Markets hit Target, Sell Moderna Puts

I sent this out earlier, this morning to paid subscribers

Jobs Report Rescue Boat Sinks

Just when markets could use some good news, the BLS comes to the rescue with a very robust number. Unfortunately nobody cares if it does not say tariffs. The US economy added 228,000 jobs in March, far surpassing the forecast, but unemployment unexpectedly jumped. Job growth was expected to be 137,000, and the unemployment rate was expected to hold steady at 4.1%. Unemployment instead rose to 4.2%, and has consistently been at least 4% for almost a year.

Federal government employment fell by 4,000 in March. DOGE and its unofficial leader Elon Musk have pushed for large-scale federal employment cuts, with a wave of terminations for probationary workers, who were in their roles for only a short period of time, coming in February and early March.

As I mentioned the other day, the government cuts will not hurt the economy short term because the vast majority of Fed workers other than probationary mentioned above took severance packages.

Interesting is that headline numbers were high under Biden leading up to the election, but we can see that the actual job numbers were heading down. They started to go up in late 2024 and early 2025 and with today's number, but it is premature to call this a new trend and I expect they will go back down.

Never the less, the above trend is there for now. With today's big jump, my first thought is they added a lot of jobs with the Birth/Death rate model but not so as it was down -33,000. I also spotted another trend. In the last year, the 8 months under Biden saw an average of 143,000 jobs per month created with the Birth/death rate model but under Trump just 10,000 per month in last 4 months. Was this another way the BLS was padding job numbers ahead of the election?

Canada down the Tubes

Job numbers were a disaster in Canada with a loss of 33,000 the worst number since January 2022. It was actually worse with 62k full time jobs loss that was off set by part time worker gains. This is continuing a trend of the last two years or more. While media will harp tariffs, the effect of tariffs had hardly started.

Recession not Tariffs

Another important factor as I mentioned numerous times is when a recession hits, the first thing to suffer are auto sales and than housing/real estate follows. As the recession deepens in Canada and hits the U.S. as I expect, the auto sector will take a big hit with low sales and lots of layoffs. Tariffs will get blamed but while both are a factor, the recession is way more so.

Just look at the last recession from the 2008 crisis, GM, Ford and Chrysler all had to be rescued by the government. There were no tariff issues then.

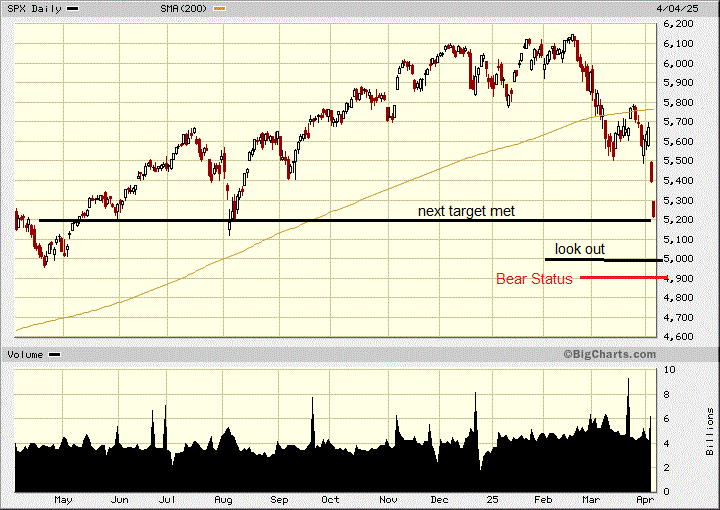

The S&P 500 hit my next target today. I am watching the 5,000 level. A drop below likely means we will soon be in a bear market. I believe that is not a matter of if, but when.

As expected China hit back big. China said on Friday it will place additional tariffs of 34% on all US goods as part of countermeasures against U.S. duties imposed. The retaliatory measures also included curbs on the export of some rare earths.

Agriculture trade took another hit as Chinese customs authorities placed an immediate suspension on imports of sorghums from grain exporter C&D (USA) Inc., as well as on poultry and bonemeal from three US firms.

I don't know if anyone will win here and see how it plays out. For sure a company like Apple will get hurt. Shares of Apple, which makes most of its iPhones, iPads and Macs overseas, fell 12 percent in the last two days.

With some better China/U.S. News, the bidders for Chinese-owned TikTok (BDNCE) are piling up ahead of a Saturday deadline. I expect there will be some kind of buy out deal, or maybe China just refuses and wants to see it go under. Anything can happen these days.

A lot of trade imbalances that Trump hopes to fix can only see a certain margin of improvement because there are underlying factors that are not just all about price and unfair trade.

While China has a surplus selling finished goods, it has to import raw materials to manufacture them. The U.S. and China were the largest trading partners, as China relied on American consumers the same way that America relied on cheaper Chinese goods. China use to invested the surplus into U.S. debt, but now they are sellers of U.S treasuries and buying gold instead.

Canada is a different scenario because the economy and population is far smaller, just fractions of the U.S. Canada's demand for U.S. good is small relatively because it is such a small country. Same applies to U.S. demand with imports from Canada, it is so much larger because the U.S. is much larger than Canada.

Trade and tariffs are complicated matters and all inter twined. The U.S. has put tariffs on Canadian made autos, but only on the portion made in Canada. The auto industry is so combined in North America. As an example a car made in Canada may have the engine, transmission and front steering made in the U.S. and the exhaust system made in Mexico. Not easy to figure out.

Who will really get hit hard in Canada is Toyota and Honda that make cars in Canada, will get more of a full blunt of the auto tariffs because they may have little U.S. components.

Trump insisted that the long-term payoff of the tariffs would be worth the pain. “The markets are going to boom,” he said. “The country is going to boom.”

We will see, maybe he will be right in a couple years, but certainly not this year.

Moderna - - - Q:MRNA- - - - - Recent Price - $24.75

Sell Moderna January 2026 Puts, Current Price - $9.30

Entry Price - $4.20

The stock broke down on the chart and we have over a 100% profits with the Puts. I may buy Puts again if there is a rally or a chance to go farther out expiry wise. I believe there is a substantial risk that MRNA shots get pulled from the market.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.