Like September and October are bad months for the markets, November and December are usually good months and we get what they call a Santa Claus rally in late December. The S&P 500 is closing in on my 4600 target. Short term, the market is over bought with RSI approaching 80. I expect a pull back or consolidation from 4600. After that, there is a good chance the S&P will break this resistance and go to 4800 and that would be a double top. We will have much better insight by January, but right now markets are pretty bullish. And as long as there is no war escalation in the middle east.

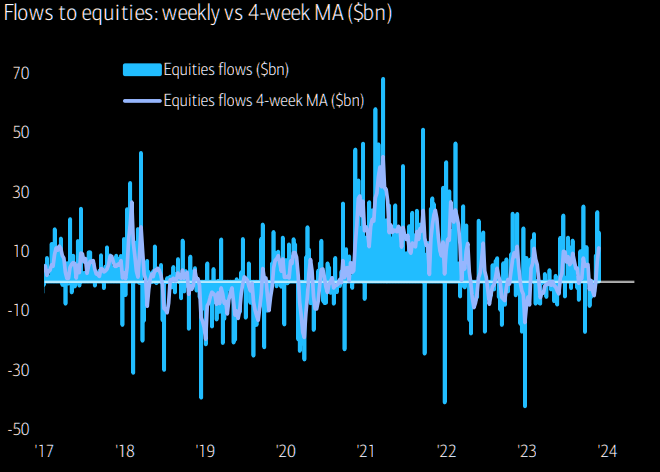

Next chart, the inflow into equity funds is the highest since February 2022, another sign we could see a pull back.

Source BoA

I have been critical of investors pouring into the TLT, 20 year treasury etf too early. I noted the high volumes in 2022 and first half of 2023. I will now say, that I think they got it right with the recent bottom. However, I don't think it is worth buying as I see upside only around $110. Interest rates are not coming down quickly and when they do, we will be lucky to see 4%. Inflation is no where near beaten and could just as easy rise up again in 2024.

Paramount Gold - - - - NY:PZG - - - - - Recent Price - $0.35

Entry Price - $0.38 - - - - - - - Opinion – buy

The stock has basically been flat since we bought in and has formed a long stage one base between $0.28 and $0.40. You pretty much always get a break to the upside out of these bases. A break above $0.40 would signal this and a new uptrend. It is a great time to accumulate in this area.

I did an interview this past week with Paramount CEO Rachel Goldman.

GSP Resources - - - - - TSXV:GSPR - - - - - Recent Price $0.11

Entry Price - $0.25 - - - - - - Opinion - buy

GSPR has successfully completed its surface diamond drill program at the Alwin mine project. The 2023 drill program consisted of five drill holes and was designed to target potential extensions of known high-grade copper zones at the Alwin property, Highland Valley, British Columbia. The Alwin property is adjacent to the western boundary of Teck Corp.'s Highland Valley mine, the largest open-pit porphyry copper-molybdenum mine in Western Canada. It has the location.

All five 2023 drill holes exhibited visual sulphide mineralization intervals interpreted to be part of or adjacent to the historic 4 zone. Observed pyrite, chalcopyrite, bornite and molybdenite mineralization exhibited structurally controlled (in the form of millimetre-scale to centimetre-scale vein sets, fracture and fault infill) as well as fine to coarsely disseminated, domanial and blebby textures.

The stock moved much high on exploration news back in late August. Some good drill results could move the stock significantly. Now is the time to buy while the stock is down and ahead of assay results. I expect we will see these in the New Year.

I listened to the Save Canadian Mining webinar on short selling. I have commented many times that the problem lies with market makers who are exempt from much of the reporting. There is nothing wrong with short selling but when it is abusive, naked and not reported it simply becomes manipulation by the big banksters that harm retail investors. It is really bad with the Canadian juniors because this big money can easily manipulate these little stocks.

It is probably the main reason that the TSX Venture is around record lows, although commodity markets have been bullish and every other stock market in the world has done relatively way better.

I did learn a couple new things. Market Makers (about 300 in the US) lend out their market maker IDs so other big entities can naked short and don't have to report anything or ever cover in some cases. There are about 18,000 US public companies and there is on average $135 billion per day in short selling. That is a huge number.

There is some hope, but I think we are years away from resolving this. The banksters are making too much money on it.

The hope, like the Harrington Global case. Warshaw Burstein, LLP, a full-service law firm in New York City, announced that on September 29, 2023, Federal District Court Judge Lorna Schofield of the Southern District of New York issued an Opinion and Order in Harrington Global Opportunity Fund Ltd. v. CIBC World Markets, Inc. et.al that will reverberate through the compliance departments of every brokerage firm on Wall Street.

In her decision, which denied the defendants’ motion to dismiss Harrington’s market manipulation claims of spoofing, Judge Schofield found that broker-dealers may be primarily liable for manipulative trading initiated by their customers because they serve as “gate-keepers” of trading on

securities exchanges, and have a “continuing responsibility to ensure that their customer’s order flow … is in compliance with all applicable rules, regulations and laws and detect and prevent manipulative or fraudulent trading … under the supervision and control of the firm.”

In their motion, the defendants unsuccessfully argued that they are not responsible for what they characterize as “their customers’ trading” — and accordingly cannot be held liable for unlawful trading that they carry out on behalf of customers. The Court categorically rejected the defendants’ argument and held that where a broker-dealer fails to monitor its customers’ trading and is “reckless in not knowing that the trades being executed at their customers’ direction were manipulative” the broker can be held primarily liable.

In September the SEC fined Citadel Securities $7 million for not marking short sales as such. Goldman Sachs was also fined $6 million for similar inaccurate reporting. These fines are minuscule for these banksters, but at least it has been recognized.

Thailand and South Korea are waking up to the short selling abuse. In Thailand short seller names will have to be identified and they are likely going to bring back the uptick rule. South Korea has totally banned short selling until rules are improved.

In summary, if you own stocks, it is heavily reported in many ways, but if you don't own them (are short) there are a lot of loop holes to avoid reporting.

Torex Gold - - - - - TSX:TXG - - - - - Recent Price $13.45

Entry Price - $13.00 - - - - - Opinion – buy

The stock closed below and above $13 for a few days after my report went out, so I will pick the even and lucky $13 as our entry price.

There was a bit of trading on the March $13 Calls and last close was $1.45 so I will pick that as our entry price.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.