I have been bullish on general markets lately and expected we would reach 4600 on the S&P with the month of December giving the best chance to go even higher and test 4800. Markets liked what they heard from the Fed yesterday and the S&P 500 jumped over 60 points. So I think we are on our way to 4800. However, it could end up being a double top.

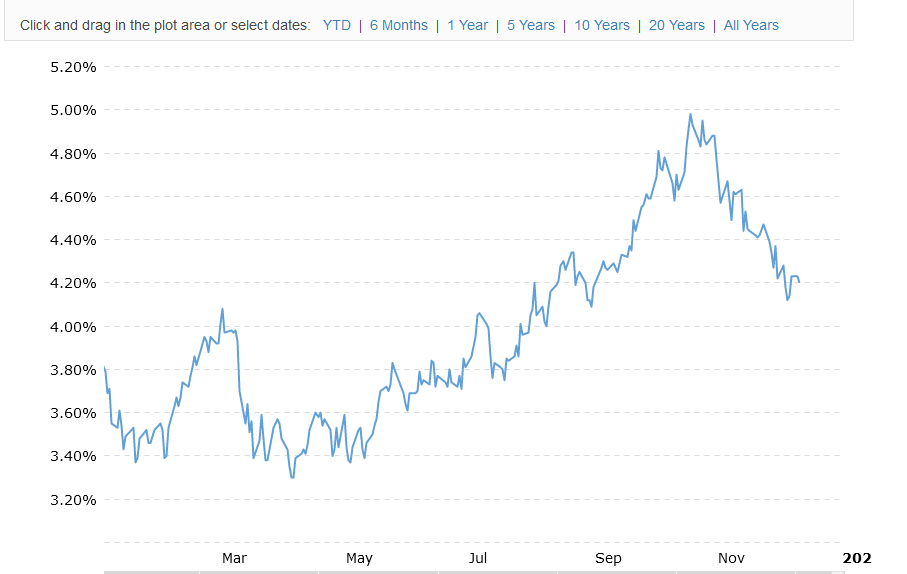

The stock rally continues on low volume and poor market breadth so it will be interesting how January plays out when volumes typically surge higher. I am not very bullish for 2024 and see the market going down again because of uncertainty with current wars and the election. I expect we will also see some negative surprises and the US economy tip into recession. The current Goldilocks outlook and soft landing is already being priced into the stock market. And the market has priced in expected rate cuts as you can see on the 10 year treasury, rates have come down almost 1.0% to 4.2%.

With better markets, I am going to sell TRML as it has had a nice run soon after they acquired Talaris which we owned. TRML looks like it is peaking out. Plus we have a very nice 170% gain from our original Talaris purchase adjusted for the takeover.

Tourmaline (bought out Talaris) - - - NASDAQ:TRML - - - Recent Price - $18.65

Entry Price - $6.90 - - - - - - - - - Opinion – sell

It has been a tough year for good profits so I want to take some where we have them. I am suggesting to sell based on the chart and markets that are starting to peak out.

Gold Soars

Gold spiked yesterday on the Fed news and market expectations of rate easing. I have been commenting that I was concerned with the typical year end weakness in December and we saw that with the drop below $2,000. There is not much in gold's way now. We need to see that close above $2150.

The other big thing of significance is an error in the chart. This is the most active Comex contract, February 2024 and it shows a paper umbrella yesterday when it should be a solid green candle that is very bullish because it engulfs 3 previous down days. A paper umbrella is often seen at tops. I don't know why this is incorrect? Are the manipulators that desperate that they have to repaint charts? I guess the market did not get fooled, because gold is higher again today.

If you look at the hourly trading yesterday, gold spiked higher from $1998 at 1 PM and hit $2043 by 3:30 PM and never looked back, topping at $2053 by 6:30 PM. I checked the chart data on another site and it had the same error. I believe 2024 will be a great year when markets figure out that gold is now a tier one asset and preferred over fiat currencies by the Central Banks. That is why Central Bank buying continues in record amounts.

The gold stocks measured by the HUI index bounced higher yesterday and today but are still way under valued and lagging the gold price. I believe we need that $2150 break out to wake up the gold stocks. If we get a pull back from this pop, I will probably suggest a new gold stock and maybe some gold stock call options.

And finally I want to show a glimmer of hope for the junior explorers. The TSX Venture index saw it's first rally in November since March, although it was small I am expecting to soon see a higher high.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.