In my May 12th update, I commented that I expect markets could make new highs but it will not be significant. Most of the rally is over for 2024. Yesterday was interesting and to me another signal the market is topping out. Market darling and leader, Nvidia spiked yesterday on heavy volume, climbing about 9% in one day. This could be a blow off top, but even so, I would not bet against it.

More troublesome is despite this big performance of the market leader, the market tanked. It was like General Nvidia made a charge and nobody followed, he was all alone!

To me this lone general is another signal that this market is topping out. Another factor to worry about is that retail is chasing Nvidia big time. It was top trending by far on all the usual places that retail traders hang out. That said, Nvidia is doing a 10 for 1 stock split and often stocks go up after splits. I might look at some option strategy because premiums are crazy.

What we got on the S&P 500 chart was a bearish engulfing candle stick. This occurs when a red or down candle stick engulfs the high and low of the previous days trading by a significant amount. The last time we saw this in early April, a significant correction followed. I am suspecting the same again.

The Gold Stealth Rally

There is very little participation in this gold rally so far. This is a good sign, because all big bull markets start this way. You need the buyers to come in at higher prices. The market is mostly clueless what is going on because it is different to what they have become use to.

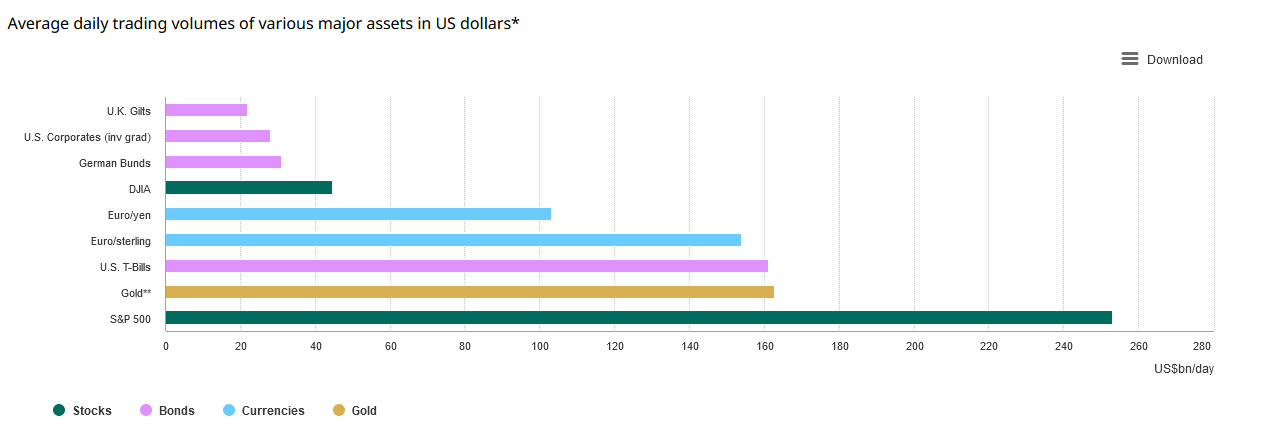

Basically gold is taking over the US$ as the world's reserve currency as Central Banks continue to load up on gold while selling US treasuries. Pre 2022, bonds have been out performing gold and were the #1 safe haven asset, but no longer.

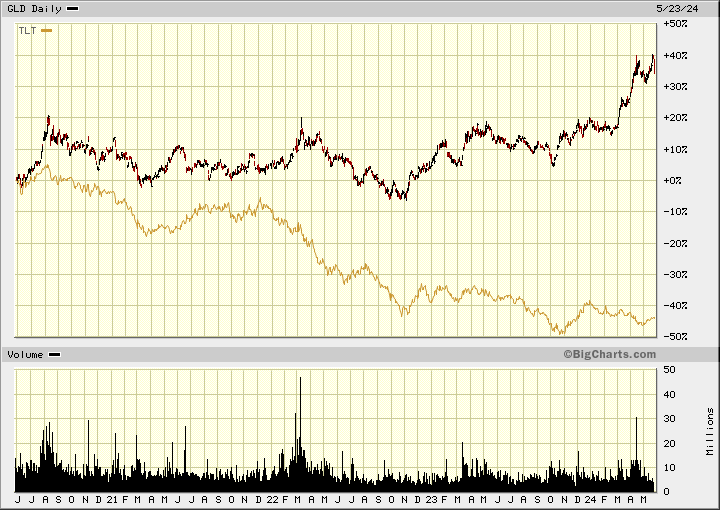

This next chart compares gold 'GLD' to the popular 20 year treasury etf 'TLT.' Since 2022, gold has been widening it's performance over US treasuries and bonds. The difference or margin between the two now is a whopping 80% or so. This will continue in our current environment of stagflation. Despite this massive better performance by gold, the majority of funds are still playing the bond market and the interest rate cut narrative. Sure there might be some cuts, but they will be modest and won't rally bonds all that much. If cuts are significant it will be because market and economic problems that will end up putting rocket fuel to gold's upward trajectory.

I have been following this graph, for months because I wanted to be certain it was not just a short term phenomenon. Gold now has higher daily liquidity than US Treasuries.

Next is a chart of Newmont Mining and Barrick Gold. I have Newmont on our Selection List and suggested Call options that are doing well, because these well known majors are usually the first to move and the big funds come into the gold market. They buy these big seniors because of more liquidity. As you can see Newmont is only up about half way to it's last highs. The chart on Barrick Gold is much the same. The majority of funds have not bought this gold rally so far.

The Newmont September $40 Call is now up 200% for us and I may suggest to sell on the next rally. With gold, my feeling is for some sideways trading between support and resistance. I am thinking the Central Banks will try to accumulate as much gold here as they can before pushing prices higher. A solid close above $2450 would be very bullish while a break below $2300 would probably mean a test of the $2200 area. Some consolidation is healthy before the next up move, the question is how much of it will we see.

******************************* UPDATES **********************************

Jackpot Digital - - - TSXV:JJ - - OTC:JOPTF - - - Recent Price - $0.05

May 8th, Jackpot has successfully completed the installation of one Jackpot Blitz casino machine at Lucky Dog Casino located in Skokomish, Wash. With the completion of the Lucky Dog installation, the company now has 73 Jackpot Blitz tables in the field. The company's order book continues to grow and is currently more than 90 additional Jackpot Blitz tables, an increase of approximately 123 per cent over the current installation base.

Jackpot will exhibit its dealerless Jackpot Blitz® electronic poker table at the 2024 World Series of Poker® ("WSOP"). The WSOP begins May 28 and continues to July 17, 2024, and will be held at Paris Las Vegas Hotel & Casino, as well as Horseshoe Las Vegas.

Jackpot Blitz® will be on display at Paris Las Vegas at the entrance to the main tournament hall next to the WSOP sign. This is going to major exposure for the company. Its amazing the stock still remains so cheap. Jackpot is the leader gambling AI.

GSP Resources - - - - TSXV:GSPR - - - - - Recent Price -$0.11

New modelling has, for the first time, enabled 3-D visualization of the shear vein system that hosts high-grade copper at Alwin mine project and represents a significant leap in the company's ability to drive expansion and discover new zones of high-grade copper mineralization.

The Apex Geoscience Ltd. resource modelling team has made significant progress in the geologic model development for the Alwin project. To date, Apex has georeferenced, in 3-D space, a total of 70 historic underground level plans and cross-sections and digitally captured these data comprising detailed underground mapping completed during mining operations between 1968 and 1979. The modelling program has yielded over 18,000 mineralized polygons, 1,200 fault traces, and 300 structural strike and dip measurements.

This is a significant leap for GSPR's ability to develop high-conviction drill targets with meaningful potential to drive expansion and discover new zones of high-grade copper mineralization.

This work will build on the recent drilling campaign executed by GSP in late 2023, which returned significant high-grade mineralization, including drill hole AM23-01 intersected 2.42 per cent copper, 47 grams per tonne silver and 0.57 gram per tonne gold over 12.8 metres (3.14 per cent copper equivalent), including 5.7 metres averaging 5.21 per cent copper, 103 grams per tonne silver and 1.22 grams per tonne gold (6.77 per cent copper equivalent)

A very cheap junior copper stock that had great drill results but released in a crappy market.

Aztec Mining - - - - - TSXV:AZT - - - - - - Recent Price - $0.18

Aztec has also done 3-D modelling of gold-silver mineralized features that supports a high-confidence interpretation for continuity of shallow, oxidized gold-silver exploration and drilling targets, below, alongside and to the west of the Contention open pit at the Tombstone project in SE Arizona. The continuing review and modelling of extensive historic and current data, combined with continuing fieldwork at the Tombstone project has provided the key elements to building the first 3-D model of the historic Tombstone silver district, incorporating: underground workings, mined stopes, geology, multielement geochemistry, SWIR (short-wave infrared) alterations and geophysics. This will be a big help in this years drill program, and to propel the stock up from cheap levels.

Greenbriar - - - - - TSXV:GRB - - - - - Recent Price - $0.80

Greenbriar put an update out on their solar project. Greenbriar/PBJL has worked diligently with PREPA over the past few months to finalize a revised PPOA (Power Purchase Agreement) as per the settlement reached between the parties and submitted to the Puerto Rico Energy Bureau (PREB) on Oct. 3, 2023.

The revised PPOA will be based on the 2020 PPOA as approved by both PREPA and PREB back then, but with the necessary amendments to make it financeable in the new market realities of 2024.

This work is happening now. Thus, PREPA has not submitted the revised PPOA to PREB for its final approval. In a process that mirrors the one from 2020, only after PREPA board and PREB approval are secured for the final PPOA, will the revised PPOA be submitted to the FOMB for its consideration.

Government bureaucracy always moves slow, but it will happen. I expect we will see construction start on Sage Ranch before this Montavla solar project. Again buy now on the cheap before the positive news comes out.

Midnight Sun - - - - - TSXV:MMA - - - - - - Recent Price - $0.36

Entry Price - $0.27 - - - - - Opinion – strong buy on this breakout

Huge news and breakout for Midnight Sun. There was such strong demand for the financing they increased it from $3.3 million to $10 million and closed that on May 23rd, then the stock popped on strong buying. Hopefully you bought on my April 24th update. I would buy this break out with mu near term target around $0.50.

Zonte Metals - - - - - - TSXV:ZON - - - - - - Recent Price - $0.09

Entry Price - $0.09 - - - - - - - Opinion – strong buy to $0.11

On May 17th, Zonte closed a $405,000 financing and I expect the next drill program will start soon.

There has been a seller in the market and I expect it is a fund that did a financing one to two years back. Once this seller is gone, I expect the stock to quickly move up to the $0.13 area than much higher on either better markets, drill speculation and/or drill results.

All these copper juniors are going to pop higher like Midnight Sun, just a matter of what the timing will be with each of them.

#nvda #gold #copper

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.