Welcome and thank you to all the new smart, savvy and contrarian investors who have joined my substack. Please share and subscribe while this is free.

I have been updating the gold market and I plan a report on copper and copper stocks next week, but today I want to highlight the S&P 500 that hit my first target and where does it go from here.

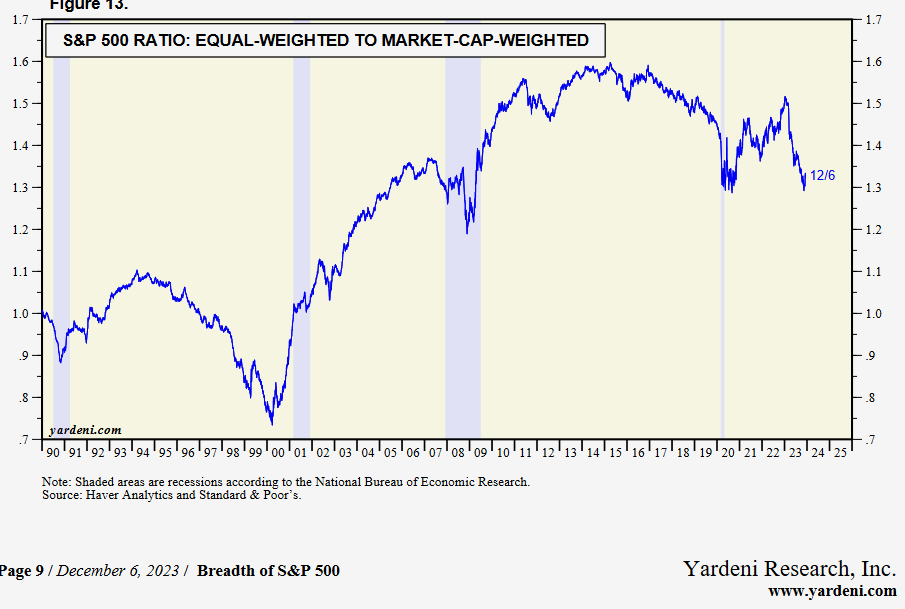

The S&P is up well above +20% from last October lows so is technically a bull market. I expected the market would get to 4600 however, there are a few issues that concern me. This rally was on low volume and RSI got to the high side around 70. The best chance for markets to break 4600 resistance will probably be this month. January is often optimistic for markets but I believe there will be surprises in 2024 regardless of the January effect. Despite the strong rally this year, less than 50% (49.8%) of S&P 500 stocks are positive on the year. This also shows in the equal weighted to market cap weighted ratio shown in next chart.

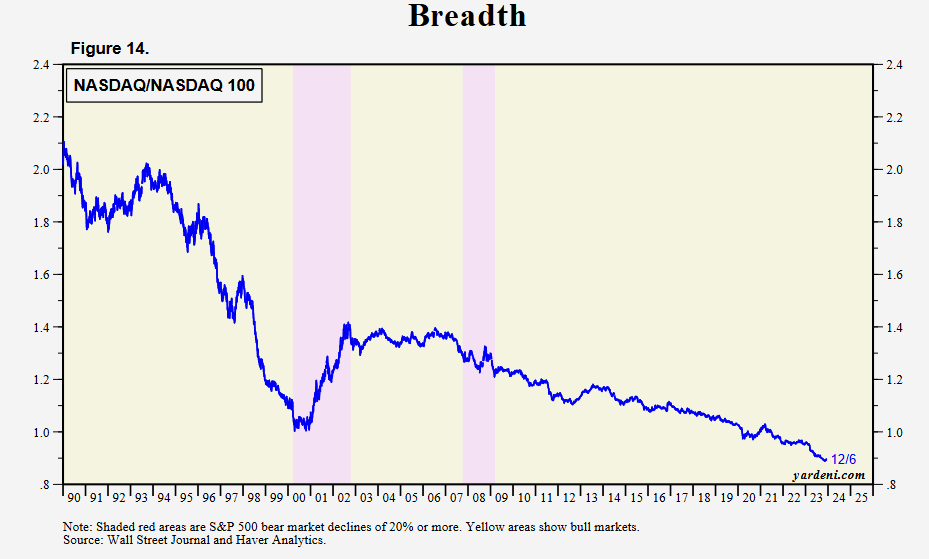

Information technology shows the worst breadth and this is the sector that has led the market. And this has been going on for a long time as just a handful of stocks have moved this market up. Just look at the NASDAQ 100 breadth below.

Goldman Sachs' equity research team led by chief US equity strategist David Kostin described the Magnificent Seven's outperformance as a "defining feature of the equity market in 2023."

Many investors are wondering why their portfolios are struggling and that is because the other 493 stocks in the S&P 500 are only up on average 8%, they are no doubt in the basic bear market rally. A bull market in 7 stocks is not a bull market, it is a fake out. Or as I like to call it 'The Great Bear Trap'. It makes one wonder, how much is this market simply manipulated for good looks! Another big warning signal is Dow Theory.

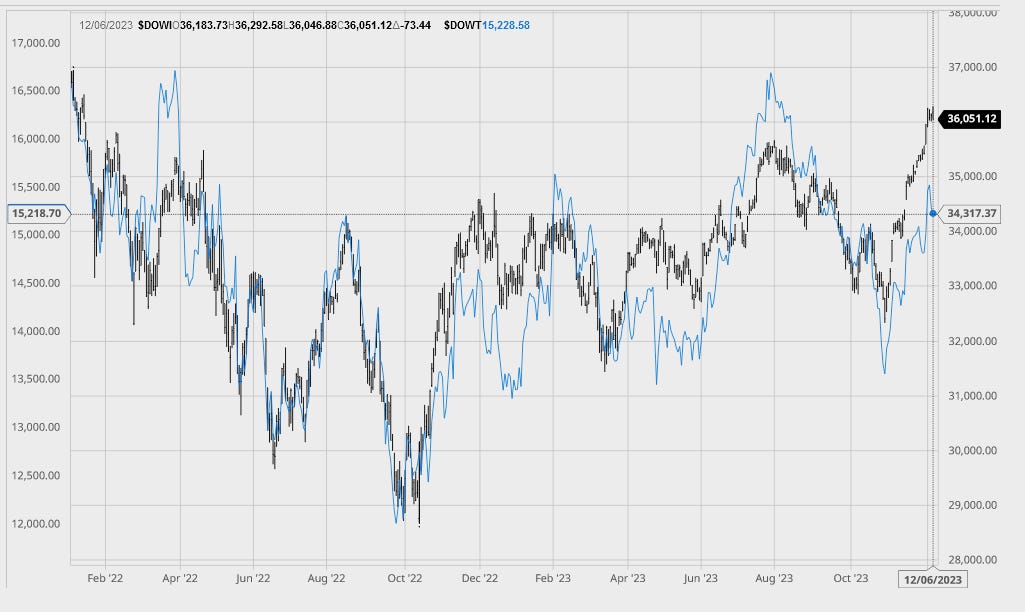

With Dow Theory, the transportation index should confirm the move in the industrial index. The reasoning being is if the economy is doing well than transportation should be also. The chart compares the Dow Jones Industrial index to the Transportation index (blue line). You can see that the Transportation index confirmed the Oct 2022 low, the bear rally high in August and the recent October low. However, it is a long way off in confirming the November/December move up.

And keep in mind that you can have short term bull markets. I am concerned we could still be in a longer term bear market. The economy is getting weaker, rates are still high, inflation is still up and the real estate market is rolling over. I will have an in depth look into the real estate market in the near future but I want to comment on Bitcoin because it has gone a bit higher from my sell level.

I believe Bitcoin and the Crypto market really reflects speculation and it tends to perform up and down with the stock market. There was much talk that gold hit record highs, but also Bitcoin that hit new highs in it's bear rally, but still a long way off from the $67,500 top. I am not surprised it has rallied some more but it is still in a strong resistance area between about $37,000 and $50,000. I erred on the side of caution with my sell at $37,500 and I am confident we can buy back lower.

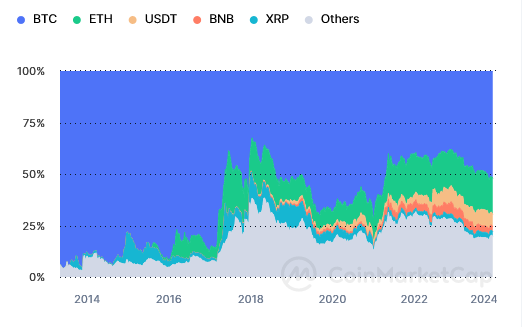

The crypto market is like the S&P 500 where just a handful of them are doing well while the other several thousand are still down or going to zero. As you see on this chart from coinmarketcap.com , just 5 crypto currencies make up over 75% of the market and the others are barely above their bear market lows in 2020.

And when you look at the next chart - market cap of the total crypto market, it looks more like a bear market rally, or at best a short bull move in November.

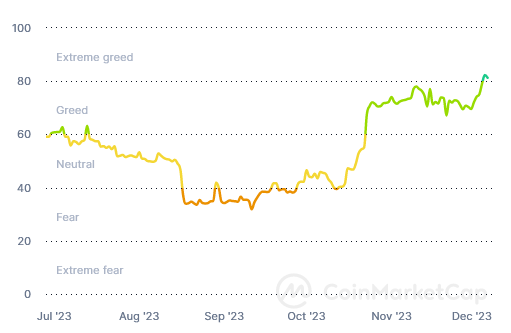

And I will finish off with one last chart, the fear and greed index that just went into the extreme greed range. Another strong sell signal for Crypto.

Cryptos will also face a battle from governments and regulators and these new ETFs will simply be a scheme to manipulate the market. During a Senate Banking Committee hearing, JPMorgan Chase CEO Jamie Dimon strongly criticized crypto currencies Speaking with Senator Elizabeth Warren, Dimon stated, "I’ve always been deeply opposed to crypto, bitcoin, etc." He emphasized his belief that the primary applications of these digital currencies are for illicit activities, saying, "The only true use case for it is criminals, drug traffickers … money laundering, tax avoidance." Furthermore, Dimon suggested "If I were the government, I’d close it down," he remarked, indicating his view on the need for stringent regulatory measures against cryptocurrencies.

I believe the Crypto market, like the stock markets are best described as bear market rallies. I define bear markets in three stages, that are hope, denial and despair. Right now we are in the hope phase as investors hope their crypto currencies recover so they can get their money out and that is starting to happen with the market leaders. With stocks, investors are hoping the stocks of the other 493 in the index recover so they can get their money out. This hope phase occurs because investors who bought near the top took a big hit in the 2022/23 bear market and just want their $$ back. Denial happens in the next leg down when investors just can't believe what has happened> And the final is despair, when they throw in the towel and sell near the bottom.

To compare to mining stocks, they are in or just finishing the despair phase.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.