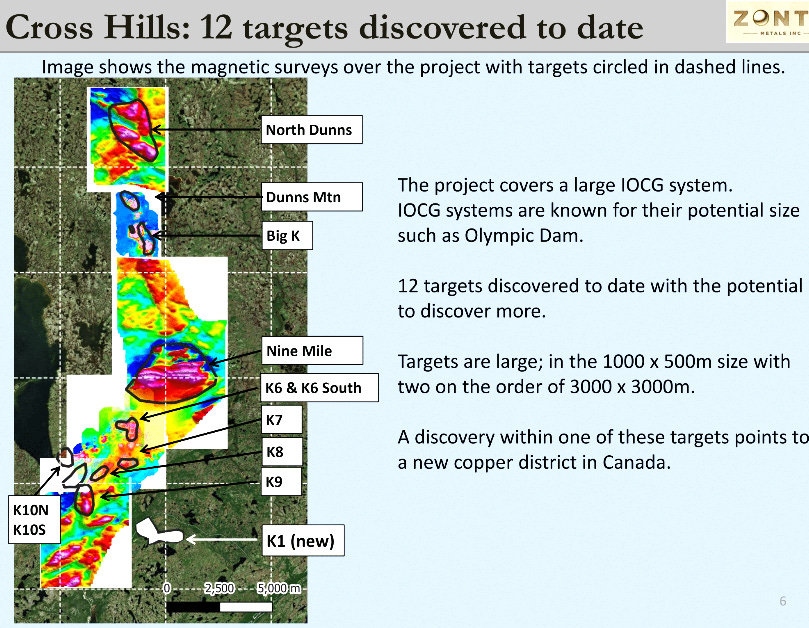

Yesterday, I had an update on our Moderna Put options, so I thought it would be a good idea to update the gold stock call options that I suggested in April and June of this year. They are mostly down after the sell off in gold and gold stocks but have rebounded some in the recent rally. Kinross is among the best of them but we have until December to March before they expire, so I believe we can still get some good gains in most or all of them, given the change in the gold market.

Zonte Metals - - - - TSXV:ZON - - - - OTC:EREPF - - - - Recent Price - $0.04

Entry Price $0.12 - - - - -Opinion – Strong buy to $0.06, average down to $0.09

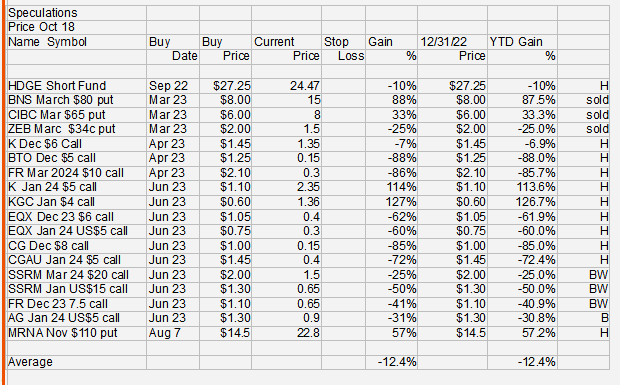

Today Zonte announced the rest of their soil sampling at the K6 target. The K6 soil data shows a Cu-in-soil anomaly about 700m long and up to 250m wide. The anomaly is coincident with structural, geological and geophysical changes as well as surface copper mineralization. I expect drilling to start in the next week or so. Here is the map of K6 showing the copper in rocks and copper in soils.

Terry's comment from the news release is excellent describing how Zonte came to this point.

Terry Christopher, President and CEO comments, “The recent soil data has confirmed a copper-in-soil anomaly coincident with numerous other datasets within the K6 target area. The K6 target was previously drilled in 2019 when two drill holes tested magnetic and gravity geophysical highs, which sit north of the newly define drill target. Drilling at several targets in the Cross Hills Copper Project, between 2019 and 2020, focused exclusively on geophysical anomalies. While high-grade and long intervals of fracture-controlled copper mineralization was discovered in drill core, the Company made a strategic decision to suspend drilling and focus on gaining a more comprehensive understanding the mineralizing system to better define drill targets. To this end, since 2020, numerous additional exploration programs have been conducted, and drill locations in the upcoming drill program at K6 will be derived from an integrated interpretation of multiple datasets. The new K6 target area represents the first site to be drill-tested since 2020, positioned approximately 200-300 meters to the south of the previous two drill locations. The dataset for the K6 target is presently being modelled to help define drill locations, which will be followed by drilling.”

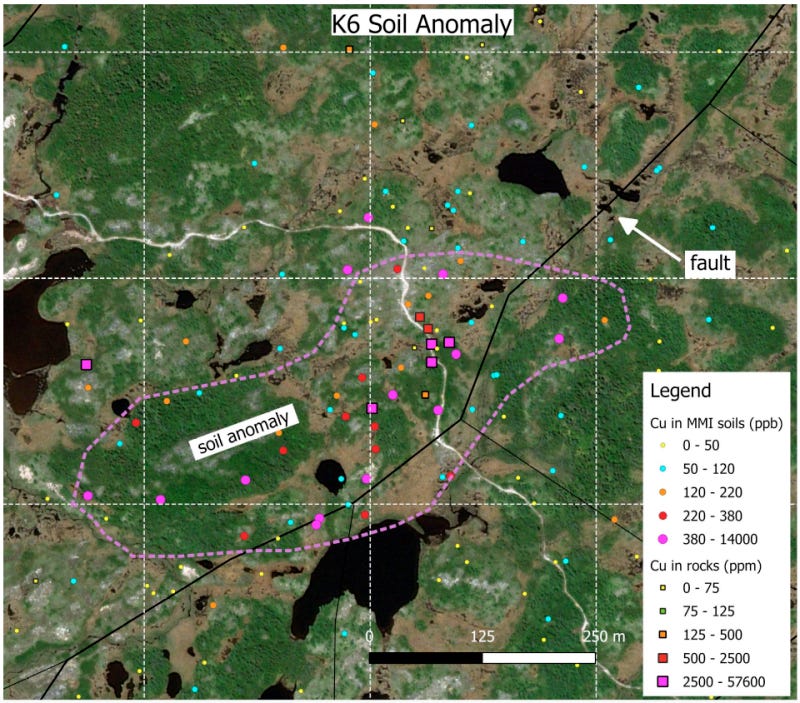

The odds appear much better than the past for the drills to hit on this K6 target, but keep in mind this is just one small area on the property among numerous drill targets, shown nicely on the next map. While K6 is quite large, it is one of the smaller targets on the property.

The stock is as cheap as it has ever been in it's history and the company has far more advanced projects then it had 8 or 10 years ago when at this price. I think buying here is a no brainer with huge upside if a discovery is made and practically no down side at these prices. Especially since the fund selling pressure is gone. It is a strong buy here and I would average down to $0.09.

Zonte has a relatively small number of shares out with a current market cap of less than $3 million.

DHT Holdings - - - - NY:DHT - - - - Recent Price - $10.60

Entry Price - $7.45 - - - - - - Opinion – hold and buy on weakness around $10

According to figures from Clarksons, the weighted average for the largest tankers shot up 11.6% on Monday to hit $49,200 per day, doubling over the past week and up nearly 137% over the last month. The prospect of other countries being pulled into this middle east conflict has spurred some traders to book ships at this stage, thereby driving rates higher. If the conflict intensifies we could see rates of $200,000 per day as in some past middle east conflicts.

In the second quarter of 2023, DHT achieved average combined time charter equivalent earnings of $56,300 per day, comprised of $36,200 per day for the Company’s VLCCs on time-charter and $64,800 per day for the Company’s VLCCs operating in the spot market

For the third quarter of 2023, DHT estimates time charter equivalent earnings for its fleet at $42,500 per day, comprising of $35,500 per day for the Company’s VLCCs on time-charter and $44,700 per day for the Company’s VLCCs operating in the spot market.

So Q3 is a drop from the Q2 rates but the market is expecting and pricing in higher rates into DHT's stock. DHT paid $0.35 per share dividend in Q2 and I expect the Q3 payment will be in the $0.25 to $0.30 range and it could be much higher in Q4 the way the middle east is brewing.

The current uptrend, marked in green with closest support around $10. I see the highs earlier this year around $12 as resistance. Based on a conservative $0.23 dividend/QTR the yield is about 9%. A very good yield while we see how things unfold in the middle east and with tanker rates.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.