Interest Rate Decline Ending, Oil, Intel (INTC)

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

Interest Rates are Headed Back Up

For the past year I have been warning that interest rate reductions would be limited to a drop of around 1.0% to 1.5%. My reasoning was too much government debt and out of control spending would pressure the bond markets where rates are really set. Plus, inflation is not defeated yet, although good progress has been made. Falling energy saved the day. The Fed and BoC make all the headlines with their rate cuts but that only effects short term rates. We need Bond markets to agree if we want to see good reductions on loans and mortgages where it really counts.

Now we are seeing prove that my warning and prediction is turning out. I am surprised it took this long. Bond markets are not happy with the crazy spending of governments in Canada and the U.S. and their rates are increasing while the Central Banks are reducing rates. If you were hoping lower rates would save you at mortgage renewal time, I suggest forgetting about hope and get a plan.

Canada has dropped rates so far 1.25% and the U.S. 0.50%. I will look at Canada first and then the U.S..

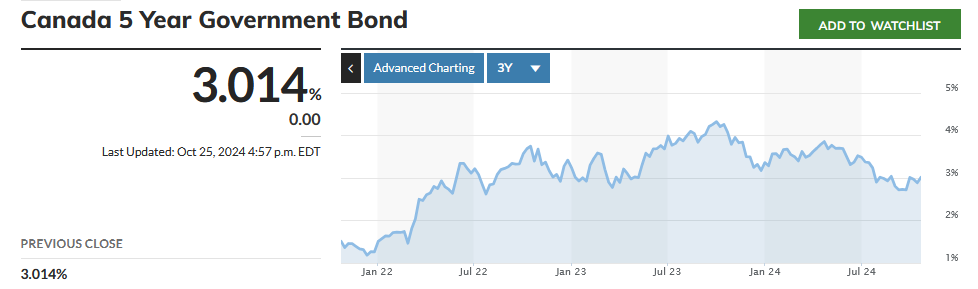

There was much news and fanfare with Canada's 1/2 point cut, but the 5 year bond that is the biggest influence on mortgage rates went the opposite direction and increased.

This is a 3 year chart and rates peaked around 4% last year and are now down to around 3%. Mortgage rates will typically be 1% to 1.5% higher and 5 year mortgage rates are currently around 4.35% to 4.75%. Shorter term on the above chart, rates dropped to about 2.7% in September and are now higher even though the BoC cut rates a big 0.5%.

It is going to be government debt and spending that influences rates the most as I have been warning. Canada just released deficit numbers for the last fiscal quarter and it is very bad.

The federal government’s deficit was $9.8 billion for the April-to-August period. The Finance Department’s latest fiscal monitor says the result compared with a deficit of $4.3 billion during the same period a year earlier.

Revenue for the period rose by $16.7 billion or 9.3 percent compared with a year earlier due to increases in all major categories.

Program expenses excluding net actuarial losses rose by $17.9 billion or 11 percent, as Ottawa spent more on direct program expenses, major transfers to persons, and major transfers to provinces, territories and municipalities.

Public debt charges were up by $4.4 billion or 23.1 percent, mostly due to higher interest on marketable bonds and treasury bills.

As you can see the government does not have a revenue problem as it was up 9.3%, but they have a big spending problem. I don't see any change with this Trudeau government so don't expect much more in interest rate relief. We will be lucky to see the 1.5% reduction at the top of my range.

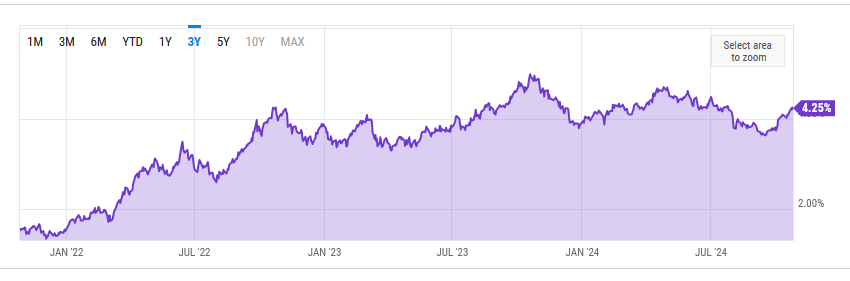

It is the same story in the U.S., where the best yard stick for their rates is the 10 year treasury yield. The yield (interest rate) peaked around 4.7% a couple times and dropped to about 3.7% in September. Since the Fed cut 1/2% and the Treasury yield has popped back up to 4.25%.

Like Canada, out of control spending by the U.S. government is putting pressure on bond markets.

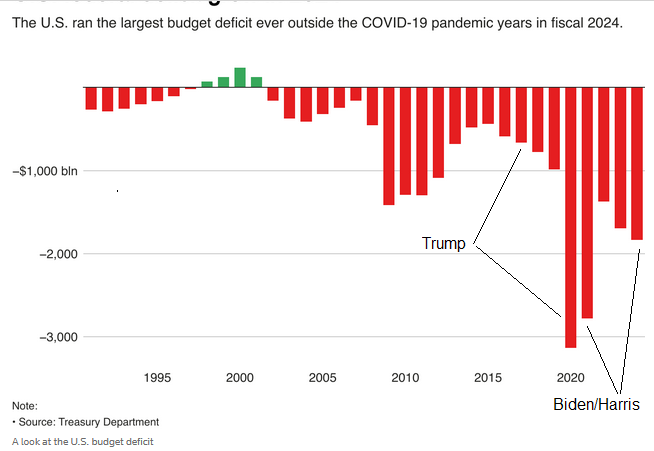

Oct 18 (Reuters) - The U.S. budget deficit grew to $1.833 trillion for fiscal 2024, the highest outside of the COVID era, as interest on the federal debt exceeded $1 trillion for the first time and spending grew for the Social Security retirement program, health care and the military, the Treasury Department said on Friday.

The deficit for the year ended Sept. 30 was up 8%, or $138 billion, from the $1.695 trillion recorded in fiscal 2023. It was the third-largest federal deficit in U.S. history, after the pandemic relief-driven deficits of $3.132 trillion in fiscal 2020 and $2.772 trillion in fiscal 2021.

The sizable fiscal 2024 budget gap of 6.4% of gross domestic product, up from 6.2% a year earlier, could pose problems for Vice President Kamala Harris' arguments ahead of the Nov. 5 presidential election that she would be a better fiscal steward than Republican opponent Donald Trump.

U.S. receipts for the 2024 fiscal year hit a record $4.919 trillion, up 11%, or $479 billion, from a year earlier, as individual non-withheld and corporate tax collections grew. Fiscal 2024 outlays rose 10%, or $617 billion, to $6.752 trillion.

The government had an excuse in 2020 and 2021 with the Covid-19 Plandemic and it looked like things were getting back in control in 2022 but not so. Excess spending has occurred at an alarming rate and that is what has bond markets concerned. They already saw one round of inflation erode the value of the US$ caused by excess spending and markets are going to command higher rates going forward until the government gets spending under control.

It is looking like Trump will win the election and I commented that if that happened there was a slight chance of reduced spending. I am now going to say there is a fair chance. Trump held a sold out rally at Madison Square Gardens in NY on the weekend and they are talking of reduced spending, so it is on the platform.

Musk epically told the packed audience at Madison Square Garden, “We're going to get the government OFF your back and OUT of your pocketbook!”

“All government spending is taxation. So whether it's direct taxation or government spending, it either becomes inflation or it's direct taxation,” Musk explained.

“Your money is being wasted, and the Department of Government Efficiency (DOGE) is going to fix that.”

Funny how Musk referred to it as 'DOGE’ his past favourite crypto currency. However talk is cheap and a lot of election promises have a habit of fading away.

There is a lot of economic data out this week accumulating with the jobs report on Friday. The expectation is 110,000, but I would bet it will be much larger as the Harris government is grasping for straws in this election race.

Trump is inching higher at Polymarket and Real Clear Polling has Trump leading in all 7 battleground States but the lead is quite small, under 1% in 5 of them. However, like I commented before Trump/Republicans usually do better than the polls predict.

Are Oil Stocks a Bargain?

And it's another month end take down in Oil, but this time there is a valid reason. On the weekend. Israel retaliated on Iran and did not strike any oil or nuclear facilities so short term fear, the war premium subsided. That said this is just near term vision as this is the first Israeli direct attack on Iran so is an escalation in this war.

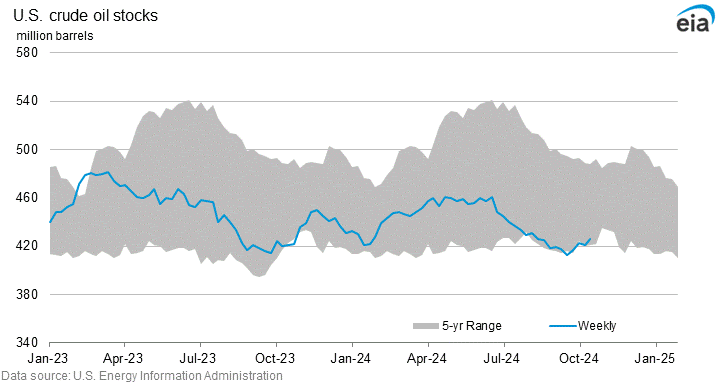

Oil might test the September lows and this could be an opportunity. I have not picked any new oil&gas stocks for just over 2 years. US oil inventories remain a multi year lows so there is no room for any problems. I think it is time to start adding some good bargains to our list. Stay tuned.

Intel Corp - - - Q:INTC - - - - - Recent Price - $22.68

Entry Price - $22.60 - - - - - - Opinion - buy

Since I suggested buying Intel on October 18th, there was lots of opportunity to buy around my suggested level. The stock even dropped below $22 last Wednesday, so I will use $22.60 as our entry price.

Intel will release Q3 results on Thursday and bad news and poor results are all priced in. If Intel reports better than expected, this may be the last chance to buy at these prices. As I mentioned in my report, near term, I expect the stock to fill the gap up to $30. A trump win and Intel's strategy to build in America could give them a nice advantage and I also expect them to directly compete with Nvidia on AI.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.