Gold Reversal, B2Gold, Canadian Titanic, Housing Bubble, MRNA Puts

There is some U.S. housing data out early in the week and then we have some more data Thursday and Friday. The most important news today is the strong reversal pattern in Gold. A morning doji star reversal is the strongest and most reliable trading pattern I know of. It consists first of the down day or days, the red candles and then a doji candlestick (Friday) that signals indecision. That is followed by a decent up day, a green candle that confirms the pattern and reversal. We also have a bounce off of strong support, pretty much a hammer candlestick on Thursday. First resistance will be around $2,700 and I see this as the near term target.

War escalation was part of the reason for today's up move. Biden approved the use of long range missiles to strike within Russia. I believe this was a very dangerous move and it makes little sense to escalate a war in your last days of office. Is it just an anti Trump move to do something before Trump takes power with his stance to end the war? It is sickening to play these games with people's lives.

Was it tit for tat because North Korean has sent troops to Russia? To be clear and above the propaganda, North Korea is not fighting Ukraine. They are in a defensive role and will aid Russia in taking back Russia's Kursk region that Ukraine invaded.

I doubt North Korea wants to fight Russia’s war but it would be an ultimate training exercise and strengthens their alliance. Regardless, these are all dangerous escalations. And the middle east is on course for more escalation as well. It is only a matter of when there is full confrontation with Iran that will drag the U.S. into direct war. It is still 2 more months before Trump is sworn in so we are likely to see a continuation of the far left war policies.

A lot can happen in war during 2 months. Election uncertainty was a big bullish factor for gold and now it is probably going to be war escalation. There is also still a serious threat to a resurgence with inflation and too much government debt.

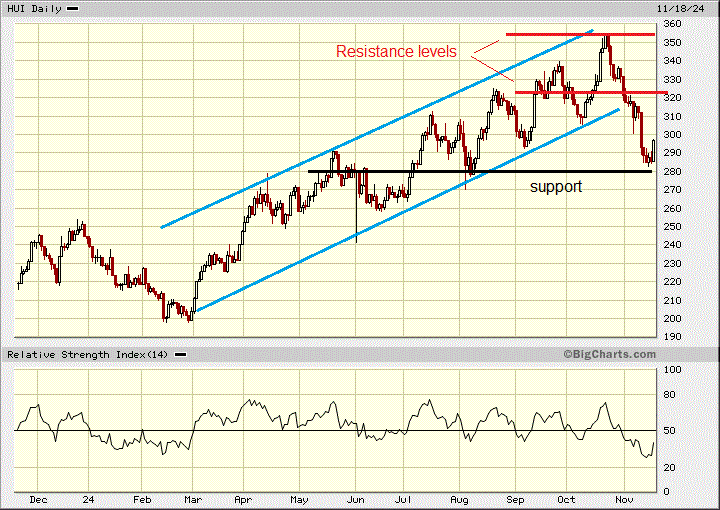

The gold stocks corrected quite far but also bounced off strong support. The uptrend was broken so I expect some sideways trading possibly into year end. That said a lot will depend on the wars.

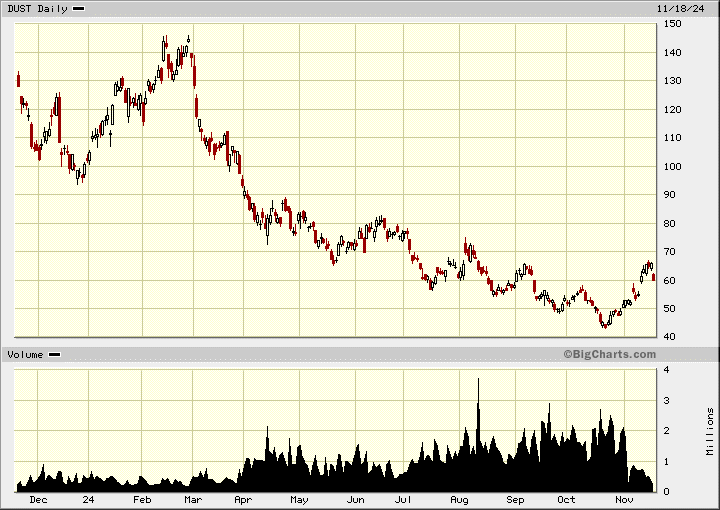

There is another important signal for gold stocks. For the first time since this bull market started, volumes in the DUST etf that is 2 times short the gold stock index has dropped off significantly.

Ironically and par for the course the retail investors stopped buying into DUST just as it had it's best up move since February. Also encouraging is volume has picked up some in the long gold stocks etf NUGT.

My favorite gold stock to buy right now is B2Gold TSX:BTO NY:BTG C$3.94

It corrected more than most other gold producers, dropping about -23%. Officially putting it into bear market status. Does not make much sense but so far gold stocks have still been lagging this gold rally. It is starting to change though.

The other good signal is the junior explorers measured by the TSX Venture index did not drop very much at all, only about -5%. The index is back up above 600 today

Canadian Titanic

If Canada was the Titanic, we already hit the ice burg but the band is still playing and we have not deployed any life rafts yet. But make no mistake, the ship will sink.

There was more of the usual bad news and reports:

Average age of new home buyers is 36 and home prices falling;

Carbon Tax increases food costs;

Rat infestation in major cities;

Foreign students with fraudulent school acceptance letters;

Temporary Foreign Workers committing fraud too.

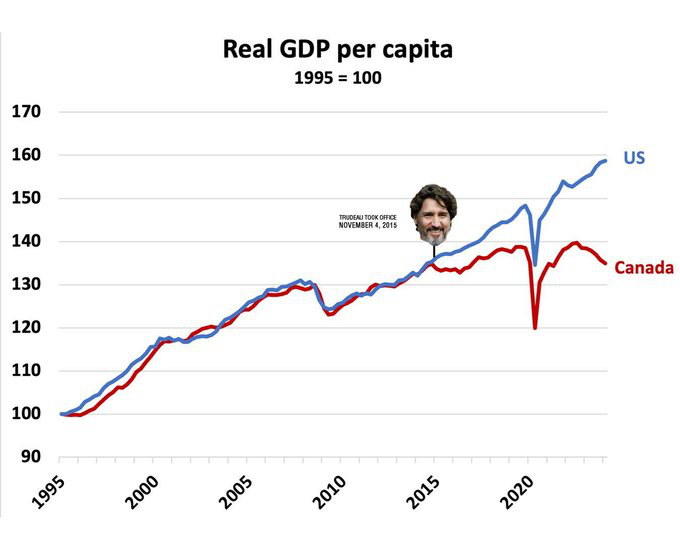

I have shown this chart before but I like this one that shows the face of the culprit that did the damage. For people living in this country it has gone no where for 10 years, vastly under performing the U.S. Canada has broken away from benefiting and following the U.S. economy. Trudeau has painted a false economy by bringing in more migration than any country in the world (on a population basis), giving them government money to spend on goods and services.

Real Estate represents almost 40% of Canada's GDP so as it goes so does the economy and unfortunately that is down.

The average age of a first time home buyer is 36 in Canada. That means they will be paying a mortgage to retirement age and pretty late to have kids and start a family. The average value of a new mortgage in Ontario has jumped over $100,000 since 2019 to $427,000 at Q2 2024, and at much higher interest rates. According to CMHC, nearly 3 times as many buyers delayed purchases in 2024 compared to 2023 because of higher mortgage rates.

I have mentioned before that this year and next are going to be most negative on the market. According to the Canada Mortgage and Housing Corp (CMHC), 2.2 million mortgages, or 45% of outstanding mortgages in Canada, are up for renewal in 2024 and 2025. The average monthly mortgage payment in Canada at the end of 2023 was $2,143 with B.C. the highest at $2,913 and Ontario next at $2,770. That is where the majority of Canadians live and these averages will go much higher with all the renewals coming due. Mortgage rates at the big 6 banks range from 6.8% to 7.8% depending on the term.

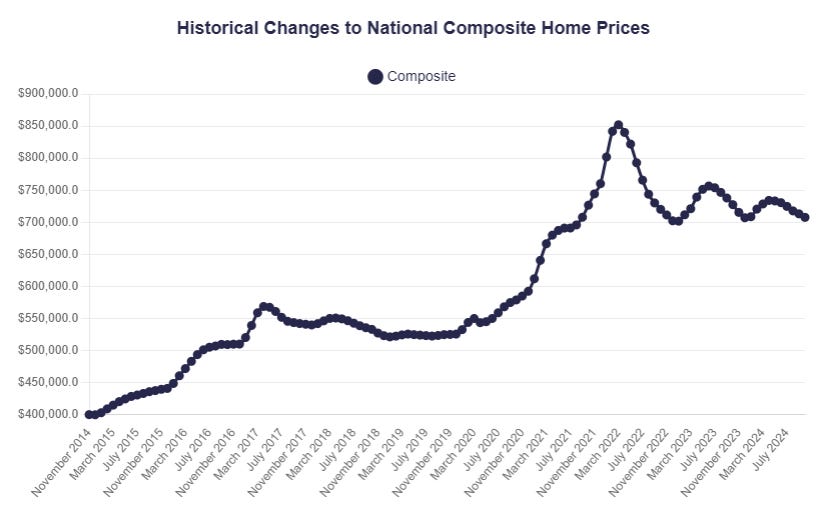

I called the top of the housing bubble in April 2022 pretty much ban on. I expected prices would drop around 30% to 40%, unwinding most of the bubble. In September this year, the last data, prices dropped almost 1% in that one month alone. As you can see on the National Composite index, prices have fallen from about $850,000 to $700,000 or almost -18%. The current price level has held the last couple years but I think that will break down with all the mortgages coming due. New listings are surging and as the Canadian economy continues to decline it will add more downward pressure.

New Study points to Carbon Tax increasing food costs

The study says that while carbon pricing schemes are “crucial” to reduce greenhouse gas emissions, they can drive food prices up and hurt low-income households. Researchers note the potential effects of carbon pricing on food production come through higher fuel prices to run farm machinery or transport products, as well as increased costs to make fertilizers and pesticides.

“Frankly, what we discovered is that we just don’t know much about it,” the study’s lead author Sylvain Charlebois told The Epoch Times in an interview.

“And so we can only come to the conclusion that the Trudeau government implemented this policy without really understanding how it would impact Canada’s food affordability situation,” said Charlebois, who is senior director of the Agri-Food Analytics Lab at Dalhousie.

That should come as no surprise as we have the most incompetent government in history.

And remember we are only a bit more than 4 months away from Trudeau's next carbon tax increase in April 2025.

Rat Infestations are what you see in 3rd World Countries

Pest control companies and city councils across Canada are troubled by a radical explosion of rat populations in recent years, leaving them scurrying to rationalize why the surge is happening and come up with solutions.

“We’re seeing 10 to 20 percent increases every single year. It’s in every city across Canada. They just keep on growing and growing,” Bill Dowd, CEO of Skedaddle Humane Wildlife Control, which has locations in B.C., Ontario, Quebec, and Nova Scotia, said in an interview.

The rats have also taken over the federal government a long time ago! Maybe that is where they came from?

Fraud rampant in Canada Migration Programs

Canada’s temporary resident population has doubled since 2021 to an estimated 2.8 million people. A lot of this is the Temporary Foreign Worker program.

After granting thousands of Permanent Residencies to people with fake jobs that give them PR status, the Immigration, Refugees, and Citizenship Canada (IRCC) is finally cracking down on employment fraud

“Bad actors are taking advantage of people and compromising the program for legitimate businesses. We are putting more reforms in place to stop misuse and fraud from entering the TFW program,” employment minister Randy Boissonnault told representatives from Canada’s largest business associations.

Thousands of university and college acceptance letters used by foreign students applying to study in Canada this year may be fake, an official with IRCC said at a Commons Citizen and Immigration committee meeting.

Bronwyn May, director-general of the International Students Branch, told the committee on Nov. 7 that more than 10,000 letters could not be verified by the IRCC and are “potentially fraudulent.”

Just more examples of an incompetent government being taken advantage of to Canada's determent. Why has it taken so long for this to be discovered?

Moderna MRNA $39.25

The stock has bounced up a bit today so everyone who did not get in late Friday afternoon can get in the January 2026 $25 Puts around $4.00 an average and even number I will pick as the entry price.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.