Inflation and Gold, AZT, GSI SALT, MMA, AYA

Inflation and Gold

Dear reader, I expected inflation would ease in the 2nd half of the year as the economy slowed, but it appears to have started. The consumer-price index rose just 0.1% last month, the Bureau of Labor Statistics said today. That was a tick below Wall Street’s forecast.

The 12-month increase in consumer prices edged up to 2.4% from a four-year low of 2.3%. As I previous explained, trade and tariffs are complex and simply don't mean rising prices. Surprise, surprise, surprise!!! as Gomer Pyle would say. Consumer prices showed little sign of tariff-related increases for the third month in a row, defying main stream expectations of a significant rise in inflation tied to ongoing U.S. trade wars. As I commented a few times, the main stream is so focused on Trump bashing, they spin a negative story on everything he does, those people don't get a balanced view of what is really happening.

The so-called core rate of inflation also moved up a slight 0.1%. The core rate excludes volatile food and energy prices and is seen as a better predictor of future inflation. Year over year core inflation was 2.8%.

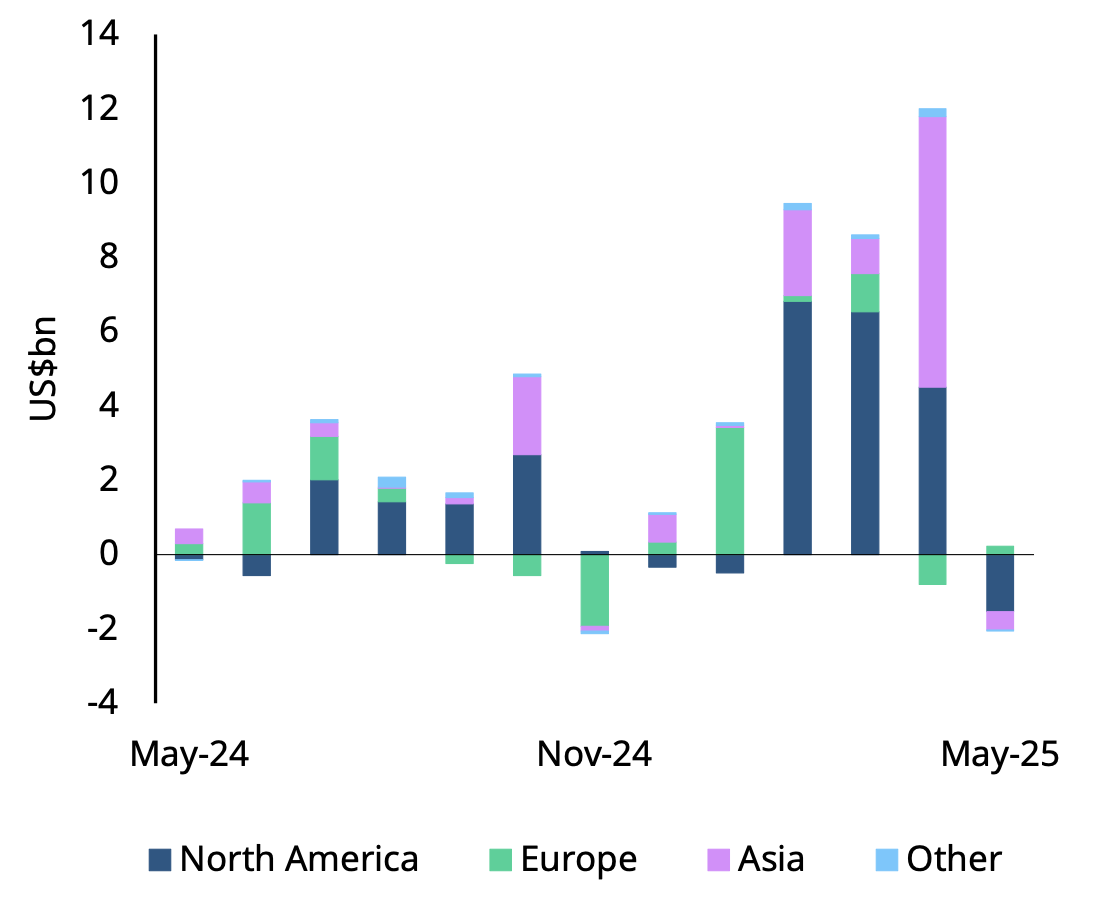

While gold is a good inflation hedge, so it is a positive factor, but this bull market thus far is mostly driven by Central Banks movement out of US$ and into gold. There has also been strong investment and retail demand out of Asia. North America has just started to catch on in the last few months as gold remains under owned by most.

The last study by the World Gold Council last year revealed that more than half of investment professionals held at least 1% in gold assets while 24% had an allocation of 3% or more. I remember days when the average was around 6%.

Optimized “60/–40/+Gold” models: Studies show substituting 10–35% of bonds with gold improved risk-adjusted returns (Sharpe ratios), particularly through the 2005–2020 period.

It looks like investors took some profits in May. Global gold ETF flows flipped negative in May (-US$1.8bn): North America (-US$1.5bn) and Asia (-US$489mn) led outflows while Europe witnessed inflows (+US$225mn). Global gold ETFs’ total AUM fell 1% to US$374bn amid the May outflow. Meanwhile, holdings lowered by 19t to 3,541t.

Aztec Minerals - - TSXV:AZT, OTCQB: AZZTF - - - Recent Price - $0.22

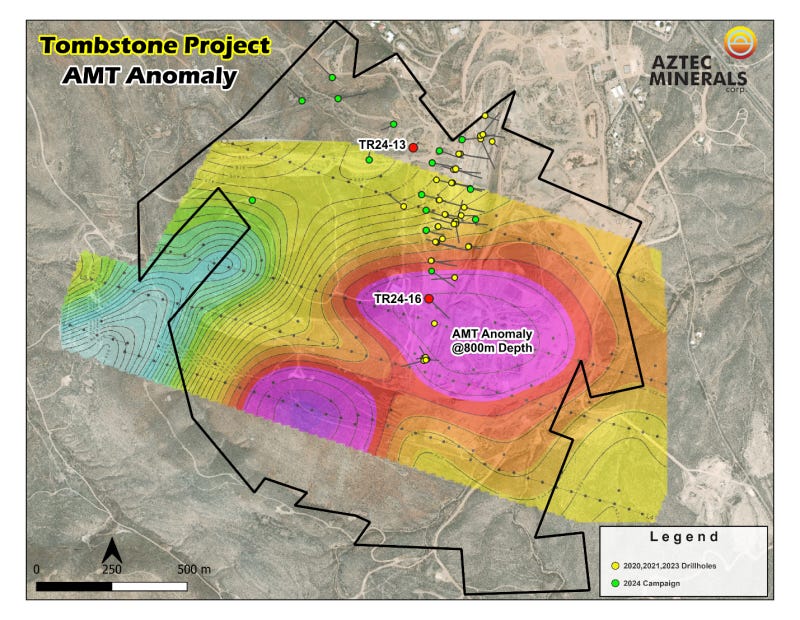

Aztec announces a 5000-meter reverse circulation (RC) and core drilling program at its Tombstone project, Arizona. The drilling program now underway is targeting shallow zones identified as prospective for high-grade oxide gold-silver mineralization associated with recently completed drilling in late 2024, including the discovery of bonanza grade silver-gold in a new Southern extension discovery in hole TR24-16 of 569 gpt AgEq (18.3 opt AgEq – 290 gpt Ag, 3.48 gpt Au) over 25.8 m , the highest silver grade encountered in drilling to-date by Aztec at the Tombstone Project.

The above map shows the high grade hit in TR24-16 and one hole will be drilled as a step out from that to the North. The drilling program is designed to expand the known mineralization horizontally and down dip beyond the holes drilled in 2020-24 at the Contention Pit and Westside areas with step outs to enlarge the shallow, broad, bulk tonnage gold-silver mineralization discovered there, and explore the identified deep CRD targets in the property.

I have been suggesting to buy the stock ahead of drilling and it has moved up in the past month. It now looks poised to break out on the chart. It appears it will soon break $0.24 and test $0.30

Like many advanced juniors, it is amazing how cheap this stock is for the discovery they have.

Atlas Salt - - - - TSXV:SALT - - - - Recent Price $0.52

SALT has announced a new CEO and is updating their feasibility that has helped push the stock back up. Nolan K. Peterson, MBA, CFA, PEng, is the new CEO and has over 20 years experience in the mining sector.

He was a senior leader in the successful delivery of the New Afton ($750-million), Rainy River ($1-billion) and Hope Bay ($250-million) mining projects in addition to extensive project development work with companies including Barrick, Newmont, Rio Tinto and QuadraFNX. Most recently served as CEO and president of World Copper Corp. from 2021 to 2023, where he completed the merger with Cardero Resources Corp. and concurrently advanced the Escalones and Zonia projects in Chile and Arizona, respectively.

Building on the feasibility study completed in 2023, thie updated one will incorporate significant advancements and optimizations to enhance the project's development strategy.

On the chart, the stock looks undecided with strong resistance at $0.60. I suggest a hold for now until some further developments of price action provides better timing to buy

Gatekeeper Systems - - - TSXV:GSI - - - - Recent Price - $0.72

I have not updated GSI in a while. The company has been doing well, but like most TSX Venture listed stocks cannot get any traction. It recently moved up on a slew of sales announcements

June 9th Gatekeeper has won a $420k project to provide video solutions and software subscriptions for a school district fleet of over 70 buses in Nebraska.

June 4th Gatekeeper signed a $900k contract with a major school transportation company to install video on a school district fleet of over 200 school buses in Missouri.

June 3rd, Gatekeeper expanded its contract with a school district in Florida.

May 28, Gatekeeper signed a $315k contract with a school district in Virginia to upgrade its fleet of approximately 100 buses with new video, mobile data collectors and live view wireless subscriptions.

May 27, Gatekeeper won a $333K contract with a school district in Indiana for a fleet of approximately 100 buses.

May 22, Gatekeeper executed a $78sk contract with Marion County Public Schools, Florida, to upgrade its entire fleet of approximately 300 school buses with new mobile data collectors and video devices.

May 12, Gatekeeper was awarded a $523k contract with a school district in Nevada.

April 28th they reported Q2 results. Revenue for the three and six months ended February 28, 2025 was $5.9 million and $ 13.2 million respectively. In Q2 they added two new Canadian transit agencies to a growing list of transit customers, which now stands at over 60. More are expected in the U.S. They have great technology and trends are in their favor. Transport Canada regulation came into effect Dec. 18, 2024, and all new school buses will be equipped with perimeter visibility systems as of Nov. 1, 2027.

The chart action is very positive with a break out and higher high. I will be watching the $0.88 level and expect a test of that. If the stock cannot break through this, I will probably suggest selling. We have been in the stock a long time, but in fairness they went through the whole covid fiasco that set all Canadian companies back.

Midnight Sun Mining - - - TSXV: MMA OTC:MDNGF - - - Recent Price - $0.62

Midnight Sun reported that diamond drilling is underway at the Kazhiba Target 2 sulphide copper target on the Company's Solwezi Project in Zambia.

Midnight Sun's President & CEO, Al Fabbro, states "Kazhiba Target 2 represents an exciting opportunity to reach a major new milestone for Midnight Sun. By utilizing a phased sequence of exploration methods, we have checked all the boxes to prepare for this initial drill program, and I am extremely excited for the results of the hard work being done by our technical team."

The planned six to eight diamond drill holes totalling approximately 1,000 metres are designed to test the ~four-kilometre by two-kilometre Kazhiba sulphide copper target, where the Company has identified an overlapping copper signature in Partial Ionic Leach testing, a strong VTEM geophysical anomaly, and high chargeability / low resistivity responses from induced polarization geophysics all coinciding with geology consistent to most deposits in the Zambian Copperbelt. A water supply borehole has been completed, and the company is now underway with the first diamond drill hole, which is KAZ-25-003, and has a target depth of 150 metres.

Additionally, geochemical sample collection at Mitu has been completed. The samples are now being prepared for Partial Ionic Leach assaying at ALS Chemex.

Near term direction of the stock seems uncertain and could make a big move on drill results. Right now we have a break out from a wedge pattern, but I would like to see a break out to a higher high as a buy signal. However, any move to the bottom up trend line would be a buy, under $0.60.

Aya Gold & Silver - - - TSX: AYA; OTC: AYASF - - - Recent Price - C$13.30

The stock was breaking out but then AYA announced a $100 million bought deal financing at $13.35. Today with excess demand they increased it to $125 million.

Late last week AYA announced new high-grade drill exploration results from its 2024 - 2025 program at Boumadine in the Kingdom of Morocco. Today's results extend the Imariren mineralized trend by 400 meters (“m”), confirming high-grade continuity along the Boumadine Main Trend. In addition, Aya is pleased to announce the addition of four (4) new permits to the west, expanding the Boumadine exploration footprint by 15.7% to over 314.5 square kilometers (“km2”).

High-Grade Intercepts on the Boumadine Main Trend:

BOU-DD25-516 intercepted 5,373 g/t silver equivalent (“AgEq”) over 0.5m (66.7 g/t gold (“Au”), 111 g/t silver (“Ag”), 1.6% zinc (“Zn”), 1.0% lead (“Pb”) and 0.1% copper (“Cu”) and 114 g/t AgEq over 9.0m (1.24 g/t Au, 6 g/t Ag, 0.2% Zn, 0.1% Pb and 0.1% Cu)

BOU-DD25-513 intercepted 591 g/t AgEq over 1.8m (5.19 g/t Au, 118 g/t Ag, 1.0% Zn, 0.2% Pb and 0.5% Cu) and 698 g/t AgEq over 2.9m (5.52 g/t Au, 109 g/t Ag, 5.2% Zn, 0.2% Pb and 0.3% Cu)

BOU-DD24-465 intercepted 199 g/t AgEq over 10.6m (0.48 g/t Au, 81 g/t Ag, 2.0% Zn, 1.3% Pb and 0.02% Cu)

High-Grade Intercepts on the Tizi Zone:

BOU-DD24-478 intercepted 460 g/t AgEq over 3.3m (4.61 g/t Au, 75 g/t Ag, 0.5% Zn, 0.1% Pb and 0.1% Cu)

BOU-DD24-474 intercepted 302 g/t AgEq over 4.0m (2.38 g/t Au, 37 g/t Ag, 2.5% Zn, 0.6% Pb and 0.1% Cu)

Extension of the Imariren Strike Length to 0.7km:

BOU-DD25-509 intercepted 296 g/t AgEq over 9.3m (2.18 g/t Au, 62 g/t Ag, 1.5% Zn, 0.7% Pb and 0.1% Cu), including 1.6m at 897 g/t AgEq

BOU-DD25-504 intercepted 349 g/t AgEq over 6.6m (3.69 g/t Au, 46 g/t Ag, 0.3% Zn, 0.2% Pb and 0.05% Cu), including 1.2m at 851 g/t AgEq

BOU-DD25-511 intercepted 449 g/t AgEq over 4.9m (1.95 g/t Au, 270 g/t Ag, 0.6% Zn, 0.1% Pb and 0.1% Cu)

From the news release “Today’s high-grade drill exploration results highlight the scale and continuity of Boumadine and mark a significant step in unlocking its full potential,” said Benoit La Salle, President & CEO. “High-grade holes BOU-DD25-513 and BOU-DD25-516 confirm strong continuity of the Boumadine Main Trend at depth—this is the backbone of the deposit and will form the foundation of our upcoming PEA.”

This is going to be a very robust mine for AYA's 2nd mine. We are up pretty good on the stock, but with these results and the big money is fine to buy here, we can too if you don't already have a position. The pull back below the break out is probably temporary because of the finance news.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.