Welcome and thank you to all the new, smart, savvy and contrarian investors who have joined my substack. I hope my following of market and economic cycles along with my unique short barometers are great insights to share and subscribe too.

Given the recent market activity, I am putting my Mid Day Market Report out a bit early. Although the market dive has surprised many, it should not be for readers here. I have spent decades studying and watching market and economic cycles and have steadily improved at it. With recent market peaks and bottoms it is like I almost get a gut feeling about when to call it. I was very close calling the exact 1999/2000 tech bubble top and 2007 market top. I was within days calling the October 2022 gold bottom and within days calling this most recent peak, assuming it will be the peak.

Just a Market Correction

In my May 31 update “I am concerned about the major equity markets in the months ahead. We are in unprecedented times with a bubble in AI, first stagflation in 50 years, election interference, war and heavy market intervention among a few other things.”

In my July 12 Mid Day Market Report - “I have been commenting for the last couple months that the market is topping out and suggested selling, booking the profits for 2024 and wait on the sidelines. Yesterday gave me more confidence in that prediction.

• A good inflation report was sell the news;

• Bearish engulfing pattern on major indexes;

• Major market rotation out of big tech to gold and small cap;

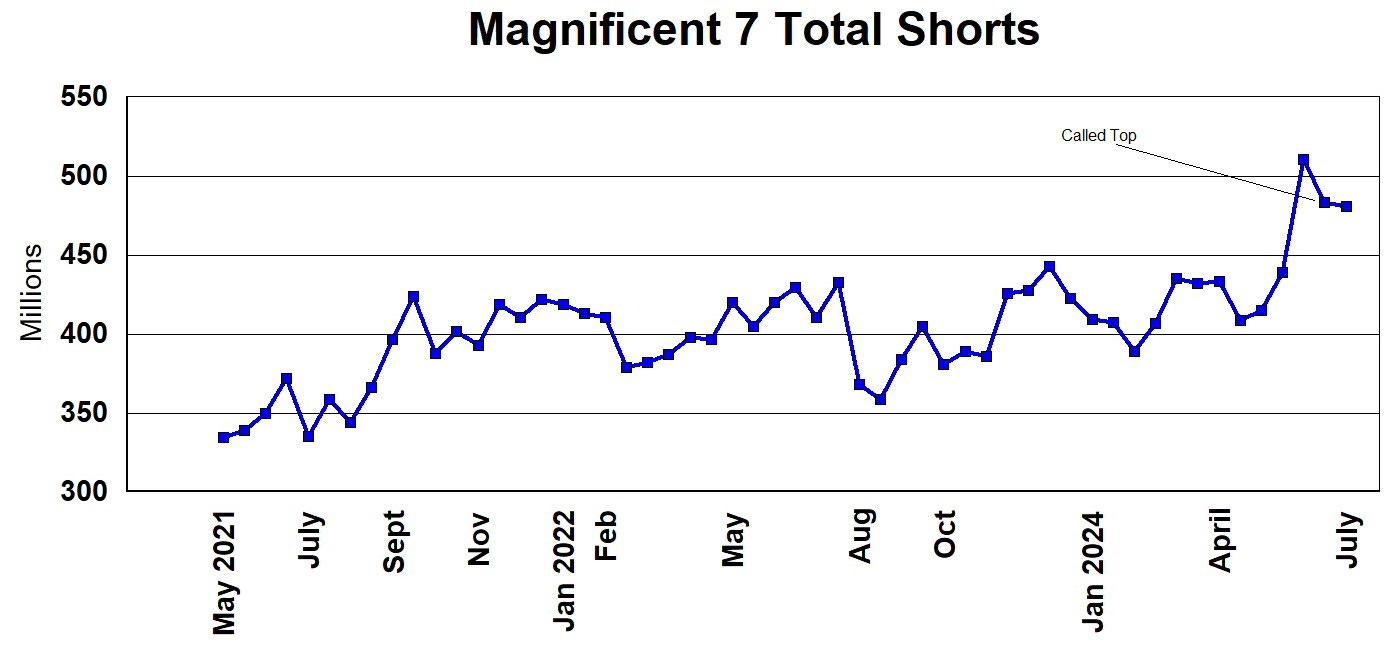

• Record short levels on the Magnificent 7.

The increase on Magnificent 7 short positions was across the board with the biggest increase with Apple and Tesla short numbers were about flat. This chart signals that a lot of smart money believes these market darlings are over bought and over priced. If I were you, I would heed this signal. I am, and it comes as no surprise as they are starting to agree with what I have been saying for 2 months.”

July 15 Mid Day Market - I have been highlighting numerous economic indicators that paint a far weaker economy than the government narrative and here is another.” This is what the market finally caught on to in the past week”

The S&P 500 hit it's peak of 5669 on July 16th, two trading days after my July 12th warning. Now the jury is still out if this is the eventual peak but I am betting on it. We have been in a bubble with AI, Bitcoin and Big Tech driving bubble equity markets. Seldom we have 2 or 3 bubbles at the same time, but they always end the same. They pop and we get a severe bear market. So far we only have a market correction, the bear market has yet to appear. However, I have no doubt the Goldilocks economy and market is going to meet at least one of the three bears within a year.

This is just a market correction and nothing more. We are a long way off from a bear market and I am not looking for one yet. Lets see where this correction ends and where the rally goes?

The market has been falling right through support areas with hardly a hesitation. I expect this is because there is so much manipulation and intervention along with computers doing most of the trading. You had some computers unwinding the yen carry trade and the down move triggered other sell programs. But always remember, these computer programs were built by human investors.

And It was not that I was a bear all year.

The market was having a good correction in April and in my April 16th market update “There is support around the 5,000 area on the S&P and I think this will hold. It is Q1 earning report times and I expect little surprise as positive earnings will be driven by tech mostly.”

Feb 14th - “Although the S&P 500 fell on the news, I am still expecting new highs since the double top break out. The markets are a bubble, plain and simple. Bubbles are easy to see but the bubble tops are hard to predict, especially with so much manipulation and government intervention, but they all end up popping.”

My 2024 outlook on Jan 22, 2024 is shaping up very accurately, where I predicted the best time for equity markets would be the first half of the year and these bullets, what does 2024 look like:

A Strange US election year (not even over yet)

More War and less Oil (more war in Mid East on the way)

Economies weaken while inflation remains entrenched (ya)

Climategate unravels further (ya)

Gold to new highs in 2024 (ya)

The other problem these days is that more effort is put on a narrative rather than the facts and truth. When the facts and truth do come out, it surprises many investors/markets and we have hardly witnessed any of that yet.

Like I have often commented, it is the market that really gets the Fed's attention. Market panic is already setting in as some big market players are calling for an immediate Fed 75 point cut. On Monday some Fed officials commented not to worry on just one jobs report.

Japan's Nikkei ended the session up 10% overnight, marking its best session since 2008, following a plunge of 13% on Monday. Much of the volatility is caused by the Japan yen carry trade. That is where large investors borrow/short a falling yen yielding about 0% and buy a rising US$ and invest that in US stocks and bonds. If the Yen rises big it all blows up!

On the weekly chart you can see that trade was working all year until July. It really went bad as the BOJ raised rates during the same week the Fed signalled its intention to cut. There was a similar yen unwind trade during last years September/October correction but this recent unwind has been far steeper and faster. The -13% decline in Japan is more like a crash, not what we saw in the US markets, it is just a correction.

Warren Buffett’s Berkshire Hathaway sold nearly half its huge Apple stake last quarter, perhaps an unexpected move for a long-term investor. However, all the big tech CEOs have been sellers lately. Despite the sale, Apple remains Berkshire's largest stock holding. Apple shorts are still high but have come down some from their June 15h peak.

I updated my Magnificent 7 short barometer with July 15th short data. We should get the July 31 numbers late this week or early next. The short level is still elevated and will be interesting to see if there was covering in this correction, but that would not show until we get August 15 numbers. This barometer helped me call a market top and I highlighted it on the chart.

It is official, Google is a monopoly. This is the first major anti-monopoly ruling against a tech company in decades. Judge Amit Mehta stated, “Google is a monopolist, and it has acted as one to maintain its monopoly.” I have known this and their censorship for years, join me and use DuckDuckGo for unbiased search. The short position on Google hit a new high of 45.7 million on July 15, up from 36.7m at the end of May.

Bitcoin Trades

On July 8th I suggested selling our short position, the SBIT etf at $53.45 as I was happy for a small loss on this badly timed trade. However, Bitcoin rallied and we could not make the sell target until we got a bit of luck with the market volatility and market hours of the etfs because yesterday SBIT opened at $54.88 (+$15.91) and went as high as $55.10 after the open. So I will list the sell at an even $54.90 for a very slight gain above our $54.75 buy price, so we have 3 out of 4 wining trades but gains have been small.

Bitcoin made new lows yesterday around $50,000 since it's double peak earlier this year. It is currently around $56,000 and I expect we could rally to around $60,000

Buy the IBIT long etf currently around $31.90

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.