Welcome and Thank you to the savvy and contrarian investors who have joined my substack. Please share with your investor friends as I intend to keep this free for some time. Plus you may want to follow a seasoned expert in the precious metals market, now that a very strong bullish trend has asserted itself.

I have been bullish on gold, pointing out the current stagflation scenario like the 1970s and recent turmoil in the middle east would be very bullish for gold. That said the strength and speed of the current rally has even surprised myself.

As you know, I was expecting a major up move since August. I thought the gold market was pretty dead in August and a bottom would form. I thought gold could go a bit lower to around $1890. However, I was a month early as we saw a plunge in the Comex gold price in late September that broke below $1890 to around $1840.

Oct 10th with gold about $1870, I commented “ Gold has reversed and I believe the bottom of this correction is in”.

I believe I was quite accurate in calling a new bullish move in gold as we now have. My timing was off about a month, but in the scheme of things, I don't think this is a big deal. It is more important to see a change coming, because predicting the exact timing is always most difficult. I prefer to tell you about the signals and price levels I am looking for and watching. Why they are important and what they might mean.

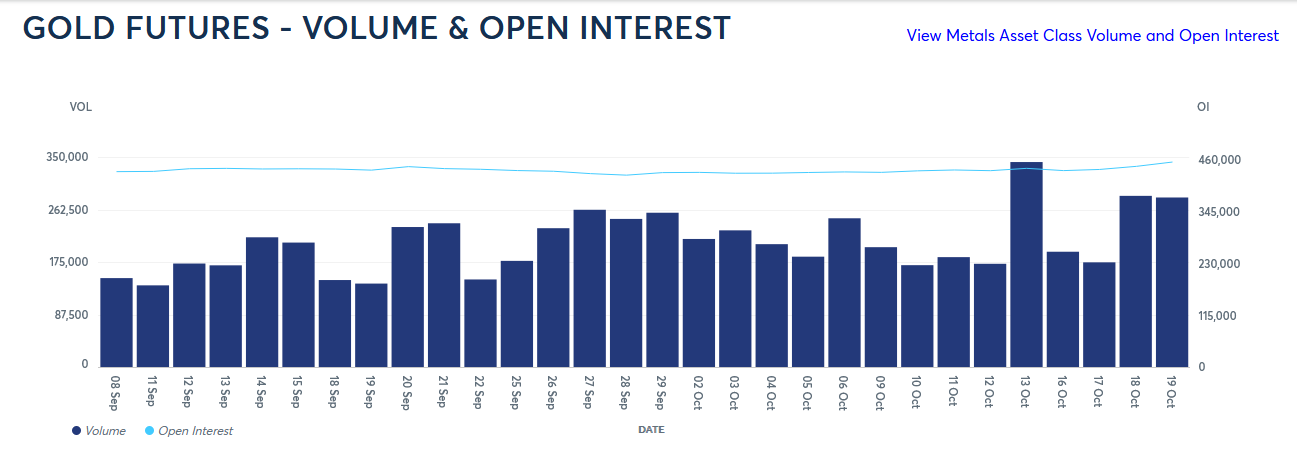

I believe most of the rally so far is caused by short covering and we will soon see that in up coming COT reports on Managed Money. Another good indicator of this, open interest (light blue line) has only begun to rise in the last couple trading days that also show higher volume. Rising interest signals new buyers coming into the market.

With the HUI index, I predicted a bottom between 180 and 210 in my Sept 27th issue and that proved accurate. The gold stocks have been lagging gold for the last couple of years and continue to do so. In the last 2 years, gold is up +10% while the HUI index is down about -12%. Gold stocks typically out perform gold and I believe we will see this happen as the gold rally gets stronger and goes higher. A break above this years highs around $2130 will be a huge driver of this. Meanwhile as gold moves towards this target, the gold stocks will start to catch up.

We are going to do very well with the gold stock call options and now I want to add a few stopped out positions back on our list. As you can see on this chart of the HUI, the down trend channel is broken but the index has not been able to make a higher high. This will come, but it could be stubborn with resistance between 230 and 250.

Newmont Mining - - - - NY:NEM - - - - - Recent Price - $39.25

We got stopped out of Newmont at $39 and it is currently about the same price. It would be nice to get it a bit lower, but it is still a good price, down from an $84 high in 2022. When fund managers decide to get back into gold stocks, the majors like Newmont are the first they jump into.

Newmont is buying Newcrest of Australia which makes for a great portfolio of world class assets. It combines high-quality operations, projects and reserves focused in low-risk jurisdictions, supporting multiple decades of profitable gold and copper production.

The acquisition enhances their copper production which I think is a good thing in an electrified world. The portfolio will have approximately 30 percent of the combined reserves in copper. The new Newmont will have the industries strongest balance sheet.

Newmont is paying a $0.40 quarterly dividend and this gets adjusted higher if gold prices rise. Currently the yield is about 4%, pretty good for a gold stock. In conclusion, it will be one of the early go to stocks in a new gold bull market.

The stock has given back all it's gains going back to 2019. The first resistance level is around $41.

B2Gold - - - - TSX:BTO - - - -NY BTG - - - - - Recent Price - C$4.65

We got stopped out of BTO at $4.40, the same price we bought it so we went no where. Lets try again. Although we made no gain, we actually did because of a decent dividend. B2Gold is paying US$.16 annual dividend so gives the stock is about a 4.7% yield at current prices.

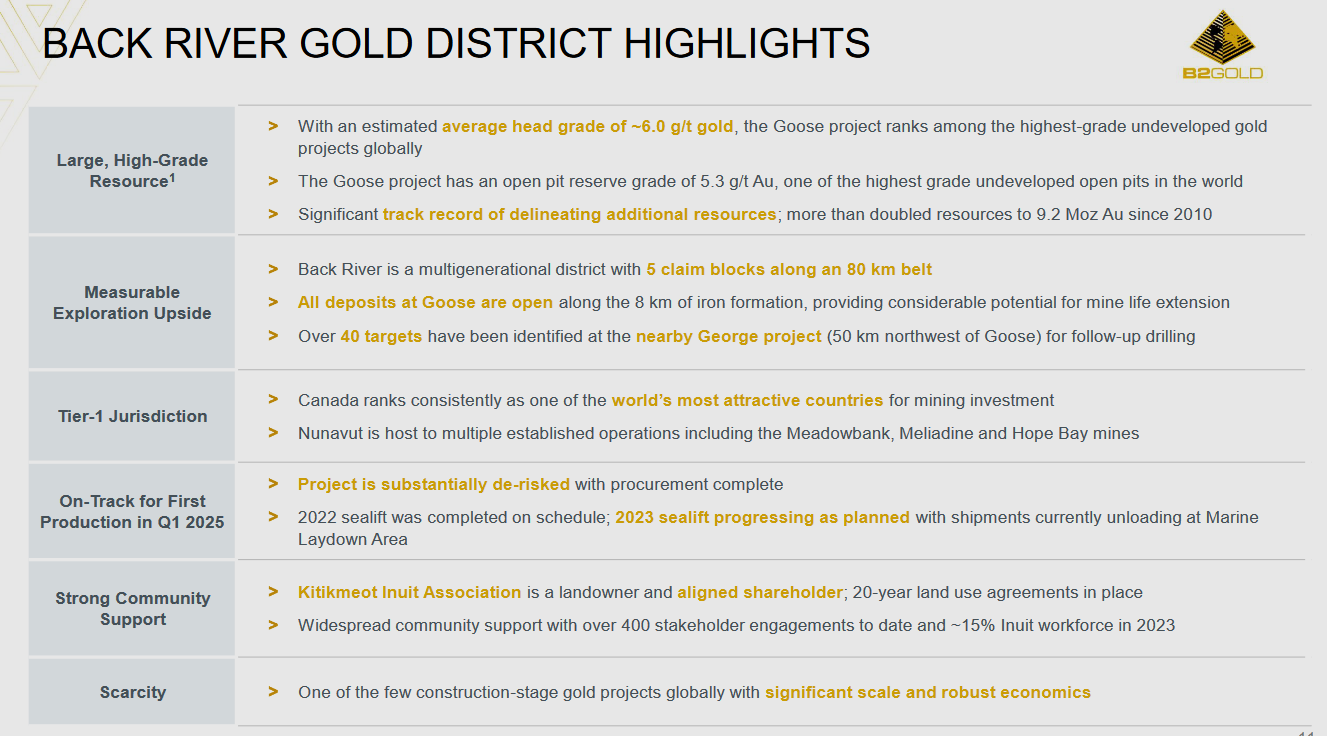

I commented on B2Gold in my September 14th issue on their new Goose project in the middle of nowhere. The first gold pour is scheduled for Q1 2025. Although I expect high costs here, it will be a very high grade for an open pit mine, at about 6 g/t. I wonder on how much costs have gone up, but the positive is that BTO does not have to borrow money to build it.

What is of great interest and to Zonte shareholders, is B2Gold CEO, Clive Johnson comments on why they bought out AngloGold's Gramalote share.

He said Gramalote was never seen as a smaller potential mine because AngloGold Ashanti and B2Gold each needed to add around 200,000 ounces. That changed when AU asked if BTG would buy out its share.

"No one's ever looked at it and said what if we don't need 400,000 ounces to satisfy two companies? What if it's 200,000 oz a year for a single company, which would be in our wheelhouse."

"We believe that if we look at it as a smaller project there's a higher-grade core in Gramalote and therefore can we drop the capital dramatically, build a smaller mill, have less of all expenses, lower our actual environmental footprint there as well."

The company plans do an updated PEA in 2024 to determine if it can be a profitable smaller mine.

The stock has broke the down trend with a strong bounce off of long term support.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.