Markets and Tariffs, Canada Election, Gold not Silver

There was a nice rally in markets but they failed to break resistance. A bearish signal is that the S&P 500 broke below the 200 day MA and this will now act as resistance to the upside. The market got to the top of the resistance area and only managed 1 day above the 200 day MA. A break down to new lows is what I am expecting next.

Tariffs Deja Vu

Tariff uncertainties is being blamed for market weakness and they certainly are a factor. I want to emphasize to Canadians that Trump did the exact same thing back in his first term. He imposed tariffs on Canadian steel and aluminum and next threatened tariffs on Canadian autos in 2018 as a new trade deal was under negotiations. The auto tariffs were never actually imposed and a new trade deal was reached.

Trump clearly uses tariffs and threats of them as a negotiating tool. The U.S. consumer economy is a monster, creating a lot of demand world wide so is a powerful lever that Trump is using.

Tariffs in his 2nd term look to be getting more intense. This go around he is threatening 25% tariffs on all vehicles imported into the U.S. For sure this is a hit on Europe as they impose tariffs on U.S. vehicles. I expect many European countries will drop their tariffs on the U.S. and Trump's tariffs will be dropped. We will see what happens with Canada and Mexico on the April 2nd implementation date. Trump is notorious for delaying tariffs if some kind of progress is made and likes to keep using the threat more than once.

“On April 2, we’re going to move into the reciprocal tariffs, and hopefully Mexico and Canada will have done a good enough job on fentanyl that this part of the conversation will be off the table and will move just to the reciprocal tariff conversation,” Lutnick said.

The bigger problem for the U.S. is that the illegal immigration was propping up the economy more than first thought. I have been following Ed Dowd of PhinanceTechnologies.com for a few years now and he has proven to have accurate data and projections. He is back with an update of a report on“Danger of Deep Worldwide Recession in 2025.”

It was not just heavy government spending on illegal immigration, but “mind shocking” fraud that has been revealed with DOGE (Department of Government Efficiency). Basically NGOs, Non Government Agencies were given $billions to support illegal imigration and refugess.

Investigators have uncovered $115 billion so far with many hundreds of billions more to be exposed. Dowd says, “Both sides of the aisle are probably going to have problems..."

“The 10 million plus illegals that came in over the last four years, you just don’t wake up one day in Central America and say I am going to the Darien Gap, and go to the Mexican border and then meander my way into the interior of the US without a tremendous amount of aid along the way. NGOs facilitated that and probably took their cut.”

As more and more economic data starts to reveal this big cut in econimic activity with that added in from government job cuts and tariff uncertainty, the U.S economy is going to take a short term hit but a big one and the market will be surprised, so expect more down side.

On Tuesday it was reported that Consumer confidence sank to 4-year low of 92.9 from 100.1 in February. The U.S. consumer is a huge driver of the U.S. economy and world economy.

New home sales are flat as prices are decling and builders offering more incentives. Durable goods orders rose almost 1% in February as U.S. manufacturers rushed to procure supplies ahead of the Trump administration’s tariffs on foreign steel and aluminum. This is a small jump and we can expect it is temporary. There is not much change in economic data and we get inflation data tomorrow with PCE data that could sway markets.

Canada Election

The polls show a pretty close race with Liberals under Carney with a small lead, It seems the Liberals have gained at the expense of the NDP. As I commented before the NDP provide no differential with the Liberals as both parties have moved far left, with socialist policies. Of course for the left Carney is a much better leader than the NDP's Singh.

I would not put much confidence in Canadian polls as they typically take small samples of 1,500 and less. In fact margin of error numbers should be ignored because none of the polls follow criteria to make such calculations valid.

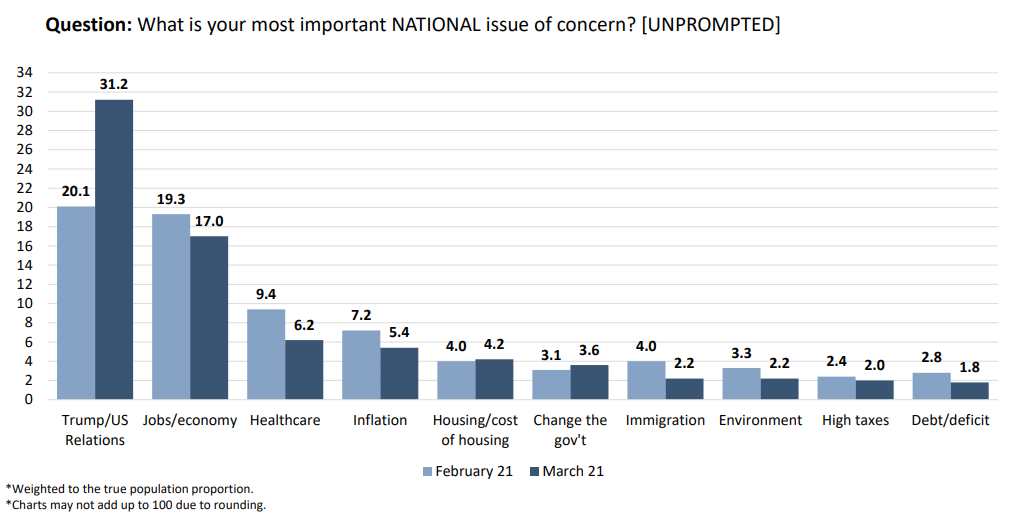

The above chart of polls clearly shows the Liberal gain at the expense of the NDP and a decline in Conservative support.. The polls count intention, those who say yes or are leaning toward a party. They drop out undecided and interesting that Ipsos says up to 10% decide in the voting booth.

I would not put much faith in Research that only polled a small sample of 1,003 adults and Angus Reid at a higher 2,400 adults only polls those that joined the Angus Reid forum.

Ledger polled 1,599 Canadians, Pallas 1,225 eligible voters, Abacus 1,500 eligible voters and Innovative polled 1,548 Canadians.

Nanos is a bit unique as it does phone interviews of randomized land line dialing and cell phones of those 18 and older. Their numbers are also a rolling 4 week average. Here is an interesting chart in their data.

The Liberals with their pushed narrative have convinced many voters that Trump and his tariffs are the problem. They are trying to divert Canadians from the fact that the Liberal policies under Trudeau and Carney as his economic advisor have created the mess the country is in. Liberal policies caused Canada's current problems, do you really think giving them a 4th mandate will fix it?

Now that an election is near, the Liberals are promising the same things that Conservative leader Poilievre has been pushing for 2 years or more. Carney will drop the carbon tax, only to put it back on later as a hidden tax.

The Edmonton Journal makes a good point. Mark Carney's new economic promises go against everything he values. Where will it put Canada if we follow Carney, if we swim against the new tide of world economic trends?

“Carney’s current statements don’t just fail to align with his past statements, they contradict his most cherished values, everything he’s said, written and fought for in the last five years as an economic adviser to Trudeau and as United Nations special envoy on climate. “

As I have been saying, Carney is simply Trudeau 2.0

What is happening in the real world? If we look at the turn out to Carney's and Poilievre's rallies, Poilievre is getting bout 5 times the turn out. Carney is lucky to get 200 or so people at his rallies or outings.

My son was at Poilievre's Hamilton rally and the Hamilton news paper said there was thousands and my son says easily 1,000 and sent this photo. This is inside and not everyone could get in.

Carney is promising a 1% tax cut on the low income bracket, Poilievre is at 2.5%. I don't think 1% makes much difference but 2.5% is at least decent.

Both say they will eliminate the carbon tax and both talk against Trump's tariffs and both say they will improve the economy and create jobs. Also both say they will increase the military and border security. Both say they will fix health care and housing.

Carney will make no changes on immigration, Poilievre will cut it further. Carney like Trudeau says there is no drug or Fentanyl crisis even though B.C. has the highest death rate in the world from fentanyl. This is part of their narrative that Trump's tariffs are unwarranted and an attack on Canada. Poilievre wants life sentences for traffickers.

Carney is doing nothing for seniors other than some fake youtube videos that say he is handing out $2,000 checks or so for seniors. Poilievre will increase the old age deduction by $10,000 so seniors can earn $10,000 more tax free $$. This is a big deal for seniors that also have a company pension plan.

If you remember the U.S. election, Harris had a big jump in the polls after replacing Biden, but the honeymoon ended and she fell back down. Con man Carney is trying to take advantage of his honeymoon by calling a snap election.

Can you trust him when he is making promises that go against all his beliefs and actions of the last 5 years or Poilievre saying much the same thing for 2 years?

I have also learned Poilievre's rational on not taking security clearance. Once he does he wold not be able to comment or push on the Liberals about foreign interference because he would be privy to inside national security issues. The party current chief of staff has security clearance so the Conservative party knows what is going on

Ipsos poll, since 1987 (with Global News) has never seen such a reversal in polls. They say it took a new PM and Trump tariffs. They also say polls are no longer very representative

I would not put a lot into these polls but will follow them never the less. Trends may be more important than the actual numbers. I have also started to follow Polymart where people bet on events such as an election. That is currently pretty close

Gold and Silver

As I have been commenting, these two precious metals have a complete different market. Many are hyping about the high gold to silver ratio, but there is a reason for that.

Central Banks have taken control of the physical gold market and the paper markets on Comex no longer control the price, but they are still controlling the silver market. Silver needs that buyer or buyers that gobble up physical silver and that is not happening yet. I believe it will sometime n 2025 but we are not there yet. Silver made a higher high but it could not hold very long. There is a strong move today but I expect resistance at $36 to prevent a new high.

I am also seeing in my silver stock short barometer that shorts on silver stocks are at record highs. Another indication that shorts in the paper market are still trying to control prices.

We need to see strong physical demand and that has not happened yet. My coin dealer still shows lots of physical silver available but at least inventories have fallen.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.