First intervention in gold market for some time. Gold closed at a new high on Friday of $2425 and the take down started very typically on Sunday evening into early hours Monday. By 6AM gold was down over -$55 to $2355. Gold was due for a correction so I would think the intent of intervention was to trigger profit taking. It will be interesting to see how gold responds this week. There is still little interest in this rally and I would bet that those on the sidelines figure it is all over now. Here is the 5 day chart with Friday's high and weekend take down.

I will probably take advantage of this correction to add another gold stock to our list, but for now, an opportunity to short Bitcoin. It had a pretty good rally over the weekend, rising about $2,500. In hind sight it would have been a good idea to hold the long position over the weekend, but like I commented, it is very risky because we can only trade the ETFs during weekday market hours.

Bitcoin $66,010

Proshares Trust Short Bitcoin ETF - - - - NY:BITI - - - - Recent Price - $7.85

This is a daily chart for start of the year. Bitcoin is at a mild resistance area and could easily see a pull back at any time. If we have seen the top in this rally around 72,000, this rally close to 66,000 might be the best we do in the short term. I am looking for a pull back to around $60,000.

You can also see the short Bitcoin ETF near it's bottom. About $8.50 is my near term target.

Jackpot Digital (Best AI Gambling stock) - - - TSXV:JJ OTC :JPOTF

Recent Price - $0.06 - - - - - Entry Price $0.06 - - - - Opinion - buy

Late March, Jackpot Digital signed a distribution agreement with Jade Entertainment and Gaming Technologies Inc., a diversified slots and gaming machine distributor with a presence in key Asian casino markets.

The partnership is aimed at accelerating sales and deployment of Jackpot Digital's revolutionary Jackpot Blitz electronic multiplayer dealerless poker machines into casinos throughout Asia. It represents a synergy of expertise, innovation and shared values. Together, Jade Group and Jackpot Digital will leverage their respective strengths to drive growth, foster innovation and enhance customer experiences in Asia.

"We are very excited to be working with Jade Group, an established gaming machine distributor based in Asia. The collaboration marks a significant milestone in our expansion strategy and our first formal distribution agreement to enter the Asian marketplace," states Jake Kalpakian, president of Jackpot Digital.

In early April Jackpot Digital signed a distribution agreement with A&W Enterprises LLC to distribute, install and service the company's Jackpot Blitz casino machines throughout tribal casinos in the state of Oklahoma and other regions in the United States.

Due to its location bordering the state of Texas, Oklahoma is a large gaming market with 139 casinos and $4.36-billion (U.S.) in gross gaming revenue (source: American Gaming Association). The Oklahoma territory boasts several large casino properties and includes the 600,000-square-foot WinStar World Casino, located in Thackerville, Okla., and owned by the Chickasaw Nation.

CEO Jake Kalpakian states: "We are excited to collaborate with A&W Enterprises as we expand into the Oklahoma market. A&W Enterprises is a trusted distributor with a long-standing reputation and deep relationships in this market. We anticipate that this turnkey relationship will accelerate our ability to deploy our Jackpot Blitz machines into many well-known casinos throughout Oklahoma."

In addition to Jackpot's cruise ship customers, which include Carnival Cruises, Virgin Voyages, Princess Cruises, Holland America, AIDA and Costa Cruises, Jackpot has announced land-based installations or orders in the Canadian provinces of Quebec and Saskatchewan, 12 states and territories in the U.S., including California, Kansas, Louisiana, Michigan, Minnesota, Mississippi, Montana, Nevada, Oregon, South Dakota, U.S. Virgin Islands, Washington, as well as several international jurisdictions.

The company is gaining serious traction installing their poker AI tables and machines but the stock is not reflecting it yet. A good buy opportunity. Again, I strongly recommend you watch this short 2 minute video on Jackpot Blitz by Jimmy Johnson of NFL fame. You will get all the key points in 2 minutes. Video click here.

Aztec Minerals -- - - - - TSXV:AZT, OTCQB: AZZTF - - - - Recent Price - $0.22

Entry Price - $0.40 - - - - - - - - Opinion - buy

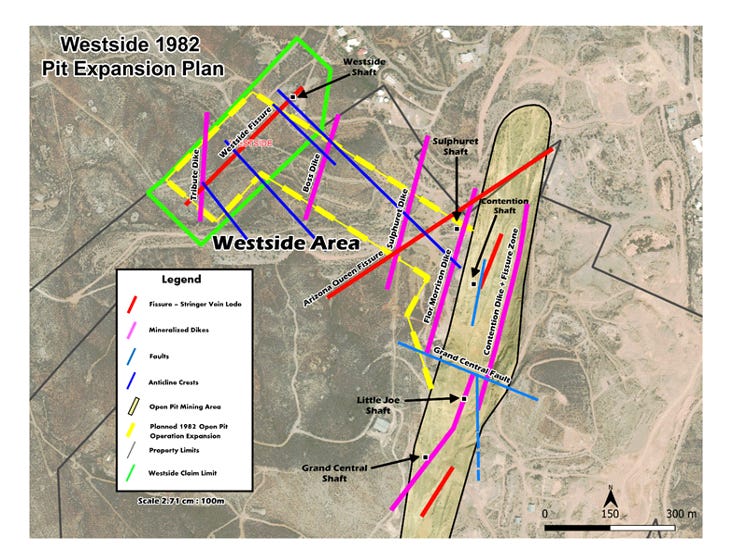

Today Aztec announced that recent field work and review of historical data at the Tombstone Project has identified the Westside area (see below) as a high potential target for shallow gold-silver mineralization, almost doubling the project’s potential gold-silver oxide mineralization footprint near to the historic Contention Pit.

The westside target was slated for open pit production in 1982; but was not developed due to declining commodities prices in the early 1980s.

AZT believes this new target zone – situated partly within their recently acquired Westside Patented claim, could nearly double the mineralization footprint of the Shallow Gold-Silver zone at the Tombstone project.

The historic west side mine was known for producing some of the highest Silve&Gold grades in the Tombstone district’s history. Aztec Minerals Corp. - Display.

A review of historical data has confirmed that the Westside anticline was mined along multiple, replaced sediment layers near the axis to its crest in the sediments over all its 450+ m length, noting that, at its intersection with the Arizona Queen Fissure, the 120 m long Sulphuret stope, was mapped at over 60 m wide and 10-20 m thick. The Sulphuret stope was reported (Butler, 1938) to have production averaging 70 opt silver and high-grade gold as well. Aztec’s drilling has confirmed that the gold-silver mineralization in the property extends beyond the limits of the historic mined stopes.

Be of great interest to see some drill results in this area with the next drill program. A better gold market now so we could get a very good reaction this go around.

#bitcoin #gold #gambling #casino

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.