Mid Day Market Report – Good CPI Report, Stocks down - Gold up, Torex & Pan American new highs

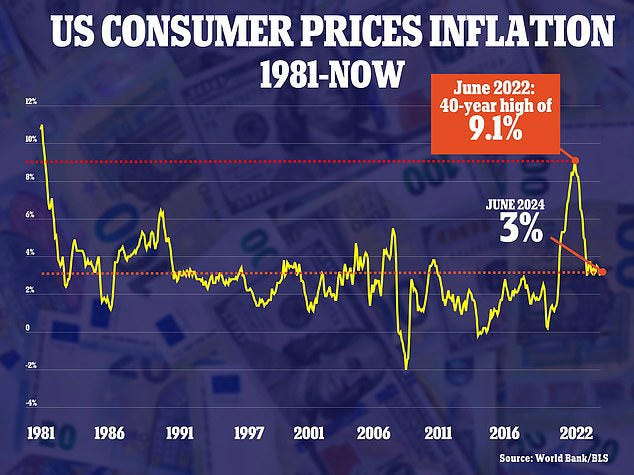

Probably the best inflation report for some time. Annual CPI for June was 3 percent, lower than the rate for May and lower than Wall Street expectations. And month-on-month, from May to June, inflation fell 0.1 percent - the first time that has happened in four years. Economists polled by Reuters had expected it would increase by that amount.

Gasoline prices fell 3.8% in June after falling 3.6% in May, more than offsetting higher housing costs, according to the figures released Thursday by the Bureau of Labor Statistics. Food edged 0.2% higher in June. At least this month it was not just a seasonal adjustment for gasoline to come down, non adjusted it was also down -2.5%.

The index for all items less food and energy rose 0.1 percent in June, the smallest increase in this index since August 2021. The shelter index increased 0.2 percent in June. The index for rent rose 0.3 percent over the month, as did the index for owners' equivalent rent. The index for all items less food and energy rose 3.3 percent over the past 12 months.

A big question is whether falling gasoline prices can keep influencing the index down. I think they can next month and perhaps just enough to get one rate cut in that the Biden Administration can brag about before the election.

Last year gas prices rose with the typical high summer demand, but not so much so far this summer. As I have been pointing out, the economy is not doing so great and this lower inflation report is being viewed as a signal of a weaker economy. While the easing of inflation is fuelling hopes of a rate cut, stocks are down (S&P 500 -46) and gold soaring, up $49. I have been commenting for a long time that interest rate relief will be more so for the wrong reasons. A weak economy and not just easing inflation. A hurricane in the gulf or stronger demand for gas, could still move gas prices up.

Gasoline stocks fell by 2 million barrels to 229.7 million barrels, much bigger than the 600,000-barrel draw analysts expected during U.S. Fourth of July holiday week. While there was no damage to gulf refineries from hurricane Beryl the shutdown for a few days helps to tighten supply.

Two of our gold stocks hit new highs today, Torex and Pan American while Cameco is our top performer for the Millennium index and a surprise pop in Methode Electronics.

Torex Gold Resources (TXG) C$23.35 – new 52 week high

Torex Gold is showing promising signs for investors, bolstered by its recent operational successes and robust financial performance. The company's ELG Underground Drilling Program has yielded positive results, indicating a strong potential to expand resources and extend the mine's life. Torex has also released a multi-year exploration strategy aimed at unlocking the full potential of the Morelos property, highlighting its commitment to growth and resource development. The consensus among analysts is a "moderate buy" with a price target suggesting a significant upside, reflecting confidence in Torex's strategic direction and operational stability.

Tuesday, Torex Gold reported Q2 2024 gold production of 113,822 ounces (oz) and gold sold of 113,513 oz. With strong production of 229,316 oz through the first half of the year, the company is on track to achieve annual gold production guidance of 400,000 to 450,000 oz. I expect the stock will continue higher and soon test 2023 highs of $25.50.

Pan American Silver (PAAS) US$23.80 – new 2 year high

Pan American Silver is a strong candidate for bullish investors, particularly with the recent stabilization of silver prices and the company’s strategic acquisitions. The integration of Yamana Gold's assets has significantly boosted PAAS's production capacity and geographic diversification. Moreover, the company reported strong Q2 results with increased silver and gold production, which is expected to enhance profitability and cash flow. Analysts have a positive outlook on PAAS, with several upgrades reflecting the company’s enhanced operational capabilities and strong market position. The company will Q2 results on August 8th. The $30 or so high in 2022 and a resistance level will act as a magnate.

Cameco (CCJ) US$53.81

Cameco, a leading uranium producer, is well-positioned to benefit from the growing global demand for clean energy. The company's recent long-term contracts and strategic partnerships, including a significant supply agreement with Ukraine, underscore its robust market position. Additionally, the rising spot prices for uranium and the renewed focus on nuclear energy as a sustainable power source provide a favorable backdrop for Cameco's growth. Analysts have noted Cameco's solid fundamentals and growth prospects, with several rating it as a buy, reflecting confidence in its long-term value. The stock just tested all time highs near $56 (2007) and just a matter of when it breaks above this.

Methode Electronics Inc (MEI) $13.84 +46.6%

Methode Electronics is experiencing growth driven by its diverse product portfolio and strong presence in the automotive and industrial markets. The company's recent quarterly results exceeded expectations, highlighting robust demand across its key segments. Methode's innovations in electrification and autonomous driving technologies position it well to capitalize on the automotive industry's shift towards electric vehicles. With a strong balance sheet and strategic investments in high-growth areas, analysts have a favourable outlook on MEI, rating it as a buy with expectations of continued revenue growth and margin expansion.

The stock surged today on a Q4 revenue beat for the quarter that was $277.3 million, surpassing the consensus estimate of $266.95 million. Not spectacular news but the stock was over sold, down from $22 in February.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.