Instead of the Mid Day Report, I have this newsletter update. Look up, its (soaring) an eagle, it's a Boeing, the magnificent 7, oh the NASDAQ, it must be Bitcoin. No it's gold. Gold is the only market making all time highs. Why is that?

Well I could simply say read my past updates or I could say. 'The stealth bull market continues'. I did not hear much news and there has been little fanfare on golds record highs. I believe this is because it is Central Bank driven. The big funds have not got all their positions yet so are not blowing their horns, like talking up there book.

For the first time ever, a bar of gold is worth a cool one million dollars. The milestone was reached Friday, when the precious metals spot price surpassed $2,500 per troy ounce, an all-time high. With gold bars typically weighing about 400 ounces, that would make each one worth more than $1M.

Since the mid/late 1970s, I have invested and watched many bull and bear markets with precious metals and the precious metal stocks. They all have some similarities and some differences. Here are the four major ones:

The 1970s was driven by the U.S. abandoning the gold standard and featured many retail investors in long lines outside bullion exchanges. Precious metal stocks soared;

The 1990s was all about the mining stocks. Junior explorers were $10 to $30 and often jumped $5 to $10 on one drill hole. That craze accumulated with BreX, a junior gold explorer going to over $200 around 1997 and than collapsed from $6 billion to a penny stock as fraud was discovered;

The 2,000s bull market was started after the collapse of the tech bubble and then the financial crisis. It was driven by easy money and the QE programs after the 2007/08 crash;

This bull market has been in stealth mode, so far because it is early days. It is driven by Central Banks buying physical gold diversifying out of Euros and the US$. For the 1st time in 2023, gold became a tier 1 asset. Most investors have not caught on yet or are in disbelief at this stage.

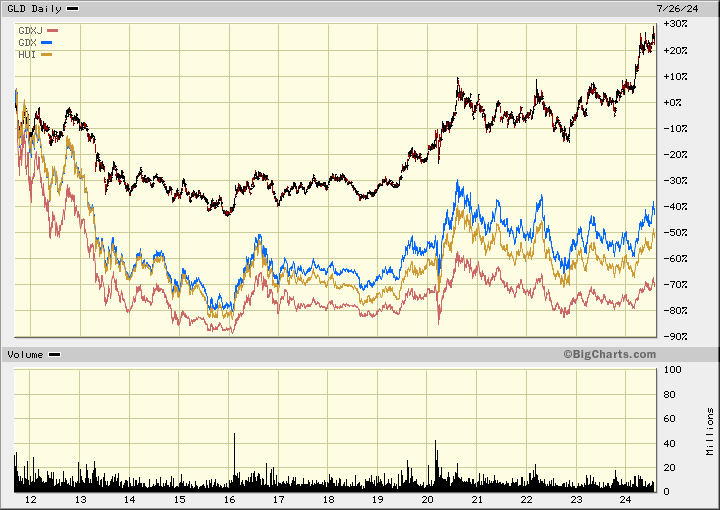

Like I said, they all have some differences. With this bull market, the mining stocks are lagging instead of leading as in the previous bull markets. This is the opportunity of a lifetime. The mining stocks will play catch up and lead this bull market to it's final top, still years down the road.

South Africa’s Gold Fields, NYSE: GFI grabbed headlines with its recent acquisition of Canada’s Osisko Mining (TSX: OSK) in a deal valued at C$2.16 billion. The move expanded Gold Field’s asset portfolio in the Americas, where it already has mines in Chile and Peru, and made it the sole owner of one of Canada’s most promising gold projects – Windfall in Quebec.

CEO Mike Fraser said in an interview with MINING.com. that one of the present challenges in the gold sector is that junior developers are not seeing real value of the gold price reflected in their equities. Bingo and that is why junior miners are being bought out at a record pace.

This is very bullish because it consolidates and results in fewer mining companies including juniors for investors to buy, as well as provides investors of bought out companies, more cash to invest.

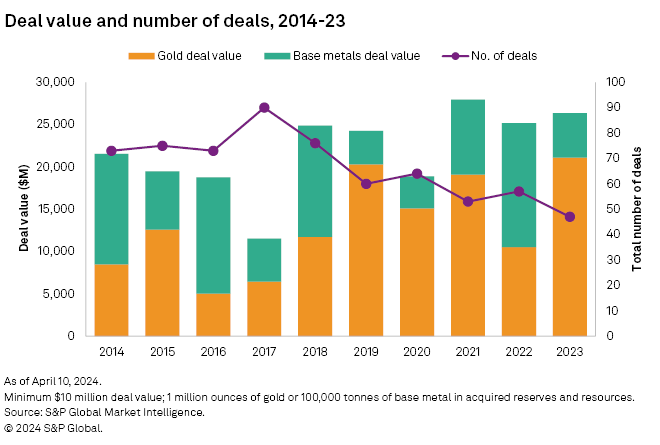

Note that 2022 was the year of base metal stocks and 2023 gold stocks buy outs.

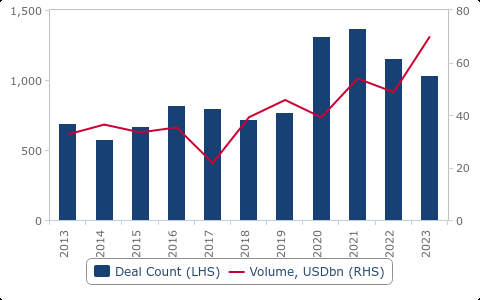

Canadian announced M&A in 2023 dropped 27% to $183.9 billion from the previous year, LSEG data showed. But mining kept on going!!!!!!!

The mining sector has seen the highest number of transactions in 2023, with 643 deals having an aggregate value of $14.8 billion. Australian companies were the acquirers in 69 of these transactions (compared to 28 in FY 2022), representing one of the most notable trends in the Canadian mining industry of late.

FitchSolutions and expert in M&A says: The ongoing surge in M&A activity in the metals and mining sector will continue into 2024, driven by global energy transition and industry consolidation trends, with industry players targeting critical metals.

We note a significant uptick in the M&A activity within the mining industry in recent years, starting in 2020 and accelerating throughout 2021-2022. In 2023 (as of the end of November 2023), deal activity remains robust, approaching the highest level seen in the last decade.

We have a number of takeover targets on our list, like the recent Goliath Gold and Calibre Mining with older picks NewGold, Amex Exploration, Paramount Gold, Great Pacific and Discovery Silver.

This next chart shows the number of deals and value. You can see the number is dropping as consolidation occurs with less numbers to buy, but the value keeps rising higher.

Next I want to highlight this chart that compares Gold (GLD) to gold stock indexes HUI, GDX and GDXJ. Since the 2011 peak, gold is up about +30% while the HUI index is down about -50%. The gap is unprecedented currently around 80%. Even at the 2015 low the gap was about 35%. The junior gold producers (GDXJ) are fairing worse with about a 100% gap.

This will not last and that is the opportunity. I plan on adding some more junior/intermediate producers, advanced juniors and even some small junior explorers while they are still at the bottom.

The junior explorers as measured by the TSX Venture index are still around their bottom. However, a new bull market was born in May with an uptick in volume. Next was a correction and got amplified with the early August panic from a yen carry trade sell off. There has been a nice rebound since then, but key is a higher high and a break above resistance. I want to see a close at 660 or higher as a sure sign. I know it is coming so I am going to bottom fish a few penny juniors. They could see enormous gains from 10 cent or so levels.

Despite a patchy move in the gold stocks, we have many on our list at all time highs and very big gains. I am going to update a few with actions and targets.

Newmont Mining - NY:NEM - - - Recent Price US$51.60

Entry Price - $32.50 - - - - - - Opinion – hold, but sell September $40 Calls

The stock is at 2 year highs but still way below it's 2022 high around $85. It has been a better performer and is only down about -50% if I compare to gold in 2011.

Q2 on July 24 - “Newmont delivered a solid second quarter, producing 2.1 million gold equivalent ounces and generating $594 million in free cash flow," said Tom Palmer, Newmont's CEO. "We continued to advance our divestiture program and, to date, have announced $527 million in proceeds this year. With this momentum, we completed $250 million in share repurchases and repaid $250 million in debt. As we head into the second half of the year, we remain confident in our ability to continue executing on shareholder returns, meet our full year guidance and deliver on our commitments."

Reduced nominal debt by $250 million for a cash cost of $227 million

Delivered $539 million in total returns to shareholders through share repurchases and dividend payments in the second quarter; declared a dividend of $0.25 per share of common stock for the second quarter of 2024

Produced 1.6 million attributable gold ounces and 477 thousand gold equivalent ounces (GEOs) from copper, silver, lead and zinc, including 38 thousand tonnes of copper; primarily driven by production of 1.3 million gold ounces from Newmont's Tier 1 Portfolio

Generated $1.4 billion of cash from operating activities, net of working capital changes of $(263) million; reported $594 million in Free Cash Flow6

I suggested the September $40 Call options at $1.30 and they are now around $11.70 for a whopping 900% gain. On the chart there is resistance around $54 so short term the stock could go go a bit higher, but our options are running out of time. I am suggesting selling at $12 or higher.

Kinross Gold - - - - TSX:K Recent - - - - - Price - $12.82

Entry Price - $6.35 - - - - - - - Opinion - hold

July 31, they reported strong Q2 results with production of 535,338 gold equivalent ounces .

Production cost of sales of $1,029 per Au eq. oz. sold and all-in sustaining cost of $1,387 per Au eq. oz. sold.

Margins increased to $1,313 /Au eq. oz. sold, outpacing the rise in the average realized gold price.

Operating cash flow of $604.0 million and adjusted operating cash flow of $478.1 million. Attributable free cash flow of $345.9 million.

Reported net earnings of $210.9 million, or $0.17 per share, with adjusted net earnings of $174.7 million, or $0.14 per share.

The stock is near it's 2020 highs, but still a long way from $25 the 2009 highs. According to Marketwatch the stock is trading at just 1.22 times book value and just over 5 times cash flow, historically low cash flow ratio for a gold stock.

Iamgold - - - TSX:IMG - - - - Recent Price - $7.00

Entry Price - $3.51 — - - - - Opinion – Buy on Weakness

The stock has moved up to 6 year highs with a good pop after announcing start of production at Cote.

As I commented August 2nd when the stock was $5.70. This is a big deal to Iamgold as Cote will produce on average 495,000 ounces gold per year for the first 6 years. In 2023 Iamgold produced 490,000 ounces so 70% of 495k is 346K so a very significant increase in production. This is the main reason I suggested buying the stock and I expect we will see much higher prices going forward as Cote production ramps up.

IMG, gold and many gold stocks have saw a nice jump higher so some consolidation and correction could come at anytime, so why I have a buy on weakness.

Giant Mining - - - - CSE:BFG, OTC: BFGFF - - - - Recent Price - $0.46, Opinion - buy

Today BFG announced the successful completion of Hole MHB-31 to a depth of 1,086 feet (331 meters). MHB-31 is the second hole of the diamond core drilling program planned for the Majuba Hill Porphyry Copper Deposit, Nevada.

GSP Resource - - - - - TSXV:GSPR - - - - - Recent Price - $0.10

Entry Price $0.25 - - - - - - Opinion - buy

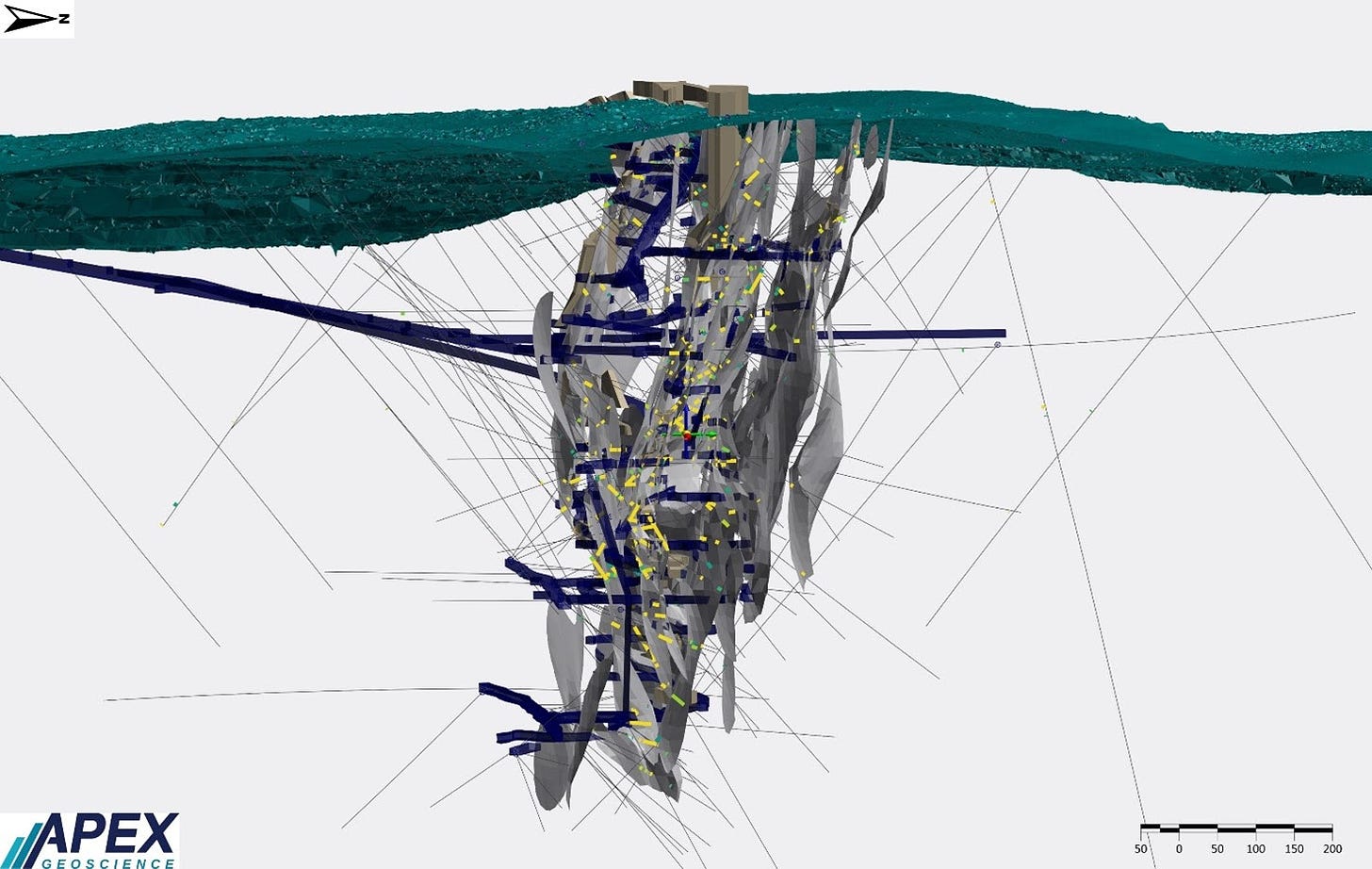

GSPR provided an update related to continuing advancement of the Alwin mine copper-silver-gold project. Recently compiled historic and modern diamond drilling has highlighted the presence of high-grade gold mineralization at the Alwin property, which is not yet well understood, in addition to the well-established laterally and vertically extensive high-grade copper zones. New modelling has for the first time enabled 3-D (three-dimensional) visualization of the Alwin mine project shear vein system, enhancing the company's ability to target expansion and discovery of new zones of high-grade copper mineralization.

Significantly, 1968 diamond drilling at Alwin yielded multiple high-grade gold intercepts including assays of 61 grams per tonne (g/t) gold (Au) and a total of five individual assays greater that 20 g/t Au within surface drill hole 68-67 over a 29.5-metre downhole interval. These assays yield composite grades of 3.05 metres averaging 14.4 g/t Au, including 1.52 metres grading 26.1 g/t Au; and 2.77 metres grading 8.6 g/t Au.

In more recent drilling - drill hole AM-21-08B returned 1.6 m grading 10.4 g/t Au and 1.2 per cent copper (Cu), in addition to, 6.4 m averaging 2.3 g/t Au, 3.4 per cent Cu, and 40 g/t silver (Ag) within drill hole AM-21-01A.

Here is a graphic of the 3D modelling and although this has taken a lot of time and effort it should pay off on future drill programs.

Goliath Resources - - - TSXV:GOT, OTC:GOTRF - - Recent Price - $1.29

Entry Price - $1.22 - - - - - Opinion – buy

I picked the average price of the range the day my newsletter went out as the entry price. At that time I commented a close above $1.35 would be a good sign of a rally to much higher prices. The stock got to $1.34 and has pulled back some. Perhaps we will see the move above $1.35 on the next drill results.

It will eventually happen

Victoria Gold - - - - TSX:VGCX- - - - - Recent Price – Toast

VGCX was not a stock pick but they were exploring up to Zonte's McConnells Jest border so I was watching their progress. In my July 9th update after they had a heap leech pad failure, I said the company would probably go bankrupt and that is what has happened.

Yukon’s government said it moved to place Victoria Gold into receivership because of environmental concerns at the Eagle mine and so that the operation can reopen after clean-up efforts are completed.

“We chose this course of action so that Victoria Gold and mining could resume at this site,” Yukon’s Attorney General Tracy-Anne McPhee said in a press briefing. “We had no intention of ending the work of that corporation, but the environmental concerns were simply not being addressed to our satisfaction.”

The appointment of PricewaterhouseCoopers as receiver of Victoria Gold and its assets last Wednesday followed weeks of mitigation efforts at the site. The receiver will undertake further mitigation work at the mine site with funding from the Yukon, according to the government, though it did not provide a timeline on the clean-up effort.

The government said the money advanced for the efforts will constitute a debt that will be recovered from Victoria Gold’s assets.

“A lack of action by Victoria Gold left us with serious concerns about the heap leach failure,” said McPhee.

Victoria Gold’s board of directors resigned following the receivership placement on Wednesday. Chief executive officer John McConnell told Canada’s CBC News on Thursday he thinks the receivership is “totally unnecessary.”

Canada’s Yukon Territory wants to eventually reopen a gold mine it seized from Victoria Gold Corp. after a major landslide and cyanide spill at the facility earlier this summer.

Unfortunate but mining is not risk free and I have heard a number of $130 million for the environmental clean up, maybe on the high side but much lower is still substantial.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.