I would say it is safe to say my prediction of a more normal, cold winter has come about. This also gives a lot of credence that volcano Hunga Tonga in January 2022 was the main reason we had abnormally warm years in 2022 to 2024. A main reason Natural Gas prices declined with much less heating demand in the past couple winters. Gas prices have made quite a move higher so some consolidation is in order.

The EIA report today is expected to show a 191 Bcf storage draw, well above the 5-year average of 145 Bcf—key for price momentum. The EIA number just out came at a 196 Bcf decline in storage, pretty much in line with expectations.

Here is the Millennium Index for 2025 and the prices are of Feb 19th so we have good start to the year with an average gain already of 7.7%. Because oil&gas prices have been weak, I have quite a few of these type stocks on the list. I will probably sell one or two this year to better diversify the index.

I am also adding B2Gold to the list because it has over 2.0% yield, better than AngloGold. I will probably sell AngloGold this year as well and keep B2Gold on the list.

Millennium Index List for paid subscribers only

B2Gold - - TSX:BTO NY: BTG - - - Recent Price $3.90

Entry Price $4.45 - - - - - - - Opinion – buy

The stock had a nice jump today after they reported Q4 results and another record high in the gold prices today. They are currently breaking about even financially but have strong cash flow and 2025 will a huge pivotal year for the company. The stock seems to be trading based on the past and not giving any credit for a big increase in production for 2025.

Total consolidated gold production for 2024 was 804,778 ounces (including 19,644 attributable ounces from Calibre Mining Corp., at the low end of the Company's 2024 guidance range.

Total consolidated cash operating costs and all-in sustaining costs for 2024 within their guidance ranges: Total consolidated cash operating costs for 2024 were $889 per gold ounce produced, at the upper end of the annual guidance range of between $835 and $895 per gold ounce. Total consolidated all-in sustaining costs for 2024 were $1,465 per gold ounce sold, within the annual guidance range of between $1,420 and $1,480 per gold ounce.

Attributable net loss of $0.01 per share in Q4 2024; Adjusted attributable net income of $0.01 per share in Q4 2024.

The Goose Project construction and development continues to progress on track. All planned construction activities in 2024 were completed and project construction and development continue to progress on track for first gold pour at the Goose Project in the second quarter of 2025 followed by ramp up to commercial production in the third quarter of 2025.

Feasibility Study on the Gramalote Project in Colombia underway and targeted for completion in mid-2025: The positive Preliminary Economic Assessment (“PEA”) results on the Company’s 100% owned Gramalote Project, completed in the second quarter of 2024, outlined a significant production profile with average annual gold production of 234,000 ounces per year for the first five years of production, and strong project economics over a 12.5 year project life. As a result, B2Gold commenced work on a feasibility study with the goal of completion in mid-2025. Feasibility work including geotechnical investigation, processing design and site infrastructure design is underway and the study remains on schedule.

It will be interesting to see how they handle the Zonte claim dispute in the feasibility because claim ownership will have to be disclosed, but they have a considerable contingency cost for what they call resettlement programs.

Outlook

Total gold production in 2025 is anticipated to be between 970,000 and 1,075,000 ounces, a significant increase from 2024 production levels primarily due to the scheduled mining and processing of higher-grade ore from the Fekola Phase 7 and Cardinal pits made accessible by the deferred stripping campaign that was undertaken throughout 2024, the expected contribution from Fekola Regional starting in mid-2025, the commencement of mining of higher-grade ore at Fekola underground and the commencement of gold production at the Goose Project by the end of the second quarter of 2025. The Company's full year total cash operating costs for the Fekola Complex, Masbate and Otjikoto are forecast to be between $835 and $895 per gold ounce and total all-in sustaining costs are forecast to be between $1,460 and $1,520 per gold ounce. Operating cost guidance for the Goose Project will be released in the second quarter of 2025 (prior to the commencement of initial production), after the publication in the first quarter of 2025 of B2Gold's initial Goose Project life of mine plan based on updated Mineral Reserves.

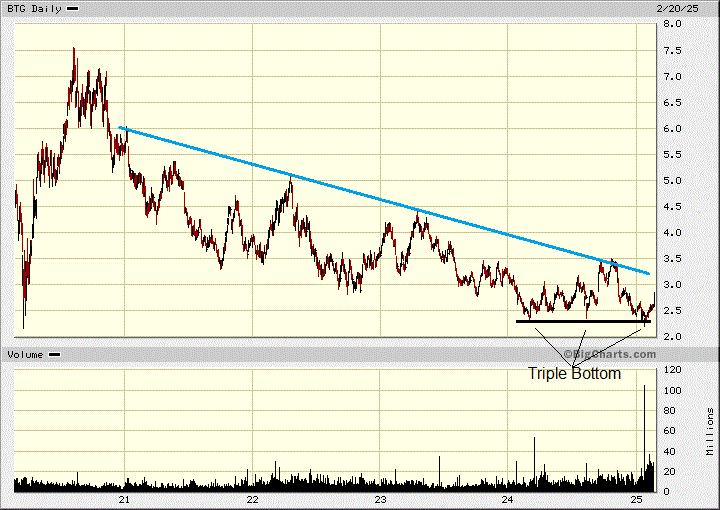

This is a chart of BTG the US$ price so it does not reflect the drop in the Canadian loonie. You can see how badly the stock has lagged the sector. The market is still in the past penalizing companies growing with new projects. This is backward thinking and we are taking advantage of this. The stock has made a triple bottom and has developed a wedge pattern. Today we have a higher high in the short term. There will be resistance between $3.10 and $3.50.

Devon Energy - - - NY:DVN - - - - Recent Price – $38.54

Devon has responded well with higher Nat gas, it is in our Millennium Index and as such the plan is to hold long term, collecting dividends and accumulation capital gains longer term. We did very well at the start in 2022 as the stock was paying a much higher dividend and it jumped about 75% for us that year. In hind sight, we should have sold it, but I never expected natural gas prices to fall as far as they did. Gas prices saw the perfect storm as far as weather goes to send them to bottoms last seen in the 2020 panic and previously in 2016. However, we have been collecting nice dividends and even at the current cut rate, the yield is about 2.5%. The capital gains will come.

DVN experienced a significant stock price increase yesterday , rising over 10% to over $38.64. It has gained further today. The company's fourth-quarter financial results surpassed market expectations, driving the positive momentum.

Devon reported earnings per share (EPS) of $1.16, which exceeded analysts' predictions by $0.18, as they had anticipated $0.98. Additionally, the company's quarterly revenue reached $4.4 billion, outperforming the forecasted $4.17 billion

“I am proud to report that Devon ended 2024 with exceptionally strong results,” said Rick Muncrief, president and CEO. During the fourth quarter, our diversified, multi-basin portfolio once again delivered across our assets, with the Rockies and Eagle Ford exceeding estimates due to strong new well productivity and solid base performance. In addition, the company achieved a 154 percent proved reserve replacement ratio in 2024.

“We continue to see tremendous value in our company and leaned-in on our share repurchases this quarter, buying approximately $300 million for a total $1.1 billion repurchased for the year. In addition, the Board approved a 9 percent increase to the fixed dividend beginning with the first quarter of 2025, reflecting confidence in the energy outlook and Devon’s future free cash flows.

FULL-YEAR 2024

Delivered $2.9 billion of net earnings, or $4.56 per share; $3.1 billion of core earnings, or $4.82 per share

Record performance of 737,000 barrels of oil equivalent production (Boe) per day

Generated $6.6 billion of operating cash flow and $3.0 billion of free cash flow

Returned $2.0 billion to shareholders through dividends and share repurchases

Exceeded environmental and safety targets, reducing emissions, spills and serious incidents

Increased operating scale and economic drilling inventory with the acquisition of Grayson Mill

Board approved a 9% increase to the quarterly fixed dividend in 2025 to $0.24 per share

2025 OUTLOOK

2025 capital program expected to be $3.8 to $4.0 billion, with more than 50 percent allocated to the Delaware Basin

2025 production anticipated to be 805,000 to 825,000 Boe per day, including 380,000 to 386,000 barrels of oil per day

Reached agreement with BPX to dissolve partnership in the Eagle Ford

Extended joint venture with Dow to develop an additional 49 wells in the Anadarko Basin

I would like to see a break above $40 on the chart which would be a higher high, a move through resistance and break above the upper range of the recent down trend channel.

Birchcliff - - - - TSX:BIR - - - - - Recent Price $6.05

Our Canadian natural gas stock Birchcliff on the Millennium index has been moving back up again, but for now I think the stock will be retained by resistance around $6.45. However cash flow is rising and dividends could increase later in the year. They announced Q4 results last week.

2024 Financial and Operational Highlights

Delivered annual average production of 76,695 boe/d (82% natural gas and 18% liquids) in 2024 and quarterly average production of 77,623 boe/d (82% natural gas and 18% liquids) in Q4 2024.

Generated annual adjusted funds flow of $236.8 million in 2024 and quarterly adjusted funds flow of $71.8 million in Q4 2024. Cash flow from operating activities was $203.7 million in 2024 and $45.6 million in Q4 2024.

Reported annual net income to common shareholders of $56.1 million in 2024 and quarterly net income to common shareholders of $35.2 million in Q4 2024.

F&D capital expenditures were $273.1 million in 2024 and $58.3 million in Q4 2024. Birchcliff drilled 29 (29.0 net) wells and brought 27 (27.0 net) wells on production in 2024.

Returned $107.8 million to shareholders in 2024 through common share dividends.

Birchcliff brought 27 new wells on production as part of its 2024 F&D capital program with strong PDP reserves additions of 34.1 MMboe (1.26 MMboe per well) and delivered PDP F&D costs of $8.01/boe, resulting in a PDP F&D operating netback recycle ratio of 1.4x in 2024 on additions.

“Our strategy for 2025 builds off of the operational momentum from 2024, maintaining our focus on capital efficiency improvements and further driving down costs. Our 2025 capital program has been designed to ensure that our capital is strategically deployed throughout the year, providing us with the flexibility to adjust our capital spending if necessary in response to the commodity price volatility we expect during 2025, including as a result of the potential for U.S. and Canadian tariffs and the start-up of LNG Canada.” commented Chris Carlsen, President and CEO of Birchcliff.

Russel Metals - - - TSX:RUS - - - - - Recent Price - $42.30

I had some concern for Russel with steel tariffs but in Trump's last regime that resulted in higher steel prices benefited Russel and this will probably happen again with tariffs.

“We have outlined a scenario where our 2025E EBITDA goes to $487-million if steel prices respond like they did during the prior regime. Spot HRC prices are up 10.4 per cent since the start of the year, and market commentary is getting more constructive regarding prices and demand. Perhaps more importantly, we still have a high affinity for management's capital allocation prowess and the discounted valuation of the stock using our normalized 2026E scenario (10.1x P/E)." The Globe reported on February 4, that Stifel analyst Ian Gillies rated Russel Metals "buy."

In the 2024 fourth quarter, their revenues, EBITDA and net earnings per share were $1.0 billion, $61 million and $0.47 per share, respectively compared to $1.0 billion, $82 million and $0.78 per share in the fourth quarter of 2023 and $1.1 billion, $67 million and $0.59 per share in the third quarter of 2024. Fourth quarter 2024 results declined relative to their third quarter 2024 primarily due to the typical seasonal dynamic. In addition, our fourth quarter results were negatively impacted by:

(i) $2 million for non-cash charges, including $1 million for the unamortized issuance costs on the redeemed term notes and $1 million for equipment write-downs;

(ii) $2 million expense for the mark-to-market on stock-based compensation, and (iii) $1 million for transaction and transition costs for acquisitions and other non-recurring items.

Market Conditions reported by Russel

After declining for much of 2024, steel prices stabilized in the latter part of the year. In 2024, the average price for hot rolled coil and plate averaged US$776 per ton and $1,074 per ton, respectively, which represented a 14% and 27% decline compared to 2023 averages. By comparison, the average price realizations of our metals service center segment declined by 13% on a year-over-year basis, as a result of our broad product mix and growing portion of value-added processing. Our energy field stores continue to benefit from a steady energy sector.

Steel prices have made a triple bottom and are breaking out of a wedge pattern this year. Russel makes a lot of pipe for the oil&gas industry as well so an increase in exploration and development will help the company here too. They now have a bit more U.S. exposure.

On December 4, 2024, RUS completed the acquisition of Tampa Bay Steel for approximately US$75 million, which was lower than the originally announced purchase price of US$79.5 million, as a result of favourable adjustments related to closing working capital. The Tampa Bay acquisition provides RUS with a platform for growth in the Florida market place and augments value-added processing capabilities and product offerings in aluminum and stainless steel.

The stock has done very well for us, up over 100% and a 8.4% yield on our buy price. At current prices the yield is a very good 4%.

Recon Africa - - TSXV:RECO, OTCRECAF - - - Recent Price - $0.58

Entry Price $0.56 - - - - - Opinion – buy on weakness

I listened in on the investor conference call and will give a summary using two slides. Remember this is a brand new play, no oil ever discovered here so they have no historic data or data from other on land discoveries in Namibia. RECO had to build their own data base and the recent Naingopo well adds significant more data to that. Based on this well data RECO has decided to go to Prospect I next instead of the original plan of Kambundu.

Because this is grass roots, investors need to have patience but by the stock price we know that many do not. CEO Brian Reinsborough harped about - it takes time and patience to make a grass roots discovery. Reinsborough sited another exploration play he was in and it took 4 wells to make the discovery. I have said all along that it is only a matter of when, what well will make the discovery All we need is patience and can accumulate more stock.

The above slide reveals there are 23 prospects identified so far and the Naingopo well only tested the first one. This well had all the right stuff except a trap to hold the oil in a reservoir.

The CEO was happy with the well as it derisked future prospects. They have over 23 structures identified and need to find the sweet spot. The current structure they drilled is 20-kms long, highlighting their large size. Truly world class targets. RECO believes Prospect I has higher odds of having a trap to create an oil reservoir.

Chris Sembritzky, VP exploration commented that the Damar Fold Belt has world class structures.

Results from Naingopo pushed them to prospect I next. Prospect I is best shot in fold belt, based on their current data and if it misses they would go to the Rift basin next, after a 3d seismic on their targets on the Rift basin. They are very excited about Rift play but need 3d seismic first.

The targeted closure is 6,000 acres with prospective oil reserves of 365 MM Bbls and 1.9 Tcf of gas. They expect to spud the Prospect ! Well in June and are building 10km road into prospect I and doing the PR work with locals as normal course of the exploration business.

It is unreal that the stock has come all the way back. It hit new lows under $0.80 and I have a buy on weakness, only because I cannot see any sure sign of a bottom the the stock chart. Everyone selling now is doing so at a loss, so this selling should soon exhaust itself.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.