Gold, Red or Blue Pill, Ignorance and Lies, NEM, NKTR Pops!

Today is a bad news good news story. The last rally with the precious metal stocks was in 2020/2021 to the Covid-19 response. It has been down hill since then and I see this as the worst bear market for the precious metal miners ever. There are 5 main points that have made this bear market more painful.

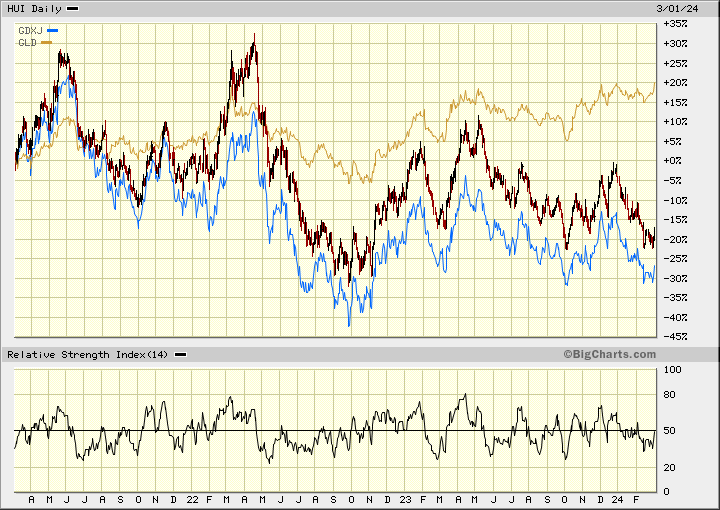

The gold miners are down despite gold considerably higher:

Multiples on cash flow, ounces in the ground is lowest in history:

The trading volumes in the juniors is at lowest levels in history:

And we have been dragging along this bottom for about 20 months.

There is very extreme bearish sentiment among investors.

This what makes bottoms though. This chart compares gold to the HUI gold bugs index and the GDXJ, the junior gold miner producer ETF. In the past 3 years, gold is up about +20% while the HUI gold bugs index is down -20% and the junior producers, far worse at -30%.

This performance gap between gold and the gold mining stocks is the largest in history. It reflects the extreme bearish sentiment. Normally gold stocks trade at a premium to gold because they have leverage to the gold price. The good news is that when the rally comes, it will be a big one. On the chart you can see that the miners rallied some from August 2022 lows but they are right back down there again.

This next chart is the TSX Venture index that reflects Canadian junior exploration miners. I show a 5 year chart to show the last rally, because when they do rally the percentage gains are larger than the precious metal producers. I also highlight how they been dragging at this bottom since July 2022 and on record low volume.

I have done little trading because my experience is that it is pretty useless to try and trade one bad stock for another that might not be so bad, because it ends up going down too. My experience is that it is best to be patient and start making adjustments when a rally takes hold. Selling strong movers to buy laggards.

Now for the good news. Gold had the strongest rally on Friday in about 6 months with spot gold making historic highs. Most market commentators are dumb founded and have no good reason for the rally. This does not surprise me at all and I have been predicting a big move in gold for 2024, although this is just a start and won't get much attention, yet.

I have been commenting for months that the U.S. economy is not doing very well despite what government numbers portray. My thesis has been that the Fed will not get inflation down to 2% and there will not be much interest rate relief. I have been predicting that the Fed will be pressured to lower rates, not because inflation has come down but the economy is tanking. The latest, PCE inflation (FED’s preferred inflation measure) comes in line with expectations of 2.4% in January. BUT month-over-month up +0.4% (4.8% annualized), the most in 1 year.

I am thinking of starting a new monthly newsletter on this topic, because it fits so well with whats going on in markets, the economy and society. The market has been like the Red Pill or Blue Pill in the Matrix movies. Most in the market have been taking the Blue Pill, that is like a sedative, being content with the status quo and rosy market narrative and the adjusted government economic data. Taking the Red Pill awakens you to a different market reality that is an unsettling truth of the real world. On Friday, some investors took the Red Pill and saw the great economy and low gold price is not real.

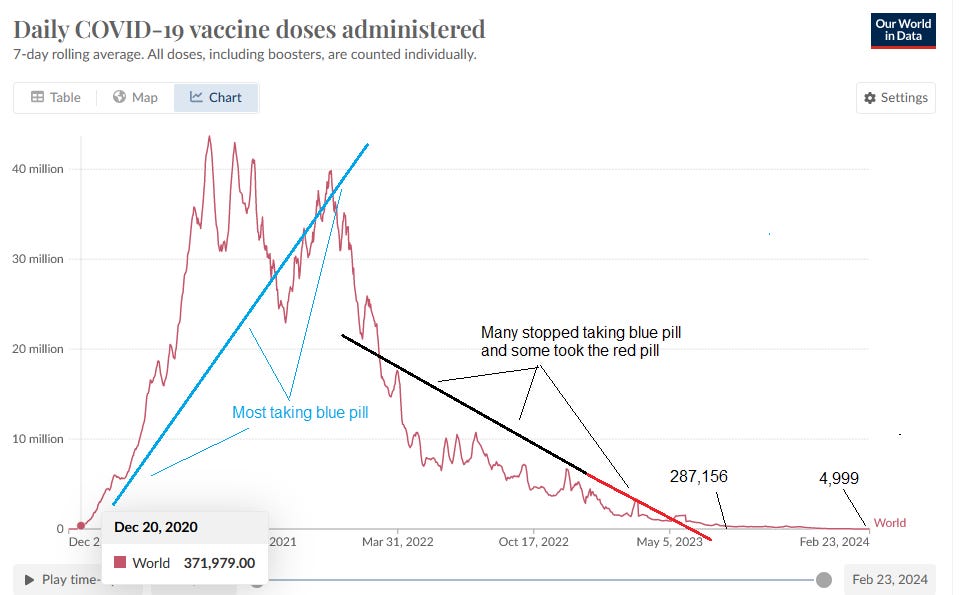

I also see how ignorance by investors and society explains a lot. It might not be ignorance, perhaps laziness, easier to go with the flow, denial or too busy in day to day life under the blue pill. The lies are obvious as they have been coming in record amounts from government, stats and the establishment that you could call the Matrix. This chart on the Covid shot uptake is amazing and a good example.

When the shots came out, most people were on the blue pill, believing everything they heard from the establishment and being good citizens of the Matrix. However, as more truth became known, many stopped taking the blue pill and some actually took the red one. These numbers are amazing and a very good illustration of change. At the beginning they were giving out almost 400,000 shots per day and it got up to over 40 million per day. There is not many fooled now with just 5,000/day. Very few want those boosters, It has even caused vaccine hesitancy in non Covid vaccines.

No, just because you stopped taking the shots, the boosters does not mean you took a red pill. There is a lot more too it than that. Here is a few examples and I will get into a lot more if I decide to do a monthly newsletter. Any feedback on doing this newsletter would be great. I am on the fence yet.

If you use 'Google' for your search you have not taken a red pill yet. Google does not give you what you search for but what they want you to find. Google is in bed with government in censoring the internet, they are part of the Matrix. I use duck, duck go and get far different and better search results. Google and Bing, censored my web site for about 3 years from 2020 sometime.

Part of what the Matrix does, is condition you to accept their ways and fall inline. Remember when streaming came out for TV etc. You paid a monthly fee and there was no advertising. Now they are bringing back advertising so you are going to pay like the old way through watching ads and a monthly fee too. Most people under the blue pill will just go along and not put up any fuss. People need to start voting with their wallets. If enough cancelled monthly subscriptions to rebel, they would back off from the ads, but nope, too many blue pills.

A lot of people still use social media a lot and get all their news there among other things. These are all censored by the Matrix to ensure you mostly see what they want you to. X (former twitter) might be an exception. I think Elon Musk took the red pill some time ago. He released the 'twitter files' and see here too 'twitter files'.

Social media did not start this way. I believe what happened is the Trump campaign was very successful with social media back in their 2016 election campaign. Remember that Trump used twitter a lot, he could reach the people directly. He was criticized for this but it worked. The Democrats could not allow this again and with the social media bosses pretty well all Democrats, they did a two prong approach. They censored and blocked the right view while heavily promoting the left view. They did much the same promoting the Covid shots with medical/science facts and view points, where some were allowed and others censored.

Ok, enough of that, back to gold etc.

The only economic data Friday was the ISM Manufacturing PMI that dropped to 47.8 from 49.1 in January. This reading missed the market expectation of 49.5 by a wide margin. Other details of the report showed that the Employment Index declined to 45.9 from 47.1, the New Orders Index retreated to 49.2 from 52.5 and the Prices Paid Index edged lower to 52.5 from 52.9.

Readings below 50 indicate contraction. None of this surprises me and I have been pointing out numerous data reports that are real and not very good. I took the Red Pill a long time ago.

This ISM data never seems to be key economic data so market commentators are having problems explaining gold's pop. I have been saying for months that the market will wake up to reality eventually and we will see much higher gold prices. That is all that happened on Friday as there was some awakening to the true reality (a few red pills). It is just the beginning and we need to see much more. This chart is the futures price, the April Comex gold contract so it does not show the record spot price.

The recent down trend (blue lines) has been broken to the upside. It looks like gold will continue higher this week or at least a good start here on Monday or we see selling from the managers of economic data. As I have been saying for a long time, we need to see a close at $2150 or higher and that is approximately where the market will snap out of the Blue Pill dream narrative.

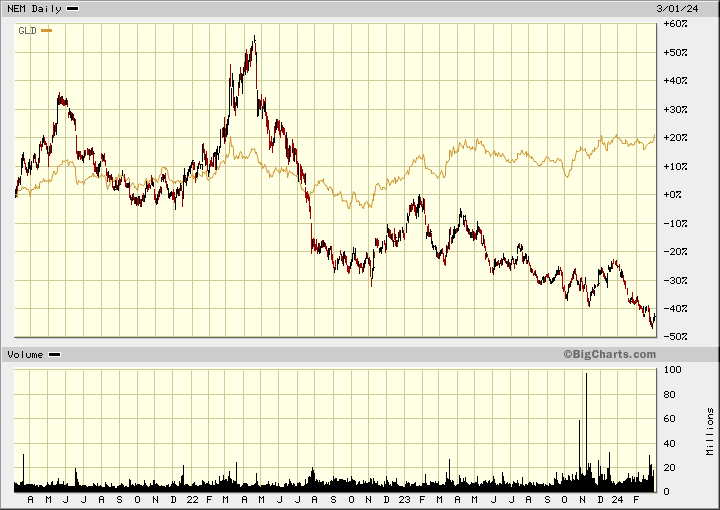

Oil also hit $80 this morning and then pulled back. Here is an update on Newmont and you can relate to how cheap it is.

Newmont - - - - NY:NEM - - - - - - - Recent Price – US$32

Entry Price - $38.65 - - - - - - - Opinion – strong buy

Newmont has a market cap of $34.4 billion and 174 million ounces of gold resources so is selling fro $197 per ounce of gold in the ground. Not very high for the top gold producer. The stock has a 3.1% dividend yield as well.

For 2023 they produced 5.5 million gold ounces and 891 thousand gold equivalent ounces (GEOs)2 from copper, silver, lead and zinc; in-line with revised guidance range and incorporating the legacy Newcrest assets from the acquisition close date.

Reported gold Costs Applicable to Sales (CAS) per ounce3 of $1,050 and gold All-In Sustaining Costs (AISC) per ounce3 of $1,444; in-line with revised guidance range and incorporating higher sustaining capital spend for 2023

Generated $2.8 billion of cash from continuing operations and reported $88 million in Free Cash Flow after unfavorable working capital changes of $513 million and $2.7 billion of reinvestment to sustain current operations and advance near-term projects.

On the chart, I did a 3 year comparison to gold 'GLD'. It was holding up, but like everything else it began tanking in mid 2022. The stock is at strong support and lower prices have not been seen since 2016 when gold was $1200/$1300. It is obvious a strong buy here.

Here is the 10 year chart and you can see how beat up the stock is. It is a steal here and therefore I am suggesting the September $40 Call option around $1.30. It is out of the money quite a bit, but if gold goes, Newmont will be among the first to react and could easily go back to $70.

Nektar Therapeutics - - - - - Nasdaq: NKTR - - - - - - - - Recent Price $0.95

Entry Price - $0.68 - - - - - - - Opinion – buy under $1.00

NKTR popped this morning on news of an above market financing. That screwed up some shorts. They entered into a securities purchase agreement with TCGX, an institutional accredited investor, to sell securities in a private placement financing (the "PIPE") for gross proceeds of $30 million, before deducting expenses.

In the PIPE, Nektar is selling 25 million shares of its common stock, in the form of a pre-funded warrant, at a price of $1.20 per share, representing a premium of approximately 80% to Nektar's 30-day volume-weighted average price. The pre-funded warrant will have an exercise price of $0.0001 per share and will not expire.

The PIPE is expected to close on or before March 6, 2024, subject to customary closing conditions. Nektar has agreed to submit a registration statement filing for the underlying Common Stock no later than 90 days after the closing.

"We are pleased to bring on TCGX as a new high-quality, long-term investor in Nektar as we advance rezpegaldesleukin through our Phase 2b studies in atopic dermatitis and alopecia areata," said Howard Robin, President and Chief Executive Officer of Nektar Therapeutics. "We are on track to report topline data from these studies in the first half of 2025, which will represent significant inflection points for Nektar. Today's financing further bolsters our financial position and extends the company's cash runway well into the third quarter of 2026."

The Stock is still well below cash value and I would be a buyer on any weakness under $1.00. I have noticed with these under valued bio techs that once they get a new financing and major new shareholder, they end up going a lot higher.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.