Gold Record, Trump Lead is Rising, Intel Inside INTC to Benefit

I am very small and not known yet on substack so please share and subscribe to try this out.

Gold did break to a new high yesterday and is up to another record high today, currently +$25, at $2732. Mainstream is talking about election uncertainty for the reason but I disagree. I think the main current factors are the BRICS summit next week with speculation of a gold backed currency and the same old story of Central Banks diversifying out of US$ into gold.

According to National Bank of Poland Governor Adam Glapiński, the county holds 420 tons of gold “on behalf of all Poles.” Glapiński noted that Poland “has thus entered the exclusive club of the world's largest gold reserve holders.” The central bank governor has set a goal of increasing the country’s gold holdings to 20% of its total reserves."Once we achieve this, we will join the ranks of the world's top economies" noted Glapinski.

Poland was the biggest central bank gold buyer in the second quarter. In the last five months, the Polish central bank has accumulated an additional 39 tons of gold. It now holds about 15% of its reserves in the yellow metal. Another 5% to get to 20%. More media may finally be starting to report on gold. Yesterday the Epoch Times had a lengthy article on Central Bank buying.

I wonder if retail investors shorting gold stocks were betting on a September plunge? A previous Bloomberg report noted that bullion has dropped every September since 2017. Over that period, the average decline has been 3.2% in September, easily the worst month of the year, and far below the monthly average gain of 1%. I would just as easily bet after 6 years of the same thing a change would be in order. Indeed it was as gold popped about $150 in September. Regardless I am sticking to the $3,000 magnet as we are just entering the annual period where gold does best.

Trump Lead is Growing

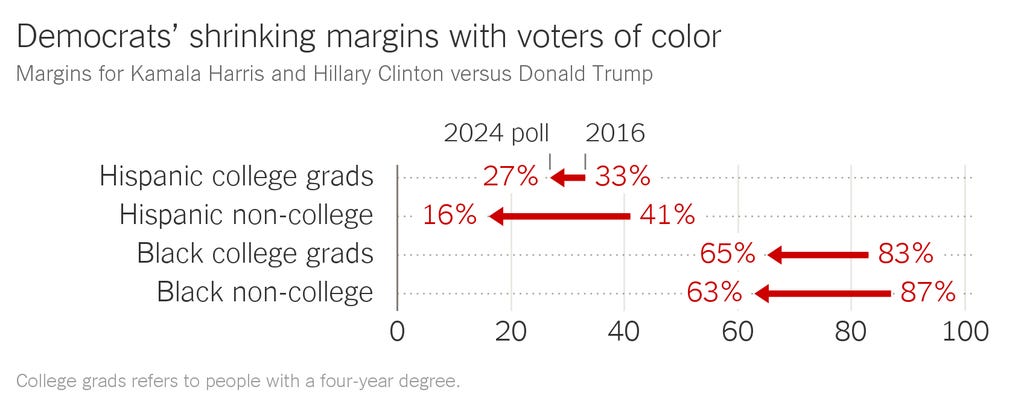

Polymart is now agreeing with my odds putting Trump odds at 60.4% and Harris 39.6%. This poll below is NY Times which is a far left media outlet and they report that Harris and the Democrats are even losing their previous strong base of Hispanic and Black voters.

Trump's lead in polls is unprecedented and today I see NBC news has Trump even in National polls. This has never happened with Trump because Democrat strong numbers in California and NY normally sway the National Popular vote. It appears Trump is headed for a landslide victory where he could get 320 to 350 electoral votes (270 required to win).

I commented about many mentioning that the paint was coming off Harris, but I would say it is mostly off and the primer is starting to peel. This week she was asked about voters requiring ID to vote. She started with what most call 'the word salad' but concluded that because many rural Americans don't have access to photo copy machines that ID should not be required. Is she really from the stone age? Most rural Americans are on the internet and have printers to scan and certainly most all have smart phones that they can take pictures of ID. A very poor excuse, Canada is far more remote and rural than the U.S. and we require ID to vote and ID by mail as long as I have been around.

I think the more she talks and has interviews just more paint comes off. Harris may be smart in many regards but she simply does not come across as presidential material, nor relates to many everyday Americans, despite her middle class uprising rhetoric.

Another but unofficial poll, shares in Trump’s media company have nearly tripled in value in recent weeks, adding about $2 billion to the former president’s net worth.

I am concerned about election interference, the gloves are off and it appears the Democrats are grasping at straws and using the justice system to their advantage. As we already know with all the Trump charges of the past couple years.

In Georgia, a judge ruled that election officials have to certify results even if voter fraud is suspected.” Remember, the election started before Trump's big lead in the polls with early voting. More than 300,000 people cast ballots on Georgia’s first day of early voting, compared with 136,000 in 2020. For strange reasoning it is heavily Democrat voting early and with mail in.

Democrats are also “suing to prevent Dropbox surveillance.” The Department of Justice even went as far as to sue Virginia Governor Glenn Youngkin for cleaning up the state's voter rolls, which has been a standard practice for years. This effort removed more than 6,000 non-citizens from the voter rolls, why does the Biden administration have an issue with this?

If Trump loses with these shenanigans going on and such a big lead in polls, I am afraid it could lead to rioting after the election, like you see in 3rd world countries? Gold would pop further.

I don't think that Trump is very good and many people agree with this and many more hate the guy. His personality sucks and he is not much of a politician, but I guess that is also what a lot like. It has really become a race between two evils or -

Which one would do the least damage! and Bill Ackman

Renowned hedge fund manager and longtime Democrat donor Bill Ackman broke his silence on his unexpected decision to endorse Donald Trump for the 2024 election. He also publicly blasted the Democratic Party and mainstream media for misleading the country about Joe Biden’s mental acuity and health following his disastrous debate.

But, as Ackman explains, it’s his commitment to the nation’s welfare—not political allegiance—that has pushed him to this decision. Ackman one of the most successful and smart Americans posted 33 issues that swayed him on a X post. I know many of you are not on X so here are his 33 reasons. You can read and be the judge.

Ackman says “while the 33 actions I describe below are those of the Democratic Party and the Biden/Harris administration, they are also the actions and policies that unfortunately our most aggressive adversaries would likely implement if they wanted to destroy America from within, and had the ability to take control of our leadership. These are the 33:”

(That is a powerful statement. This is a lengthy 2 page read and very good points, but if not interested, skip down to see what additional advantage Intel will have with a Trump win)

open the borders to millions of immigrants who were not screened for their risk to the country, dumping them into communities where the new immigrants overwhelm existing communities and the infrastructure to support the new entrants, at the expense of the historic residents,

introduce economic policies and massively increase spending without regard to their impact on inflation and the consequences for low-income Americans and the increase in our deficit and national debt,

withdraw from Afghanistan, abandoning our local partners and the civilians who worked alongside us in an unprepared, overnight withdrawal that led to American casualties and destroyed the lives of Afghani women and girls for generations, against the strong advice of our military leadership, and thereafter not showing appropriate respect for their loss at a memorial ceremony in their honor,

introduce thousands of new and unnecessary regulations in light of the existing regulatory regime that interfere with our businesses’ ability to compete, restraining the development of desperately needed housing, infrastructure, and energy production with the associated inflationary effects,

modify the bail system so that violent criminals are released without bail,

destroy our street retailers and communities and promote lawlessness by making shoplifting (except above large thresholds) no longer a criminal offense,

limit and/or attempt to limit or ban fracking and LNG so that U.S. energy costs increase substantially and the U.S. loses its energy independence,

promote DEI ideologies that award jobs, awards, and university admissions on the basis of race, sexual identity and gender criteria, and teach our students and citizens that the world can only be understood as an unfair battle between oppressors and the oppressed, where the oppressors are only successful due to structural racism or a rigged system and the oppressed are simply victims of an unfair system and world,

educate our elementary children that gender is fluid, something to be chosen by a child, and promote hormone blockers and gender reassignment surgeries to our youth without regard to the longer-term consequences to their mental and physical health, and allow biological boys and men to compete in girls and women's sports, depriving girls and women of scholarships, awards, and other opportunities that they would have rightly earned otherwise,

encourage and celebrate massive protests and riots that lead to the burning and destruction of local retail and business establishments while at the same time requiring schools to be shuttered because of the risk of Covid-19 spreading during large gatherings,

encourage and celebrate anti-American and anti-Israel protests and flag burning on campuses around the country with no consequences for the protesters who violate laws or university codes and policies,

allow antisemitism to explode with no serious efforts from the administration to quell this hatred,

mandate vaccines that have not been adequately tested nor have their risks been properly considered compared with the potential benefits adjusted for the age and health of the individual, censoring the contrary advice of top scientists around the world,

shut down free speech in media and on social media platforms that is inconsistent with government policies and objectives,

use the U.S., state, and local legal systems to attack and attempt to jail, take off the campaign trail, and/or massively fine candidates for the presidency without regard to the merits or precedential issues of the case,

seek to defund the police and promote anti-police rhetoric causing a loss of confidence in those who are charged with protecting us,

use government funds to subsidize auto companies and internet providers with vastly more expensive, dated and/or lower-quality technology when greatly superior and cheaper alternatives are available from companies that are owned and/or managed by individuals not favored by the current administration,

mandate in legislation and otherwise government solutions to problems when the private sector can do a vastly better, faster, and cheaper job,

seek to ban gas-powered cars and stoves without regard to the economic and practical consequences of doing so,

take no serious actions when 45 American citizens are killed by terrorists and 12 are taken hostage,

hold back armaments and weaponry from our most important ally in the Middle East in the midst of their hostage negotiations, hostages who include American citizens who have now been held for more than one year,

eliminate sanctions on one of our most dangerous enemies enabling them to generate $150 billion+ of cash reserves from oil sales, which they can then use to fund terrorist proxy organizations who attack us and our allies. Exchange five American hostages held by Iran for five Iranians plus $6 billion of cash in the worst hostage negotiation in history setting a disastrous and dangerous precedent,

remove known terrorist organizations from the terrorist list so we can provide aid to their people, and allow them to shoot rockets at U.S. assets and military bases with little if any military response from us,

lie to the American people about the cognitive health of the president and accuse those who provide video evidence of his decline of sharing doctored videos and being right wing conspirators,

do nothing about the deteriorating health of our citizens driven by the food industrial complex, the fraudulent USDA food pyramid, and the inclusion of ingredients in our food that are banned by other countries around the world which are more protective of their citizens,

do nothing about the proliferation of new vaccines that are not properly analyzed for their risk versus the potential benefit for healthy children who are mandated to receive them,

do nothing about the continued exemption from liability for the pharma industry that has led to a proliferation of mandatory vaccines for children without considering the potential cumulative effects of the now mandated 72-shot regime,

convince our minority youth that they are victims of a rigged system and that the American dream is not available to them,

fail to provide adequate Secret Service protection for alternative presidential candidates,

litigate to prevent alternative candidates from getting on the ballot, and take other anti-competitive steps including threatening political consultants who wish to work for alternative candidates for the presidency, and limit the potential media access for other candidates by threatening the networks' future access to the administration and access to 'scoops' if they platform an alternative candidate,

select the Democratic nominee for president in a backroom process by undisclosed party leaders without allowing Americans to choose between candidates in an open primary,

choose an inferior candidate for the presidency when other much more qualified candidates are available and interested to serve,

litigate to make it illegal for states to require proof of citizenship, voter ID, and/or residence in order to vote at a time when many Americans have lost confidence in the accuracy and trustworthiness of our voting system.

I have followed Nvidia for many years and when the stock dropped down to around $140 to $160, today $14 to $16 with the split, I was planning a report and started a draft. I felt the stock was way too cheap. The NASDAQ was in a bear market and I thought it could go on longer so I waited. I have been kicking myself for over a year and I am not going to make that mistake with Intel.

Intel Corp. NASDAQ:INTC - - - - Recent Price - $22.62

52 week range $18.51 to $51.28

Most of you will know this company and stock. It was famous in the tech boom especially with PC's with the popular slogan of 'Intel Inside'. Intel has a strong legacy of technological accomplishments. It pioneered advancements like DRAM memory chips. It became dominant in the microprocessor market, but then slid down hill in the 2010s then to new lows this year.

Intel became a story much like Boeing where short term profits became more important than the engineering that made the company a huge success. Intel had too much of an ego and got complacent, shortchanged R&D, and repurchased too much stock. Meanwhile Taiwan Semiconductor (TSM), a long-term focused competitor, ate Intel's lunch. Intel loss a lot of market share to (TSM) and Advanced Micro Devices (AMD).

In the past 5 years Intel stock dropped over -50% and it's competitors soared 100s of percent.

However technology is always changing and Intel started a path to reinvent itself. CEO Pat Gelsinger is revitalizing Intel’s engineering culture. In March 2021, he unveiled his vision for Intel. He strongly committed to a U.S.-based chip manufacturing strategy. This includes a $20 billion investment in new chip factories in Arizona and Ohio. It takes time to turn a big company around but like Nvidia in the past, the stock has dropped too far.

Right now there is a lot of focus on graphics processing units (GPUs) that Nvidia makes and AI, but AI is not going to take over all computing applications. CPUs are designed for sequential processing and do the grunt work in computers and servers. Demand on their function is only going to grow along with AI. They are valuable for running operating systems, general-purpose computing, low-latency tasks, and many database operations.

That said, Intel is not sitting on it's hands and is going to directly compete with Nvidia

In April, Intel hosted its Intel Vision event. It unveiled a new AI chip named Gaudi 3. Intel claims accelerator, delivering 50% on average better inference and 40% on average better power efficiency than Nvidia H100 – at a fraction of the cost. Customers including Dell and Hewlett Packard committed to building servers with these chips. Intel claims Gaudi 3 is competitive with Nvidia’s next-generation Blackwell GPU chip. Gaudi 3 could substantially boost Intel’s earnings in 2025.

AI software engineers are used to working with CUDA, Nvidia’s proprietary software system. Intel is encouraging the use of open-source alternatives, which are likely to ultimately win out in the long term as the AI ecosystem develops further.

Open Platform for Enterprise AI (OPEA) members are working to develop and standardize enterprise-grade Retrieval Augmented Generative AI. Intel is part of OPEA and Gaudi AI chips running on open source software could take significant market share from Nvidia chips by offering chip buyers a lower-cost option. There’s plenty of room for Intel to gain market share from Nvidia.

Gelsinger/Intel are strongly committed to a U.S.-based chip manufacturing strategy. This includes a $20 billion investment in new chip factories in Arizona and Ohio. Funding from government tax credits will limit risks and ultimately boost returns. If Trump wins the election his promised tariffs will hit Intel's off shore competitors and benefit Intel's onshore manufacturing initiative

Taiwan Semiconductor is building a fab in Arizona but it is behind schedule and won't be producing chips for years. Furthermore their most advanced chips will still be made in Taiwan.

Intel could also benefit from a geopolitical premium If China invades Taiwan it would halt chip exports to the world that Taiwan is a world leader of. China could also use a blockade that would also achieve that. Worst case with an invasion the Taiwanese government might sabotage its own plants to fight back.

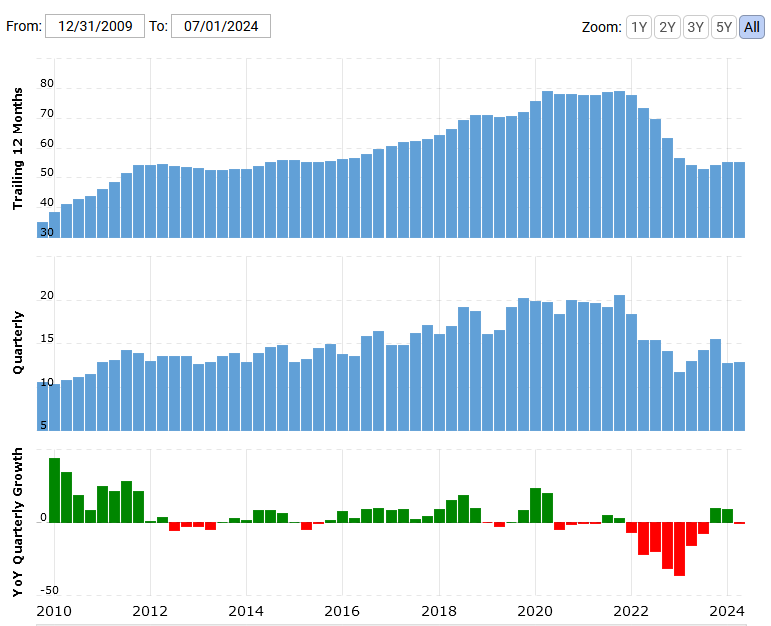

Short term the company and stock has suffered from the CPU recession. There was a big boom for computers with the Covid lock downs and than a plunge in demand as that subsided.

Intel annual revenue for 2023 was $54.228B, a 14% decline from 2022. Intel annual revenue for 2022 was $63.054B, a 20.21% decline from 2021. Intel annual revenue for 2021 was $79.024B, a 1.49% increase from 2020.

Intel will report Q3 financial results on October 31. They are forecasting third-quarter 2024 revenue of $12.5 billion to $13.5 billion; expecting third-quarter GAAP EPS attributable to Intel of $(0.24); non-GAAP EPS attributable to Intel of $(0.03). They have also suspended the dividend as of 4th quarter.

This next graphic shows Intel's revenue rise into the pandemic and the following plunge.

Last quarter Intel announced cost cutting initiatives. They “will follow the establishment of separate financial reporting for Intel Products and Intel Foundry, which provides a "clean sheet" view of the business and has uncovered significant opportunities to drive meaningful operational and cost efficiencies. The actions include structural and operating realignment across the company, headcount reductions, and operating expense and capital expenditure reductions of more than $10 billion in 2025 compared to previous estimates. As a result of these actions, Intel aims to achieve clear line of sight toward a sustainable business model with the ongoing financial resources and liquidity needed to support the company’s long-term strategy.”

This separation of Intel Foundry could be a precursor to sell off that division.

Intel is looking to sell at least a minority stake in its Altera unit worth around $17 billion, according to a report from CNBC that cites people familiar with the matter. Intel did not immediately respond to a Barron’s request for comment. On Intel’s second-quarter earnings call in August, Chief Executive Patrick Gelsinger said that “as Altera reaches full operational separation by yearend, we are actively working toward capitalizing the business to generate proceeds for Intel on a path to an IPO in the coming years.”

US based chip manufacturing is also supported under the current government and if Harris wins. The Biden-Harris Administration announced September 16th that Intel Corporation has been awarded up to $3 billion in direct funding under the CHIPS and Science Act for the Secure Enclave program. The program is designed to expand the trusted manufacturing of leading-edge semiconductors for the U.S. government.

The Secure Enclave program builds on previous projects between Intel and the Department of Defense (DoD) such as Rapid Assured Microelectronics Prototypes - Commercial (RAMP-C) and State-of-the-Art Heterogeneous Integration Prototype (SHIP). As the only American company that both designs and manufactures leading-edge logic chips, Intel will help secure the domestic chip supply chain and collaborate with the DoD to help enhance the resilience of U.S. technological systems by advancing secure, cutting-edge solutions.

The Secure Enclave award is separate from the proposed funding agreement ($8.5b) that Intel reached with the Biden-Harris Administration in March of this year to support the construction and modernization of semiconductor commercial fabrication facilities under the CHIPS and Science Act.

The stock was hammered Aug 1st when Intel reported worse-than-expected quarterly results and issued light guidance for the current period. Intel announced plans to cut around 15,000 employees, eliminate its fiscal fourth-quarter dividend and reduce capital expenditures.

Q2 - Earnings per share: 2 cents adjusted vs. 10 cents expected.

I believe all the bad news and more is priced into the stock. It is only 2 times book value vs around 5 for competitors and Nvidia at 35 times. The stock has put in a double bottom and just bounced off of near term support around $22. I expect it will continue to fill the gap between here and $30 for the rest of the year and into 2025.

The company does not have to see a big bounce up in revenues and earnings. If the market sentiment goes from negative to balanced or even positive if it gets a tariff bump with Trump and a geopolitical premium as China seems to keep escalating pressure on Taiwan. China may also jump if the US gets further tied up than Ukraine with a middle east escalation.

For call options, we could go way out to January 2026 and buy the $30 Call for about $2.90. If Intel gets back to $30 in the next several months there is still lots of time premium and this Call would be worth around $6 or $7. I will add this option to our list.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.