Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

The big focus was on Nvidia and the stock dropped on their earnings report but markets soared higher anyway. My focus was more on how the market would react rather than on the stock. Nvidia

reported a 122% year-over-year revenue increase to over $30 billion for the July quarter—marking four consecutive quarters of triple-digit growth. It seem expectations are way too high and perhaps this means a top in this soaring AI sector for now.

Initial claims for state unemployment benefits fell 2,000 to a seasonally adjusted 231,000 for the week ended Aug. 24. Economists polled by Reuters had forecast 232,000 claims for the latest week. This ended up as run of the mill and did not cause a stir.

The strong up move today took it's clue from The Bureau of Economic Analysis revised second quarter U.S. real gross domestic product, increasing it from 2.8% to a 3% annual rate. The update primarily reflected an upward revision to consumer spending. This seemed to alleviate the market's fear of a weakening economy.

"Compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in consumer spending," the BEA statement added. "

I don't think building inventory is a good sign in the economy and increased consumer spending has a lot to do with inflation driven prices and soaring credit card debt. Neither healthy in the long term.

With gold, I figured there would be a pull back after the run to record prices but it is trading sideways, more like just a consolidation. I will see what next week into September brings and may add another gold stock to our list.

Market Movers

Tat Technologies (TATT): $17.60 – All time Highs

Tat Technologies, a global leader in providing thermal management solutions and maintenance services for the aerospace and defense industries, is well-positioned for growth. With increasing global demand for aircraft, both military and commercial, TATT’s expertise in producing heat exchangers, fuel systems, and other critical components places it at the forefront of this expanding market. The company’s strategic partnerships with major aerospace firms and its consistent contract wins highlight its robust market presence. As airlines and defense sectors continue to upgrade and expand their fleets, TATT is poised to benefit from the rising demand for high-quality, reliable thermal management solutions.

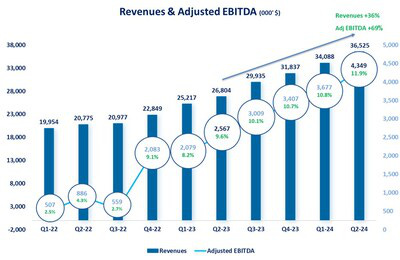

The stock popped higher today on their Q2 results. Revenues up by 36%, Increases Net Income by 78% and increased adjusted EBITDA by 69%.

"During the second quarter, we secured orders of more than $40 million, resulting in a record backlog and LTA Value of over $414 million," continued CEO Mr. Zamir. "These new orders give us significant visibility into revenue potential over the coming quarters and bolster our confidence in continued success. On top of the continued revenue growth, we invest efforts in improving our operational efficiency and cost structure. This resulted in an improved Gross margin and EBITDA margin."

Iris Energy Limited (IREN): $8.68 Up +16% today

Iris Energy, a sustainable Bitcoin mining company, stands out in the crypto mining sector with its focus on renewable energy. As global interest in environmentally-friendly practices grows, IREN’s commitment to using 100% renewable energy positions it as a leader in the green crypto space. With its scalable infrastructure and focus on efficiency, the company is set to capitalize on Bitcoin’s potential resurgence. The increasing institutional adoption of Bitcoin, combined with growing environmental concerns, makes IREN an attractive play in the crypto mining industry.

They reported yearly results yesterday with record Bitcoin mining revenue of $184.1 million, as compared to $75.5 million in fiscal year 2023, driven by growth in operating hashrate and higher Bitcoin prices. Also record 4,191 Bitcoin mined, as compared to 3,259 Bitcoin in fiscal year 2023, primarily driven by growth in operating hashrate.

Despite todays move the stock is still well below it's July $15 highs

Cintas Corporation (CTAS): $804 – All time highs

Cintas Corporation, a leader in uniform rentals and business services, continues to thrive amid economic fluctuations. The company’s diverse product offerings, including safety supplies, cleaning services, and first aid products, provide a steady revenue stream. As businesses prioritize hygiene and safety, Cintas is well-positioned to capitalize on this demand. Its strong customer base, efficient operations, and commitment to innovation ensure continued growth in a competitive market.

It looks like a pretty boring business to me but is up from $580 at the start of the year. I can't figure out why it is so expense with high valuation multiples. They do win all kinds of corporate awards and praise as a great company. Maybe investors are so happy, nobody wants to sell?

Late July Cintas approved an additional share buyback program under which the Company may buy up to $1.0 billion of Cintas common stock at market prices.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication