There is a slew of economic data and Fed speakers on Thursday and Friday, but what data has come out so far this week is not very good

On Monday The S&P flash US manufacturing PMI for September was 47.0, far weaker than the 48.6 economists were expecting. It compares to 47.9 in August.

On Tuesday, news of home prices grew at the slowest pace in 8 months, Case Shiller says, but still inch up to new record high.

Consumer confidence plunges on weaker job market and high cost of living. Americans are anxious ahead of election. Consumers are the most pessimistic about the economy since 2021. The Consumer Confidence index came in at 98.7 compared to a consensus of 104.

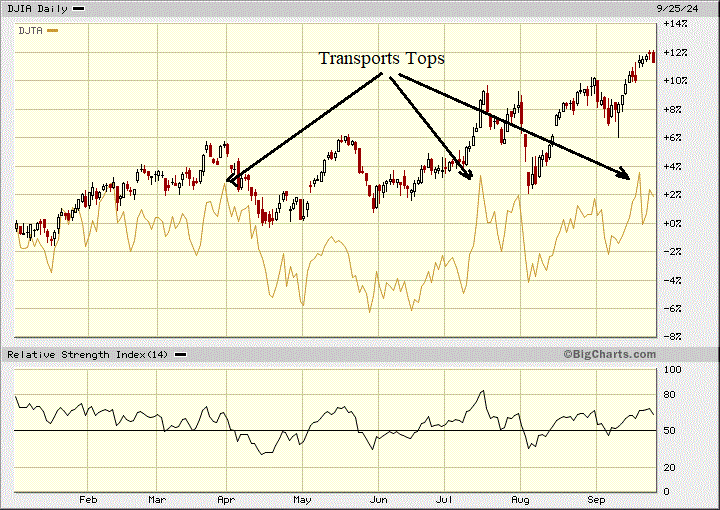

I predicted that July was a market top and I am sticking to it even as the S&P 500 has inched higher. It might end up my call was not perfect timing but will be very close. The S&P 500 has not increased much and the Nasdaq is still quite a ways below it's July top.

Perhaps we get a head and shoulders topping formation? I commented that the DOW made new highs but that is a thin index. Also important with Dow Theory is the Transport Index has not confirmed the rally. The Transports ran up to their March and July highs and have now retreated in the past week.

I believe the narrative of inflation now under control and further interest rate reductions ahead is standing on very weak legs.

What if Energy Prices go Back Up!

Most important is the recent easing with inflation is because of falling energy, oil&gas prices. However, China has started significant stimulus programs that could boost demand. OPEC is biased but never the less eyeing growth in India, Africa and the Middle East, as well as a slower adoption of EVs and greener fuels, OPEC sees global oil demand rising into 2050 and holding a nearly 30% share of the energy mix with other sources, “there is no peak oil demand on the horizon," OPEC commented, and "over the past year, there has been further recognition that the world can only phase in new energy sources at scale when they are genuinely ready." The group expects oil demand to reach 120.1M bbl/day in 2050 compared to102.2M bbl/day consumed last year.

We are only about half way through hurricane season and already a 2nd one, Helene is shutting down some gulf production. It is expected to reach a category 3, possibly a 4. U.S. oil producers scrambled Monday to evacuate staff from Gulf of Mexico oil production platforms.

According to Reuters, 16% of crude oil production has been suspended along with 11% of natural gas output. This equals some 284,000 bpd in oil production and 208 million cu m of gas production. The last hurricane that passed through the Gulf of Mexico shut-in close to 700,000 bpd in production for days, serving to prop up oil prices. Some production remained shut in a week after Francine made landfall in Louisiana.

Offshore platforms in the Gulf of Mexico produce some 14% of total U.S. crude oil production.

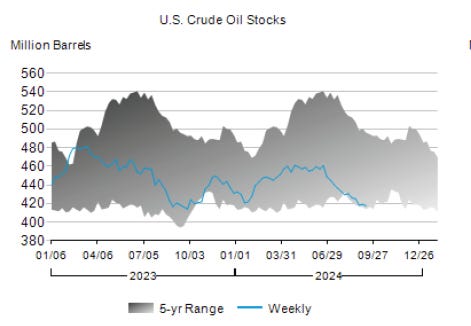

US oil inventories were reported today for the week ended September 13th. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.6 million barrels from the previous week. At 417.5 million barrels, U.S. crude oil inventories are about 4% below the five year average for this time of year.

We have inventories at multi year lows, hurricanes raging and a Middle East war that is escalating but still weak oil prices. Over the past four weeks, crude oil imports averaged about 6.4 million barrels per day. The US has weaned itself quite a bit off middle east oil but still imports almost 400,000 barrels per day from Saudi Arabia and Iraq.

It appears Lebanon and Iran are on the verge of declaring war. Some Israeli officials believe the recent strikes against Hezbollah achieved short-term goals, but fear there’s no clear further strategy to bring calm. The Israeli military said it intercepted a Hezbollah missile fired at Tel Aviv. It appears to be the group’s deepest attack into Israel.

Iran’s president says Israel is trying to goad his country into a wider war. The conflict with Hezbollah, an Iranian proxy, raises the pressure on Tehran to strike back, according to NY Times.

Oil Prices are at resistance on the chart and I am wondering if we see another month end knock down. I have been suspicious that there has been government intervention in oil prices to bring down inflation and interest rates ahead of the election. If this is true, there will not be much need to hold them down after another month or so.

If oil prices rise and I think the odds of that are quite high, inflation heads back up and further interest rate cuts would be put on hold. That would really rattle markets that are pricing in aggressive rate cuts. Regardless, if there has been intervention, it has already achieved its goal and we have probably seen the bottom in oil prices given the current fundamental scenario.

Bitcoin climbed up to about $64,000 and pulled back, meaning it was unable to make a higher high from the last August high.

Former CEO of Alameda Research Caroline Ellison has been sentenced to two years behind bars with three years probation for her role in the fraud that led to the collapse of cryptocurrency exchange FTX. Along with the jail time, she would also have to forfeit about $11B, according to a ruling from U.S. District Judge Lewis Kaplan. Ellison received a more lenient punishment due to her cooperation with investigators, which included testifying against the founder of FTX, Sam Bankman-Fried, who had been convicted and in prison.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.