Mid Day Market Report – Retail Sales, Homebuilder Confidence, Trump wins with Rumble

LTC Properties new high

The Commerce Dept. Reported today that U.S. retail sales were unchanged in June and the underlying trend was strong, which could boost economic growth estimates for the second quarter. Sales were upwardly revised to 0.3% gain in May.

Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, falling 0.3% after a previously reported 0.1% gain in May.

I have not been that bullish on retail sales because they are not even keeping up with inflation. If you take the inflated prices out of the equation, sales have been falling all year. Also households are becoming more price sensitive and focusing on basic needs, evident in earnings reports from major retailers and manufacturers.

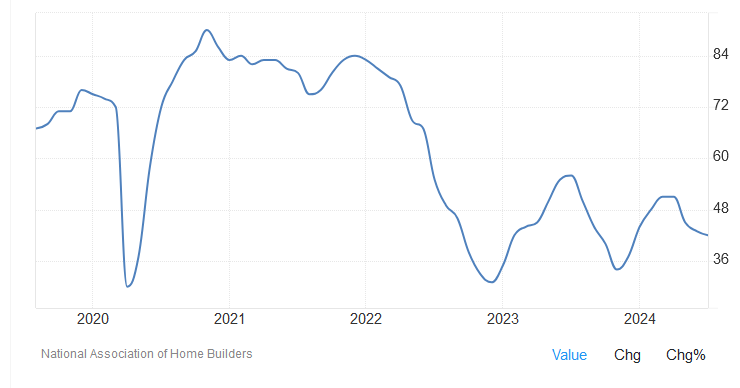

Mortgage rates that averaged 6.92% in June per Freddie Mac, along with elevated rates for construction and development loans, continue to put a damper on builder sentiment.

Builder confidence in the market for newly built single-family homes was 42 in July, down one point from June, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest reading since December 2023.

Calbre Mining on our selection list is close to 52 week highs and Rumble was strong last two days on news that Donald Trump selected Ohio Senator J.D. Vance as his running mate in the presidential election. Vance is an investor in the media platform and his stake may be worth around $1.5M at current levels.

With Trump Media jumping higher and now Rumble, the markets are predicting a Trump election win. Trump also believes that he’ll win in November by recapturing the Midwestern states he lost in 2020. Vance is well thought of in the mid west and has Trump-aligned ideology, this is Trump’s attempt to appeal to those voters. Selecting Vance also signals the party’s commitment to what some call Trumpism. Vance is one of the most aggressive and ideological disciples of the MAGA movement.

Also, LTC Properties on our Millennium index has been strong with new highs

Calibre Mining Corp. (CXB) C$2.20

Calibre is positioned for significant growth due to its robust portfolio of gold assets in Nicaragua and Nevada, supported by strong operational performance and strategic acquisitions. The company has demonstrated consistent production growth and operational efficiency, leading to lower costs and higher margins. Continued exploration success and resource expansion further enhance its long-term growth prospects, making CXB a compelling investment in the gold mining sector.

Calibre will see considerable production growth when their new Valentine mine is complete. July 9th they reported it was 73% complete with first gold pour expected in Q2 2025. Gold production in Q2 was 58,754 ounces of gold and Valentine will add about 45,000 per quarter.

Rumble Inc. (RUM) $7.10

Rumble is emerging as a strong player in the online video platform industry, driven by its commitment to free speech and a diverse content ecosystem. The platform’s rapid user growth and increasing engagement levels reflect its growing popularity as an alternative to mainstream video services. Strategic partnerships and a focus on content creator monetization are boosting Rumble's revenue streams. With a loyal and expanding user base, Rumble is well-positioned to capture a significant market share in the digital content space, making RUM an attractive investment opportunity.

Currently at about $7.10, up from $5.60 last week

LTC Properties Inc. (LTC) $36.19

LTC is poised for growth, supported by its diversified portfolio of senior housing and healthcare properties. The aging population and increasing demand for healthcare services create a favourable market environment. LTC's strategic investments in high-quality assets and strong relationships with experienced operators enhance its revenue stability. The company's prudent financial management and consistent dividend payouts make it an appealing choice for income-focused investors. As the healthcare real estate sector continues to expand, LTC Properties is well-positioned to benefit, presenting a bullish outlook for LTC.

I picked the stock for my Millennium Index because of it's focus on an aging baby boomer and strong dividend, currently 6.3%. The stock has jumped higher 4 days in a row, making 2 year highs.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.