Nat Gas, US Housing slows, Toronto Condos Collapse, NGMD, HEM

U.S. industrial production was better gaining 0.9% in the last month of 2024, stronger than the 0.3% increase expected and November's 0.2% rise (revised from -0.1%), says the Federal Reserve. Capacity utilization 77.6% vs. 77.0% consensus and 77.0% prior (revised from 76.8%). However, the latest reading trailed the metric's long-run (1972-2023) average by 2.1 percentage points.

My warning of a more normal, cold winter appears to be materializing. Natural Gas hit over $4.00 yesterday, it's highest level since 2022 as cold weather grips most of the U.S. and more so next week.

On January 16, 2025, EIA released its Weekly Natural Gas Storage Report. The report indicated that working gas in storage declined by -258 Bcf from the previous week, compared to analyst consensus of -255 Bcf. In the previous week, working gas in storage decreased by -40 Bcf. At current levels, stocks are 111 Bcf less than last year and 77 Bcf above the five-year average for this time of the year. Gas is down a bit today with a sell the news event.

U.S. single-family home building increased solidly in December, but further gains were seen limited by rising mortgage rates and a glut of new homes on the market. Single-family housing starts, which account for the bulk of home building, rose 3.3% to a seasonally adjusted annual rate of 1.050 million units last month

The average rate on the 30-year fixed-rate mortgage rose above 7% this week for the first time since May and there is an oversupply of unsold new homes, with inventory at levels last seen in late 2007.

Canada Housing Flat while Toronto Condo Market Collapsing

"Canada's urban centres saw an uptick in housing starts in 2024 compared to last year, marking the third-highest year on record," said CMHC chief economist Mathieu Laberge in a news release.

While the two per cent increase shows some progress, it falls significantly short of the level needed to address Canada's housing affordability challenges. CMHC says Canada will require an additional 3.5 million housing units by 2030, on top of the 2.3 million already projected to be built, to restore affordability to levels seen in 2004.

The Canadian real estate market is mostly hanging on except Ontario which is the largest market. There the housing remains around recent lows and Toronto Condos are in free fall The optimism is potential record demand on the sidelines and still a chronic shortage of supply. However the problem is most of those on the sidelines cannot afford the current prices and the hope of lower mortgage rates is fading. A bigger problem is the recession is deepening and if Canada gets hit with tariffs, Ontario will suffer the most putting downward pressure on real estate there.

The Canada 5 year bond best represents mortgage rates and it has not been dropping at all. At least it has not risen as much as U.S. interest rates probably because of the Canadian recession but tariffs may also accelerate the fall in the C$ loonie and push rates up.

The CREA National Home Price Index, a more like-for-like comparison of dwelling prices, rose 0.3 per cent year-over-year, a second consecutive monthly increase. So prices pretty much flat with some areas outside Ontario doing much better while Toronto area down.

The City of Toronto's average home price declined more than the GTA average, as it falls 4.3% monthly to $1,033,742 in December 2024, which is 2.7% lower annually. That’s after already decreasing by 7.3% month-over-month in November 2024. Brampton's housing market experienced a larger decrease in its average home price. The average price decreased 3.9% year-over-year to $948,170, a four-year low.

Toronto Condo Market in Freefall

Just as I expected, this market is collapsing as investors all run for the exits.

Sales of new condo units in Toronto hit the lowest level since 1996 as the individual investors who have powered the market for decades pull back. Transactions of new condos in Canada’s biggest city fell 64% in 2024 from a year earlier, the third straight annual decline, according to a report released Thursday by market research firm Urbanation.

“The new condo market just experienced its toughest year in three decades,” Shaun Hildebrand, Urbanation’s president, said in a statement. “Expectations for the market remain low this year as investors, the primary driver of presale activity, continue to deal with negative cash flow, difficulties arranging financing and declining prices and rents.”

Among the 1,829 units that launched for presale across six projects in the last three months of 2024, only 10% found buyers, compared with the 52% sales rate typical of the period in the last 10 years.

Developers racing to close out projects they’d already begun pushed the number of finished condos hitting the market to a record 29,800 units in 2024, with that number expected to go even higher next year, 2025 with 30,793 units scheduled to finish construction. There are 13 projects that have been cancelled and a lot more in receivership.

blogTO (@blogTO) October 30, 2024

The 4,590 individual units sold in Toronto, Hamilton and surrounding cities and towns over the course of the year marks an astounding 64 per cent decline from 2023's figures, and a 78 per cent drop below the 10-year average for new condo sales in the area.

Big busts follow big booms!!!!!!!!!!!!!!!!!

Prices are Falling and Cranes Have Left the Building (faster than Elvis)

With more supply in the market, the average condominium apartment price dipped by 3.3 per cent annually to $692,672. as of Q3 2024. Prices started to decline in 2023 but this latest quarter of 2024 was the steepest decline that Urbanation has tracked over the past two decades.

Preconstruction condo prices fell 15 per cent in the Toronto region in the final quarter of 2024, as sales plunged to their lowest level in nearly three decades and a glut of unsold units hit a record high.

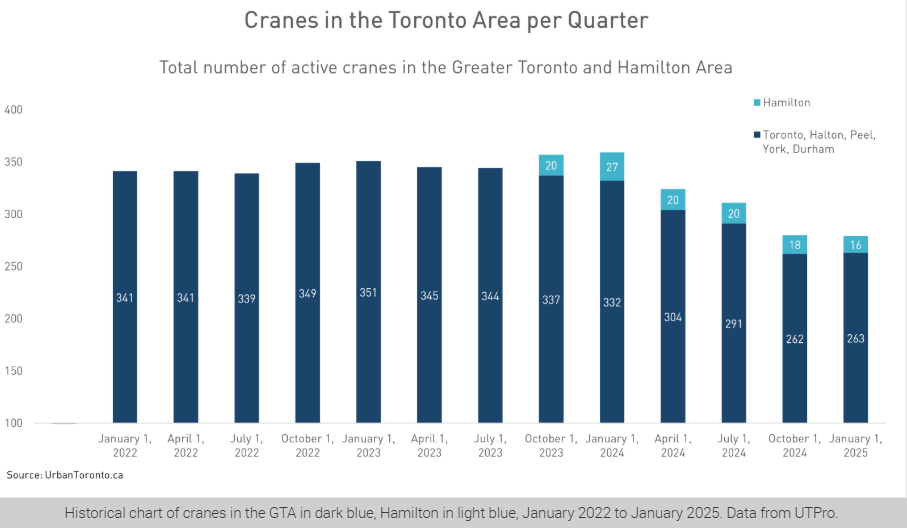

A number of times I pointed out the crazy number of building cranes in Toronto area but these saw a big drop in 2024 with about 70 falling by the wayside.

This is only the start as Condo prices will plunge much further in 2025 and historically they can affect the whole housing market in the GTA as they become cheaper competition.

After predicting the housing top within weeks, my challenge now is to predict the bottom. I doubt this will happen in 2025 as there is a lot of uncertainty in the economy and markets, but not the good kind.

I commented about Trudeau's capital gain tax increase going to be defunct. It is certain if Poilievre wins the next election.

Conservative Party Leader Pierre Poilievre says a Tory government will cancel the hike on the capital gains tax, commenting during a press conference in Delta, B.C. on Jan. 16.

He summed it well in a post on social media the same day, Poilievre said the idea of hiking the capital gains tax was “bad” before U.S. President-elect Donald Trump threatened 25 percent tariffs on Canada and now it’s “outright insanity.”

“This is a tax on home builders when we have a housing shortage, a tax on doctors when we have a doctor shortage,” Poilievre told reporters. “It is a tax on small business when we have an economic crisis, it’s a tax on farmers when we have a food price crisis, and it will send billions of dollars away.”

Hemostemix Inc. - - - - CSE:HEM, OTC:HMTXF - - - Recent Price – C$0.28

The day my newsletter went out the stock traded between $0.20 and $0.235 and closed at $0.215 so will use the closing price as our entry price. I have heard there is significant news coming next week.

NuGen Medical Devices - - - TSXV: NGMD - - Recent Price - $0.08

Entry Price - $0.12 - - - - - - - Opinion - buy

My last update was about wealthy Chinese pharmaceutical execs/company taking control of the company. This is moving along as Nugen announced the appointment of Mr. Liang Lin as the new Chief Executive Officer of NuGen.

Liang is the founder and CEO of Sol-Millennium Medical Group ("SolM"), an organization committed to transforming the medical device sector through innovative approaches and a strong focus on patient safety. He initiated the SolM project in Shanghai, motivated by a vision to enhance health outcomes for patients globally. His unwavering commitment to innovation has led to the development of advanced medical devices that not only meet but exceed industry standards. Under Liang's dynamic leadership, SolM has made significant strides in expanding its international footprint. The organization has successfully penetrated the North American and Brazilian markets through strategic acquisitions, including Inviro Medical Inc. and Medica Brazil. Additionally, SolM has established offices across Europe and the Middle East, allowing the company to address a diverse range of healthcare needs and adapt to the unique challenges of various healthcare systems. To support its ambitious growth objectives, SolM has invested heavily in research and development, creating state-of-the-art facilities in both Asia and Europe. This commitment to R&D has enabled the company to build a robust pipeline of innovative products poised to make a significant impact on the medical device industry.

Liang joined the Company's board of directors in September 2024 concurrently with the closing of Sol-M's strategic investment in NuGen.

"As NuGen's Chairman, over the past 4 months, I have been actively working with management to further understand InsuJet'sTM production capabilities in order to meet anticipated global demand in 2025. With this challenge, along with the Company being properly capitalized, I am honoured to assume the role of CEO. My goal is to leverage my experience and grow sales worldwide. I am confident that my expertise in the medical device industry will serve us very well and my object will be met," commented Liang Lin, Chairman and CEO of NuGen.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.