Market Vacuums and a Dim Future with Digital Currency

From v29 #3.6 March 28 includes Gold, Oil, Drones

Everyone needs to wake up and realize the path we are all on is not a good one and will effect your freedom and finances very significantly.

Market Vacuums

Investing successfully is not a 100 yard dash, it is a marathon. Markets will go up and down short term and have done that more so in recent years. This short term volatility can negatively effect your portfolio, but it is important to keep your eyes on the longer term horizon and be positioned properly.

The majority of the time there are some stock market sectors doing well even though most are not. Most of 2022 was a prime example where energy stocks did well while bonds and major market indexes went into a bear market. Energy was the main reason our Millennium Index had a 19.0% return in 2022 well most everything else collapsed. Often gold and gold stocks will do well when other sectors are not.

That said, every once in a while you hit what I am going to call a 'market vacuum'. Practically nothing is going up but mostly down or sideways. We had a couple of those vacuums in 2000 to 2002 and then gold soared higher. Another one in 2008 and then in 2009 gold soared higher. We had a short one in 2020 for a couple months when Covid-19 first hit then gold went higher and markets too. We have been in another vacuum since the later part of 2022 to now. The energy sector went down and the major market indexes have basically been sideways. Gold has gone higher since November 1, 2022 so I believe it is starting it's rise from this recent vacuum. The gold stocks have not responded much yet, but they will. During these vacuums we have to keep are eyes focused longer term and realize that in these vacuums there is not much you can do, just be patient. That is a very hard market discipline to learn.

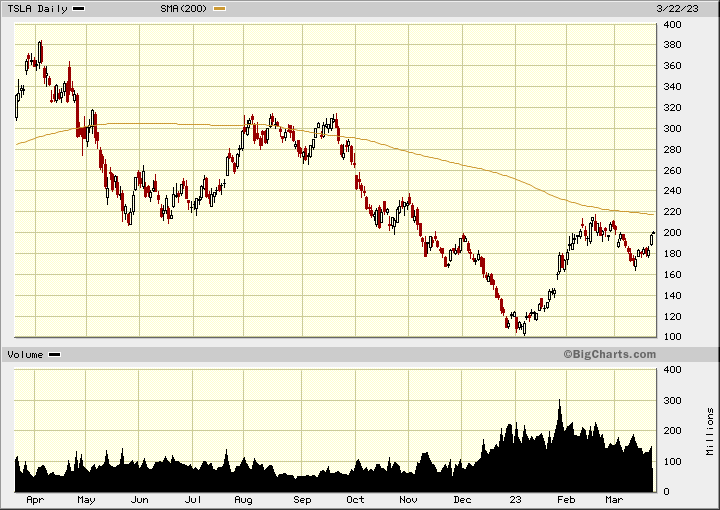

Now there is always the odd situation that can do well in these vacuums, there is just not many of them. For example I picked Tesla (TSLA) on January 9th at around $115 and it has gone up to about $200. We made some profits on our Bank Put options, but other than that it has been slim pickings with everyone I know experiencing weakening portfolios in the last several months.

I have been advocating a significant cash position for the last few years. The recent US banking problems highlights some things and has raised concerns among many. It is important to realize that banking regulations were significantly changed after the 2008 crisis. This was done in the back pages of government bills or budgets in pretty much all of the western world. To explain in simple terms, the cash or deposits in your bank accounts are not yours, under the new rules, you have agreed to lend your money to the bank and they can do as they please with it. So far they have been bailing out customers of these failed banks, except the Crypto related bank Silvergate. At anytime the central planners could say no more bailouts and the banks would be forced to do bail ins. In this case the failing bank takes part of your money in your account to bail them selves out. For example they could confiscate 30% of your funds they have and issue some bank stock in it's place.

If the big banks start to fail this could happen, but I believe they have a new plan now since this bail in legislation was implemented back in 2009/2010 and it is called 'Central Bank Digital Currency' (CBDC).

Interesting this banking crisis is among small banks that will be disappear or be swallowed up by the big ones. It would be easier to implement a digital currency with less banks. Swiss authorities announced last Sunday that UBS had agreed to buy rival Swiss bank, Credit Suisse in a shotgun merger aimed at avoiding more market-shaking turmoil in global banking.

Dealing with inflation, challenging investment/economy and what the future holds, the government's going to have to say to voters why they are putting citizens' money, taxpayer money at risk to bail out a bank that was predominantly servicing the ultra wealthy.

We need a new bill of financial rights, but the reality is they are planning on taking more of your financial rights away. The Fed and several banks have already been testing this digital currency for several months.

The Fed announced on Wednesday that it will begin formal certification of participants in the FedNow system in April in anticipation of a July launch. First announced in 2019, FedNow will allow banks to instantly transfer payments across the financial system. This is like testing the back bone of CBDC before expanding further.

“With the launch drawing near, we urge financial institutions and their industry partners to move full steam ahead with preparations to join the FedNow Service,” Ken Montgomery, first vice president of the Federal Reserve Bank of Boston and FedNow program executive, said in a statement.

This is another step towards a digital currency. Basically this digital currency system is just the same as the debit cards and bank cards you are already using, but the two key new components is to eliminate cash and be able to track everyone's financial transactions in a central repository controlled by the Fed/government.

For example, at some date in the future when they implement this, the government comes out and tells us that we have 6 months to deposit any cash dollars for digital dollars. Jim Richards calls them 'Biden bucks', but I doubt Biden will still be president when this happens. The total surveillance and control of how you use your money is their ultimate goal and it is likely tied to the 'climate scam'. Sorry Ron, no more gasoline purchases for you this month as you are at your carbon quota and by the way no more plane travel this year. Sorry Ron, you cannot purchase any more steak or beef this month, you reached your quota.

And if you still don't believe this, hear it from Agustín Carstens, the general manager of the Bank for International Settlements (the 'central bankers’ bank), at a 2020 IMF event, Cross-Border Payments—A Vision for the Future. Go to about 24 minute mark

“For our analysis on CBDC in particular for general use, we tend to establish the equivalence with cash, and there is a huge difference there. For example in cash, we don’t know for example who is using a hundred dollar bill today; we don’t know who is using a one thousand peso bill today. A key difference with a CBDC is that the central bank will have absolute control on the rules and regulations that determine the use of that expression of central bank liability. And also, we will have the technology to enforce that. Those two issues are extremely important, and that makes a huge difference with respect to what cash is.”

You might still have doubt, but many signals point quite clearly to this. Covid-19 was really a practice run for them to see how much control they could impose on people. There are countless examples of proof and I will just highlight two of them.

Matt Hancock the former UK Health Minister during the pandemic recently provided information to a publishing company to write a book on how well he did during the pandemic, but it back fired. When the writer saw the information she tore up the contract and leaked the info. Basically messages show they were planning to scare people and then joking and laughing at people complying to their nonsense.

Dell Bigtree at thehighwire did some coverage. Go to the 40 minute and listen to about 1 hour 5 minute mark

Huge leak on how UK government planned pandemic and planned timing of variants with the goal of stoking fear. “yup thats what will get proper behavior change” Matt Hancock UK Health Minister. Also MPs who spoke against lock downs were put on a secret red list.

The CDC paid one firm $420,000 and another $208,000. That bought access to location data from at least 55 million cellphone users. The contracts, obtained by The Epoch Times, state.

The CDC said it would be using the tracking data to “assess home-by-hour behaviors (i.e. curfew analysis) by exploring the percentage of mobile devices at home during specific period of time.” The data could also be integrated with other information “to provide a comprehensive picture of movement/travel of persons during the COVID-19 pandemic to better understand mandatory stay-at-home orders, business closure, school re-openings, and other non-pharmaceutical interventions in states and cities.”

Your Future and more so your children and grand kids are at stake

Their next endeavour by these central planners who I refer to as mad scientists or evil communists is just unbelievable. Considering the North American and most western governments have been caught is so many lies and scandals, I truly believe we have to go back to medieval times to find more corrupt governments.

The current banking crisis could go much further,but probably run away inflation could provide the crisis for them to implement CBDC. They will perfect a narrative and events to convince the public that CBDC will fix all problems and is required for the future. I don't know how long this will take, within the next 3 to 8 years.

They are also starting with other controls like you must scan your drivers license to buy alcohol. I found Walmart was doing this when I was in the US. It will come to the point where they will limit you if they want to

The prices of many Crypto coins jumped significantly during this banking crisis. The Crypto bulls believe the crisis proves Crypto is better than banks. What they should know is at least at banks you will get bailed out, well for $250k each per bank per person in the USA. If you have $250k in 2 different banks you have $500k in deposits insured.

These central planners see Crypto as another thing that must go just like cash. You can see the writing on the wall. The FDIC has already backstopped the uninsured client deposits of Silicon Valley Bank (SIVB) and Signature Bank (SBNY), while Crypto focused Silvergate (SI) was left to liquidate and Credit Suisse (CS) was rescued by Swiss authorities and UBS (UBS).

The SEC's Crypto crackdown looks set to continue after Coinbase (COIN) revealed it had received a Wells Notice from the agency. Potential charges were not specified, but an enforcement action alleging violations of securities laws is expected, which may relate to the exchange's spot market, staking service Coinbase.

Earn, Coinbase Prime and Coinbase Wallet.

You could retreat to your own garden or space and hide in the dark. People need to start speaking out until we get to the point of mass objection to what is going on and what is being planned. Soon it will be to late and we will be a complete Totalitarian state. You are mistaken if you don't think it will effect you. Maybe you are older like me and your life is 3/4 gone so what the heck, but think of your kids and grand kids.

Your only protection from CBDC and it's controls is gold and silver. Silver coins might be ideal as they could be used for lower value person to person transactions. Gold and Silver are proven currency for over 1,000 years. Ask yourself why Central Banks have been buying gold hand over fist in record amounts for the last 10 years. They know whats coming because they are part of it. After the 2020 market vacuum gold went up 40% or from 2019 up 58% (gold was predicting a problem) . In the 2008 aftermath gold went up 170% and after the market vacuums in 2000 and 2002, from 2003 gold up 150%. In each of these cases, the main driver pushing gold was Fed easing and printing money. I think we could see the mother of all gold bull markets because this one will be driven by high inflation and money printing, like throwing gasoline on the inflation fire. It could be like a combination of the 1970s and post 2008 gold bull markets.

In the current rally, gold has gone from around $1,660 to $2,000 (20.5%) in just 5 months and has now hit official bull market status, defined as a 20% gain or more. Based on past rallies after a market vacuum and easy money, this move has hardly started. Gold stocks have not moved much yet either. I forgot to note in my last update but the COT reports are available again. Not much new here, managed money was around zero net positions with the early March lows and have been buying again in the last 2 reported weeks.

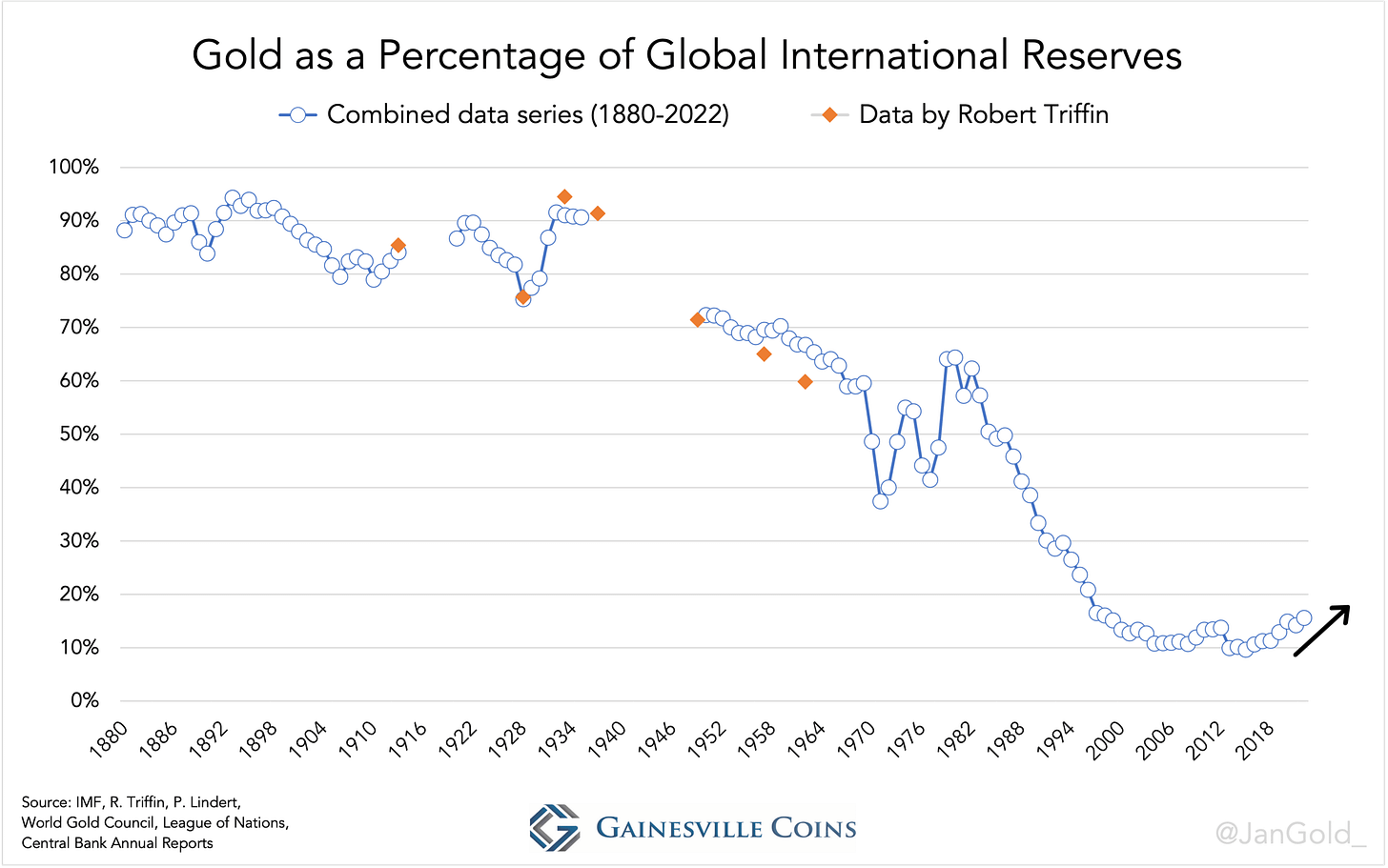

I came across this interesting chart and it was presented as Central Banks having low gold reserves as a percentage of total reserves. I see other interesting factors. I believe the data gap around 1940 was when gold was confiscated from citizens. There was a big increase during the 1970s inflation period and then after 1981 they steadily declined along with inflation and falling interest rates that eventually went to around zero after 2008. However, we see gold reserves picking up again along with another inflationary period upon us.

Oil. It makes no sense that oil prices dropped and I am certain the actual cause was one ore more of these failed banks or banks in trouble had a large interest in oil derivatives that had to be dumped. When I look at open interest, there was a huge spike on March 15th, more than double normal levels. In fact open interest was abnormally high from March 13th to the 20th.

Drone Delivery - - - TSXV: FLT; - - - OTC QX: TAKOF - - - - Recent Price - $0.42

Entry Price - $0.43 - - - - - - - - Opinion – buy on weakness under $0.40

March 23rd FLT announced that, with the assistance of its sales agent Air Canada (TSX: AC), it has signed a contract with the Canadian Government to work with Transport Canada in operating and evaluating DDC’s proprietary drone delivery platform using DDC’s heavy-lift Condor remote piloted aircraft, the largest drone currently being developed by DDC. The Contract, with a value up to approximately $1.2 million is with the Canadian government’s Innovative Solutions Canada program. Under the terms of the Contract, DDC will provide Transport Canada with a Condor drone, and collaborate with Transport Canada in operating, testing and evaluating the capabilities of the Condor drone solution until December 2023.

The stock popped to over $0.50 on the news with high volume but in this crappy market could not hold on. I would buy on weakness, under $0.40. In time FLT will be a dominate player in the drone delivery market.