Welcome and thank you to the recent smart, savvy and contrarian investors who have joined my substack. Please subscribe and share with your investor groups while this substack remains free.

In the last 20 months I have only picked two junior miners because the junior market has been in a severe down trend, especially since June this year. That said, I am very confident a major bottom is in and I plan to do some bottom fishing.

This is a chart of the TSX Venture index that a seasoned colleague in junior miners sent me. It confirms my analysis of a bottom and highlights a long term inverted head and shoulders bottom pattern with the head being the 2020 low.

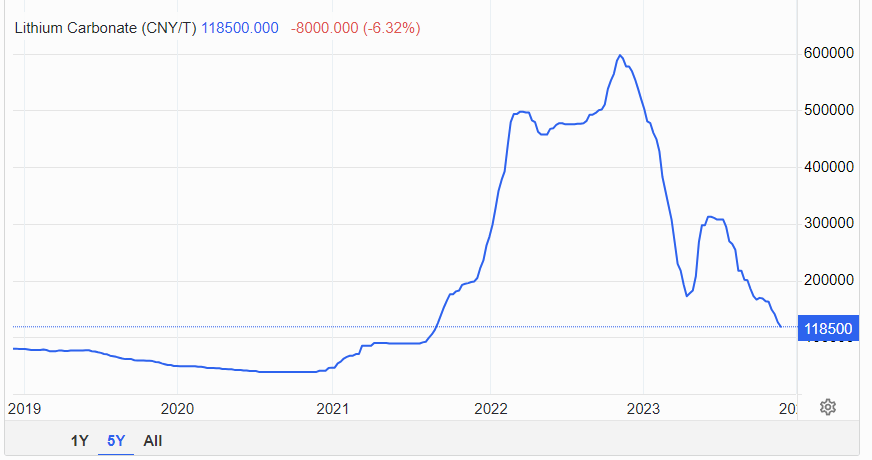

The best performing sector in the junior miners in those past 20 months was lithium but even this sector saw a correction this year. I predicted that lithium prices bottomed in April of this year and with a rally that soon followed, this looked like a great call. However, it was short lived as lithium prices dropped below the April low in late October. As you can see on the chart, lithium has pretty much given back all it's gains so there is little down side left.

The blame goes to weak electric vehicle (EV) sales growth that led to high stockpiles and sent prices of the metal tumbling down. As a result the lithium market balances shift to adequately supplied in 2023 and probably oversupplied in 2024/2025. The market has priced in the over supply prediction.

Regardless of lithium prices, junior explorers can still do extremely well on a discovery. With this in mind I have a new pick that I recently bought a position in, called Max Power Mining. First off, an update on our other two lithium juniors with a sell and a hold.

Global Battery Metals - - - TSXV:GBML - - - - Recent Price - $0.075

Entry Price - $0.09 - - - - - Opinion – sell, sold at average of $0.50

I often stress the importance of taking part profits and often do it selling 1/3 at a time. When the stock ran in 2021, we took part profits at $0.27 and again at $1.15. Given today's price, our average sell price is $0.50 for a whopping 450% gain. See chart below.

Eureka Lithium - - - - CSE:ERKA - - - OTC:SCMCF - - - - Recent Price - $0.50

Entry Price - $0.60 - - - - - - Opinion – hold

The stock was doing well, but myself and the market were expecting a late season drill program, but it is the end of November and too late to drill in this far north location this year. Lack of drill news and the correction in lithium weighed on the stock. Eureka announced today that they closed $1.8 million flow through financing at $0.75 per share, so they will be well funded for exploration in the spring of 2024. I would not rule out a new acquisition in a year round drill location. I have not heard anything from the company on this, just my speculation. The stock is back to where we first got in.

Max Power Mining - - - - CSE:MAXX - - - - OTC: MAXXF - - - Recent Price $0.47

52 week trading rand $0.34 to $0.85 - - - Shares outstanding – 47.5 million

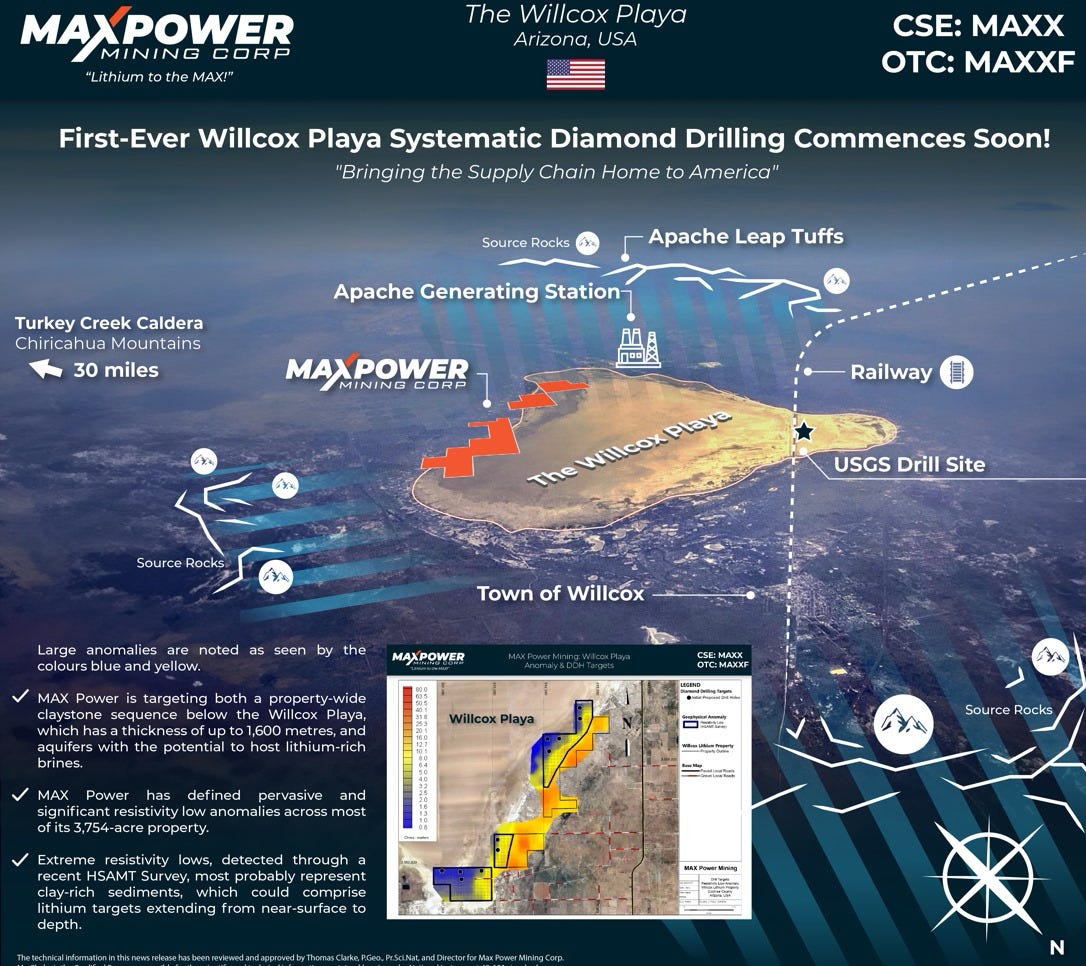

I am presenting a short report or an alert and will do a more in depth report in December. Max Power has lithium properties in Quebec, Nunavik like Eureka, but what really caught my interest is their Wilcox Playa acquisition in Arizona USA. I visited this area in the 1990s and back then, there was a theory that these playas concentrated and trapped precious metals from the surrounding mountain sources. Unfortunately it was never proven one way or another as the BreX scandal hit the market in 1997 and killed mining exploration for many years. Nobody cared much about lithium back then, but now it is known that these playas have trapped lithium if they have the right conditions.

I remember the air force activity in this area back then, but decades of U.S. Air Force activity in the Wilcox Playa has recently ended. As a result, MAX benefited from first-mover advantage and securing three well-situated blocks totaling 3,754 acres mostly leased from the state of Arizona.

On July 24th MAXX announced results of a completed geophysics survey by Hasbrouck Geophysics over its 100%-owned Willcox Playa Project (3,754 acres) in Arizona. It identified multiple high-priority drill targets from the northernmost claims to the southernmost, a distance of approximately 6 miles (10 km). The Company is targeting both an aquifer domain with potential high brine volume at Willcox and coincidental claystone mineralization. The property is now considered drill-ready.

The gravity low near the centre of the playa and the fact that it is a hydrologically isolated basin, as demonstrated by the Arizona Department of Water Resources, suggests the existence of a closed hydrological reservoir. The HSAMT and gravity surveys strengthen the possibility of lithium accumulation and concentration under the property.

A gravity and Hybrid-Source Audio-Magnetotellurics (HSAMT) survey was completed across the entire property, measuring gravity and resistivity on a 500 meter x 500 meter grid, and results identified a series of high-priority lithium drill targets;

MAX Power identified the target zone can reach to around 1 mile (1,600 m) thick;

MAX Power replicated the relevant geophysical surveys the U.S. Geological Survey (USGS) completed in the 1960’s and 1970’s.

Above, I highlighted in bold that this is trapped basin, because that is important as it allows millions of years of lithium concentration. We also know the playa is charged with lithium because of historic work by the U.S. Geological Survey (USGS) that included limited drilling in the 1970’s. The USGS summed up Wilcox as one of the most prospective locations for lithium in the Western United States, similar in its potential to Clayton Valley, Nevada, and the lithium brine and claystone deposits that have been identified there.

On November, 21, MAX Power announced that it has received a permit from the Arizona State Land Department (ASLD) to carry out imminent first-ever diamond drilling at the Willcox Playa. The playa is considered highly prospective for economic lithium mineralization based on MAX Power’s recent work program and compilation of historical data from the U.S. Geological Survey and other sources.

MAX Power has contracted Willcox-based Godbe Drilling LLC to commence a Phase 1 drill program at Willcox with mobilization to begin shortly after American Thanksgiving. Abundant claystone and liquid brine targets have identified.

Mr. Peter Lauder, MAX Power Senior Geologist, commented: “The Willcox Playa has significant lithium discovery potential, so it’s very exciting that MAX Power will be the first company to ever carry out systematic diamond drilling on the Playa. The targets are compelling.”

It is now up to the drills to tell us how thick the lithium zones are and what grade. I believe it is a good time to buy the stock, before drill results come out. On the chart you will see that for the most part, the stock has been trading between $0.40 to $0.65 for the last two years, so pretty range bound. A close above $0.68 would be key for a break out and result in a test of next resistance around $0.84. After that it is blue sky.

I have bought stock between $0.45 and $0.50.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.