion in household spending (or $190 billion per year).

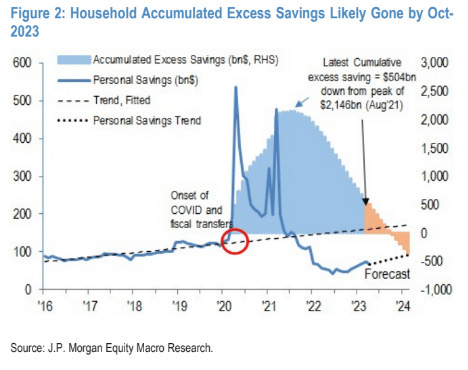

Before this student loan thing, JP Morgan calculated households will have eliminated their excess savings from the Covid policies by October.

A quarter of a million small businesses in Canada, roughly 19 percent of all small businesses in the country, may have to shut down next year if the government does not extend a deadline to repay COVID loans, according to an industry group.

The Canadian Federation of Independent Business (CFIB) issued a statement on June 7 stating that small businesses that cannot meet Ottawa’s Dec. 31 deadline to repay the Canada Emergency Business Account (CEBA) loan could be forced out of business. The CEBA program provided interest-free loans of up to $60,000 to small businesses and not-for-profits.

In Canada we are in a vicious cycle of tax and spend driving inflation higher. Trudeau buried part of the 2nd carbon tax in fuel regulations that require producers to reduce the carbon content of their fuels. If companies can’t meet the requirements, they’ll be forced to buy credits. Those costs will be passed on to you through higher pump prices.

The Parliamentary Budget Officer released a report calculating how much the second carbon tax will cost you by 2030. Trudeau’s second carbon tax is being layered on top of his current tax. By 2030, Trudeau’s two carbon taxes will increase the price of gas by about 55 cents per litre.

And furthermore, “The federal government seems determined to inflict severe economic pain on the Canadian economy with almost no environmental benefit in return,” said Kenneth Green (Fraser Institute) in a news release.

His report adds if Canada eliminated all GHG emissions from the oil and gas industry by 2030, it amounts to a reduction of four-tenths of one percent of global emissions. In 2020, the oil and gas sector generated $118 (billion) in GDP (gross domestic product) and accounted for 16 per cent of Canada’s exports,” said the paper,

The Canadian housing bubble will soon pop. The banks are kicking the can down the road while they set aside $billion each quarter to deal with the future blood bath. Canadian Banks have been bending the mortgage rules and this cannot last much longer.

Canadian Imperial Bank of Commerce has been under remediation orders from the Office of the Superintendent of Financial Institutions for more than a year after an audit of its mortgage portfolio uncovered breaches of rules that limit how indebted borrowers can be. The problems surfaced last year in a routine regulatory audit of CIBC's mortgage portfolio conducted by the OSFI. The issues involve thousands of clients, many of whom had lines of credit that were secured against their homes. When these lines were combined with a CIBC mortgage, the total credit available exceeded allowed regulatory ratios.

Head of Canada's housing agency says measures such as extending mortgage amortizations and changing the threshold to qualify for an insured mortgage are not the answer to the country's housing affordability challenges. The Globe says that even though homeowners have seen a rapid increase in what they are paying to cover mortgages as interest rates have risen, Canada Mortgage and Housing Corp. president Romy Bowers is not in favour of allowing borrowers to repay their mortgages over longer periods of time. A borrower whose down payment is at least 20 per cent of the purchase price can have a maximum amortization period of 30 years. "What I worry about is sometimes that seems like a quick fix," Ms. Bowers said.

Many of the Canadian small businesses mentioned above are restaurants. These numbers came out today in the UK, but much the same is going on in Canada and many parts of the U.S. In the UK, 569 restaurant businesses filed for insolvency in Q1, says Price Bailey. It averages five restaurants per day, up from three-a-day in 2021.

The S&P 500 broke above 4300 and could see some more strength in thin July/August markets. I am not very bullish on this market and expect a significant correction come September/October. It might even start in August. Pretty much the whole market has been driven up to this level by just 7 tech stocks.

The S&P earnings yield, corporate bonds and treasury bills are all offering around the same yield of 5.3%. This means, a medium risk, low risk and no risk asset is offering the exact same yield. Simply put, the markets are manipulated and broken.

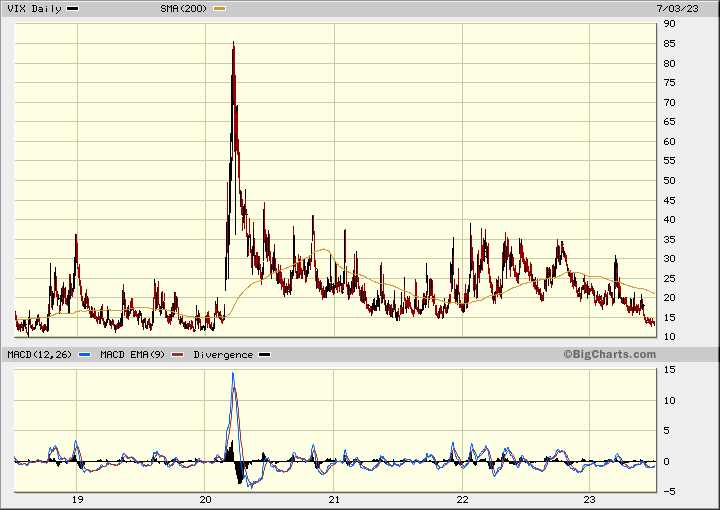

The options market points to much optimism as demand for call options 2 weeks ago reached its highest in 14 months. The Volatility Index (VIX) shows a very complacent market with the VIX at it's lowest level sine 2019.

And just out today, the U.S. manufacturing sector fell deeper into recession territory in May, extending a multimonth slump as experts warn that the economy faces “clear challenges.”

The Institute for Supply Management (ISM) said in a report Monday that its manufacturing purchasing managers index dropped to 46.0 last month, the lowest reading since May 2020 and the eighth consecutive sub-50 reading. Any readings below 50 represent recession, with all key sub-components in contraction, including the employment index, suggesting layoff pressures are building.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication