Whether a Bitcoin bull or bear. I have been accurate calling the last top and move down. Please subscribe to my substack so you don’t miss my outlook on where the current up move ends.

Is Bitcoin (Crypto Currency) a Safe Haven Asset?

I have heard many comment that Bitcoin as an alternative asset will do well in times of uncertainty and trouble as a safe haven asset. It is not! Gold has been around a long time and has a very good track record as a safe haven asset but Bitcoin has a short history. However, with a middle east war beginning we now have 3 recent periods of uncertainty and trouble with the Ukraine war and the Covid-19 panic previously. We can look at how Bitcoin has performed verses gold in these 3 times.

With the outbreak of the Covid-19 panic starting in March 2020, Bitcoin did nothing and was basically flat. It turned up in late 2020 and into 2021 and I believe this was more a response of excess money printing. Remember, everyone getting Covid-19 checks and opening Robinhood accounts. Meanwhile, gold took a short term drop, but by end of July was over $2,000. If we take the $1600 level, before the initial drop so not to exaggerate the move, that is about $450 increase or +28% to Bitcoin 0%.

The next uncertainty and trouble is when Russia invaded Ukraine in late February 2022. Bitcoin had a small initial rise but by the end of April was down to 34,206 and continued to fall further. Gold went from about $1850 to a high around $2070 within a few weeks and came back down to where it was by the end of April.

Now most recent is the middle east conflict. So far Bitcoin has done a bit better this time with a gain of about 3,500 or about +1.3%. Gold went from $1845 to a recent high of $2009 or about a +8.5% gain.

It is very obvious looking at the two charts and timing that Bitcoin is not a safe haven asset while gold continues to do well in that role.

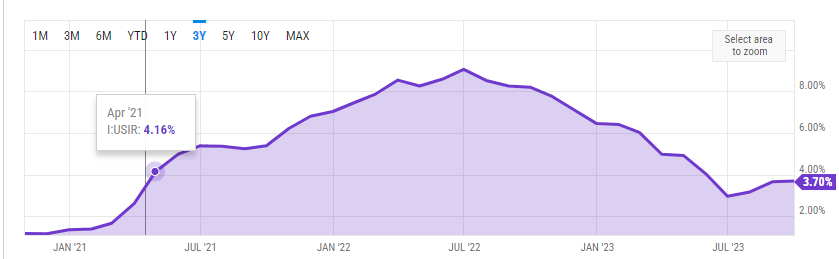

What about inflation? Is Bitcoin and Crypto a good inflation hedge? I am sorry, it has proven useless for that as well. Crypto has not been around very long so we can only compare to the recent inflation surge. The last big surge with inflation was the 1970s to early 80s and gold did extremely well, going up several 100%. Actually Bitcoin has reacted very negatively to inflation. April 2021 was when inflation started to raise it's ugly head and peaked in July 2022. Bitcoin went from about $56,000 in April 2021 to about 21,000 in July 2022. A whopping -63% loss.

In that same time period, gold went from about $1760 back to about the same level. However, it did go to a high of $2070 in March 2022. The market anticipates and gold was likely anticipating inflation would ease and it has some. Even so, the flat gold performance was way better than Bitcoin.

What is wrong with Bitcoin, Whats the difference?

I believe there are many and Bitcoin should not be compared to gold or thought of as a replacement. They are too different.

The gold market is many times larger so has bigger scale and liquidity. The crypto market is just over $1 trillion (Bitcoin is just over half of that, about $600 billion) in size while gold is around $11 trillion, so 10 times bigger. While crypto could grow, so could gold, so comparing current values is what it is.

The supply of gold is limited to slow growth because it has to be mined in a labour intensive way and costly matter. While Bitcoin supply is limited, the crypto market is not with something like 7,000 different crypto currencies in the markets recent peak. You cannot make different kinds of gold, but perhaps you could add some competition with silver and platinum, but these are very small markets with the same production constraints as gold.

Gold has a long history of many centuries, crypto does not.

Central Banks hold fiat currencies and gold, not crypto.

I believe a huge difference that many have not put much thought into is that crypto is totally reliant on a working infrastructure. You must have power and a working communication structure (internet, cell service) to use crypto. Furthermore you must have a 3rd party trading platform to move crypto currencies. Ask people how that worked with FTX.

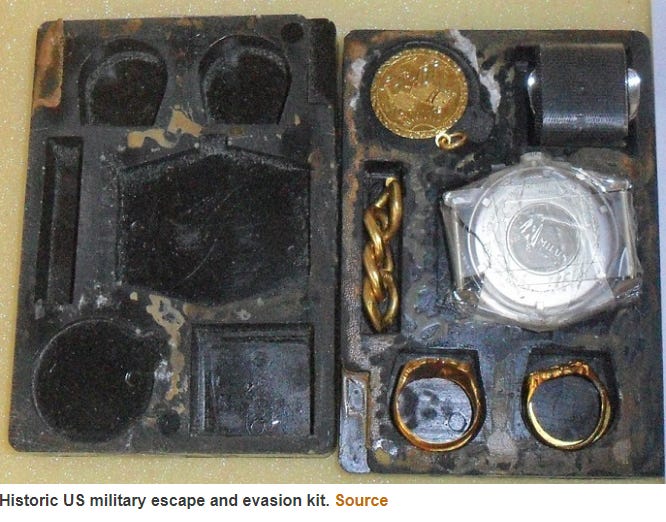

Ask people in Gaza and many parts of Ukraine how their crypto works. In the Vietnam war and WW2, US pilots were given gold barter kits to aid with escape.

Imagine today, the pilot holds up his cell phone. Is there a signal, I can show you my Bitcoin balance. As soon as I get a signal I can do a transfer.

What do you mean, you don't have a crypto currency account.

My whole point here is that gold and crypto are far too different to compare. I think crypto fits more like into a high risk equity category. Maybe it compares better to junior gold exploration stocks?

Bitcoin is having a strong move today, but one day volatility in crypto is nothing new.

Even better news with Greenbriar today

Greenbriar Capital - - - TSXV:GRB - - - - - OTC:GRBEF - - - Recent Price – C$1.14

Entry Price - $1.15 - - - - - - - - - Opinion – strong buy

The stock has been inching higher since it's bottom and will probably continue with today's news. GRB announced the planning commission will meet November 13 to approve the Sage Ranch development. Nothing is done until it's done but this will mean strong revenues for Greenbriar in 2024.

Sage Ranch will provide low cost entry level homes that will not be effected by any down turn because it is exactly what the market needs and wants at this time. It is a great location and near large military operations that are becoming the theme of this decade.

Jeff Ciachurski, CEO of Greenbriar, says in the news release: "The effort provided by both Greenbriar and the City of Tehachapi left no stone unturned to make sure the development is top of its class, innovative and groundbreaking to match the demands of a new sustainable world. Throughout the process we tailored our work product for a final submission that would leave a legacy and provide no doubt that only a top-quality product will be provided. The city made all parties aware of the significant impact Sage Ranch will have on the exceptional quality of life in the region and the tremendous economic impact to the city and surrounding area."

And some more great news, Tommy Sullivan, Greenbriar's chairman of their real estate advisory board, is bringing an opportunity for the company to JV into his 1,361-acre 3,500 home sustainable subdivision in the fastest growing region in Utah. This new project will give Greenbriar a 20-year runway of building several hundred entry-level homes per year, and further provides Greenbriar the status of regional builder and developer, specializing in recession proof sustainable housing. Greenbriar and Voya have just re-executed the USD $40 Million Sage Ranch funding agreement.

On the chart there is some resistance between $1.05 to $1.15 so might give a chance to buy some stock around these prices. Next resistance is around $1.55 and I believe the stock is headed there next. A break above that would be a solid higher high.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.