Mid Day Market Report – PPI, Shorts on Magnificent 7 Soar to Record, Four 52 week highs

Yesterdays CPI was pretty good but not so good for today's PPI. I believe this points to a longer term underlying inflation issue. The US June PPI final demand rose +0.2% m/m and +2.6% y/y, stronger than expectations of +0.1% m/m and +2.3% y/y, with the +2.6% y/y gain being the largest year-on-year increase in 15 months. The June PPI ex-food and energy rose +0.4% m/m and +3.0% y/y, stronger than expectations of +0.2% m/m and +2.5% y/y, with the +3.0% y/y gain being the largest year-on-year increase in 14 months.

I have been commenting for the last couple months that the market is topping out and suggested selling, booking the profits for 2024 and wait on the sidelines. Yesterday gave me more confidence in that prediction.

A good inflation report was sell the news;

Bearish engulfing pattern on major indexes;

Major market rotation out of big tech to gold and small cap;

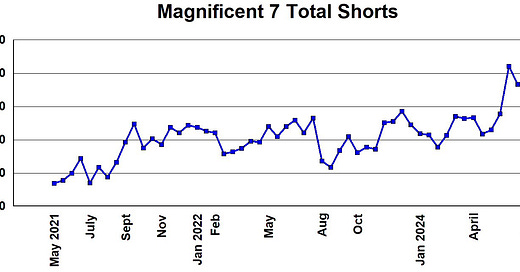

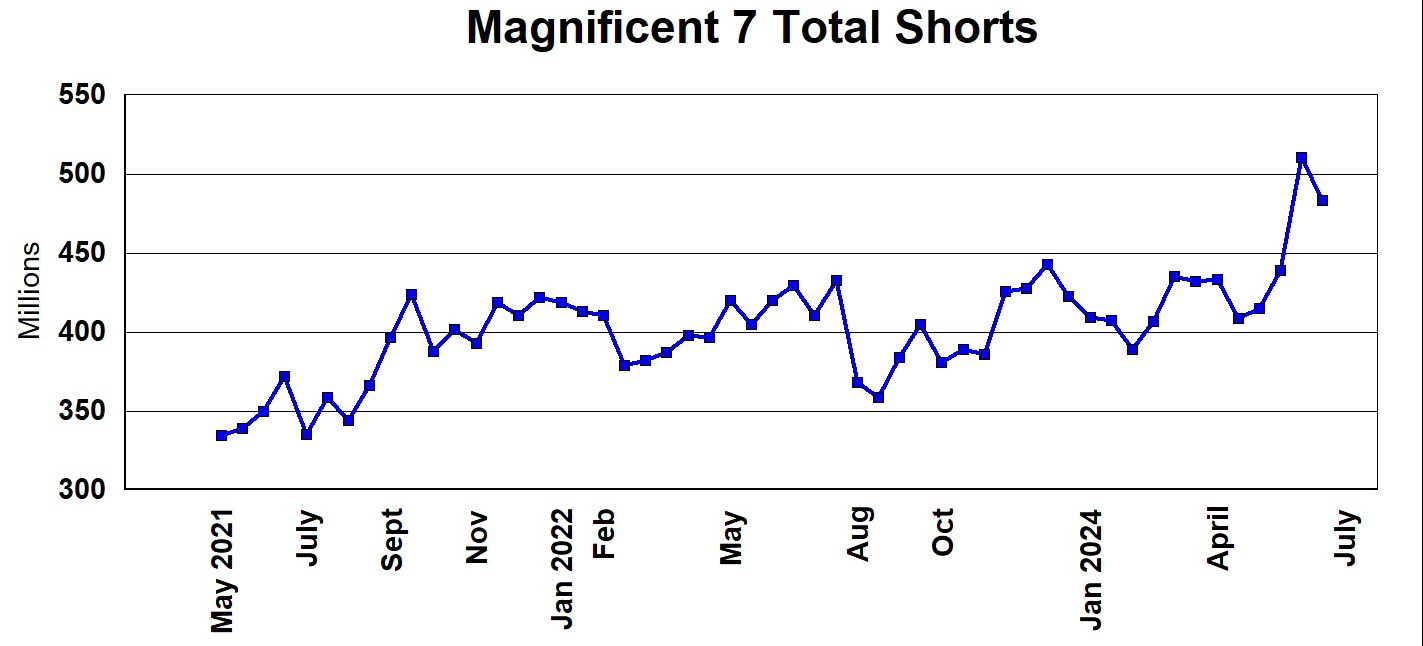

Record short levels on the Magnificent 7.

The increase on Magnificent 7 short positions was across the board with the biggest increase with Apple and Tesla short numbers were about flat. This chart signals that a lot of smart money believes these market darlings are over bought and over priced. If I were you, I would heed this signal. I am and it comes as no surprise as they are starting to agree with what I have been saying for 2 months.

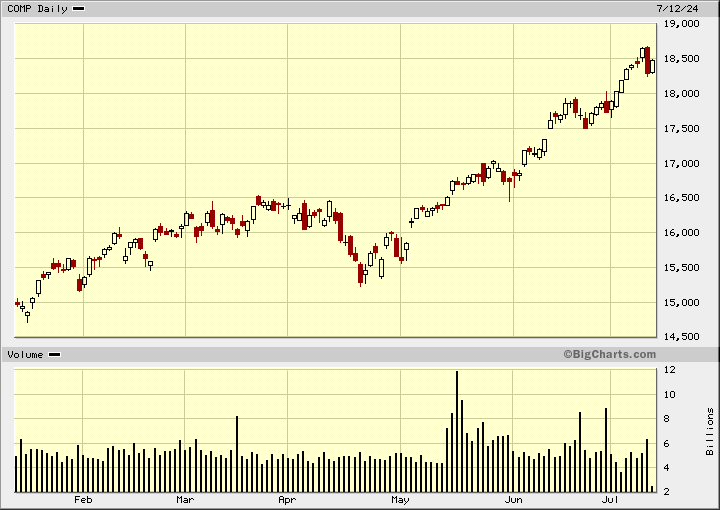

The bearish engulfing pattern on the NASDAQ, the big techs, probably points to at least a correction. Support is around 18,000.

Market rotation was obvious yesterday, out of big tech and into gold and small caps. The approximate 110 two day leap in the Russel 2,000 was the largest in sometime and a break out to new highs in this rally. The index is still well below the 2021 high of about 2,460. The break out signals a test of that high is likely, but short term it may be over bought. Note RSI approaching 80.

Some interesting 52 week highs today

Kimberly-Clark Corporation (KMB) $141.94

Kimberly-Clark stands as a beacon of stability and growth within the consumer goods sector. The company boasts a robust portfolio of well-known brands, including Huggies, Kleenex, and Scott, which dominate their respective markets. Amid economic fluctuations, Kimberly-Clark's essential products ensure consistent demand, providing a reliable revenue stream. The company's commitment to innovation and sustainability further strengthens its market position, appealing to environmentally conscious consumers and investors. Additionally, Kimberly-Clark's strategic cost-saving initiatives and global expansion efforts promise enhanced profitability and market penetration. With a strong balance sheet, consistent dividend payouts, and a proven track record, KMB remains an attractive investment for those seeking steady growth and income stability.

The stock has been in a sideways pattern the last 4 years, but eked out a new 52 week high today. It should soon test resistance at $147.

Vertex Pharmaceuticals Inc (VRTX) $493.24

Vertex Pharmaceuticals is a leader in the biotechnology sector, renowned for its groundbreaking treatments for cystic fibrosis (CF). The company's flagship CF drugs, including Trikafta, have revolutionized patient care, driving significant revenue growth. Vertex's robust pipeline, focusing on gene editing and other innovative therapies, positions it at the forefront of medical advancements. The company's strategic collaborations and acquisitions further bolster its R&D capabilities. Financially, Vertex exhibits strong fundamentals with impressive revenue growth and a solid cash position. As the company continues to expand its therapeutic portfolio and explore new markets, VRTX presents a compelling growth story, making it a prime candidate for bullish investors.

The stock is at all time highs and has been making new highs for 3 days in a row now.

Electronic Arts Inc (EA) $146.76

Electronic Arts is a powerhouse in the interactive entertainment industry, boasting popular franchises like FIFA, Madden NFL, and The Sims. The company's strategic shift towards digital and live services has significantly boosted recurring revenue, enhancing profitability. EA's strong pipeline of upcoming game releases, coupled with its foray into mobile and esports, promises sustained growth. The company's focus on player engagement and community building strengthens its competitive edge. Financially, EA's consistent revenue growth, strong cash flow, and robust balance sheet provide a solid foundation for future expansion. With the gaming industry poised for continued growth, EA stands out as a promising investment long term opportunity.

The stock has hit new 52 week highs, 2 days in a row now, however there is major resistance between $145 and $150 that it has failed to breach despite numerous attempts. A close at $152 or better is key.

Fluor Corporation (FLR) $48.30

Fluor Corporation, a global leader in engineering and construction, is well-positioned to capitalize on the growing demand for infrastructure development and energy projects. The company's diverse project portfolio, spanning oil and gas, industrial, infrastructure, and government services, ensures multiple revenue streams. Fluor's focus on operational efficiency and strategic project execution enhances its competitive advantage. The recent surge in infrastructure spending, particularly in renewable energy and green technologies, aligns with Fluor's expertise and growth strategy. Financially, the company's efforts to streamline operations and reduce debt are expected to improve profitability and cash flow. As global infrastructure investment accelerates, FLR emerges as a compelling investment with substantial growth potential.

The stock has jumped up last two days from under $45. On July 8th, they announced completion of the final weld on the first production train at the LNG Canada project, in Kitimat, British Columbia, Canada. This marks a pivotal moment in the construction of one of the largest energy projects in Canadian history.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.