Mid Day Report – Banks & Gold, Numbers don't Lie, Politicians Do, 5 Stocks

It is reported that China did not buy any gold for the 2nd month in a row, but keep in mind that China is notorious for not reporting gold purchases and is likely only trying to influence market prices lower.

Even so, according to Max Layton, global head of commodities research at Citigroup Inc., gold demand from China and central banks accounted for 85% of mine supply through the first three months of 2024 and 70% on average during the prior two years. That's up from 25% during the three-year period from 2019 to 2021. ...

That shift in demand is evident in Canada’s gold exports to China, which have steadily risen to $589 million in 2023 from $189 million in 2020, according to Statistics Canada data. That is more than a 200 per cent increase in value during a time period when the average price of gold rose nine per cent.

Criminal Imports

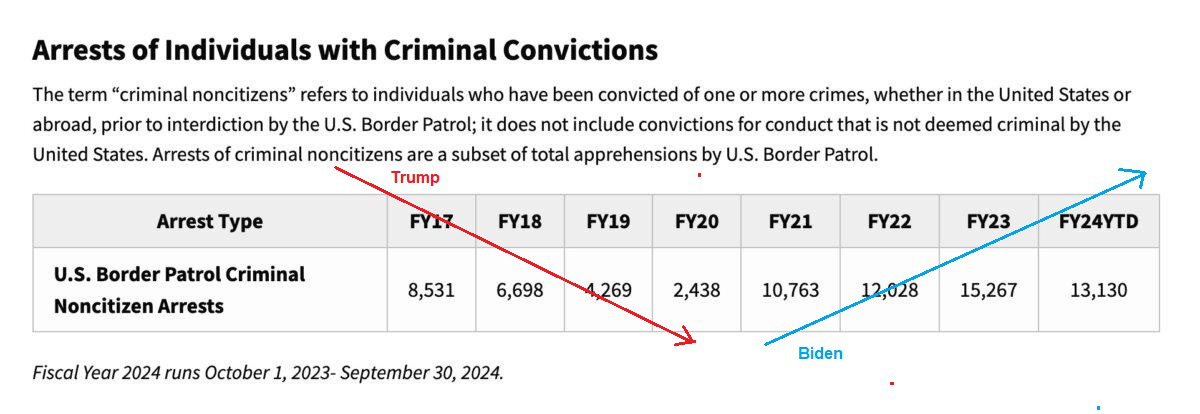

The US is on track for a record 17,000 + arrests of convicted criminals apprehended by U.S. Border Patrol. I wonder what the number is that is not caught? You can believe what you want from Trump and Biden on the border policy, but numbers don't lie.

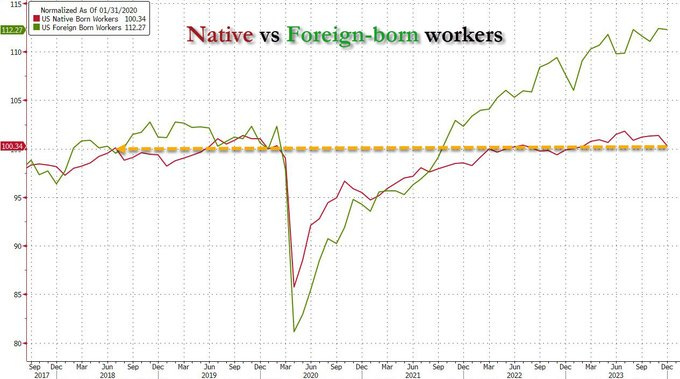

Another interesting chart shows that the US government data on the great jobs numbers reported each month has a very strange new twist. Basically all the jobs are going to foreign born workers. I am sure a lot to all the illegal immigrants and refugees. Another new trend under Biden. I would bet the problem in Canada is far worse, because we have much higher amount of illegal immigration and refugees based on our much lower population compared to the U.S. I believe I originally saw this chart at Zerohedge.

Four Top Stocks and What happened to Helen of Troy

Soligenix Inc. (SNGX) $10.59, +429.5%

Soligenix is an innovative biopharmaceutical company dedicated to developing and commercializing products for rare diseases and unmet medical needs. The company’s robust pipeline includes candidates for oncology, biodefense, and inflammatory conditions, positioning it to address critical health challenges. Key among its developments is SGX301, a photodynamic therapy for cutaneous T-cell lymphoma, which has shown promising Phase 3 results. Additionally, Soligenix's biodefense programs, supported by government grants, enhance its financial stability and growth potential. With a focus on niche markets and significant unmet needs, SNGX offers substantial upside as it advances its clinical programs and moves towards commercialization. The stock went crazy today on news their HyBryte Treatment demonstrated positive outcomes in early-stage Cutaneous T-Cell Lymphoma.

UniQure NV (QURE) $6.01, +59%

UniQure is a pioneer in the field of gene therapy, aiming to transform the lives of patients with severe genetic disorders. The company's lead product, AMT-061 (etranacogene dezaparvovec), for hemophilia B, has shown promising clinical results and is on track for regulatory approval. UniQure's proprietary technology platform and robust pipeline, including treatments for Huntington’s disease and other genetic disorders, position it at the forefront of gene therapy innovation. Strategic partnerships and strong financial backing further enhance its growth prospects. As the demand for curative treatments for genetic diseases rises, QURE offers significant long-term investment potential. The stock surged today when they announced interim data from its Phase I/II trials of AMT-130, a potential treatment for Huntington's disease. The data suggests a significant slowing in disease progression and a reduction in neurofilament light protein (NfL) levels, a neurodegeneration marker, in the cerebrospinal fluid (CSF) after 24 months.The trials, conducted in the U.S. and Europe, included 29 patients.

Zapp Electric Vehicles (ZAPP) $12.14 +31.43%, 2nd day in a row

Zapp Electric Vehicles is revolutionizing urban mobility with its high-performance, eco-friendly electric scooters. The company’s flagship product, the i300, combines cutting-edge technology with sleek design, making it a standout in the rapidly growing electric vehicle market. As urban areas increasingly prioritize sustainable transportation solutions, Investors are celebrating a two day jump in the stock price, up from $4.07 close on Friday. Since their 20 for 1 reverse split there is only 3,944,846 shares outstanding. Yet the stock traded almost 105 million shares yesterday, which is over 26 times the shares outstanding. Amazing, only in today's manipulated markets. This is how you Zapp!!!!!!!!!

Citigroup Inc. (C) $66.49 (new 52 week high)

Citigroup is a leading global financial institution with a diversified portfolio of services, including banking, investment, and wealth management. The company’s extensive global reach and strong presence in emerging markets provide significant growth opportunities. Citigroup’s focus on digital transformation and technological innovation enhances its competitive edge and operational efficiency. The bank’s robust balance sheet, strategic cost management, and commitment to returning capital to shareholders through dividends and buybacks further strengthen its investment appeal. As global economic conditions improve, Citigroup is well-positioned to benefit from rising interest rates and increased financial activity, making it an attractive investment for long-term growth. All the banks stocks are up today. Thank you FED.

The U.S. Federal Reserve is considering a rule change that could save the country's eight largest banks combined billions of dollars in capital, in a potential long-sought win for the industry.

At issue is how the central bank calculates an extra layer of capital it imposes on U.S. global systemically important banks (GSIBs), known as the "GSIB surcharge," which it introduced in 2015 to boost their safety and soundness. The Fed is considering updating inputs it uses in the calculation, which it fixed in 2015, to adjust for economic growth and in turn more accurately reflect the size of the banks relative to the global economy.

It is assumed that updating those inputs or "coefficients" would reduce the banks' systemic scores and resulting capital surcharge

Helen of Troy Ltd. (HELE) $64.21 -27.86%

Helen of Troy Ltd. (HELE) is a global consumer products company with a diverse portfolio of well-known brands in the health, home, and beauty segments. The company’s strategic acquisitions and strong brand management have driven consistent revenue growth and market expansion. Helen of Troy’s focus on innovation and product development ensures it stays ahead of consumer trends and maintains its competitive edge. The company’s robust e-commerce strategy and increasing direct-to-consumer sales further bolster its growth prospects. With strong financial performance, a commitment to operational excellence, and a diversified product portfolio, it was thought that HELE offers significant upside potential for investors seeking exposure to the consumer goods sector.

Helen fell from grace today on an earnings miss by $0.60 and lower guidance. Consolidated net sales revenue of $416.8 million was a decrease of 12.2%.

I am not surprised and what the market has not figured out yet is that we are not really in this Goldilocks economy. Things are far worse than most realize. The three bears are going to be back this fall or sooner, well at least one of them. It is why we are on the sidelines with our gains locked in for 2024.

US consumers are hitting the wall as consumer credit shows the biggest gain in borrowing in three months. Total consumer credit rose $11.3 billion in May, up from a $6.5 billion gain in the prior month, the Federal Reserve said Monday. Economists had been expecting a $8 billion gain, according to a Wall Street Journal survey. Revolving credit, like credit cards, jumped by a 6.3% annual rate in May.

Most consumers bought into the narrative that interest rates would have been down long before now, so they would be OK with a little more debt in the short run. Well the short run is becoming the long run and reality is setting in.

New findings published by WalletHub, a personal finance platform, show that several California cities are leading the nation in an uptick in credit card delinquencies. Chula Vista – a San Diego suburb with a population of about 279,000 – saw the biggest increase in credit card delinquencies, which surged nearly 85% during the first quarter of 2024 compared to a year earlier. The city edged out Madison, Wisconsin, and Garland, Texas, for the No. 1 spot.

San Francisco ranked in fourth place with an 84% jump in delinquencies.

Retailers like Helen of Troy are going to feel this, but the market is still pricing in the Goldilocks narrative.

Can you say a 4 letter word and fan

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.