I hope everyone had a great XMAS, but there went Santa Claus, here comes 2024!

This market is a bear trap, plain and simple. Short term the market is way over bought and it has moved close enough to 4,800 for a double top, but will probably extend higher this week as the Santa Claus rally comes to an end. Beware of January:

Active managers had less than 25% exposure to equities in late October. Now, their equity exposure jumped to 97%;

RSI hit an over bought 80 reading on the S&P 500, the week before XMAS;

The Russell 2000 has gained 24% over the last 36 trading days, one of the biggest small cap rallies in history;

S&P 500 notches 8th-week winning streak. The longest in +5 years;

Week ago Friday investors put a record-breaking $20.8 billion into SPY, marking the largest single-day inflow for any ETF in history;

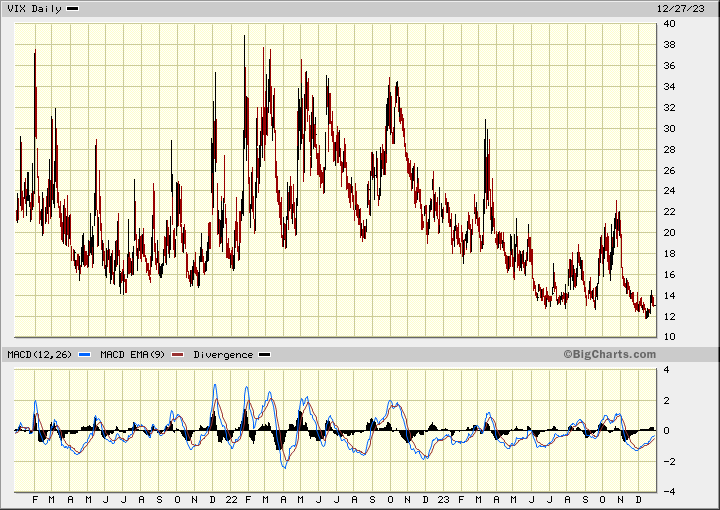

The Volatility Index (VIX) is at 4 year lows showing complacency;

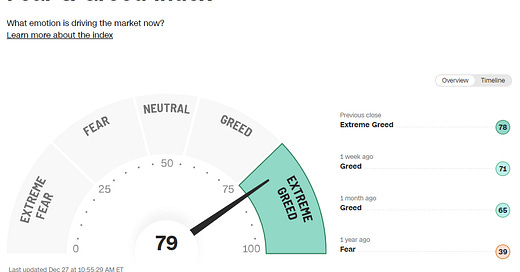

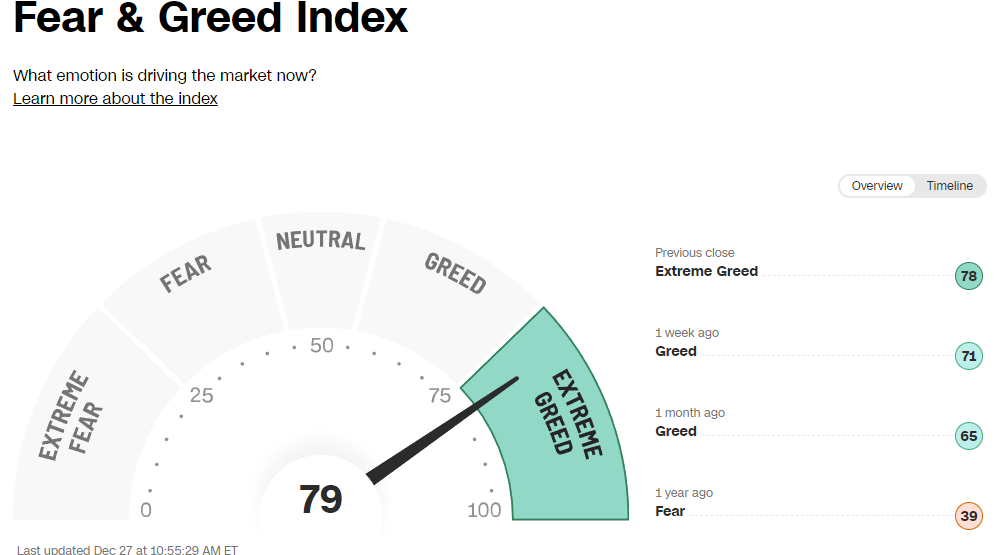

The Fear and Greed index shows extreme greed.

Stocks tend to soon bottom and rally with extreme fear and the opposite for extreme greed. The Volatility Index hit a recent low of 12, the lowest since 2019.

S&P 500 chart

The main reason I believe this market is a bear trap it's the narrow breadth so really a fake out as a bull market. The biggest contributors to the S&P 500's (SP500) banner year have been dubbed the Magnificent Seven. The group that includes Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT) Nvidia (NVDA) and Tesla (TSLA) is up a combined 75% in 2023, while the remaining 493 companies in the S&P 500 are about 12% higher, resulting in a 25% YTD gain for the index as a whole.

In reality, the majority of investors (493 stocks) are experiencing a bear market rally at best. Sure there are some investors that just focus on these high flying techs and the index ETFs of the NASDAQ and S&P 500, but for the most part these same investors lose that gain when the inevitable down turn occurs.

I see 2024 as one of those years to easily predict the broad outcomes so stay tuned for my 2024 outlook. Probably the best way to describe 2024 will be Surprise! Surprise! Surprise!!!!!!!

Nkarta Inc. - - - - NASDAQ:NKTX - - - - - Recent Price - $5.45

Entry Price $3.12 - - - - - - Opinion – sell at $11.50

Our timing on NKTX was excellent, but it would have been prefect if I picked a week earlier on the $2.70s, however we have a very large short term gain. I picked the closing price, the day of my report as our entry price.

I mentioned that there could be a short squeeze on the stock and by the looks of the chart it looks like it could be happening, but I don't think so yet. The short data for December 15th should be out tomorrow and I would not be surprised if the short position increased. Note the big spike in price and volume in mid October, that is when the short position increased from 3 to 7 million shares. So I checked the daily short volume that last few days when the stock went up:

Dec 26th - 320K short volume

Dec 22nd - 291K short volume

Dec 21st - 186K short volume

So you can see there was still quite a bit of short selling the last few days. If you see a big spike in volume and price like mid October that could signal the squeeze, I would be a seller. There are only 2 days left in this year, but you never know what will happen. The stock has broken out to the upside and there is not much resistance until around $12, so that is why I have the sell at $11.50 for now. I will see what the New Year brings and may suggest a different outlook or profit strategy.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.