Welcome and thankyou to all the new savy and contrarian investors who have joined my substack.

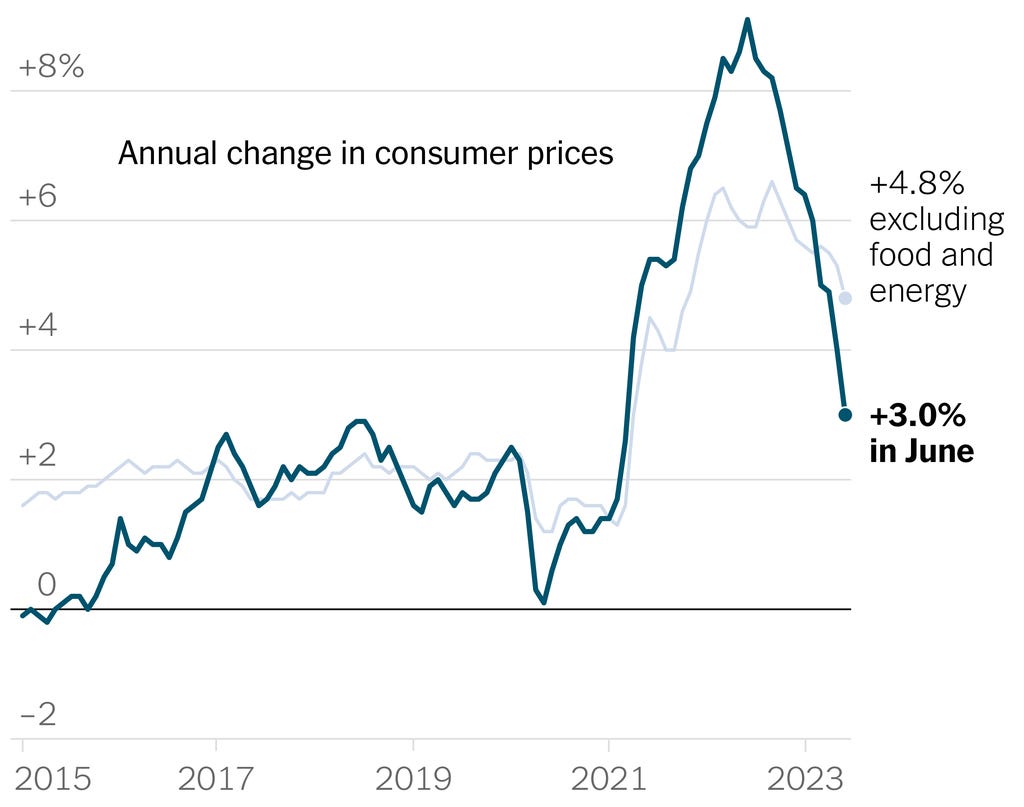

Markets have been doing well, especially the magnificent seven stocks, but I don't think it will last long. Right now the outlook is rosy for the economy and stock markets because a big belief in a 'soft landing'. Meaning the Fed is succeeding in bringing down inflation without damaging the economy too much. The June inflation report was a celebration and July's report due next week will probably look good too. CPI dropped to 3% YoY in June, down from a 4% headline in May, and expectations of 3.1%

Inflation will Return

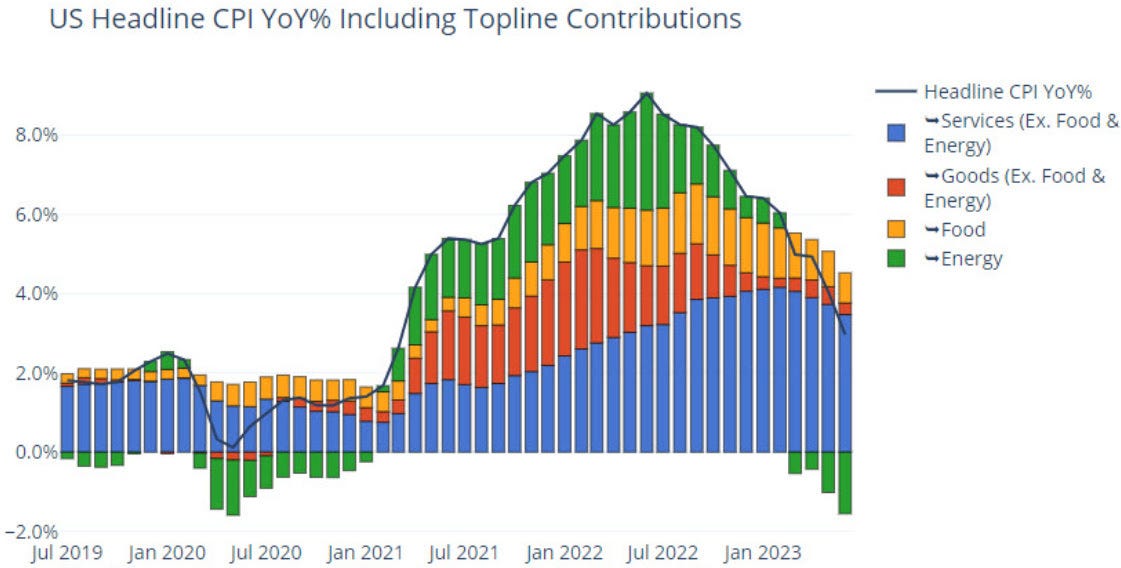

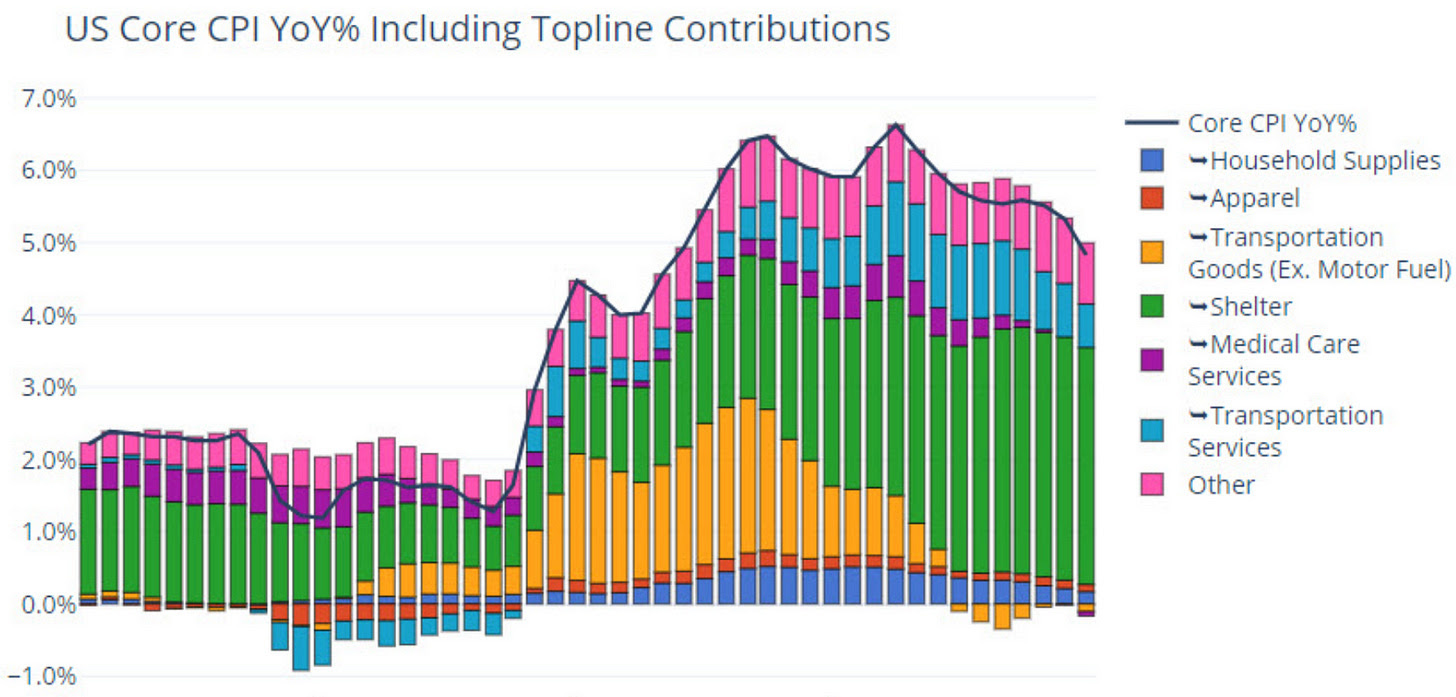

As I have been commenting for sometime, the headline number has been coming down because it is comparing to last years high oil and gas prices. While energy commodities have dropped 26.8% YoY, transportation services, new vehicles, medical care, food and shelter remain stubbornly high. You know what happens when oil and gas no longer pull down the numbers. The next chart highlights how negative energy prices are pulling down the headline number.

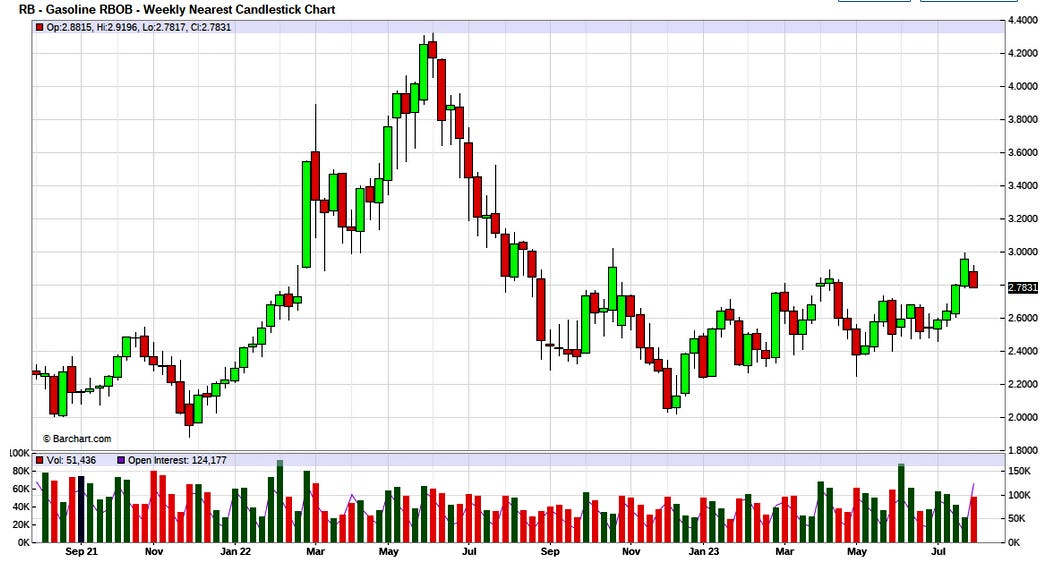

This next chart is gasoline prices and you can see that they were still quite a bit higher last July compared to this July. However, once we get into August and September we will no longer see the headline inflation number pulled down by falling energy prices. That said, maybe gasoline prices will fall, but we are in the summer driving season, hurricane season is arriving and inventories are at new lows.

This season, most forecasters have been confident of an unusually busy hurricane season. Specifically, earlier in July, the CSU team called for a "borderline hyperactive" season in the Atlantic Basin in 2023, with as many as nine hurricanes expected to form. The upgrade was primarily attributed to extremely warm ocean water in the Atlantic where storms like to form, forecasters said.

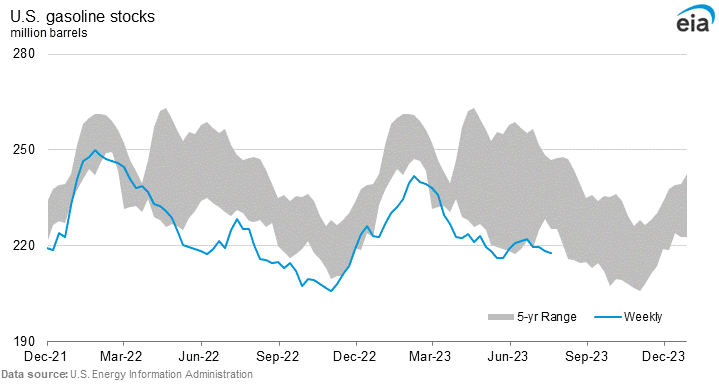

You can see on this chart of gasoline inventories that they are even below last years record lows for this time of year. Inventories are tight and any refinery shutdowns for storms are going to spike prices higher.

Core inflation, which excludes food and energy - only grew by 0.2% MoM, after climbing by 0.4% or more for the past six months. However, it remains not far off the highs. Shelter costs that measure mortgage payments that will only rise with higher interest rates and rents will remain high because of a housing shortage and record immigration. This number is going to be sticky.

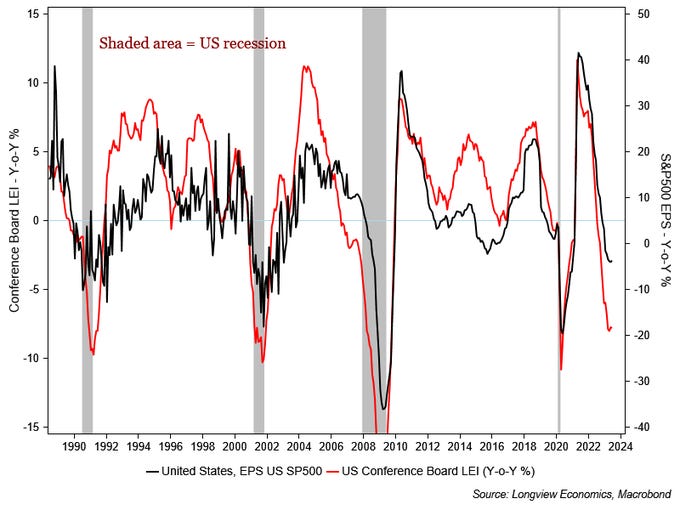

I don't believe markets will do very well when inflation raises it's ugly head this fall. I have been predicting a recession in the 2nd half of this year and perhaps it will be delayed one or two quarters, but it is coming. The most reliable indicator of recessions is the Leading Economic Index (LEI) which fell for the 15th consecutive month in June, falling 0.7%.

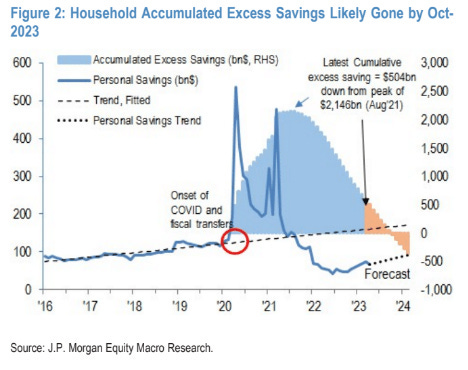

I believe what has delayed the recession is what JP Morgan calls 'Stealth Stimulus' supporting the economy. Biden's high deficit spending that is on track for a $1.5 trillion deficit for 2023. The other big factor is the Covid stimulus is still around but it will go negative in the 2nd half of 2023, according to JP Morgan. Like I have been preaching the last few years, Covid-19 policy reaction is the elephant in the room for the economy and markets.

All the Kings Men could not put him together again. Oh wrong nursery, it’s Robinhood

While I am on this topic, the Robinhood investors have lost most of their Covid-19 stimulus too. Robinhood peaked with 17.3 million users in 2021 and down to 11.4 million at the end of 2022. Insiders have been continually dumping the stock since Q4 2021 and by the looks of the stock chart, there is no big change in the trend. Other than a bit of an up tic in the last few months with a bullish market outlook.

I also watched a Netflix documentary on GameStop (GME) and it also sounds like many moved their Robinhood accounts after being screwed with buying restriction on GameStop and a couple others that caused them to plummet in price. Same old story, the big guys win at the expense of the retail traders.

Markets are too frothy and earnings keep falling. With about half the S&P 500 reporting, the decline so far this quarter is -7.3%. If -7.3% is the actual decline for the quarter, it will mark the largest earnings decline reported by the index since Q2 2020 (-31.6%). It will also mark the third straight quarter in which the index has reported a decrease in earnings.

I have been talking about a September/October correction, but I have witnessed years where fall corrections started in August. Stocks dropped today when US debt was down graded and upset Janet Yellen, so eventually the US deficits will have to be addressed. Fitch Ratings downgraded its US debt rating on Tuesday from the highest AAA rating to AA+, citing “a steady deterioration in standards of governance.” Regardless, I am following some great companies/stocks and plan on using this fall correction as a buying opportunity. Governance? They can only be talking about Biden's crazy spending.

Trudeau’s Abyss

And in other news, Trudeau and his wife are separating. We all knew it was coming, even his own wife cannot put up with him any longer, along with everyone else.

Abacus Data has released a comprehensive poll on Canadian voter intentions and the results indicate a possible electoral disaster may be looming for the Liberal government.

The Liberal Party under Justin Trudeau’s leadership has traditionally counted on consistent and strong support among women and younger Canadians. But for the first time since winning the government in 2015, the Liberals are trailing in both categories.

The rise in the cost of living is the top issue of concern for voters by a large measure, coming in at 72 percent. Health care is the second most important issue at 45 percent, followed by housing affordability at 43 percent. Climate change and the environment fall well back, as only 29 percent of those polled see it as a top issue. Trudeau is completely out in left field as a clueless fool.