Inflation, S&P 500 Retreats from Resistance, Centamin takeover, Oil

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

Headline inflation was expected to come in at 2.5% and that is exactly what it did and the lowest since February 2021. But core inflation came in hotter than expected, driven by housing costs. The surprise core increase likely erases chances of a 50-basis-point cut by the Fed this month. However the Fed will cut 25 points and the Biden administration will get it's pre-election cut.

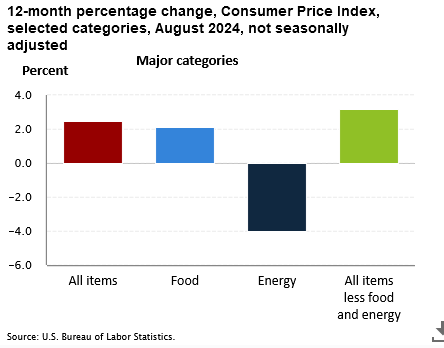

The core CPI reading rose unexpectedly to 0.3%, from 0.2% the previous month. The all items less food and energy index rose 3.2 percent over the last 12 months. The energy index decreased 4.0 percent for the 12 months ending August. Energy is very volatile and although it has helped bring inflation down, it could just as easy reverse course and head back up. The inflation battle is not won yet, but progress has been made.

There are two broad categories that are still high. Unadjusted 12 months, Shelter at 5.2% and Transportation at 7.9% (insurance and maintenance/repair). The shelter inflation, given its weight in the CPI has to come down to get back to more price stability.

Interesting is that used cars and trucks saw another -1.0% drop. For 12 months -10.4% that signals weaker demand with a poor economy.

Tomorrow we get Initial Jobless claims that consensus expects little change around 225k and Producer Price Index, expected at 0.2%.

Markets did not like the inflation news, probably because the chance of a 50 point cut looks remote and it's September as well. More important is the S&P 500 failed to break the resistance level and has fallen back. The previous support level around 5,500, now becomes resistance and the index has failed to break through the last two days.

One of our Millennium stocks, Centamin received a take over offer from AngloGold Ashanti yesterday.

Centamin PLC - - - TSX:CEE - - - Recent Price - $2.64

Entry Price - $1.72 - - - Opinion – hold for cash component and dividend

Under the terms of the Transaction, Centamin Shareholders will be entitled to receive, for each Centamin Share, 0.06983 AngloGold Ashanti Shares and $0.125 in cash. The deal values Centamin around US$2.5 billion.

I did the calculation yesterday and it will vary with exchange rates and AngloGold share price but it comes out to around $2.85. Plus, if you hold you will also get the US$0.0225 dividend on September 27th.

Although we have a nice 56% gain, I suggest to hold the shares and take the AngloGold shares and US$0.125 per share in cash. At a later date, I will probably suggest selling the AngloGold shares.

Bitcoin hit 58,000 end of the ETF trading day yesterday. I would have suggested to sell and take the quick profit in IBIT but that is one of the challenges with the ETFs because they only trade during market hours while Bitcoin trades 24/7. Bitcoin is selling off with the market today as is quite common.

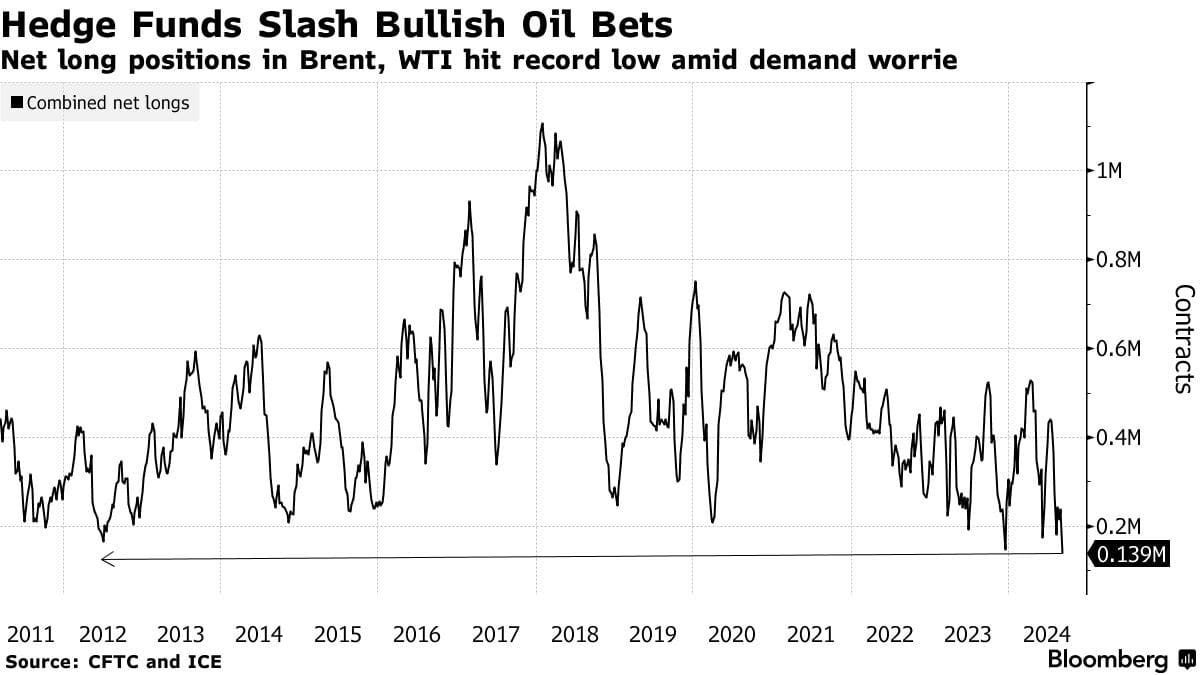

Our oil stocks have taken a hit, but in the past year when Hedge Funds get this short, the oil price has bounced back. I am watching the chart for a signal of a bottom.

In the last few years when oil got down to these levels it bottomed and bounced off the $63/$64 area so I am watching for a bounce off a little lower level. So far today we have a doji candle stick which indicates indecision. Lets see how the day ends, but short term oil is over sold and we should at least see a relief rally. Like I commented before, the oil price is screaming recession.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.