I find it hard to believe that markets were surprised by the inflation numbers. It just proves how foolish the narrative is. Wall Street has been talking about a Fed pivot for 2 years. However, as I keep saying, inflation has become entrenched and at best we get two 1/4 rate cuts as the only move down. Trudeau and Biden keep spending out of control driving inflation, crazy immigration numbers that put pressure on services and higher taxes adding to prices. As I pointed out, higher inflation was clear as day, especially with rising energy prices.

The latest Consumer Price Index has reinforced more hawkish expectations after accelerating to an annualized 3.5% in March, or an amplified 0.4% M/M, while elevated core figures are also a cause for concern. Economist were predicting at 0.3% rise and I think this was only the case because it fit the narrative and was wishful thinking. The yield on the 2-year note soared more than 22 basis points to trade near 4.97%, while the 10-year yield climbed 19 bps to top 4.55%. Stock market indices fell back. Bond traders are preparing for US Treasury yields surpassing 5%.

I also keep commenting that we are in a period of stagflation like the 1970s and early 1980s. Inflation is not going away but the economy continues weak as too many people were believing and still are on that silly narrative that interest rates will come back down. The strong job numbers and GDP is being manipulated too much, but the weak economy shows all up over the place.

Credit card delinquency rates reached their highest level on record in Q4 2023, according to the Federal Reserve Bank of Philadelphia. "Firms recording the worst 30+, 60+, and 90+ account-based days past due levels," the report said.

U.S. retail sales have been falling since last September and this is much more negative when you factor in the inflationary increases. You can basically take -3.5% from these numbers.

It is only a matter of when stock markets crack from the false narrative. My 2024 outlook is pretty much going as predicted with oil and gold moving into new bull markets. I predicted the best chance for the S&P 500 going up was in the first half of the year. That said, the first quarter was a stronger move up than I was thinking.

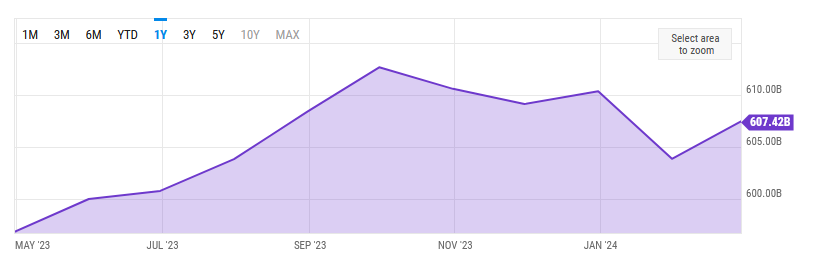

Gold bumped lower on the CPI numbers and the talking heads bring out the same narrative nonsense that it is because of a delayed Fed pivot. Gold is telling us that there is a loss of confidence in the management of the economies and fiscal policy. Central Banks continue to buy gold at record amounts. I saw reports that Costco is now selling over $200 million of physical gold per month. Comex Gold is up over $30 today.

The question should not be how high is gold going? but do you own enough?

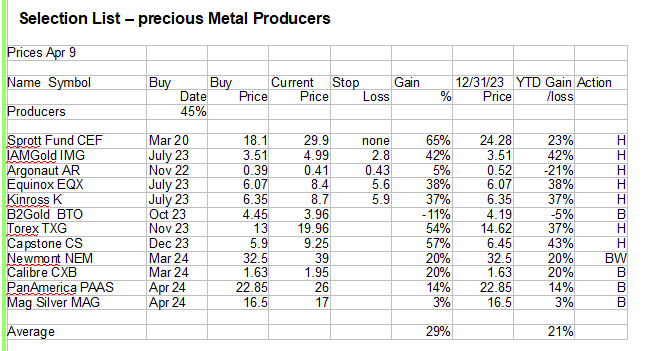

We have been buying a number of precious metal producers, the bigger companies so here is an update on the Selection List. We have a pretty good diversified lot of the better ones that I can see. I will update the list soon with new stop/loss levels on all of them.

Selection List – precious Metal Producers

My plan now is to buy some of the advanced juniors with deposits that are takeover targets. Literally hundreds of agreements have been signed, with most flying under the radar of mainstream media and retail investors.

Take the third quarter of 2023, when there were 323 M&A announcements totalling $14 billion, according to GlobalData’s Deals Database. The biggest one was the $3.4B minority acquisition of Vale Base Metals by Engine No. 1 and Manara Minerals Investment. This is typical what you see at major bottoms and turnarounds.

In my Silver report about a week ago, I commented that I expected India to drive the first phase of higher silver prices. New data just came out, reported by Reuters. India's silver imports surged by 260% in February to a record high, as lower duties encouraged large purchases from the United Arab Emirates, government and industry, adding they were on track to increase by 66% this year.

India imported a record 2,295 metric tons of silver in February, up from 637 tons in January, said a government official.

Bitcoin Trading

Now that the ETFs have been trading a while and we have some history and trends we can take advantage of the large volatility. I am going to put a web page up on my site called Bitcoin Central to provide info, data and charts etc. on Bitcoin and the ETFs. There is also ProShares Short Bitcoin ETF (BI TI) that has been out about 2 years. It only has $80 million in assets as few are playing the short side of Bitcoin. I am going to use this for sell or short suggestions and the iShares Bitcoin Trust (BlackRock) IBIT for buying or going long. I am than going to track my performance.

I will primarily use sentiment indicators, fundamental analysis and technical analysis on the charts to make my long and short suggestions. I will also use stop/losses with the high volatility of Bitcoin. Most likely the first trade will be on the short side, as I expect a correction. I am now just contemplating the right timing.

Aztec Minerals - - - - TSXV:AZT - - - - - - Recent Price - $0.22

Entry Price - $0.40 - - - - - - - Opinion – buy

AZT provided an update on the gold-silver exploration program at the Tombstone project in southeastern Arizona. The goal of the 2024 exploration program is to continue with drilling to expand the large, shallow, gold-silver-oxide mineralized system and make it amenable for future resource delineation.

Simon Dyakowski, Aztec chief executive officer, commented: "Our initial 2024 surface exploration program on the Tombstone project has the potential to create significant value for shareholders, by expanding the target area for shallow oxide gold-silver mineralization adjacent and below the Contention open pit. The broad intersections of high-grade oxide gold and silver from recent drilling support the concept of defining a potentially large mineralized system. The first phase of exploration in 2024 is expected to generate high-priority expansion drill targets to grow the mineralized zone with a goal of defining a larger geological model for future resource estimation.

The following are highlights of recent drilling intersections supporting the conceptual exploration model for mineralized footprint growth. I expect the next drilling to get similiar results and in this better market, the stock will move.

TR21-22: 2.44 g/t gold and 66.56 g/t silver (3.39 g/t gold equivalent (AuEq)) over 65.5 metres (including 16.80 g/t Au and 374.36 g/t Ag over 7.6 m);

TR21-03: 5.71 g/t Au and 40.54 g/t Ag (6.28 g/t AuEq) over 32 m;

TC 23-01: 3,477 g/t Ag over 1.52 m from a zone of 733.9 g/t Ag over 7.6 m, within 125 m of 1.63 g/t AuEq;

TR21-10: 1.39 g/t Au and 56.40 g/t Ag (2.20 g/t AuEq) over 96 m;

TC23-05: 2.82 g/t gold and 176.64 g/t silver (5.02 g/t AuEq) over 36 m, including 6.45 g/t gold and 408.47 g/t silver (11.55 g/t AuEq) over 15.5m.

Better performance is still very spotty with the junior explorers but this stock has started to firm up with the better gold market.

Nektar - - - - - Nasdaq:NKTR - - - - - - - Recent Price - $1.66

Entry Price - $0.68 - - - - - - Opinion – hold

The stock broke higher again today and often on a break out a stock will move up 2 or 3 days, so I will be watching. We now have gains over 140% and I will probably suggest selling tomorrow or next week.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.