Thank you to all the smart and often contrarian investors who recently joined my Substack. Nutrien will do well in the future I pointed out in my last weeks Substack article. I also take a look at the benefits for investors with the Telaris merger along with the CEO of Greenbriar interview.

Nutrien Ltd. - - NY:NTR - - - TSX:NTR- - - Recent Price – US$59.65

Shares out 496 million - - - Dividend 3.5%

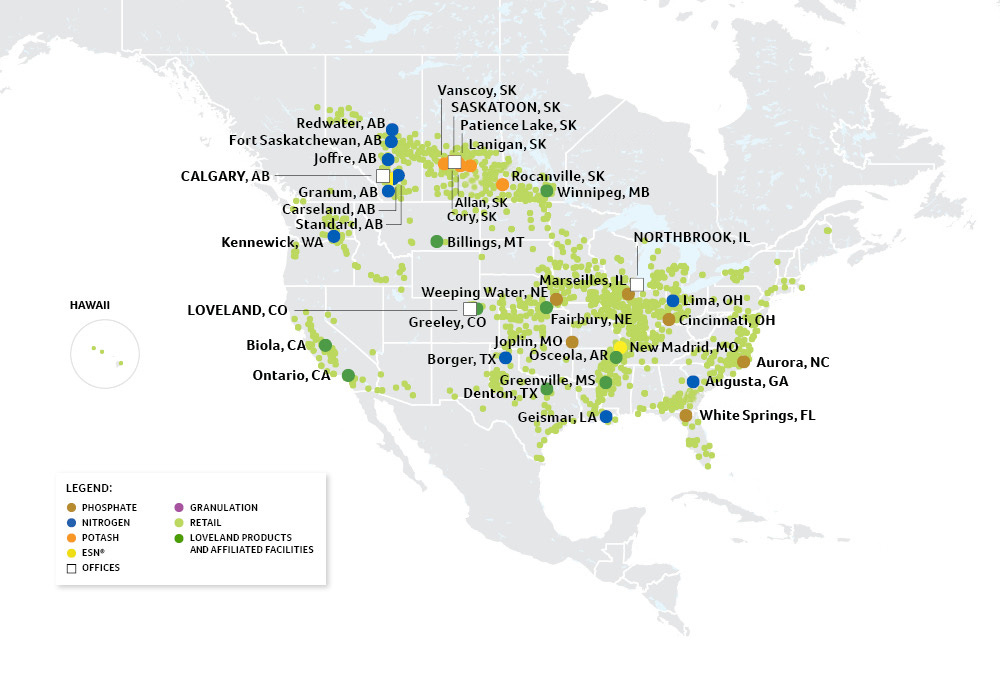

Nutrien provides crop inputs and services. The company operates through Retail, Potash, Nitrogen, and Phosphate segments. Nutrien is the world’s largest potash producer with over 20 million tonnes of potash capacity at their six lower-cost potash mines in Saskatchewan. NTR has decades of high-quality reserves and a multi-year expansions is complete. NTR is well positioned to meet the world’s long-term potash needs.

Nutrien is the third-largest nitrogen producer in the world with over 7 million tonnes of gross ammonia capacity and the ability to produce more than 11 million tonnes of total nitrogen products in the US, Canada and Trinidad. Nutrien’s nitrogen production network is low-cost and diversified, with opportunities to execute high-return and low-risk brownfield projects. They can expand production while significantly lowering their carbon footprint. As part of this effort of reducing the carbon footprint of the nitrogen operations, we NTR has focused around energy efficiency, carbon capture and CO2 abatement.

Nutrien operates two large integrated phosphate mining and processing facilities and four regional upgrading plants in the US. As the second largest phosphate producer in North America, Nutrien sells approximately 3 million tonnes of finished product annually. Nutrien is self-sufficient in phosphate rock, with access to high-quality, integrated phosphate rock reserves that allows for the production of a diverse and premium portfolio of phosphate products, including solid and liquid fertilizers, feed and industrial acids.

The NTR network of over 2,000 retail locations in seven countries provide a wide range of products and services to help growers around the world feed the future. We provide our customers with complete agriculture solutions including nutrients, crop protection products, seed, service and digital tools.

NTR reported their Q1 2023 results on May 10th and naturally they were down from record levels in 2022:

Nutrien Ag Solutions (retail) adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) declined to $(34)-million in the first quarter of 2023 primarily due to lower sales and gross margins for crop nutrients and crop protection products compared with the record levels achieved in 2022. Crop nutrient margins were below normalized levels in the first quarter as prices declined and the company worked through higher cost inventory;

Potash adjusted EBITDA declined to $676-million in the first quarter of 2023 due to lower net realized selling prices and lower sales volumes. North American sales volumes were impacted by just-in-time buying. Lower offshore demand from customers in Asia was largely offset by record first quarter Canpotex sales volumes to Brazil;

Nitrogen adjusted EBITDA declined to $676-million in the first quarter of 2023 due to lower net realized selling prices for all major nitrogen products. This was partially offset by lower natural gas costs and increased operating rates at the company's North American nitrogen plants;

Nutrien repurchased 11.8 million shares year to date as of March 31, 2023, under its normal course issuer bid programs, for approximately $900-million. The company's total shares outstanding declined to 496 million as at the end of the first quarter of 2023, representing a 10-per-cent reduction compared with the same period in 2022;

Nutrien full year 2023 adjusted EBITDA and adjusted net earnings per share guidance was revised to $6.5-billion to $8.0-billion and $5.50 to $7.50 per share, respectively.

NTR's financial guidance from their Q1 report.

Based on market factors detailed herein, the company is revising full-year 2023 adjusted EBITDA guidance to $6.5-billion to $8.0-billion and full year 2023 adjusted net earnings guidance to $5.50 to $7.50 per share. The company now projects cash from operations of $5.0-billion to $5.8-billion, which is expected to be relatively stable due to an anticipated release in working capital.

"Crop input demand has strengthened as the spring planting season progresses in the northern hemisphere and higher cost inventory is moving through the channel. We are encouraged by the continued stabilization of fertilizer markets following a year of unprecedented volatility and anticipate increased demand in the second half of 2023 due to strong agriculture fundamentals, improved grower affordability and lower inventory levels. With fertilizer prices near mid-cycle levels, we expect to generate strong operating cash flows in 2023 and to maintain a balanced and disciplined approach to capital allocation," said CEO Ken. Seitz.

Nutrien is now trading near a multiyear low after having reaching Cdn$148 in early 2022. The company reported lower-than-expected earnings in the first quarter as a result of lower selling prices in all areas, and lower sales volumes in retail, potash and phosphate. The company expects fertilizer prices to stabilize and expects increased demand in the second half of 2023 as a result of strong agricultural fundamentals. I expect we could even see fertilizer prices rise some.

Market watch shows the stock trading at a 4.2 current P/E, 5.06 times cash flow and 1.43 book value. I see 2023 EBITDA a little higher than the US$7.2-billion guidance midpoint and expect US$7.00 earnings per share which is about 8.7 P/E. NTR is now paying US$0.53 quarterly dividend and the record date for the current dividend is June 30th, so if you own the stock by then, you can catch the current quarterly dividend.

The chart is from last Friday but the set up has not changed as, it appears the stock bottomed at support levels going back to 2019. There is mild resistance around $60 and more significant resistance around the $70 area.

I looked at Call Options and the premiums are pretty high. However if you go out to January 2025 that is about 1.5 years, the premiums should not erode much if you trade out in 6 to 9 months or sooner. I like the January 2025 $70 Call for about $7.00, it has the highest open interest of over 1,000 contracts. If there is shortages and high prices in grains, as I expect, NTR could easily get back to the $85 to $100 area.

Greenbriar - - - TSXV:GRB - - OTC:GEBRF - - - Recent Price - $0.87

Entry Price - $1.15 - - - - Opinion – strong buy under $1.05

The stock has hit lows not seen since the 2020 Covid panic and I believe it bottomed with a hammer candle stick on June 7th. I did an interview with CEO Jeff Ciachurski yesterday and he indicates the news that will kick off Sage Ranch construction could come as early as July. Like many, the stock is way over sold but it is also not well understood because you never see a large real estate development in a junior company, things like this are most common with Real Estate REITs.

Greenbriar Capital TSXV:GRB California Sage Range Update - YouTube

Talaris Therapeutics- - Nasdaq:TALS - - - Recent Price - $3.09

Entry Price - $2.20 - - - Opinion – hold for $1.53 cash dividend

Talaris announced a merger agreement last Thursday with Tourmaline Bio, a private company. Upon completion of the Merger, the combined company will operate under the name Tourmaline Bio, Inc. and trade on the Nasdaq under the ticker symbol “TRML.” In addition, Talaris anticipates making a cash dividend of up to approximately $64.8 million to its stockholders prior to the closing of the Merger. The company has 42.2 million shares outstanding so the cash dividend would be about US$1.53 per share.

In essence this takes Tourmaline public, but we don't know where the new merged company stock will trade at. However, the approx. $1.53 dividend covers most of our $2.20 entry price so we might as well hold and take Tourmaline shares.

The news release estimates a value of $3.43 and with the current price around $3.00 plus a $1.53 future dividend, the current valuation is about $4.53.

Under the terms of the merger agreement, Tourmaline stockholders (including Tourmaline stockholders issued shares in the private placement) will receive shares of Talaris common stock upon the consummation of the Merger. In addition to their shares of Talaris common stock, Talaris stockholders will participate in a cash dividend of up to approximately $64.8 million in connection with, and prior to, the Merger. This reads to me that the dividend will only go to current Talaris shareholders.

In support of the Merger, Tourmaline has entered into an agreement for a $75 million private placement with a syndicate of new and existing institutional life sciences investors including Acuta Capital Partners, Affinity Asset Advisors, Braidwell LP, Cowen Healthcare Investments, Deep Track Capital, Great Point Partners, LLC, KVP Capital, Logos Capital, Paradigm BioCapital, Qiming Venture Partners USA, RA Capital Management, LP, StemPoint Capital LP, TCGX, Vivo Capital, and other undisclosed investors. Tourmaline previously completed a $112 million Series A financing in 2023. It appears the new company should have good market support.

You can learn more on Tourmaline on their web site. Here is a bit of info.

Their IL-6 drug candidate treats Thyroid eye disease (TED), also known as Graves’ ophthalmopathy, is a debilitating autoimmune disorder that affects the eyes and surrounding tissues. It is commonly associated with Graves’ disease, an autoimmune disorder that affects the thyroid gland. The annual incidence of TED in the U.S. is estimated to be around 10 per 100,000 people, or approximately 30,000 new cases a year. Of interest is their IL_6 shows promise to treat the plaque buildup of myocarditis and we know this is on the rise thanks to the experimental shots.

New research in out of South Korea published by the European Heart Journal on June 2.

They have proven vaccine related myocarditis causing death in autopsies. All of the sudden cardiac deaths (SCD) occurred in people aged 45 or younger, including a 33-year-old man who died just one day after receiving a second dose of Moderna’s vaccine and a 30-year-old woman who died three days after receiving a first dose of Pfizer’s shot.

Myocarditis wasn’t suspected as a clinical diagnosis or cause of death before the autopsies, researchers said. Thirteen other deaths were recorded among those who experienced myocarditis after COVID-19 vaccination but no autopsy results were detailed.

“Vaccine-related myocarditis was the only possible cause of death,” Dr. Kye Hun Kim of the Chonnam National University Hospital and other South Korean researchers said. The evidence continues to amount so how much longer can it be ignored by the FDA. And the FDA has pulled approval of the JNJ shot for same heart attack issues.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.