Gold Price Correction, Investors Flee Gold while Tech Gurus Buy, MMA, IMG

Cold Winter and Natural Gas Falls

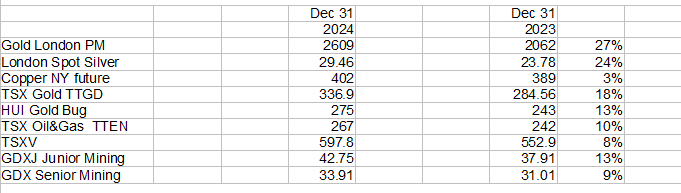

Yesterday I had an error for the amount that gold gained last year and the gold stock benchmarks. Also the NASDAQ that was up 28.6% not 36%. My spreadsheet had the wrong price for start of the year. However, it makes my gold picks look even better. Gold gained 27% last year and the gold index benchmarks were only up 13% and GDX only up 9%. The TSX gold index did better but this basically reflects the decline in C$ (loonie).

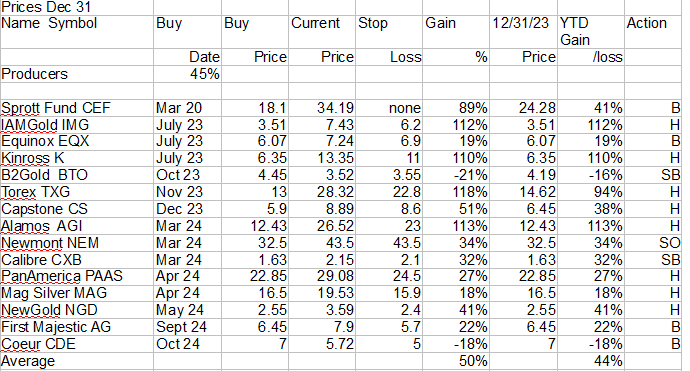

I pasted in the Selection List of our gold and silver picks with an average gain of 44%. As I noted yesterday that silver lags gold, so the silver stocks brought down the average some and just looking at the gold stocks the average gain was 53% about 4 times the benchmarks.

Take note B=Buy, SB=Strong Buy, H = Hold, SO=stopped out

Remember that this average is just a snap shot of one day in the year, but I do it because most funds etc. do an annual performance measurement. And as an average it means mathematically that half of you did better that this average and half not so well.

I labelled fields better in my spreadsheet to not make that mistake again.

Wall Street is starting to come on board the gold bull a bit with analysts on average expecting gold to gain another 7 percent in the coming year. Goldman Sachs was the most bullish, projecting gold will eclipse $3,000 per ounce in 2025. The bank's analysts cited interest rate cuts by the Federal Reserve and continued central bank gold buying as bullish factors.

And on the gold topic, I was commenting in 2024 that North American investors were finally starting to buy the golf ETFs, well that did not hold up for the year. They ran like scared rabbits with the November/December correction and according to Bloomberg ETF flows ended negative again for 2024, making it the 4th straight year. It would appear investors jumped into the bubble top of equities and Bitcoin. Meanwhile the big tech gurus who have reaped huge amounts in the tech bubble are taking some of that money and going big into mining.

Kolbold Mining Tech Gurus Boost Start Midnight Sun

Midnight Sun - - - TSXV:MMA - - - - Recent Price - $0.65

Entry Price - $0.27 - - - - Opinion – buy on weakness

We started the New year off with a bang as gold stocks went up and Midnight Sun broke through the $0.60 resistance level. It wasn't news from Midnight Sun but one of their JV partners Kobold Mining that announced a huge financing to be spent on the JV.

Private company KoBold Metals that is backed by numerous tech gurus including Bill Gates and Jeff Bezos has raised $537 million in its latest funding round that values Kobold at almost $3 billion. The round was co-led by new investor Durable Capital Partners LP and a pair of T. Rowe Price funds making their first investment in the company. The financing included participation from existing KoBold investors Andreessen Horowitz Growth, BOND, Gates’ Breakthrough Energy, Earthshot Ventures, Equinor, July Fund, Mitsubishi Corporation, and Standard Investments, as well as new investors StepStone Group and WCM Investment Management.

It is sort of ironic that these huge tech investors are moving into mining while retail investors are still piling into their high priced tech companies. This money into Kobold is smart money and they see copper with a very bright future. In February, KoBold teamed up with Canada’s Midnight Sun to explore the Zambian Copperbelt. Midnight Sun’s project lies just a few kilometers from First Quantum Minerals’ (TSX: FM) Kansanshi mine, Africa’s largest copper mining complex.

I think the comment that brought buying to Midnight Sun is when CEO KoBold’s co-founder and chief executive Kurt House said about 40% of the new capital would be spent on developing existing projects into mines, with the Zambian copper project taking “the lion’s share of that.”

Kobold's other significant asset in Zambia is Mingomba called the country’s largest copper deposit in a century and it plans to fast-track its development. However still about 8 years until production.

Continue to hold and I would suggest buying if the stock comes down to $0.60 that was previous resistance so should now act as support. Another one of our copper stocks to watch closely is

Element 29 Resources - - - TSXV:ECU - - - - Recent Price – C$0.63

Just before XMAS they announced completion of the first two drill holes, for 2,249.8 metres (m), from the phase III diamond drill program at its Elida porphyry copper-molybdenum-silver (Cu-Mo-Ag) deposit in central Peru.

Richard Osmond, president and CEO of Element 29 Resources, states: "We are pleased to announce the successful completion of the two deepest drill holes at Elida. Both holes intersected strong porphyry-related hydrothermal alteration from the bedrock surface to depths exceeding 950 metres, indicating the potential to carry copper-molybdenum-silver mineralization. Both drill holes were terminated in strong porphyry alteration and remain open for future drilling campaigns."

Richard Osmond continued "We anxiously await geochemical assay results, which are expected in the coming weeks. The phase III drill program is also scheduled to restart in early Q2 2025 following the end of the rainy season in Peru."

I believe one of the reasons my precious metal stocks out perform benchmarks is that I look for the undervalued stocks and also those with strong growth prospects. In the past bear cycle those miners with expansion projects were penalized with inflation driven cost increases on their new mine development. It is short term thinking because gold is an inflation hedge and usually rises in a high inflation environment which it has and will continue to do so. Iamgold is one example of this as the stock has out performed and not hit much in the recent correction.

Iamgold Corp - - -TSX:IMG, NY:IAG - - - - -Recent Price C$8.00

Entry Price - $3.51 - - - - - Opinion - hold. buy on pull back

Iamgold closed the sale of their Guinea assets, part of the previously announced transactions, as announced on Dec. 20, 2022, with Managem to sell the company's interests in its exploration and development projects in Senegal, Guinea and Mali for aggregate consideration of approximately $282-million. This will strengthen their balance sheet further that already had almost $1 billion in liquidity available.

The Côté Gold Mine achieved multiple milestones in the third quarter, including reaching commercial production on August 1, 2024. This is game changer for the company. It is a large-scale, long-life gold mine in partnership with Sumitomo Metal Mining Co. Ltd., which is expected to be among the largest gold mines in Canada.

Cote was one of the main reasons I suggested the stock and these achievements will position Côté Gold for a significant 2025 as throughput rates ramp-up to steady state. Also in 2025 Iamgold will be paying back their pre sale gold loans by June so this will add more profit to the bottom line.

This graphic of Canada's top 12 mines highlights the significance of Cote. I also see the stock as a potential take over target with this kind of asset.

On the chart, the up trend remains in place with resistance around $8.80. If you don't own the stock, I would be a buyer on any pull back to the bottom of the trend channel, around $7.50 currently.

Cold Winter 2025 Begins

In late December, I talked about two changing long term weather patterns that could mean a colder winter and that volcano Hunga Tonga's warming effect could be ending. It looks like this prediction is starting to play out.

Weather forecasters now predict that winter’s grip will return to half of the US this week as a rush of arctic air descends, plunging temperatures from well above average to nearly 30 degrees below average for some areas.

Two areas of high pressure are responsible for this pattern change, driving the bitter cold south from Canada and into the eastern half of the US. This setup will sink temperatures nearly everywhere east of the Rocky Mountains and increase snow chances in the Northeast and Great Lakes.

After the first round of cold, two more rounds of arctic air will dive from Canada, setting up parts of the US for a long-lasting arctic outbreak of freezing temperatures. The chill will take hold in the Deep South by next week, plunging temperatures across Texas and the Gulf Coast states with lows in the upper 20s. North Florida could see temperatures around freezing with overnight lows for Jacksonville and Tallahassee hovering around 30 degrees.

This graphic from NY Post

Ironically Natural Gas prices have given back all their break out gains and more. Kind of strange and erratic, but I think the market is looking past this current cold blast and still expects another warm winter. I believe odds are that the market is wrong here and I plan to watch closely for any good buying opportunity in natural gas stocks.

This chart is March Comex price that is the most active month. Also interesting is that heating oil also popped in price a few days ago and has not given back any of it's gains like we see with natural gas.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.