Gold Record, Oil Bottom, Junior Index, Bitcoin Trades +17.1%, BFG

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

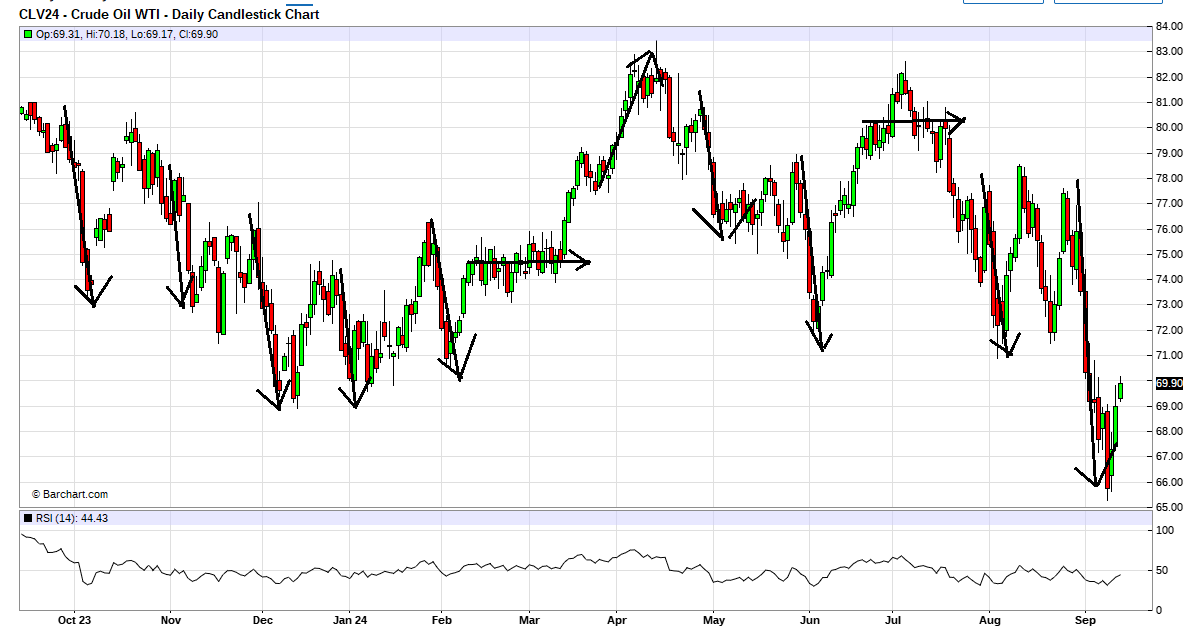

Comex gold has crossed $2,600 today and is likely signalling some troubling times ahead. Oil has made an end of month/start of month bottom again. This oil trading pattern is strange. In the past year oil has declined 9 times around month end, went up once and sideways twice. I thought it might be due to futures option expiry but they are around mid month.

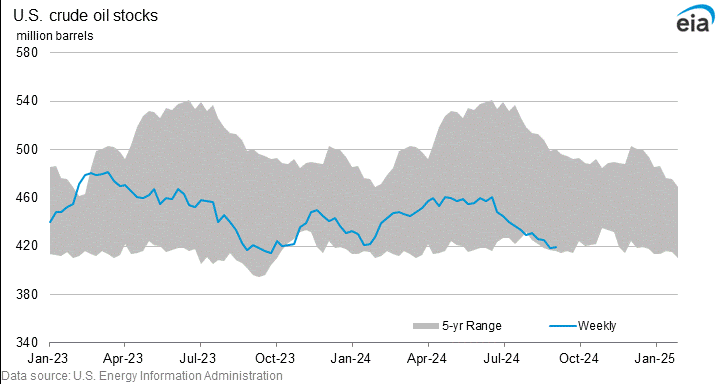

On the bullish side, US inventories are at 5 year lows and the uncertainty of war escalation in the Middle East and Ukraine. The U.S. is now contemplating permission for Ukraine to use long range missiles to strike Russia. Rightfully so, Russia claims this would be war with NATO because these are NATO missiles and would have to use NATO satellites to target them.

I think this risk is madness by the U.S. and hopefully they don't do it. That said, the Biden Administration seems to be more on an agenda than what is right or wrong. They can't have Ukraine lose or go down before the election.

I have mentioned about hurricane season and although this was a mild one, Hurricane Francine Shut in Offshore Output. As Hurricane Francine made landfall in Louisiana this week as a Category 2 hurricane, some 42% of crude oil and 53% of natural gas production was pre-emptively shut in across the US Gulf of Mexico, equivalent to 730,000 b/d and 992 million ft3/d.

From here, I think there is way more upside than downside, but it is a strange market. Perhaps there is intervention to help the inflation numbers. Anyway I think I am going to use this rally to sell some oil stocks without good dividends and move that into precious metals.

Gold stocks are starting to get some traction with the HUI gold bugs index (327) closing in on my first target/resistance around 300. Again this is early days for this gold stock bull market. The junior explorers are still around their bottoms and there has been no trickle down effect yet, but it will come as seen below in the TSX Venture Index.

The TSX Venture index did get a bit of traction in the first half of the year and got knocked down in August and early September. It is moving back up again. As I have been commenting, we need to see 660 to wake up this market. It is coming and I think it will happen before year end.

Bitcoin ETF Trades +17.1% while Bitcoin down -9%

After watching the trading activity in Bitcoin ETFs, I decided to start trading them with the first long trade using IBIT on April 16th. At the time Bitcoin was about $63,800.

Since that time, I have made 6 trades with the most recent one closed September 12th and Bitcoin yesterday was around $58,200. In that period, Bitcoin has declined about -9%. With my 6 trades there was 4 long trades and 2 short trades. So far 5 out of 6 trades were winners, with most gains small the last two were decent. I used a starting amount of $10,000 and it is now $11,710 so we have a gain in that period of +17.1%. That is in a 5 month period. Bitcoin is volatile, so trade opportunities abound.

I have deemed my strategy successful and will continue. I missed a couple big trading opportunities and if I could hit one of them, the gains would be much higher. That said if I make a big losing trade, gains could be wiped out. I will say trading these ETFs during market hours while Bitcoin trades 24/7 is not easy and very risky. If you participate in my trades, only use risk capital that you can afford to lose. For the most part these trades will go out to paid subscribers only. I also send text alerts on these with 'Signal'. I will write about some of the trades on my Substack if circumstances offer a chance to buy or sell around my suggested prices. I monitor and make sure there are at least 2 hours or more to trade at my suggested price.

Giant Mining - - - CSE:BFG OTC:BFGFF - - - Recent Price – C$0.24

Entry Price $0.45 - - - - - Opinion – strong buy

I hope some of you managed to buy some stock under $0.20 based on my last update. I think the bottom is in (double bottom). Giant Mining has completed their core drilling with two holes and is preparing for the planned 16-hole reverse circulation (RC) drilling program at the Majuba Hill porphyry copper deposit.

As previously announced, the company has engaged Boart Longyear Ltd., a global leader in drilling services, based in Elko, Nev., to conduct this significant drilling program. The RC drilling campaign is designed to drill up to 12,800 feet (3,901 metres) across 16 strategic holes. The contract with Boart Longyear allows for flexibility in the execution of the project, enabling the company to adjust the scope of the drilling as needed to achieve optimal results.

"We are very pleased with the progress of our drilling program at Majuba Hill, particularly with the successful completion of MHB-31 at a depth of 1,086 feet," said David Greenway, chief executive officer of Giant Mining. "The drilling is proceeding exceptionally well, thanks to the drillers, the hard work and dedication of Buster and his geological team. We look forward to receiving the lab results from ALS Global Services, which will further our understanding of the deposit and its potential."

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.