Is this Bud for you?

Apparently not so for many. Has America voted on Transgender?

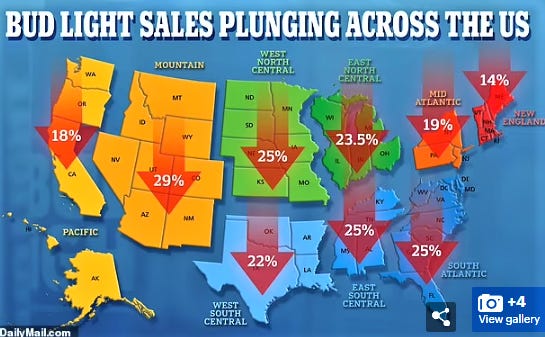

The infamous beer Bud Light is a disaster since it's tie up with trans influencer Dylan Mulvaney.

The marketing guru behind Budweiser's iconic 'Whassup' and 'Talking Frogs' commercials says they have “destroyed 20 years of work in one week”.

I don't drink Bud Light but have drank some Budweiser beer when in the US and have been to Busch Gardens in Tampa Florida. I don't care if someone wants to be this or that or what ever all those other letters mean, but when you shove things in people's face, you might get a reaction you don't like or want. And so Budweiser did. One thing is for certain, Budweiser does not know it's customers very well.

The announcement of Dylan Mulvaney as brand ambassador for Budweiser came out April 3rd and you can see on youtube here. Interesting that this only has 1,938 views, but traders in the stock skyrocketed.

I note that volume surged to around 6 million shares per day after the announcement. The stock did come down some but there must have been a lot of buyers too as the stock only dropped about $3. News is out that sales have plunged and the stock is at the first support level around $62. Next support is around $58 and a drop below that would probably spell much lower prices.

Management comments Q1 results May 4th - Our global brands grew revenue by 15.4% outside of their home markets, led by Budweiser with 17.8% growth.

The Bud and Bud Light brands are very significant to Budweiser and a plunge in these sales does not bode well. I imagine you won't see these boy cotters buy other Budweiser brands nor their T shirts, hats, etc.

Although the stock has come down, I don't believe it is reflecting a 20% drop in sales revenues that is a real possibility. Q1 results just came out so we will not know for another 3 months. I don't like to trade stocks when the news is already out, but I am looking at December Put Options.

I will look to take a position if the stock breaks below $58 or if it recovers back to $65 or so.

On the Banking Crisis front, Barclays analyst John Aiken downgraded Royal Bank of Canada, Scotiabank and TD Bank on May 9, causing the S&P/TSX financials index to drop by 1 per cent. Mr. Aiken also slashed his outlook for the sector to neutral from positive. As I mentioned before, Canadian banks kicked the mortgage can down the road by extending amortization on variable rate mortgages over increasing payments. Now approximately 1/3 of mortgages with the banks have over 30 year amortization. These normally reset to original amortization on the mortgage due date. And so the clock ticks.

PacWest Bank NAS:PACW plunged this morning. News that deposits at the bank fell 9.5% last week is the culprit. However they told the market that same week it was not experiencing "out-of-the-ordinary deposit flows". Almost 10% drop in a week looks out of the ordinary to me and most every other investor. Que the lawsuits.

These regional bank failures are because of a rush of deposit withdrawals and this news will certainly cause others to run for the exits. These banks have to keep issuing statements to reassure investors and their depositors, but it looks real bad when the reality hits that proves statements wrong. The other big factor at play here is these banks are offering near zero interest on their deposits while these same depositors can get about 5% moving their funds to money markets. This flight of capital is gathering momentum.

Once the bank uses up it's liquid assets to fulfill the withdrawals it has to sell the longer term assets (held to maturity) that are well under water because of the interest rate rise. The bank ends up with heavy losses as these assets are set to market, not their original or to maturity value. Current regulations allow the banks to carry these assets at their maturity values, not the current market value. The recent Fed program allows banks to borrow against these longer term assets at their maturity value. This can help banks avoid losses near term but does not do any good when the bank has to use up all these funds as well to pay fleeing deposits. It looks like another bank will soon bite the dust.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication