Wow, what a 'V' shape recovery in gold. If it closes at current levels or better, it will be above my first resistance level. Happy Friday the 13th!, but as I pointed out, it is no surprise this middle east uncertainty is moving gold. The important level is $1980 because a close above that would be a higher high which would be a very strong signal that the correction since May is definitely over and we are in a new bull move. Strong $50 or so up days like this are rare and when you see strong moves like this, it is usually a part of a bull trend. The last strong move was about +$47 on March 17th and that was part of a $400 up move in gold (Nov 2022 – May 2023).

Another important observation is the Managed Money position on the COT report. It is produced end of day Friday based on Tuesday's trade positions, so it is about a week old. A couple weeks ago or so I commented that Managed Money had been liquidating positions and they would likely end up short. With this reported period, they are short -7,561 contracts. I always follow this Managed Money because they are always wrong. When you see them short, you can be sure a bottom is nearby. I would bet they were further short Tuesday and part of this strong up move is their short covering.

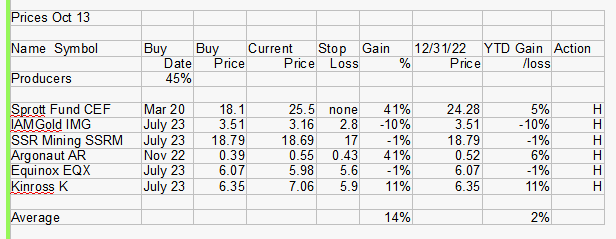

What I did not like about the 'V' shape move in gold, it stopped us out of 6 of our gold stocks and they recovered quickly. Here is the list of the 5 remaining gold stocks we were not stopped out of and the Sprott precious metal fund CEF that I don't use a stop/loss on. For a reminder and for new subscribers, I use a mental stop loss to avoid setting stops for market makers to see. They often will move a stock just to trigger these stops and create trades. If the stock closes below my mental stop loss, I sell it the next day, unless it bounces back up in morning trading. This happens often, because like I say they often move the stock just to trigger the stop losses.

Atlas Salt - - - - - TSXV:SALT - - - - - - - - Recent Price - $0.88

Entry Price - $0.80 - - - - - - - Opinion – stopped out at $1.20, and hold

This week, SALT filed a technical report on SEDAR presenting the results of a feasibility study of the Great Atlantic salt project on the west coast of Newfoundland in accordance with National Instrument 43-101 (Standards of Disclosure for Mineral Projects).

The report is entitled "Technical Report on the Great Atlantic Salt Project, Newfoundland and Labrador, Canada, Report for NI 43-101". The report was prepared by SLR Consulting (Canada) Ltd. and has an effective date of July 31, 2023. A link to the report is also available on the Company's website at www.AtlasSalt.com.

Pre-Tax payback is 4.2 years and an IRR of 23%. Net Present Value calculated at 8% discounting is just over Cdn$1 billion. In this recent market about everything has got whacked and SALT was no exception.

It is a good thing we took part profits around $3.10. If you did not use the stop/loss, I would hold as most likely the stock has bottomed. This will get bought out at much higher levels.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.