Market Bubble ,Gold, SSRM, NKTR, Super Bowl Indicator. Trudeau Taxes Tax

Welcome and thank you to all the new smart, savvy and contrarian investors who have joined my substack.

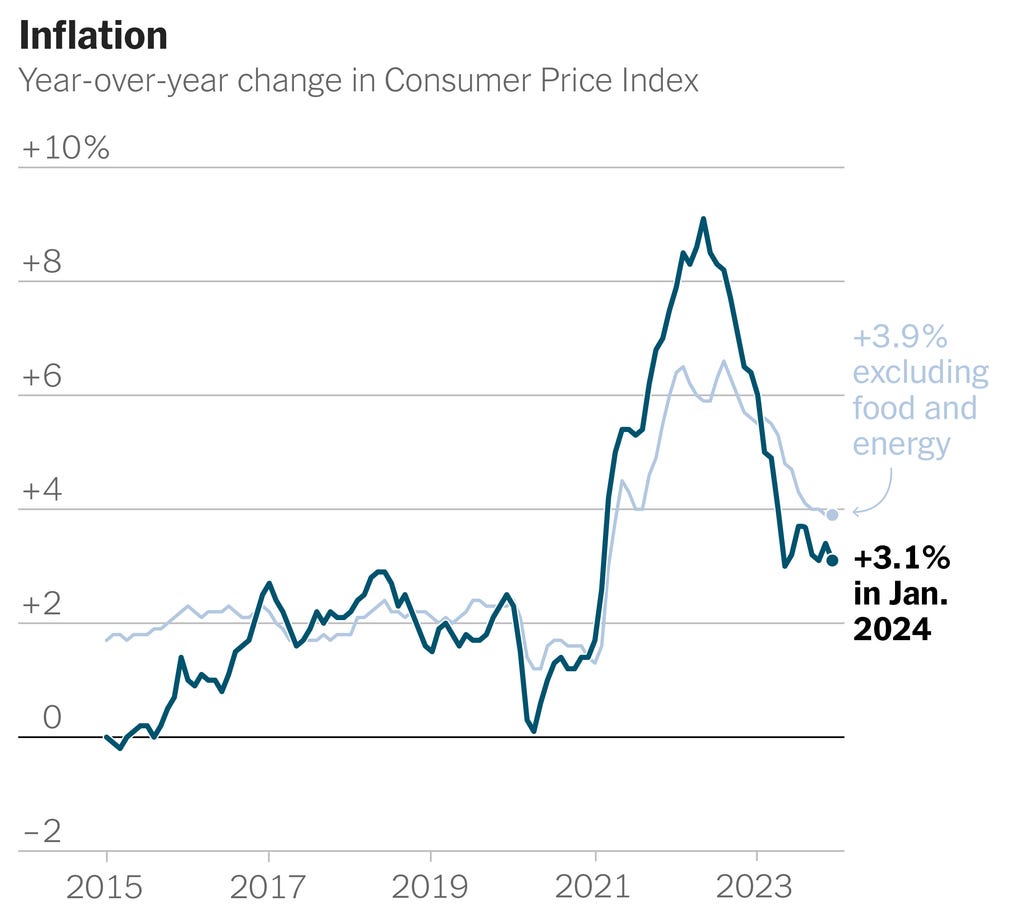

Markets got a bit of an awakening Tuesday when Inflation rose more than expected in January as the S&P 500 index fell 1.4 percent, its second-biggest daily decline this year. Stubbornly high shelter prices weighed on the consumer price index, that increased 0.3% for the month. On a 12-month basis, that came out to 3.1%. Excluding volatile food and energy prices, so-called core CPI accelerated 0.4% in January and was up 3.9% from a year ago. The forecast had been for 0.3% and 3.7% respectively. The shelter index increased 0.6 percent in January, and was the largest factor in the monthly increase in the index for all items less food and energy.

The narrative you always hear is that inflation is falling. That is totally not true. Inflation is still rising, only the pace of the increase has slowed or fallen. Another point of confusion. Markets are very strange and confused these days. I believe a lot of this is caused the heaviest manipulation we have ever witnessed. Stock indexes are driven by 7 stocks, oil&gas is being pushed down to help control inflation and economic data massaged to appear as a soft landing. And there is much more.

It is not surprising that a Seeking Alpha WSB survey, showed that nearly half of all respondents don't trust the figures published in the consumer price index.

Although the S&P 500 fell on the news, I am still expecting new highs since the double top break out. The markets are a bubble, plain and simple. Bubbles are easy to see but the bubble tops are hard to predict, especially with so much manipulation and government intervention, but they all end up popping.

I easily predicted the 2000 tech/dotcom top because the Y2K factor that drove a lot of tech revenue was very date predictable, plus the Fed was in a tightening mode. I was early predicting the 2007 top and 2008 crash because that bubble with real estate and mortgage back securities seemed to go to absurd levels. What I am saying, it is not easy to perfectly time bubble tops as the bubble can always get bigger than what you expect.

The current bubble is being driven by tech with an artificial intelligence (AI) craze. It seems ChatGPT triggered a lot of this AI frenzy but AI has been around a long time and you can go way back to 1997 when IBM's Deep Blue AI computer beat reigning chess champion Garry Kasparov.

This bubble has become so crazy that these magnificent stock values are now being compared to countries. I highlighted that Microsoft was worth more than the entire Canadian Toronto stock market and the 7 stocks even account for 23% of the entire US market.

I am not alone as Hussman Investment Trust President John Hussman, who predicted the Dotcom Bubble break and the market downturn in 2008, is warning that another fallout is coming soon.

"We estimate that current market conditions now 'cluster' among the worst 0.1% instances in history — more similar to major market peaks and dissimilar to major market lows than 99.9% of all post-war periods," Business Insider quoted Hussman as saying in a recent note.

Another indicator is that insiders of these bloated 7 are selling.

Insiders can have many reasons to sell, but so many high profile sales indicates to me that those closest to the company see them as over valued.

Jeff Bezos began selling off his Amazon shares shortly after the company's strong start to the year, disposing of 24 million shares worth over $4 billion within four trading days, according to regulatory filings. This move, his first stock sale since 2021

Meta boss Mark Zuckerberg pocketed nearly half a billion dollars after selling his company’s shares nearly every day during the last two months of 2023 — a move that coincided with a massive rebound in the Facebook and Instagram parent’s stock price. The Facebook founder sold a total of nearly 1.28 million shares to secure a $428 million windfall amid Meta’s 194% spike last year. It was the first time that Zuckerberg sold stock since November 2021.

On September 11, 2023, President and CEO Jen Huang sold 29,688 shares of NVIDIA Corp. This move is part of a series of transactions made by the insider over the past year, which saw a total of 148,440 shares sold and no shares purchased. Director, Dawn Hudson, this insider has sold 27,000 shares over the past year without purchasing any shares.

In a notable insider transaction, CEO Sundar Pichai sold 22,500 shares of Alphabet Inc. - GOOG on December 6, 2023.

I don't think this is co-incidence, they all see their companies as over valued and ripe to take profits. Unfortunately many investors will be caught holding the bag. I am not sure when this bubble pops but it will be sometime in 2024. There are many pins flirting around.

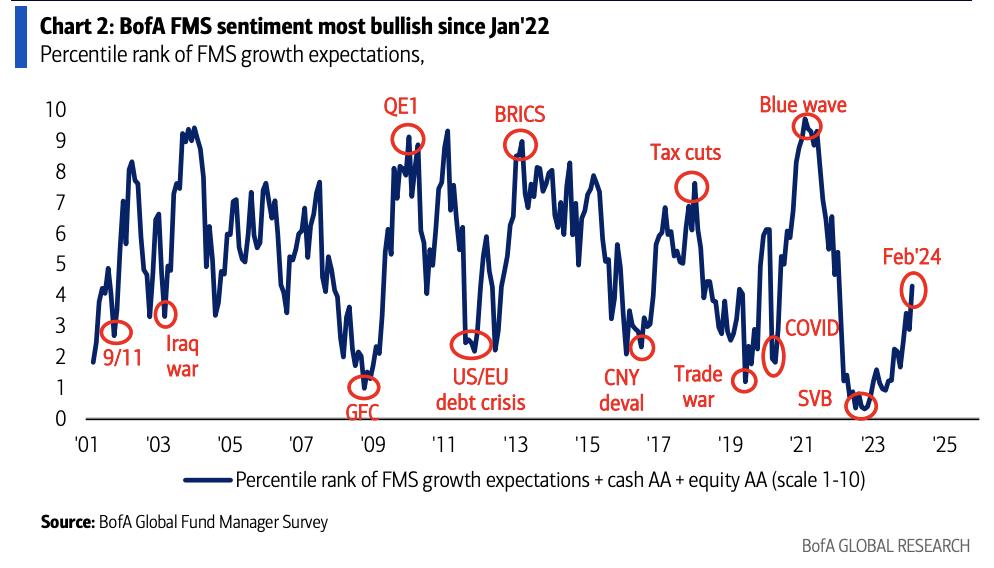

Bullish sentiment among fund managers is at the highest level since January 2022, according to the latest BofA survey. Although sentiment is high and it has been a strong recovery, it looks like there is some room to go higher. It does not mean the market goes higher, but fund managers are not in a hurry to sell just yet.

With stubborn inflation, long term interest rates have increased some. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 6.87% last week from 6.80% the week before. After a brief reprieve in December and January, mortgage rates are moving higher again, and that is taking its toll on mortgage demand.

When the ratio is so low and the average stock lags this much we usually have a problem. This time around there are apparently no problems, or is the market just not aware yet. Actually there are lots of problems but markets can ignore them for some time.

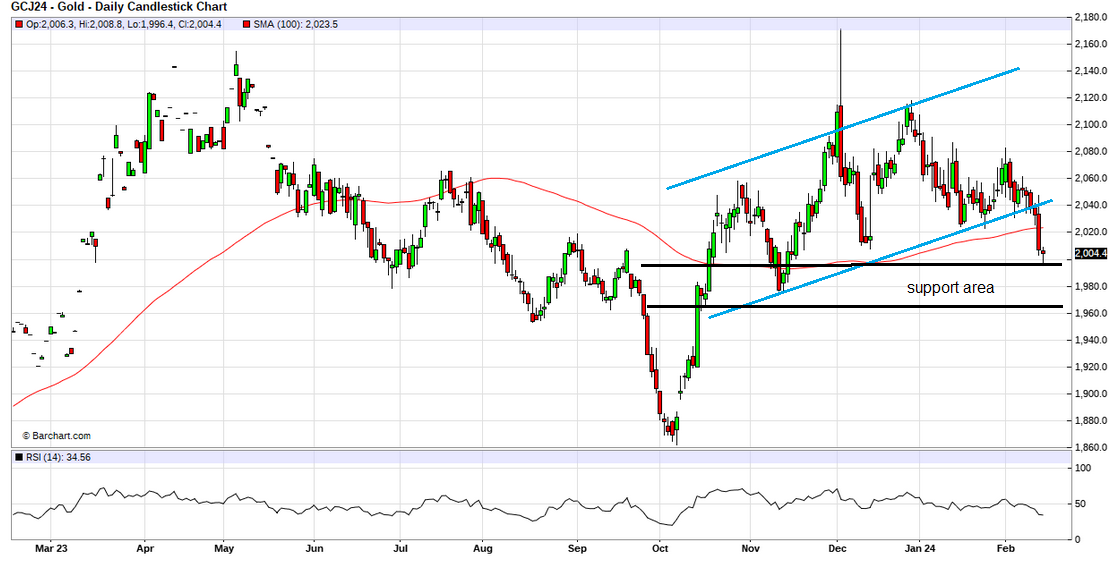

In more confusion, gold sold off on the news and the narrative goes something like this. Inflation is higher so interest rates will not go down for a while so the Fed will not inflate the economy as soon. At some point the markets will realize that inflation is eroding the value of the paper $$ and will buy gold. However, the US$ went higher on the higher inflation news. Markets are fixated on interest rates. They are looking at the last war (economic battle) when they need to look at the war of the 1970s to early 80s. That said, none of these young economists and analysts have figured it out yet, but they will.

GOLD

Whatever the case, the price on the chart is what matters and gold has broken the up trend channel to the down side. I expect gold will bounce up from the support area and maybe already has or could go a bit lower. This support will probably hold with central bank buying.

One of our previous gold stocks got whacked, not just from the gold price drop but a catastrophe at one of their mines. There is no way to avoid this risk or know it could happen, just tragic. The only risk mitigation is investing in companies with more than one mine and SSRM has four. Fortunately we were stopped out of this stock, last year at $17. I am mentioning this now, as I am watching for a time to buy and hopeful news on missing workers.

SSR Mining - - - - - TSX/NY:SSRM - - - - - Recent Price - $5.90

A significant slip occurred at their Çöpler heap leach pad at approximately 6:30am ET on February 13, 2024. At present, SSRM can confirm nine individuals are unaccounted for at site and efforts right now continue to focus on locating them. All operations at the mine remain suspended. This was their top producing mine.

Emergency response teams are actively focused on search and rescue efforts as they work to locate the unaccounted for employees. Over four-hundred personnel from the Türkiye national disaster relief agency are on scene to assist in the rescue efforts. This is very sad and it will be some time before repairs can be made and the mine come back into production. Lets hope there is some positive news on these people's recovery.

Nektar Therapeutics - - - - - NASDAQ:NKTR - - - - - - Recent Price $0.77

Entry Price - $0.68 - - - - - - - - Opinion – buy

The timing worked out here nicely as a steep sell off in the markets gave us a better price to buy NKTR. The stock closed at $0.71 the day of my report and dropped as low as $0.65 the next day, Tuesday with the market sell off and closed at $0.655. So I will go with an average of $0.68 as our buy price.

Super Bowl Indicator predicts bad market.

I have mentioned the 'Super Bowl Indicator', in previous years. It says the U.S. stock market will rise for the year so long as the game’s winning team was never a part of the original American Football League (now the American Football Conference), or was in the NFL prior to the AFL’s 1966 merger with the National Football League.

For 2024, that means the market will be higher if the San Francisco 49ers win, and fall if the Kansas City Chiefs come out on top. I don't think it is highly accurate, maybe as good as the ground hogs predicting early spring, but never the less, another bad omen.

There is just too much bad news to talk about so I will end with this. No wonder there is little faith with inflation data. I wondered why my gas heating bill was up this winter because gas prices dropped so much so I did the calculations. Last year I paid 26 cents per cubic meter for gas and this year it 16 cents so indeed it dropped. The delivery charges about the same and the cost adjustment was 7.3 cents last year and 3.2 cents per meter this year, so it dropped too.

The big increase was Trudeau's carbon tax, 9.8 cents/meter to 12.4 cents so a 26% increase in one year, so the carbon tax is close to the price of the gas.

The charge on my heating bill for gas was $57.63 (less delivery, cost adj.) and the carbon tax was $44.85, however the government taxes the tax so there is another 13% on the carbon tax so the carbon tax now totals $50.88. This means the carbon tax on the gas is 88%. This is ridiculous!!!

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.