Markets, Commodities, US$, Gold, Oil, Fedex, 3 Finance stocks. GLM

US$ Breaking down, Gold no top in sight.

Welcome and thank you to all the new, smart, savvy and contrarian investors to my substack. If you like outside the box thinking, a humble analyst that has spent his career studying market and economic cycles, picked numerous tops and bottoms, someone not afraid of controversial topics and can be a bull and a bear, your at the right place. Please share and subscribe.

I commented that a 50 point cut would mean the Fed sees some kind of trouble, but they said the exact opposite, so why the bigger cut? Again it is another example of 'do as I do, not as I say'.

Anyway, yesterday the markets saw it as a big new punch bowl to the party. I may have to rethink my market top thesis, but lets see how today and next week go. So far markets are giving up some of their gains but gold, copper and oil are up. I think a point most are missing is the negative affect on the US$.

What does the Fed see that it is not talking about?

We have some new Fed speak with the word "recalibrate". Chair Jerome Powell used the expression a total of 10x during his post-meeting press conference on Wednesday, and the markets are just loving it, Perhaps it really means filling the punch bowl.

The official FOMC statement noted, “Inflation has made further progress toward the Committee's 2 percent objective but remains somewhat elevated.” And the economy is continuing “to expand at a solid pace,” and Powell downplayed the possibility of a recession. If everything is just right, Goldilocks is alive and well, why the aggressive 50 point move? Was it an election favour for the Biden Administration? Not many will talk about that, but what else makes sense.

Nomura Capital Assets analyst Matthew Rowe told Reuters, “Many market participants see this as an aggressive move that is not justified by what normal market participants can see.”

Now here is the scary news as something maybe lurks off the radar. Principle Asset Management chief global strategist Seema Shah told CNBC that a 50-basis point rate cut with no sign of economic turmoil is “a unique move in history.” In fact, the last two times the Fed started an easing cycle with a half-percent rate cut, it was a prelude to a crisis.

In January 2001, the Fed cut from 6.5 percent to 6 percent. Over the next year, the S&P 500 crashed by 39 percent, and unemployment skyrocketed, leading into a recession.

In September 2007, the Fed cut rates from 5.25 to 4.75 percent. A year later, we had the financial crisis and the Great Recession.

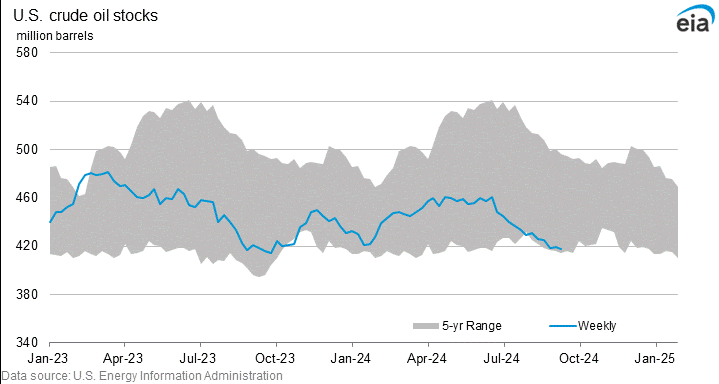

For one, I don't believe inflation is licked, core CPI is still 3.2%, it is the drop in oil and energy that has given temporary relief. See below, I don't think oil will remain weak. Makes little sense unless there is a bad recession around the corner.

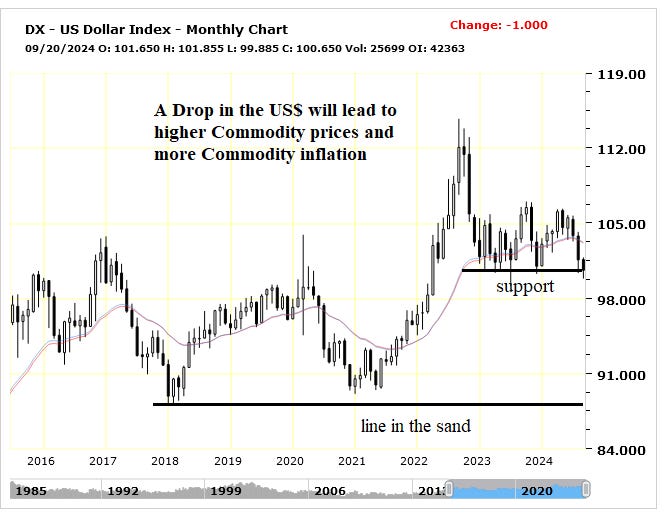

The US$ is on the verge of a break down on the chart. I expect this will soon happen and the next important level to watch is the 89 area.

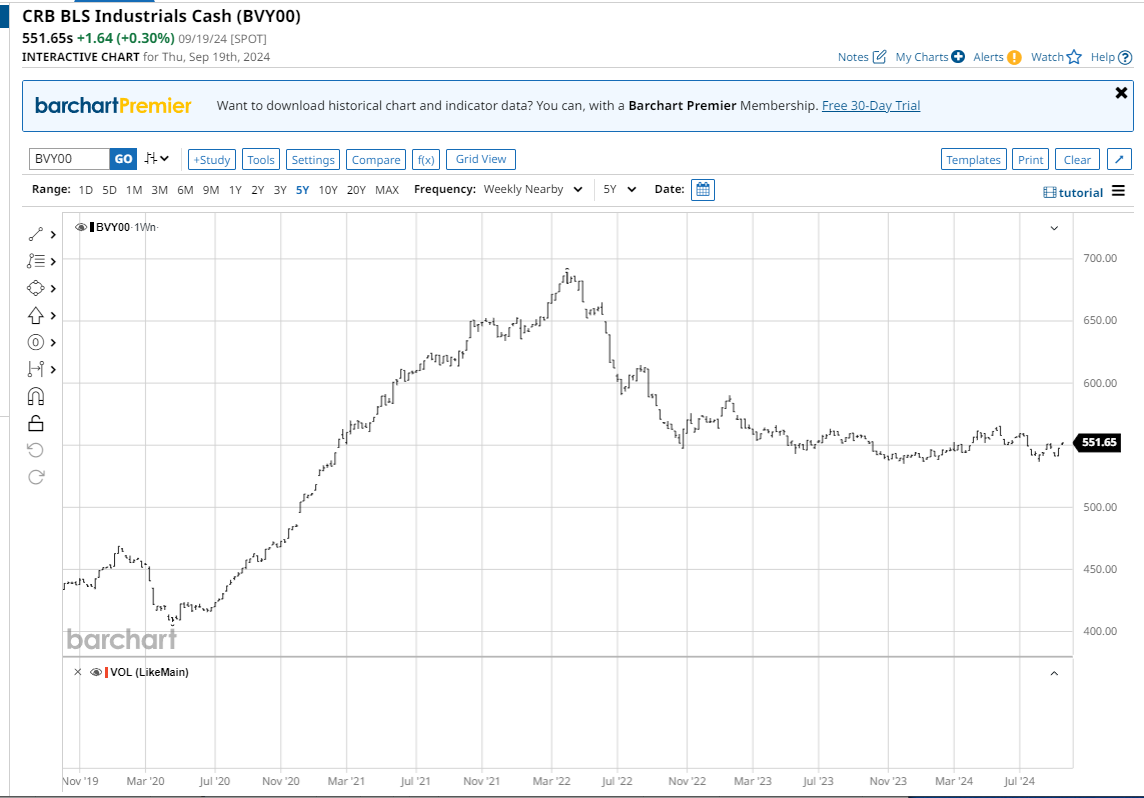

In this chart we can see that commodity prices have come down from the early 2022 peak but have stabilized at a much higher level before the next move, which I believe is up. There has only been a pause in the commodity bull market.

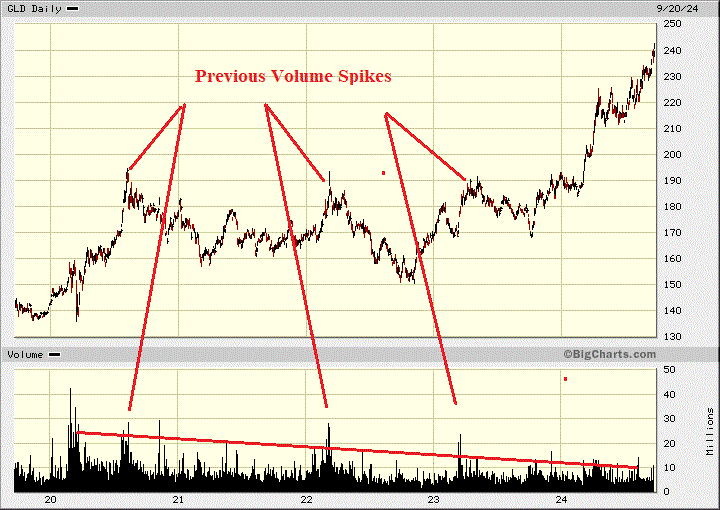

I commented that Central Bank and Asia demand is driving gold higher. Strong demand continues for Indian consumers for gold jewellery and bars after a recent cut to tariffs.

India's gold imports hit their highest level on record by $ value in August at $10.06 B, according to government data on Tuesday. That implies roughly 131 tonnes of bullion imports, the sixth-highest total on record by volume, according to a preliminary estimate from consultancy Metals Focus.

Gold sets it 7th record high this year and most North American investors are stunned in disbelief. Volume remains flat in the GLD etf since mid 2023. A volume surge could come with a short term top, perhaps later this year.

Oil responded very bullishly yesterday with an engulfing green candle, but now we are up against some resistance. I would bet it breaks above since we have some time before the month end sell off (If that pattern continues) and a weaker dollar and an improved macro risk outlook are bullish. Oil inventories remain at lows and the Middle East conflict intensifies.

US Crude Stocks Hit One-Year Lows. Crude oil inventories in the United States have dropped to their lowest level in a week, posting another week-on-week decline to 417.5 million barrels.

You probably heard about Hezbollah and friends pagers all blowing up at the same time and then next day later their talkies. I heard of about 32 people killed and thousands injured. An ingenious move by Israel but it will have repercussions. More escalation.

And food for thought. This technology could be used to booby trap cell phones and at the Authorities liking they could set any individual's cell phone off at any time.

Yesterday, I commented I was watching for FedEx earnings because they can be seen as a bell weather for the economy. The news was terrible.

FedEx Corporation (FDX) $258 down - $41.57

In its latest quarterly results, FedEx missed Q1 expectations and dropped its outlook for FY25, dragging shares 14% lower on Friday. They blamed reduced demand for priority services, constrained yield growth, as well as higher operating expenses.

FedEx faces significant headwinds, particularly from rising operational costs and increased competition from both global couriers and last-mile delivery startups. The company's reliance on international shipping exposes it to economic slowdowns and geopolitical risks. Additionally, e-commerce giants like Amazon are expanding their logistics networks, reducing dependency on third-party carriers like FedEx. Combined with potential labor issues and margin pressures, FedEx's long-term growth prospects seem challenged.

Of course financial type stocks like the aggressive Fed cut

Northern Trust Corporation (NTRS): $92, 52 week high.

Northern Trust stands out as a leader in wealth management, asset servicing, and financial services, with its robust presence in global markets. Its strategic expansion into digital capabilities and increased investments in technology solutions offer significant growth potential in an increasingly data-driven financial environment. As institutions seek more comprehensive asset management solutions, Northern Trust’s expertise in fiduciary services and institutional investing gives it an edge. With rising interest rates, the firm benefits from higher net interest income, while its conservative risk profile offers a stable outlook in volatile markets.

Insiders have been buying shares the last 12 months with 15 purchases and 1 sale. The stock currently yields 3.26% and will respond positively to lower Fed rates.

American Express Company (AXP): $270.60, New all time highs

American Express has demonstrated strong resilience through its premium brand and expansive global network. Its focus on higher-income consumers and business clients provides a loyal customer base that is less sensitive to economic downturns. AXP’s continued investments in digital platforms and partnerships with luxury brands strengthen its position in the high-spending, affluent demographic. Furthermore, the company’s ability to expand its merchant base and leverage its powerful rewards ecosystem will drive revenue and growth. As travel and consumer spending rebound post-pandemic, AXP is well-positioned to benefit.

The stock is not cheap with a 23.4 P/E and a dividend yield just over 1%

Capital One Financial (COF): $152.90, just made 2 year highs

Capital One has capitalized on its tech-driven approach, particularly in the digital banking space. With strong market penetration in the credit card industry, its substantial customer base, combined with prudent risk management, allows for steady income from fees and interest. COF’s focus on data analytics and AI to assess credit risks positions it well in an evolving financial landscape. Higher interest rates and increased consumer spending bolster the company's credit card portfolio, driving future growth. COF P/E is a more reasonable 12.2 and yields 1.57%

Of these three financial type stocks I like Northern Trust with the higher yield and strong insider buying.

Golden Lake - - CSE:GLM, OTCQB:GOLXF - - Recent Price C$0.65

Last Fridat GLM announced it has retained HD Drilling Services, to undertake the upcoming drill program at the Jewel Ridge Project, Nevada. Drilling is expected to commence the week of September 23rd, 2024, when the BLM has provided written confirmation that the reclamation bond has been received.

"We are very eager to get this long-awaited program started. A lot of hard work has gone into correlating all the data we have obtained through various work programs of our own and those of our neighbors over the last two years," stated Mike England, CEO and President of Golden Lake.

The initial phase one program is expected to consist of drilling a minimum of 4 high priority holes covering approximately 1,700 meters (5,000 feet) using a Reverse Circulation (RC) drill. Details of the targets to be drilled in this program can be found here https://www.goldenlakex.com/jewelridge.

This could be one of the most closely watched drill programs in Nevada, especially given GLM's very low stock price. To me there is little downside, just upside.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.