Jobs Plunge, Oil Inventory Drop, Buy Baytex BTE, Intel Pops INTC, ECU

Thank you to all the new, smart and savvy investors who joined my substack. I am just small here on substack, please share and subscribe while this is still free.

Surprise surprise, surprise as Gomer Pyle would say and I was surprised to on how bad the job numbers are today.

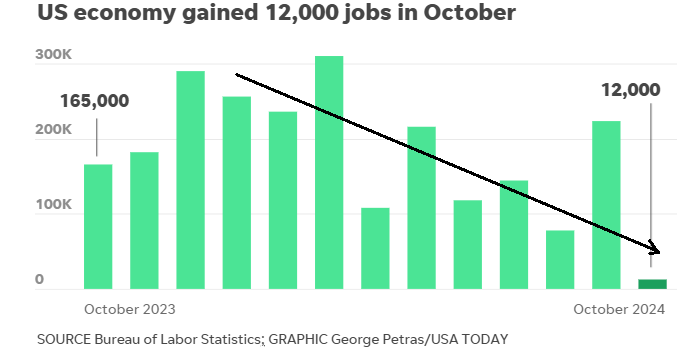

Employers added just 12,000 jobs in October as hiring slowed substantially. The total was expected to be constrained by two Southeast hurricanes and several worker strikes but the tally was far lower than expected and job gains for previous months were revised sharply downward, raising concerns about a weakening labor market. Economists surveyed by Bloomberg estimated that 105,000 job gains were added in October.

And as usual, payroll gains for August and September were revised down by a whopping 112,000. August's additions were downgraded from 159,000 to 78,000 and September's, from 254,000 to 223,000. This chart from USA Today takes into consideration the recent revisions and when you smooth out the bumps, the trend line I drew in makes it pretty obvious what is happening.

Last month we basically had a desperate attempt by the Biden-Harris administration to paint the chart and report better numbers by hiring a big whack of government employees. Who ever wins this election is going to inherit a very poor and declining economy.

Despite the poor job numbers, interest rates keep rising with the 10 year treasury up to 4.34% today and the Canadian 5 year bond yield up to 3.1%. The Canadian loonie is breaking down today falling farther below $0.72

Oil Inventories Show a Surprise Decline and Oil moves up

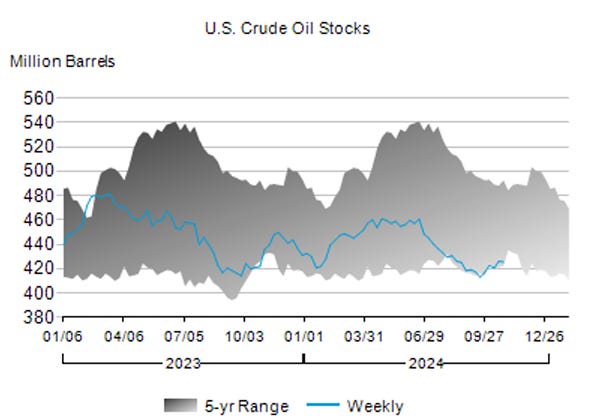

US crude oil inventories fell unexpectedly by 500,000 barrels in the week ended October 25, according to data from the Energy Information Administration (EIA). Gasoline and distillate stocks in the US also declined sharply in the week ended October 25.

Oil inventories stood at 425.5 million barrels in the US, and were about 4% below the five year average for this time of the year.

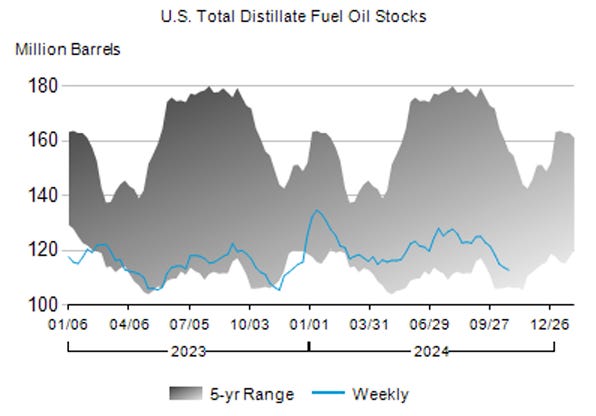

I have been warning for months how dangerously low these inventories are and the low oil price did not make sense. More worrisome is very low distillates that includes the winter heating oil. Normally inventories build in the summer/fall to meet winter demand. This has not happened for the last two years. Last year we got lucky with a very mild winter. It is not a good idea to rely on luck with the weather.

Oil prices have bounced from recent lows but are still priced on the low side. With inventories so low and the Strategic Reserve drawn way down, there is no room for any disruptions or escalation in the Middle East.

There are lots of good deals on our Selection list among the oil&gas stocks but I am taking this value opportunity to add another one. Baytex Energy is one of the better deep value plays out there. It was on our list many years ago before they moved into the U.S. Eagle Ford play so it has changed much since then and for the better.

Baytex Energy - - - TSX/NY:BTE - - - Recent Price – C$4.18 (US$3.00)

52 week trading range C$3.85 to $6.35

Shares outstanding 787 million

In the past year they bought back 75 million shares to come down to this level.

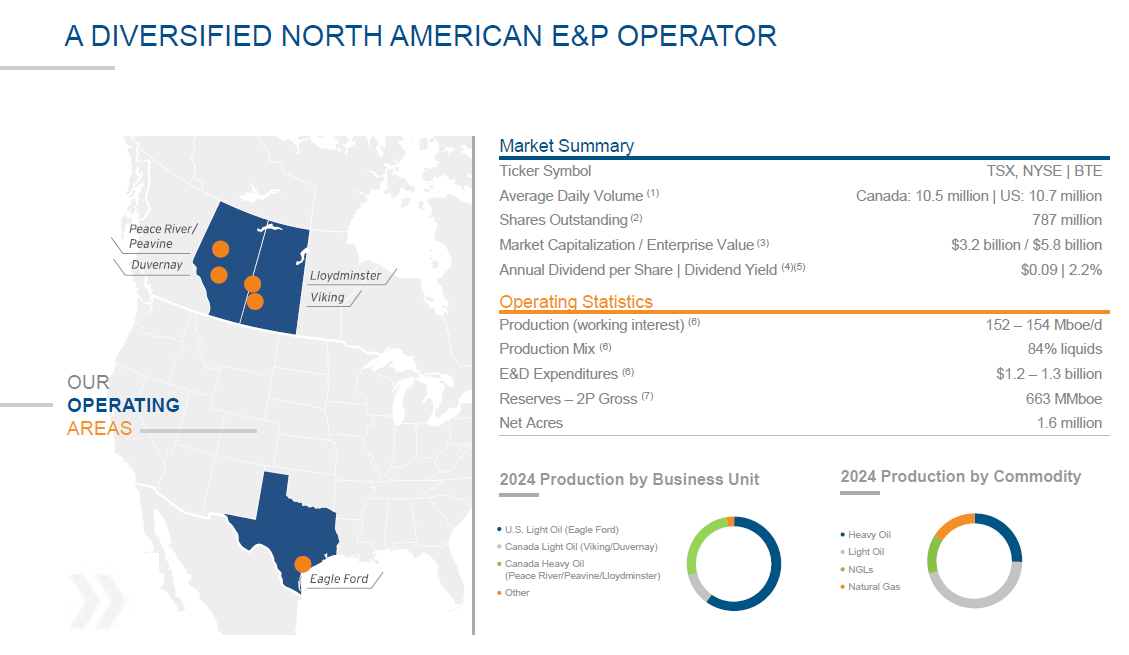

Baytex was mostly a Canadian producer but in 2014 they expanded in the Eagle Ford shale in Texas, paying US$1.8-billion for Aurora Oil & Gas Ltd. to gain a foothold in the formation. Then in February last year they acquired Ranger Oil Corporation, a pure play Eagle Ford company for US$2.5 billion. They are now mostly a U.S. producer, but the other key factor is they will benefit with better prices on their Canadian production now that the Trans Mountain pipeline expansion finally opened up around mid year.

Baytex has headquarters based in Calgary, Alta., and offices in Houston, Tex. The company is engaged in the acquisition, development and production of crude oil and natural gas in the Western Canadian sedimentary basin and in the Eagle Ford in the United States. Baytex’s vision is to be a top-tier North American oil producer focused on per share value creation. Their key oil resource plays represent some of the highest rate of return projects in North America.

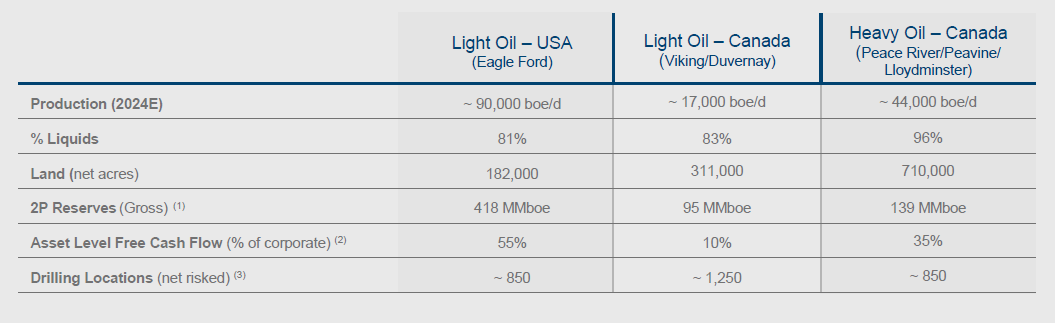

This slide from their presentation gives a very good over all picture of the company.

For 2024 they are projecting production of 152,000 to 154,000 boe/d with 84% of that Oil and NGLs. Here is a break down by asset location.

There US assets (Eagle Ford) drives 55% of cash flow but I do expect the Canadian assets to perform better with lower spreads between WCS (Canadian) and WTI or Brent.

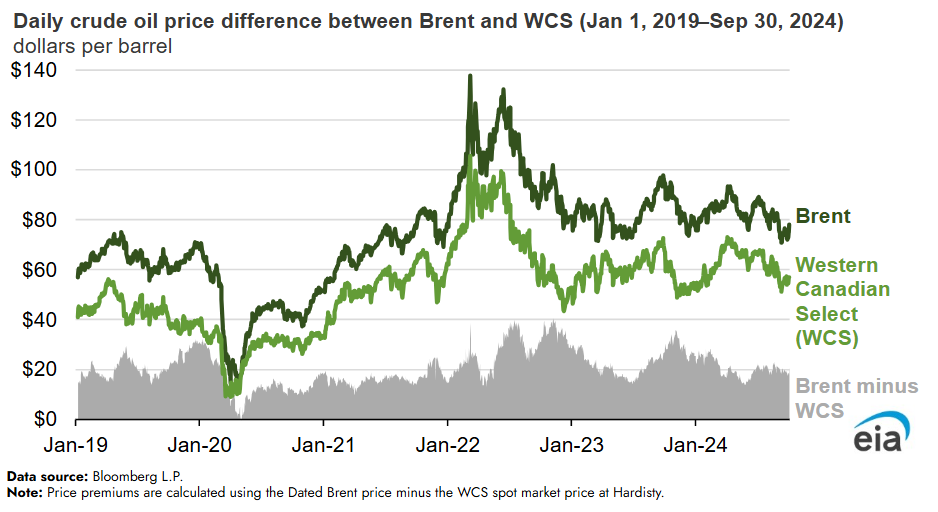

Historically, WCS spot prices are significantly discounted to other benchmarks because of WCS’s quality and the region’s landlocked geography, which limit its market. Unlike Brent (the global crude oil benchmark grade), WCS has a higher sulfur content and a lower API gravity, and additional costs are necessary to move WCS from its inland pricing location to a coastal seaborne export location.

Focus on the differential, grey at bottom and we should ignore the Covid anomaly in 2020 and 2021. In 2022 and 2023 including early 2024 we had spreads running as high as $30 and $40. This has now come down to $20 and I expect we will see $20 and lower going forward thanks to the Trans Mountain pipeline expansion.

This pipeline is the best thing that has happened in Canada for decades. Trans Mountain Expansion Project was initiated in 2013 and finally after much controversy and bureaucracy started to operate in May this year, after a very significant bloated cost of around C$34 billion.

The expansion, which runs roughly parallel to the existing pipeline, increased capacity from 300,000 to 890,000 barrels per day (48,000–141,000m3/d). You can see this is very significant because it is about a triple in capacity.

The Calgary Herald says - In a nutshell, the Trans Mountain expansion has brought an end _ for now — to the transportation bottlenecks that for years kept a lid on the Canadian oil industry’s ability to grow. With fresh ability to ship barrels out of Western Canada’s oil-producing region, companies have been able to turn on the taps.

According to Canada Energy Regulator statistics, year-to-date crude oil production in this country as of the end of July 2024 averaged 5.0 million barrels per day. That’s the highest on record, up from 4.8 million barrels on average at the same point in the year in 2023.

Year-over-year production growth of an additional 100,000 to 300,000 barrels per day will continue into 2025, said energy analyst Rory Johnston — making Canada one of the largest sources of crude oil output growth in the world.

Baytex and all Canadian producers will benefit, but I still like the fact that Baytex is mostly a U.S. producer.

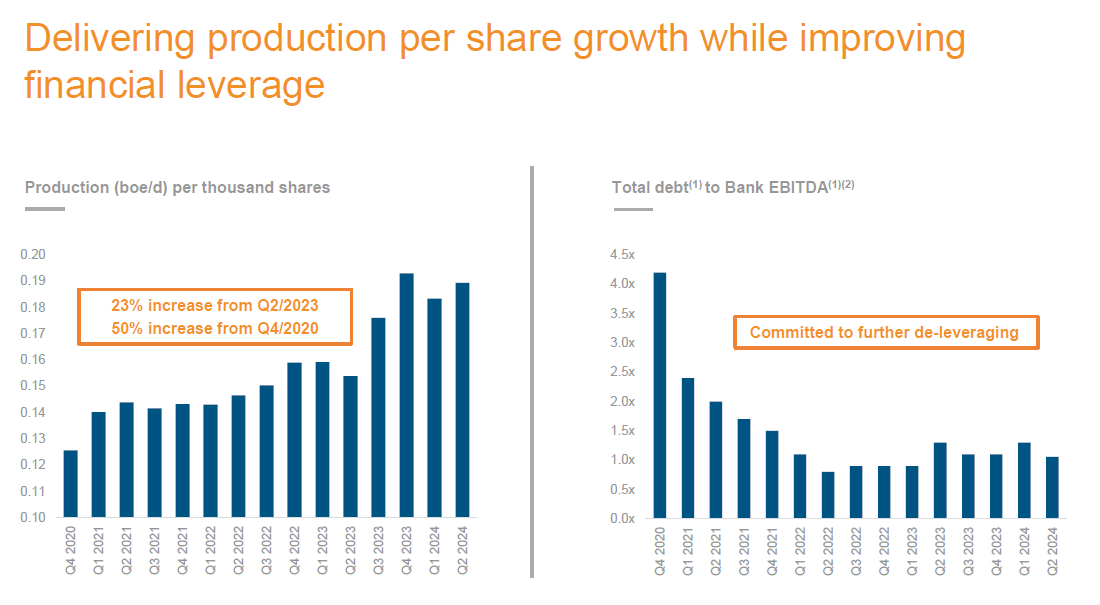

Baytex has very good production growth but the stock kept going down regardless.

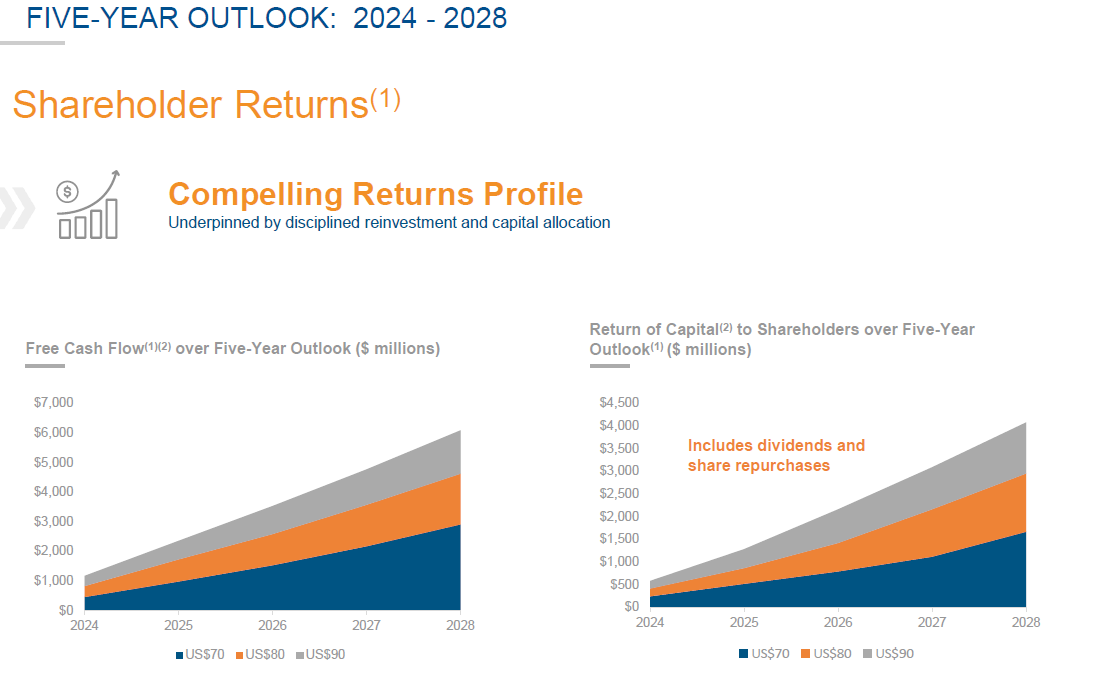

This is the company's 5 year outlook at various oil prices and even the low end at $70 looks quite decent.

Baytex just reported solid Q3 results yesterday in C$

Reported cash flows from operating activities of $550 million ($0.69 per basic share).

Delivered adjusted funds flow of $538 million ($0.68 per basic share) in Q3/2024.

Generated net income of $185 million ($0.23 per basic share) in Q3/2024.

Generated free cash flow of $220 million ($0.28 per basic share) in Q3/2024 and returned $101 million to shareholders.

"During the third quarter we generated $220 million of free cash flow, returned $101 million to shareholders through our share buyback program and quarterly dividend, and reduced net debt by 5%. Over the last fifteen months we have repurchased 9% of our shares outstanding. Our third quarter results demonstrate continued solid operational performance as well as our commitment to generating meaningful free cash flow and the delivery of strong shareholder returns. We expect to release our 2025 budget in early December. We are committed to prioritizing free cash flow and in the current commodity price environment this means moderating our growth profile and delivering stable crude oil production," commented Eric T. Greager, President and Chief Executive Officer.

The stock has a very low valuation. Marketwatch shows it a 0.94 book value and 2.4 times cash flow. The stock pays a dividend and has a current yield of 2.2%. Baytex is committed to return 50% of free cash flow to shareholders through share buybacks and dividends. This will provide a strong upward bias on the stock. For Canadians this is also a loonie hedge because they sell oil in US$.

The chart is awesome as we have a triple bottom and a wedge pattern to break out of. The stock is up today off that triple bottom with higher oil prices and the solid Q3 results they just reported. The stock was $9 in 2022 and could easily go back up there. We need to see a break above the down trend channel and a higher high, so $4.80 will do that and there is not a lot of resistance until $5.50 to $5.75.

Intel INTC - - - - - Recent Price - $23.50

Entry Price - $22.60 - - - - Opinion - buy

It looks like our timing to buy Intel is working out. Intel reported Q3 results after the close yesterday and they missed some estimates, but the market focused on the better guidance for Q4. Intel reported an adjusted loss of 46 cents a share, compared with Wall Street’s consensus estimate for a loss of 2 cents, according to FactSet. The results may not be comparable to estimates as it includes a 63 cents negative impact from impairment charges. Revenue came in at $13.3 billion, which was above analysts’ expectations around $13.02 billion.

Key Highlights

$13.3 billion in revenue, down 6% (beat by $260 million).

$-16.6 million in earnings.

$-0.46 in EPS (miss by $0.43 and down by $0.87).

$-3.89 in GAAP EPS (miss by $3.64).

An 18% gross margin, down 27.5%.

A newly announced $3 billion U.S. government Secure Enclave Partnership.

$4.1 billion in cash from operations

I believe the main reason for the move up was like I commented in my report, all the bad news was already priced in.

Yesterday when I mentioned our copper junior explorers, I neglected Element 29

Element 29 - - - - TSXV:ECU - - - - - Recent Price C$0.48

The stock has a had a very good run up this year and a new high today. There is little news but drilling approval, but as I pointed out in August with a buy on the stock, a very strong management group got behind the company this year. Under valued assets can do this.

Yesterday Element 29 reported they received exemption from the consulta previa (prior consultation) process from the Peruvian Ministerio de Energia y Minas -- Oficina General de Gestion Social (MINEM) for exploration drilling at its wholly owned Atravesado porphyry copper-molybdenum (Cu-Mo) target as part of the Flor de Cobre project, located in the southern Peru copper belt.

After receiving the declaracion de impacto ambiental (DIA) environmental approval to drill from a maximum of 40 platforms as part of the Atravesado drill permit application (refer to March 1, 2024, press release).

The stock has moved up on little volume and has lots of legs left, especially with drilling coming up on one of their excellent properties.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.