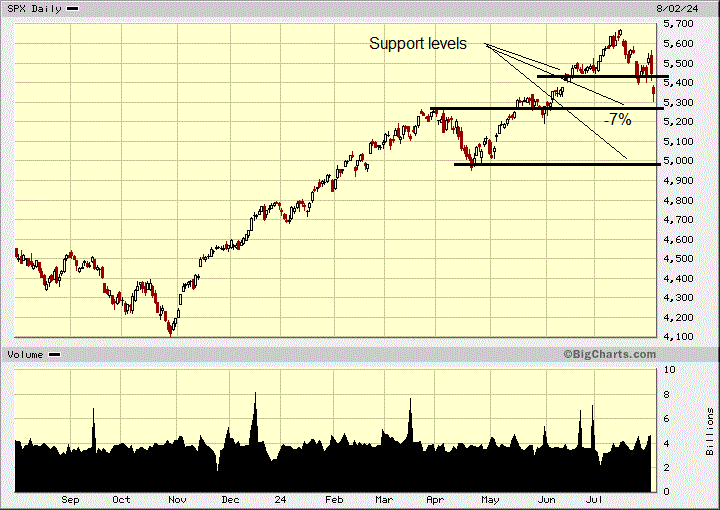

I have been warning for months now that the market was topping and the first half of the year would be best. I have also been pointing out numerous indicators that the economy was much weaker than the narrative. It seems the market woke up to my narrative and sold off yesterday and today on recession fears. It was in the headlines everywhere like USA today - Unemployment rise may mean recession. The S&P 500 has fallen through my first support level and is going to test the next one. Remember, I have often commented that September is the worst month of the year for stocks and sometimes it gets started in August. This could be one of those years.

I also commented a number of times that the Fed always reacts too late. They were late to acknowledge inflation, late to raise rates and late to realize inflation was not transitory. Now they will be late to lower rates. Like I have been saying for months, the Fed will lower rates for the wrong reason, the 'R' word.

Friday showed the labor market added 114,000 nonfarm payroll jobs in July, fewer additions than the 175,000 expected by economists. Meanwhile, the unemployment rose to 4.3%, up from 4.1% June. And as always previous months were revised down as June was revised down by 27,000, from +206,000 to +179,000.

Yesterday it was reported the U.S. PMI Manufacturing Index fell to 49.6 in July, from 51.6 in June. With the index trailing 50, manufacturers' business conditions entered contraction territory.It's the first time the gauge fell to below the 50.0 in seven months.

And U.S. manufacturing continued its decline in July, with the Institute for Supply Management's index dropping to 46.8%. This marks the fourth consecutive month of contraction

And Construction spending fell 0.3% M/M in June to a seasonally adjusted annual rate of $2,148.4B, the U.S. Census Bureau said on Thursday. The spending was expected to rise 0.2%, according to the consensus estimate of economists. The report followed a 0.4% decline in May, which was revised down from the advance print of -0.1%.

And the number of Americans who applied for unemployment benefits last week jumped to a nearly one-year high of 249,000.

Maybe the Fed was fooled by the B. S. Government data of Bidenomics, see my July 22 substack, highlighting Bidenomics performance. Although Chairman Powell admitted there was an argument for job numbers to be over stated.

Whatever the case, none of this should be a surprise to readers here. Oil sank back down on recession fears with stocks while Gold surged expecting rate cuts and re-inflating. Unless August economic data shows a surprise reversal upwards this pretty much guarantees a Fed rate cut in September.

Another one of our gold stocks is just below 4 years highs made in May.

Iamgold Corp. - - - TSX:IMG, NY:IAG - - - - - Recent Price- C$5.70

Entry Price - $3.51 - - - - - - - Opinion - buy

Iamgold has reached commercial production at the Cote gold mine. Cote is located in Ontario, Canada, and is operated as a joint venture between Iamgold, as the operator, and Sumitomo Metal Mining Co. Ltd. In May IMG completed an equity financing, which has positioned them well to repurchase the 9.7-per-cent interest in Cote this November and return to 70-per-cent ownership.

This is a big deal to Iamgold as Cote will produce on average 495,000 ounces gold per year for the first 6 years. In 2023 Iamgold produced 490,000 ounces so 70% of 495k is 346K so a very significant increase in production. This is the main reason I suggested buying the stock and I expect we will see much higher prices going forward as Cote production ramps up.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.