New Guest Column- Huntington Ingalls (HII)

Tensions Rising, Portfolios Ready: Time to Load Up on HII?

“From chaos comes opportunity” - Sun Tzu, The Art of War

My Son Joe, built my website and helps maintain it. He handles doing all the AI that I have used now and then in the newsletter. Might as well let the young dog learn the new tricks and this dog stick to the old ones. He has been dabbling off and on with a newsletter, so I decided to make him a guest columnist here. Some of his past picks are exceptional, especially in the defense sector.

Joe picked Lockheed Martin (NYSE LMT) in 2021 @ $ 336.1 it is now $439.45 and hit a peak of $618.95 in October 2024. The dividend yield when picked was 3.04% so an extra 12% gain on top of roughly 30% current gain.

Joe's Big One - Rheinmetall AG (Frankfurt RHMG - recently added to DAX) He picked in June 17th 2021 at $85.60 and its current share price is $1315.50 with a 52wk high of $1483. The dividend yield in June 2021 was around 2-2.1% so an extra 6% gain on top of a 1437.85% gain as of the $1315.50 price

Here is Joe's next defense pick as his first guest column here. Joe picked this stock on Monday and it has already moved up some. We just decided on the guest column yesterday, but anyway there is a lot of upside here yet. ------- All comments welcome!

Good morning!

Today, we're looking to beef up our portfolios with a pick from the defense sector. Subscribers of http://www.playstocks.net/ know all about the deteriorating geopolitical landscape thanks to Ron’s excellent reporting—and I believe I’ve found a timely opportunity.

Huntington Ingalls Industries (NYSE: HII)

HII is America’s largest military shipbuilder and a major provider of defense technology solutions. They design, build, and maintain nuclear-powered aircraft carriers and submarines for the U.S. Navy. Beyond shipbuilding, HII also develops unmanned systems, cyber and intelligence solutions, and AI-driven defense services—making them a key player in national security through advanced engineering and mission-critical innovation.

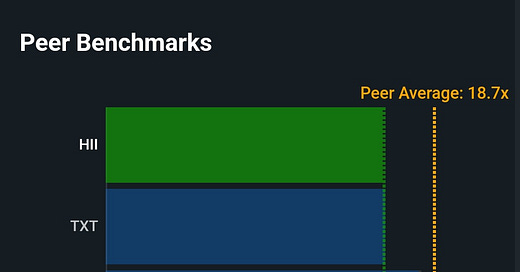

HII currently trades at $187.54 with approximately $11.77 billion in annual revenue, net income of $550 million and 39.4 million shares outstanding. Its P/E ratio sits at 13.3x—below peer averages (source: Investing.com). HII offers a solid quarterly dividend of $1.35, yielding 2.88%. Before we dive into why HII belongs in your portfolio, let’s look at the charts and decide when to buy.

The Case For Buying Now

With solid fundamentals, long term investors won’t mind picking this stock up now especially if they don’t mind picking up more and averaging down if the opportunity arises. In the chart below you can see two sell offs, one from an earnings miss and the more recent one from Trumps tariffs.

The stock was recovering and consolidating before the tariffs caused a market sell off, this alone is reason to believe the stock will recover when the markets do. RSI of 42.41 and on an upward trajectory shows the stock is not oversold either. Two pieces of news on April 7th 2025 could also help the stock recover in the near term. First Huntington Ingalls Industries (HII) signing an agreement with South Koreas HD Hyundai Heavy Industries to look into expanding ship building. And 2nd, the news of HII delivery of first two Lionfish small uncrewed undersea vehicles (SUUVs) to the U.S. Navy under a program that could scale to 200 vehicles, with a contract value exceeding $347 million.

Why Bargain Hunters May Want To Wait A Bit Longer To Grab HII

The chart and the technical s don’t look all that great and with 2 analysts downgrading their earnings estimate, another miss could give Huntington Ingalls Industries another whack down. Let’s look at some charts to further explain.

If we look at this chart below we can clearly see HII has fallen out of its recent channel, is already testing and falling through its near term support of roughly $185-187, represented by the horizontal dotted blue line. The next level of support in most recent trading is roughly $175. The volume has been higher, but that is likely just part of the recent market sell off.

In the chart below the MACD shows a recent inflection point, and the 10/40 Moving Averages have not quite converged, suggesting there may be more near term downside. With another earnings call due May 1, if HII misses again, it could put more downward pressure on the share price. The 25/100 MA says buy while the 100/200 MA says do not.

Based on the longer term chart below and the 2 channels highlighted, we expect the stock to trade in a range of $165-$175 if it continues downward.

Why Huntington Ingalls Industries?

While Ron has kept us up to speed on the conflict in Europe, Southeast Asia is becoming a powder keg. (Chinas 9 Dash Line in red, UN Exclusive Economic Zone in blue.)

China’s sweeping territorial claims in the South China Sea (Nine-Dash Line) are clashing with the Philippines, Vietnam, Malaysia, Brunei, and Taiwan. Meanwhile, land disputes with India and even Russia contribute to mounting tensions. Beijing continues to increase pressure on Taiwan through live-fire military drills and aggressive rhetoric, signaling a heightened risk of conflict in the Taiwan Strait.

Chinese naval ships blast Filipino vessel with water cannons in the image below.

Japan is shifting away from its post-WWII pacifism, significantly increasing defense spending and investing in cutting-edge technologies. The Philippines is also responding to Chinese aggression with stronger diplomatic and military actions. Tensions remain high on the Korean Peninsula, while Vietnam and China continue to militarize disputed islands. India and China are boosting military infrastructure with China looking into an airbase in Bangladesh and India a submarine base not far from there.

HII is Built for this Environment

Given the rising demand for maritime dominance and defense preparedness, HII stands to benefit in a big way.

The U.S. Navy is planning a $1 trillion fleet expansion over the next 30 years (CBO estimate). HII may not get the whole pie—but with its current offerings, it’s likely to get a sizable slice.

Submarines:

HII’s Newport News Shipbuilding division is one of only two U.S. firms authorized to design and build nuclear-powered subs. They're leading work on the Columbia-class SSBNs (to replace the Ohio-class) and partnering on Virginia-class attack subs—the Navy’s most advanced undersea platforms.

Guided Missile Destroyers:

HII builds Arleigh Burke-class DDG 51 destroyers, outfitted with the Aegis Combat System and capable of engaging threats in air, surface, and subsurface domains. Newer variants support ballistic missile defense.

Amphibious Ships:

America-class LHA 6 amphibious assault ships are critical to modern U.S. expeditionary strategy, supporting air-ground task forces, humanitarian missions, and joint-force operations.

HII is also entering the unmanned systems space and is developing next-gen naval platforms with a focus on autonomy and AI. (See their website for more.)

Key Contracts Awarded:

Ingalls Shipbuilding: Secured a $565 million portion of the multi-ship amphibious award, which includes the construction of LHA 10, LPD 33, 34, and 35.

Newport News Shipbuilding: Awarded contracts for the maintenance and overhaul of USS Boise (SSN 764) and advanced planning for the Refueling and Complex Overhaul (RCOH) of USS Harry S. Truman (CVN 75).

Mission Technologies: Received contracts exceeding $12 billion in 2024, contributing to strong top-line growth and margin expansion.

As of September 30, 2024, HII holds an order backlog of approximately $49.4 billion, with a funded backlog of $27.7 billion.

To scale production, HII signed a memorandum of understanding with South Korea’s HD Hyundai Heavy Industries (HHI). HHI builds ships equivalent to the Arleigh Burke-class and has capacity to scale from 1 to 5 ships per year. President Trump has indicated shipbuilding will feature in future U.S.–Korea bilateral negotiations, which could further benefit HII.

Final Thoughts

In today’s high-stakes global environment, Huntington Ingalls Industries is strategically positioned to meet the growing demand for advanced naval and defense capabilities. With a strong track record, steady dividends, a robust backlog, and exposure to future military tech, HII offers both stability and upside.

Bottom line: HII is a smart addition to any portfolio.

We’ll be tracking this closely in future issues. As always, let us know your thoughts—and if you're buying now, waiting for a better entry point, or looking at other picks in the sector.

Joe Struthers is a CNC machinist who writes about defense and resource stocks.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.