Markets - Hide the Recession to Election Time, Oil, Zonte-ZON

Hide the Recession to Election Time

I have often called the Fed and government the masters of economic data because they always massage and adjust to have the data fit their wanted narrative.

The surprising January jobs report is a case in point. It blew by all expectations and the numbers came in at 353K about double the consensus of 185K. January always loses a huge number of jobs like 1 to 2 million, simply because retail lays off after the XMAS rush, so the numbers are seasonally adjusted. Another word for 'made up'. I have no doubt the government is trying to portray strong numbers and economy because it is an election year. It was perfectly put by Bill Clinton in his successful 1992 presidential campaign "It's the economy, stupid" and the refrain has become political gospel in the decades since.

The economy is a huge factor on a President's rating and Biden currently has a very low one. The narrative is that is because of high inflation, but I believe a lot of the issue is Americans know that the real economy, the one they are in is not near as strong as reported by government statistics. It is becoming so bad we might as well call it propaganda.

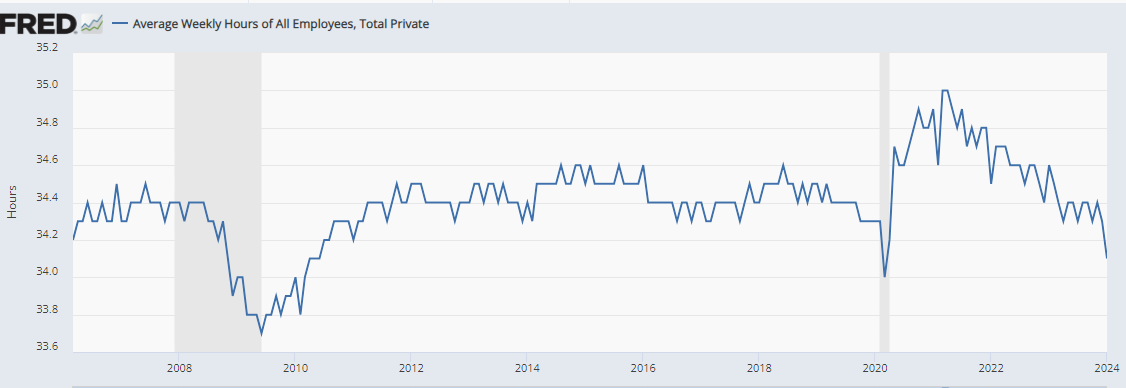

I noted that wages increased in the report by 4.5%, the highest since September. Higher wages is good – right? Well if it was true but the wage number is calculated by dividing wages into the hours worked and the hours worked is plummeting. That is not a signal of a strong economy and healthy job market. In fact, here is the chart from St Louis Fed, FRED on weekly hours worked.

The hours worked is back to levels in the Covid-19 lock downs and before that, you had to go back to the 2008 financial crisis to see a similar decline. There is simply no way the labour market is as good as the government numbers suggest. And this comes in the face of dozens of high profile lay off announcements like:

Snapchat cuts workforce 10%;

PayPal to cut 9% of workforce;

Deutsche Bank to cut 3,500 jobs (4% of workforce);

Block to cut 10% of workforce;

Microsoft cuts about 8% in their gaming division;

Google is laying off around 12,000 staff, or 6% of its global workforce;

Meta, in November was laying off more than 11,000 employees, or 13% of its workforce;

UPS to cut 12,000 jobs.

UPS is most worrisome because they are a delivery company it shows economic activity is declining. You don’t need delivery drivers if there is less to deliver. There are many more and NPR reports that “Last year was, by all accounts, a bloodbath for the tech industry, with more than 260,000 jobs vanishing — the worst 12 months for Silicon Valley since the dot-com crash of the early 2000s. Executives justified the mass layoffs by citing a pandemic hiring binge, high inflation and weak consumer demand.” Announced layoffs reached 82,307 in January, a 136% surge from December’s 34,817, according to data released by outplacement firm Challenger, Gray & Christmas. With all the tech lay offs, I conclude it is not just retail XMAS lay offs.

Yet these same tech companies that are laying off because of various problems in their industry, their stocks are flying off the charts. The value of Microsoft is now greater than the whole Toronto TSX market. It is a repeat of the greater fool theory I talked of with Nortel way back and a repeat of the Tech/dotcom bubble in 2000.

Back to jobs, remember, Americans who do not have a job but are not seeking one are not counted as unemployed. You have to actually be looking for a job without finding one to be considered unemployed. Counting these would more than double the unemployment numbers. With all the crazy illegal immigrant numbers, these people are part of the economy and we can assume they are not working. They are not included in unemployed numbers either.

This border problem will continue to at least the election. Despite the noise you hear, Biden could fix the border problem at anytime with a stroke of a pen. However, he is unwilling because it would be political suicide for him and hand the election to Trump. If Biden were to stop the illegal immigration it would admit his border policies were wrong and are the disaster that most can see that it is.

Texas Governor Greg Abbott previously wrote: “Under President Biden’s lawless border policies, more than 6 million illegal immigrants have crossed our southern border in just three years. That is more than the population of 33 different states in this country. This illegal refusal to protect the states has inflicted unprecedented harm on the people all across the United States.”

I heard this news on the weekend, just crazy. New York City, Mayor Eric Adams’ administration is rolling out a $53 million pilot program that will distribute pre-paid credit cards to migrant families housed in hotels.

ISM reports the Economic activity in the manufacturing sector contracted in January for the 15th consecutive month following one month of “unchanged” status, but it still indicates the economy is expanding.

Past bubbles occurred for various reasons, but I believe a big factor this go around is manipulation. Governments have always had a level of corruption and a thirst to control things, but the levels we see today in our governments are unprecedented by leaps and bounds. If the Covid-19 fiasco taught you anything, it should be this.

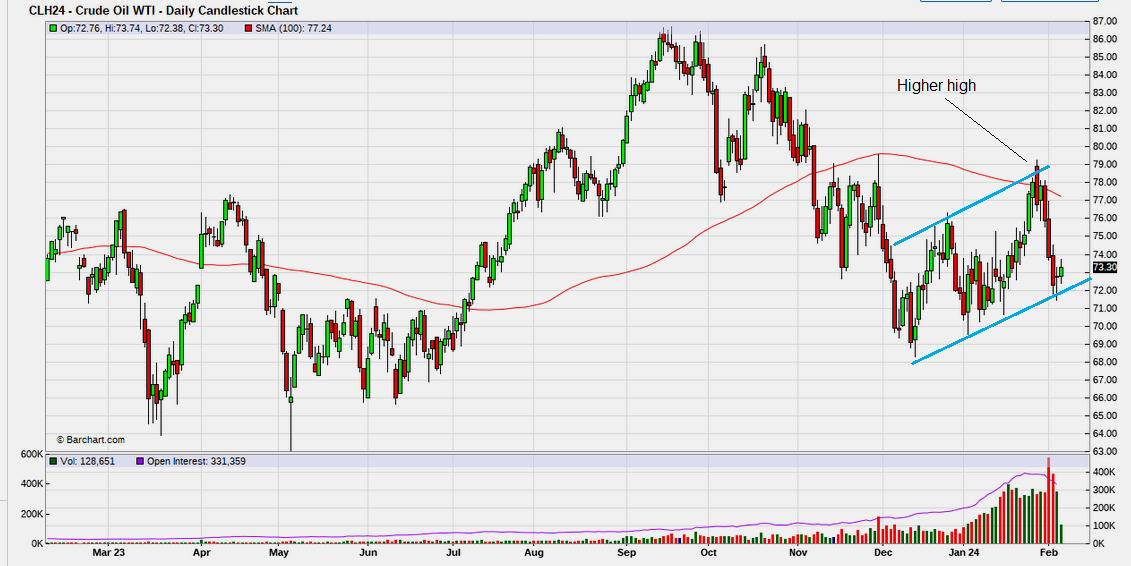

We have questionable job numbers, stock markets manipulated higher with 7 stocks and oil being bashed any time it raises it's head so inflation can be held in check. The oil up trend is still intact but there is no doubt the Biden Administration and Trudeau following his foot steps are bashing oil and gas.

I previously pointed out that oil prices made a higher high and the recent correction has bounced off the bottom of a rising channel. If you are not sure about governments attack on oil, here is a recap of Biden's actions:

Shut down construction of Keystone XL pipeline

Banned new oil&gas exploration leases on federal lands

Banned off shore drilling in many favourable areas;

Banned new drilling in Alaska

Banned new refineries

Drained most of the Strategic Petroleum Reserve (SPR), shipping a lot to China;

Sanctioned Russia oil&gas:

Spent $100s of billions subsidizing green energy

And Biden just can't stop himself. He is now halting permits for all new liquid natural gas (LNG) export terminals. Trudeau is doing the same and has followed most of Biden's foot steps but Canada has no strategic reserve to sell, so he is now putting a carbon cap on the oil&gas industry.

Now lets get to some better news to end this newsletter. I was planning on doing a video update with CEO Terry Christopher on this new soil and sample data released from their IOCG, Cross Hills project NFLD, but the stock is moving so a short update now and I still plan a video later this week or weekend. I know a lot of you own stock, some of you sent questions so an interview explaining this will help. I pasted in most of the news release, with my 'bolding'.

Zonte Metals - - - TSXV:ZON - - - OTC:EREPF - - - Recent Price - $0.10

Entry Price - $0.09 - - - - - - Opinion – buy

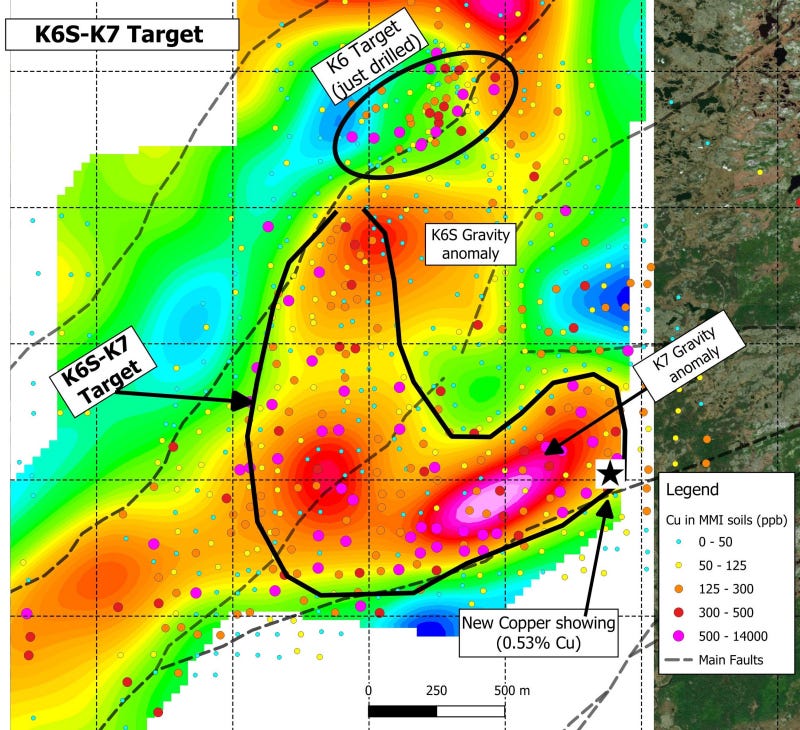

Today, ZON announced a project wide soil program was completed in 2023, with the primary goals of infilling known targets and exploring new areas. The recently completed soil program was conducted through a large valley that hosts the K6S and K7 gravity anomalies. This area sits adjacent and just south of the K6 Target, where a drill program was recently completed.

The soil data has identified a notable semi-circular copper-in-soil anomaly measuring 2400m in length and up to 800m in width. This area is mainly covered with overburden, however, during the sampling program a new copper showing was discovered in the K7 gravity anomaly area. This large soil anomaly coincides with three gravity anomalies including those at the K6S and K7 areas and an unnamed anomaly situated between them. Additionally, the soil anomaly coincides with a structural zone hosting the K7 gravity anomaly, which is intersected and truncated by a large structural corridor that hosts the K6S anomaly.

Two drill holes were completed in the K7 target in 2020, both from the same drill pad on the very SE portion of the target area. Both drill holes intersected IOCG mineralization including anomalous copper and rare earth mineralization. These drill holes, however, were completed prior to the additional exploration programs carried out over the last three years.

The Company also notes it has recently completed drilling on the K6 Target. The K6 Target area was previously drilled in 2019 with a limited dataset. Subsequent to these 2019 drill holes, the Company has carried three years of additional geological, geophysical and geochemical exploration. The just completed drill program, comprising of 1700m in seven drill holes, tested drill targets generated from analysis of the combined datasets. This new drilled area sits about 200-300m south of the 2019 drill holes. The cores have been logged, split and all samples have been submitted for analysis. Results will be reported when received and compiled.

A picture is worth a thousand words. The graphic shows the soil anomaly and I noted there was quite a bit of elevated samples in certain areas. The key point is the separation of the higher values and lower values. I will ask Terry more about the relevance of that.

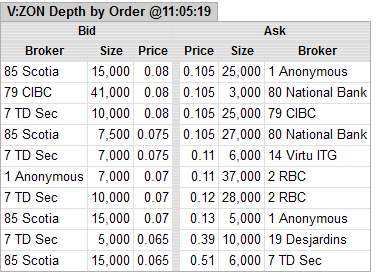

The stock is trading more volume and the up trend looks to continue.

First resistance is around $0.13 and this shows on the depth today also, as there is a big gap in the offers on sale after $0.13. ($0.13 to $0.39).

Not many juniors are moving on news, so it is good to see this. I think because there are copper shortages expected and a lot of focus there by the majors. For example, today there was news that KoBold Metals, a metal mining startup backed by Bill Gates and Jeff Bezos, has reportedly found a huge copper deposit in the African country of Zambia, the largest deposit in a century, with a potential to produce 400,000 tonnes per year at its peak.

I believe copper will be in the news a lot in 2024.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.