Gold Rocking, Gold Stock List, AI's Take on Gold

Gold set new record highs again today and as I have commented, $3,000 is my next target.

The World Gold Council came out with their gold report for 2024 and really was nothing surprising to me. Gold mine supply increased a small amount at 3,661.2 tonnes . World Jewelry demand was the weak spot declining to 1,877.1 tonnes from 2,110.6 in 2023. Higher gold prices and struggling economies were a bad combination.

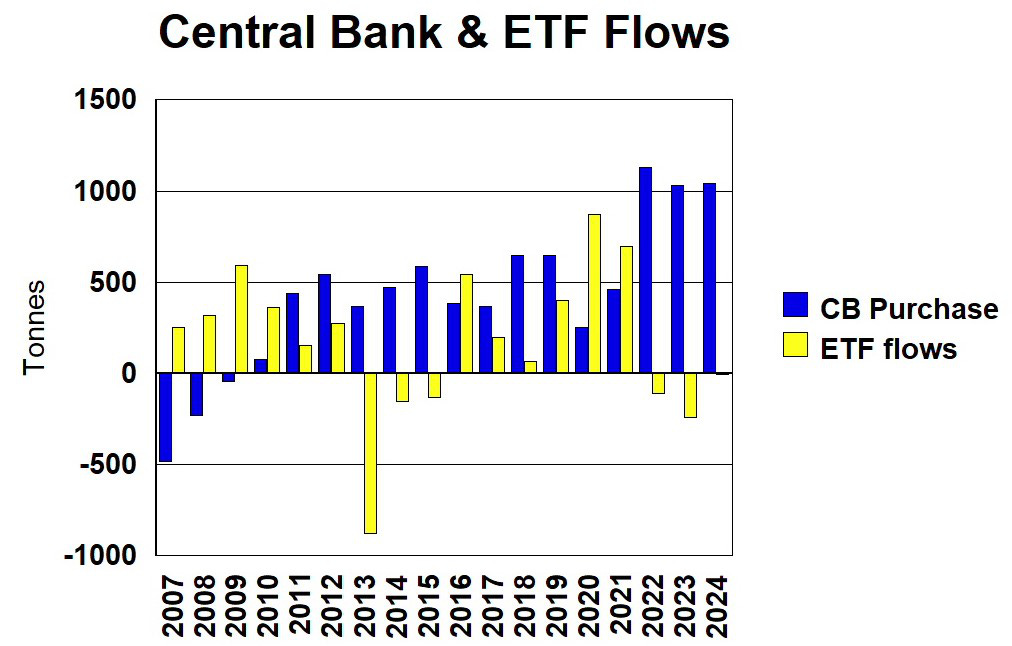

The story remains the same with strong Central Bank demand and investors through ETFs have still not caught on. I updated my charts and you can see that CB demand remains at a torrid pace and Global ETF flows were just slightly negative on the year, at least an improvement from 2022 and 2023. Overall, gold demand hit record highs in Q4 and for 2024.

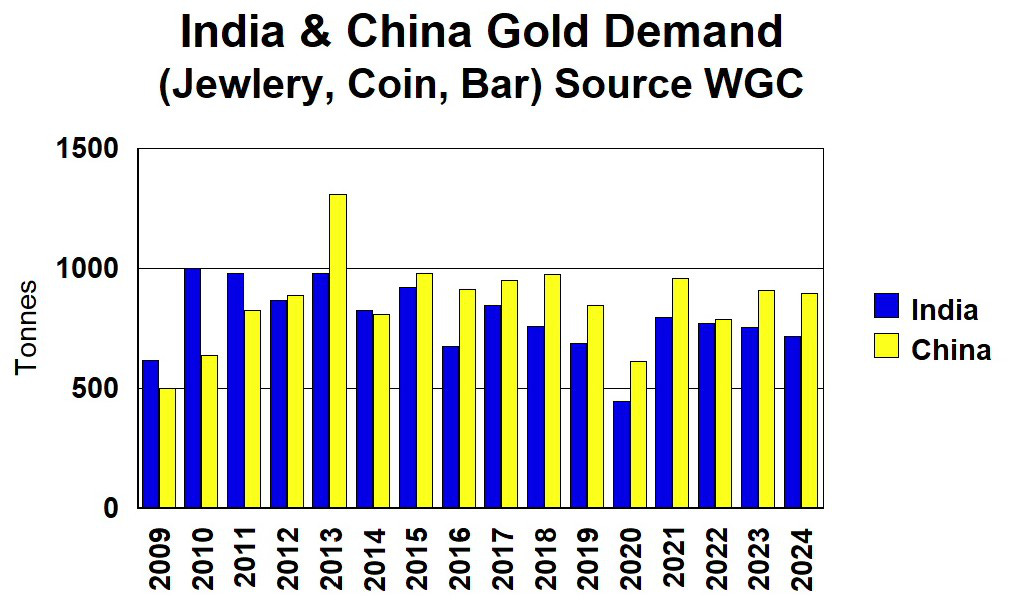

World bar and coin demand has remained in a pretty flat range last 4 years while China and India jewelry, bar and coin demand has remained about the same though at robust levels.

Chinese ETF demand hit a record in 2024. CBs will continue to gobble up gold and I expect North American ETFs to finally join the party in 2025. Global ETFs added 19 tonnes in the last 3 months of 2024 but not enough to offset outflows earlier in the year. This chart shows the quarterly flows.

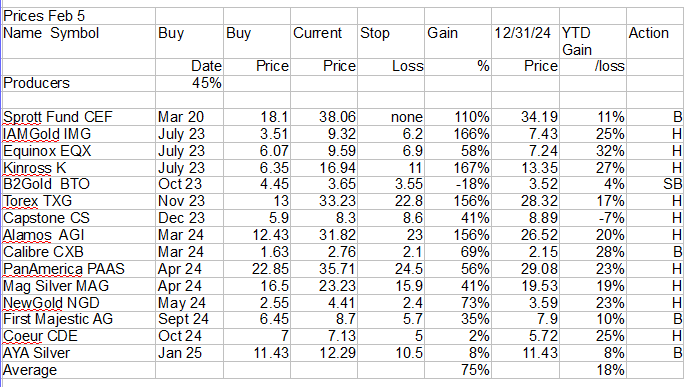

We are off to a strong start with our precious metal stocks with an average gain so far this year of +18% in just over one month. There is a few that I see as good buys. I always list the Sprott CEF as a buy because it is physical metal that you should keep buying or more accurate, keep saving.

Selection List 2025, Precious Metal Producers

I suggest these at 45% of your precious metals portfolio. I plan to update stop/loss levels soon.

For those not so familiar with gold could find this useful. I prompted ChatGDP with a number of questions involving the gold market and also provided it with today's World Gold Council Report to analyze with historic data and came up with the following summary and outlook on gold. Not as bullish as myself and I would stress some points more, but I don't have to focus on consensus data only.

ChatGPT response:

Comprehensive Bullish Report on Gold and Gold Markets

Note: This report incorporates both referenced external research and insights from the uploaded report. All data is provided for informational purposes only and should not be construed as financial advice.

1. Introduction

Gold has long been regarded as a unique asset with safe-haven qualities, a store of value, and a hedge against economic and geopolitical uncertainties. Over the past few years, shifting monetary policies, geopolitical tensions, and structural changes in financial regulations—such as the Basel III framework—have collectively contributed to the changing dynamics of the gold market. This report provides an in-depth analysis of gold’s historical role, key macroeconomic drivers (geopolitics, inflation, and interest rates), the significance of Basel III (implemented in 2022) for central banks’ gold holdings, and a comparison of investor sentiment toward gold versus other major asset classes (bonds, equities, and Bitcoin), as well as sentiment variations between Western countries and the East/BRICs.

Throughout, we present a bullish perspective, arguing that gold is poised for growth into 2025 and beyond.

2. Historical Perspective of Gold’s Role in the Past 100 Years

2.1 Gold Standard and Bretton Woods (1920s–1971)

Interwar Period (1920s–1930s): After World War I, most major economies sought to return to some form of the gold standard. However, economic turmoil and the Great Depression eventually led to frequent devaluations and abandonment of the gold standard by many countries.

Post-WWII Bretton Woods (1944–1971): The Bretton Woods Agreement established a system of fixed exchange rates, pegging major currencies to the U.S. dollar, which was convertible to gold at $35 per ounce. This effectively placed gold at the center of global monetary policy.

2.2 The Nixon Shock and Transition to Fiat Regimes (1971–Present)

End of Convertibility (1971): President Nixon’s decision to end the dollar’s convertibility into gold ushered in a fiat currency era. Gold, freed from its fixed exchange rate, began trading in open markets.

Volatile 1970s–1980s: High inflation in the late 1970s propelled gold prices to record highs (over $800/oz in 1980). When the Federal Reserve raised interest rates aggressively in the early 1980s to tame inflation, gold prices corrected.

Modern Era of Gold Investment (1990s–2020s): Gold transformed from a mere monetary anchor to a key investment asset, especially for diversification, hedging purposes, and central bank reserves.

2.3 Central Bank Holdings

1990s–Early 2000s: Western central banks were net sellers of gold (e.g., the UK gold sales between 1999–2002).

Financial Crisis of 2008: The crisis reignited gold’s safe-haven appeal. Many central banks, particularly in emerging markets (e.g., China, Russia, India), became net buyers.

2010s–Present: Central banks have continued accumulating gold. In 2022, central bank gold purchases reached their highest level in over half a century (World Gold Council, 2023). This strong accumulation trend highlights gold’s strategic value in official reserves.

3. Key Macroeconomic Drivers Affecting Gold

3.1 Geopolitical Uncertainty

Global Tensions: Intensifying geopolitical conflicts and trade disputes (e.g., U.S.-China tensions) often trigger capital flows into gold as a safe haven (World Gold Council, 2022).

Supply Chain Instability: Even if not directly related to gold production, disruptions can lead to global financial instability, making gold more attractive for risk-averse investors (International Monetary Fund, 2022).

3.2 Inflation and Interest Rates

Inflationary Pressures: Historically, gold is seen as a hedge against inflation. Periods of elevated inflation often correspond to rising gold demand (Baur & Lucey, 2010).

Real Interest Rates: There is an inverse relationship between gold prices and real interest rates. When real interest rates (nominal rates minus inflation) are low or negative, holding gold becomes comparatively more attractive. The Federal Reserve’s monetary policy to combat inflation can raise nominal rates, but if inflation remains persistently high, real rates might stay low or negative, supporting gold prices (Federal Reserve, 2023).

3.3 Central Bank Policy

Quantitative Easing (QE) and Balance Sheet Expansion: Continued QE programs or dovish monetary policy in major economies can weaken fiat currencies, bolstering gold’s investment appeal.

Reserve Rebalancing: Central banks, particularly in emerging markets, have been diversifying away from the U.S. dollar and increasing gold holdings—a trend likely to remain intact (BIS, 2022).

3.4 Outlook on 2025 Prices

Inflation Expectations: Persistent inflationary pressures are likely to keep real interest rates subdued, supporting gold prices.

Geopolitical Risks: A multipolar world, with shifting alliances, fosters uncertainty, and gold often shines in periods of global tension.

Ongoing Central Bank Purchases: The continuation of strong central bank buying (led by emerging markets) is expected to provide a floor under gold prices.

Bullish Scenario: Given these supportive factors, many analysts forecast gold prices to test new highs by 2025, with some projections ranging above $2,500/oz (World Gold Council, 2023; Bank of America, 2022).

4. Impact of Basel III Adoption in 2022 on Gold’s Role in Central Banks

Basel III is a global regulatory framework on bank capital adequacy, stress testing, and market liquidity risk established by the Bank for International Settlements (BIS).

Net Stable Funding Ratio (NSFR): Under Basel III’s NSFR rules, physical gold has been viewed more favorably compared to unallocated paper gold. This shift encourages banks to hold physical gold or fully allocated gold products, given the lower funding cost and reduced liquidity risk associated with it (BIS, 2021).

Tier 1 Asset? While gold has historically been treated as a lower “tier” asset, Basel III improvements effectively mean that certain types of gold holdings (fully allocated, with minimal counterparty risk) can be considered high-quality liquid assets (HQLA) in practice. This higher status means central banks and commercial banks may allocate more capital to physical gold.

Central Bank Response: With gold’s improved regulatory treatment, central banks can hold gold as a more stable and liquid part of their reserves, reinforcing the ongoing trend of net gold accumulation (European Central Bank, 2022).

5. Investor Sentiment Toward Gold

5.1 Gold vs. Bonds

Safe Haven Competition: Long-term U.S. Treasuries are also considered a safe haven. However, in an environment of rising rates, bond prices can decline, whereas gold may benefit if inflation remains above nominal yields.

Diversification: Institutional investors often prefer a diversified approach. A mix of gold and high-grade bonds can reduce portfolio volatility (Hillier et al., 2006).

5.2 Gold vs. Equities

Risk-On vs. Risk-Off: Equities tend to perform well during risk-on periods (economic expansions). However, in uncertain times or economic downturns, investors often rotate into gold.

Earnings vs. Store of Value: Equities are subject to corporate earnings and market sentiment; gold’s performance hinges more on macroeconomic factors such as inflation, real rates, and geopolitical risk.

5.3 Gold vs. Bitcoin

Digital Gold? Bitcoin has often been called “digital gold,” but it exhibits higher volatility and has yet to establish itself as a proven safe haven (Baur, Hong, & Lee, 2018).

Regulatory Uncertainty: Crypto markets face evolving regulations. By contrast, gold has a centuries-long history and is regulated via well-established global markets.

Institutional Adoption: While Bitcoin adoption is growing, many institutions remain cautious. Gold still dominates in central bank reserves and institutional portfolios.

5.4 Western vs. Eastern/BRICs Sentiment

Western Countries:

Long History of Paper Assets: Western investors typically hold a large share in equities and bonds. Gold is used mainly as a hedge, generally accounting for a modest portion of portfolios (5–10% range).

Recent Shift: In times of heightened volatility, there is a marked increase in demand for gold ETFs and physical bullion in North America and Europe (World Gold Council, 2022).

Eastern Countries/BRICs:

Higher Cultural and Central Bank Demand: In nations like China and India, gold demand is culturally driven (jewelry and savings). Central banks in Russia and China are also major buyers (China’s official gold reserves recently crossed 2,000 tonnes).

Diversification Away from Dollar: Many BRICS nations have openly discussed reducing reliance on the U.S. dollar, which supports larger gold reserves as a stable monetary anchor (IMF, 2023).

Potential for Gold-Backed Currency: Recent speculation about a BRICS currency backed by precious metals, including gold, indicates strong confidence in gold’s stability.

6. Conclusion: A Bullish Outlook for Gold

Historical Resilience: Over the past century, gold has proven its ability to preserve value amid global economic upheavals, policy shifts, and monetary regime changes.

Favorable Macroeconomic Backdrop: Persistent inflationary pressures, low or negative real interest rates, and continued geopolitical uncertainty set a positive environment for gold.

Regulatory Tailwinds: The Basel III framework’s favorable treatment of physical gold and fully allocated positions fortifies gold’s role in central bank and commercial bank balance sheets.

Eastward Demand: Strong central bank purchases, particularly in emerging markets and BRICS nations, reinforce the importance of gold in official reserves.

Growing Investment Appeal: For both institutional and retail investors, gold remains a critical hedge, an essential portfolio diversifier, and a potential anchor against inflation and currency volatility.

Given these factors, the consensus among many analysts—supported by central bank buying trends and macroeconomic fundamentals—is that gold prices could test or surpass all-time highs by 2025. The combination of strong physical demand, favorable regulatory changes, and geopolitical drivers underscores a bullish trajectory for gold in the medium to long term.

References

Bank for International Settlements (BIS). (2021). Basel III: Finalising post-crisis reforms. Retrieved from https://www.bis.org/bcbs

Bank for International Settlements (BIS). (2022). Annual Economic Report. Retrieved from https://www.bis.org/publ/arpdf

Bank of America. (2022). Global Research - Gold Outlook.

Baur, D. G., & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), 217-229.

Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 54, 177-189.

European Central Bank. (2022). Financial Stability Review. Retrieved from https://www.ecb.europa.eu/pub/financial-stability

Federal Reserve. (2023). Monetary Policy Report. Retrieved from https://www.federalreserve.gov/monetarypolicy

Hillier, D., Draper, P., & Faff, R. (2006). Do precious metals shine? An investment perspective. Financial Analysts Journal, 62(2), 98-106.

International Monetary Fund (IMF). (2022). Global Financial Stability Report. Retrieved from https://www.imf.org/en/Publications/GFSR

International Monetary Fund (IMF). (2023). Central Bank Reserves Data.

World Gold Council. (2022). Gold Demand Trends. Retrieved from

https://www.gold.org

World Gold Council. (2023). Central Bank Gold Reserves Survey. Retrieved from

https://www.gold.org

Disclaimer: The information provided in this report is based on publicly available data, internal analyses, and cited sources. Market conditions can change rapidly, and past performance is not indicative of future results. Always consult with a financial professional before making investment decisions.