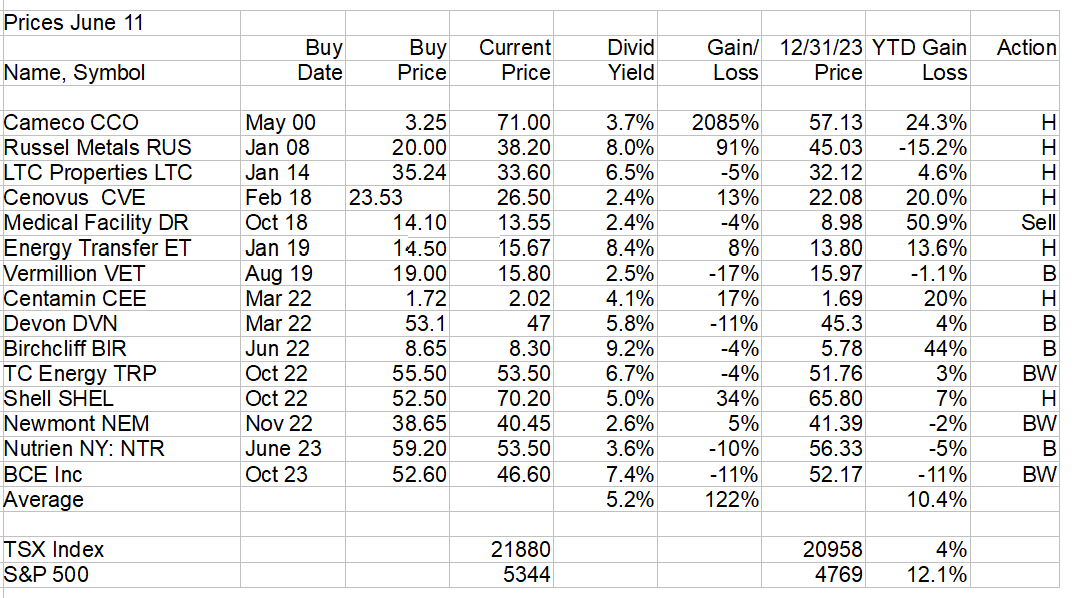

We are doing quite well with the Millennium Index, outperforming markets by a good margin. Oil and the energy stocks in the index have corrected some but even so the index is up 10.4% with a 5.2% yield so a return of +15.6% above the S&P 500 at +12.1% and way above the Toronto market.

Cameco is one of the original Millennium stocks from 2000 and there is good reason it is still on the index. It has been a strong performer again this year up +24% and a whopping 2,085% long term. There have been many other big winners in the index but they have been sold, only Cameco has been around since the start and mention to Russel Metals since 2008. Birchcliff is rebounding this year and Medical Facility DR has had a very strong year. I like this stock long term as elective surgeries are on the rise post Covid-19 and the shots, but I think it is over bought short term and I see a market correction this year where we can probably buy back.

Struther’s Mighty Millennium Index

Next, I show a 3 year chart on Medical Facilities and you can see the big run up this year.

I am also moving and building a new website. So it will probably go down some time this week until next week. Much of the content will be the same with improvements, but all the history in the chat or $$Lounge will be lost. You will also have to sign back up for the new website which should be easy and is a function not working on the current site. The new site should be easier to navigate and will have better security.

I don't like the chart on oil with the crash below $77 but it has bounced right back up. I know there is probably some election year interventions, but a bigger concern is the weakness may be signalling a coming recession. I plan a more indepth look at this.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.