Market Correction, Retail Sales & Buy Bitcoin IBIT,

GSPR Resources. Our First Bitcoin ETF trade

The market did not like the higher inflation numbers and the 'higher for longer' was the narrative. Wait until we get the 'higher forever' and that is when this market will really crack. Actually interest rates may increase after the election but the Fed will likely come up with some data manipulation or twist and give Biden 1 or 2 cuts. Interesting times.

There is support around the 5,000 area on the S&P and I think this will hold. It is Q1 earning report times and I expect little surprise as positive earnings will be driven by tech mostly.

Total S&P 500 earnings for the first quarter of 2024 are expected to be up +2.2% from the same period last year on +3.4%. For 2024 Q1, ‘Magnificent 7’ earnings are expected to increase +33.0% on +13.0% higher revenues. Excluding the Mag 7 contribution, 2024 Q1 earnings for the rest of the index would be down -3.5% higher revenues. This follows the +6.8% earnings growth on +3.9% higher revenues in 2023 Q4. Only 6% of S&P companies have reported as of Friday when most of the big banks reported. With higher interest rates and a strong quarter in the stock market, the banks beat estimates but the market was not impressed. I think a classic case of it being baked in and sell on the news.

Retail sales increased 0.7% for the month, considerably faster than the Dow Jones consensus forecast for a 0.3% rise though below the upwardly revised 0.9% in February, according to Census Bureau data that is adjusted for seasonality but not for inflation. A rise in gas prices helped push the headline retail sales number higher, with sales up 2.1% on the month at service stations. So there you have it, the masters of economic data will use higher gas prices to increase retail sales positively and on the other hand seasonally adjust gas prices lower to make a lower inflation PPI number.

Historically Bitcoin has often moved up and down with the market, especially the tech stocks. I predicted the 1st half of the year would be best for general equity markets and Q1 was exceptionally strong. I do believe the market will crack this year, but recent bullish sentiment will not give up without a fight so I see recent weakness as a correction. Same with Bitcoin, it has come down and is just above good support, around 62,000. It has also just bounced off a pretty low RSI reading, about 26.

The halving event (where the cost of mining Bitcoin doubles) is expected to happen this weekend. Many say this is very bullish but it is not being reflected in the current price leading up to the weekend, and I believe the approval of all the ETFs was more an over whelming bullish factor. I don't think the halving will matter, but if Bitcoin moves up, by Friday, I will probably sell the position.

I am suggesting to buy the iShares Bitcoin Trust US:IBIT - - - Recent Price $35.32

It trades the most volume of the ETFs and you can see it is down on the chart. I will be looking to sell around $38 or may use a trailing stop loss if we get an up move. I am starting with a hypothetical $10,000 to track performance.

One of our copper juniors had some good news. It is going to be a big year for copper. Yesterday Great Pacific TSXV:GPAC is buying out a private copper junior Tinga Valley Copper and Gold. Most interesting is they are paying about $16 million and the property does not even have a drill hole yet. Tells me acquisitions are moving down the food chain. Copper hit new highs yesterday.

GSP Resource - - - - TSX-V: GSPR - - - - - - Recent Price - $0.095

Entry Price - $0.25 - - - - - - - - Opinion -buy

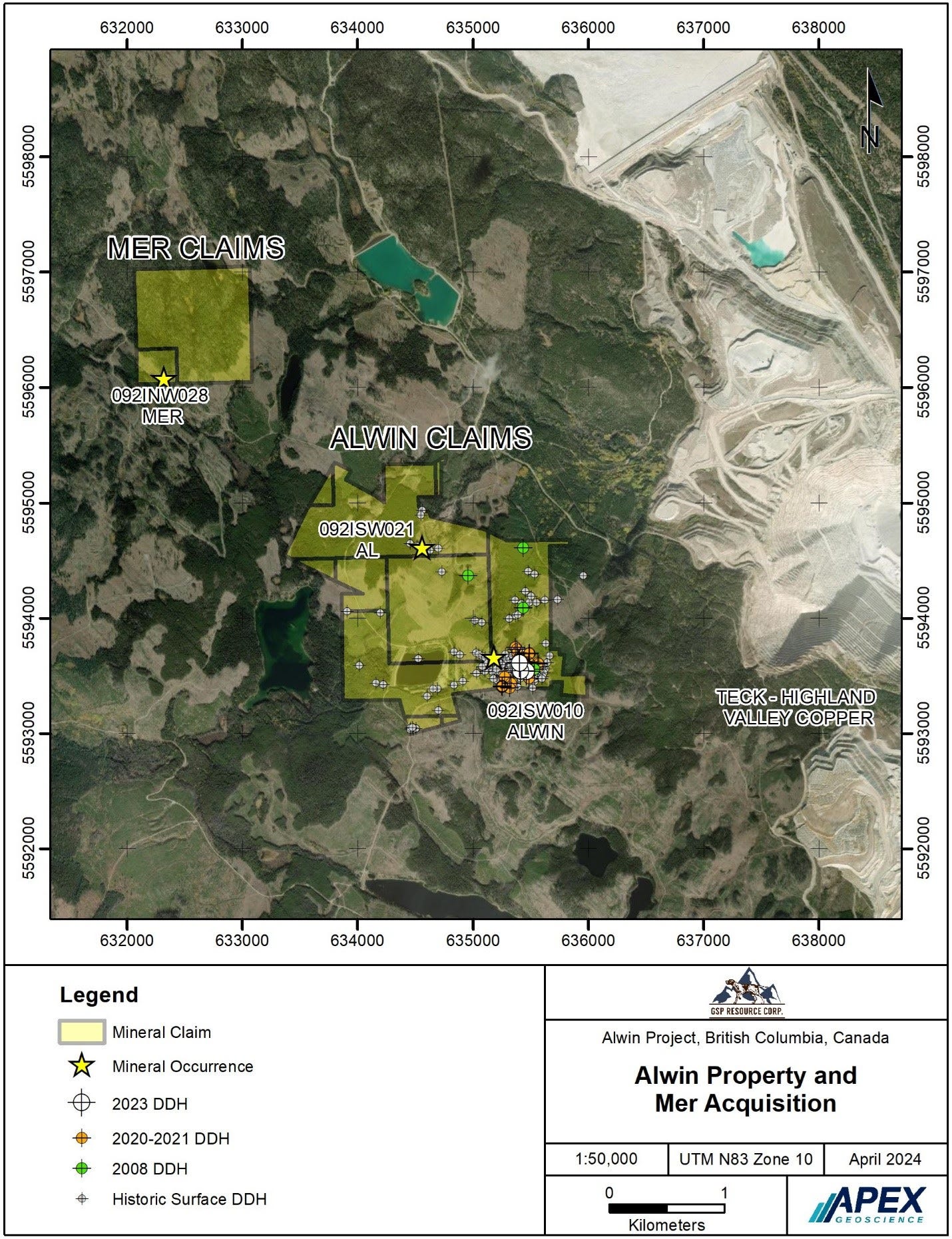

GSPR has entered into an arm’s length acquisition agreement with Dylan Adam to acquire a 100% interest in the Mer Claims in the Highland Valley Copper Camp of British Columbia. The two Mer claims are comprised of 185 hectares in the Kamloops Mining Division. The claims are situated approximately 1.5km NW of GSP’s Alwin Mine Project and are surrounded by Teck Resource’s Highland Valley Copper claim group directly west and south of the Highland Valley Copper Mine’s active operations.

A single diamond drill hole was centered on the percussion drill holes and intersected a zone of chalcocite mineralization within biotite and potassic altered granodiorite intrusive rocks averaging 0.29% Cu over 24 m from a downhole depth of 9 m. The zone of mineralization remains open to the north and west. No significant exploration has been reported within this project since the initial work programs ending in the early 1970’s.

This is a great addition to GSPR's property holdings.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Thanks Bob, interesting comparison. might be because many see Bitcoin as an inflation hedge and US$ alternative

McClellan shows that gold leads bitcoin by a week:

https://www.mcoscillator.com/learning_center/weekly_chart/bitcoin_matching_golds_footsteps/