It has been very brutal markets in our sectors since May, but I am happy to report good news with energy, two stocks going to new highs, Argonaut and Earthstone along with Inomin's drill hit.

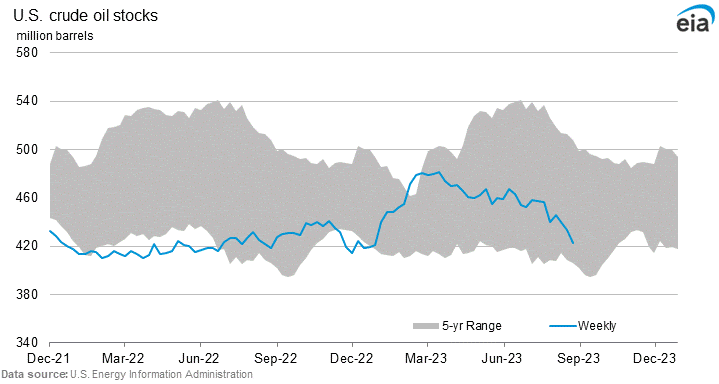

The oil market is doing much better as inventories have been falling in the U.S. (chart below) and Russia and the Saudis extend cuts. The consensus was OPEC would lengthen their cuts into October, but the three-month extension to December was a bit of a surprise. The latest cuts by the Saudis (1M barrels per day) and Russians (300K bpd) are on top of the April cut agreed by several OPEC+ producers (1.66M bpd) - which extends to the end of 2024.

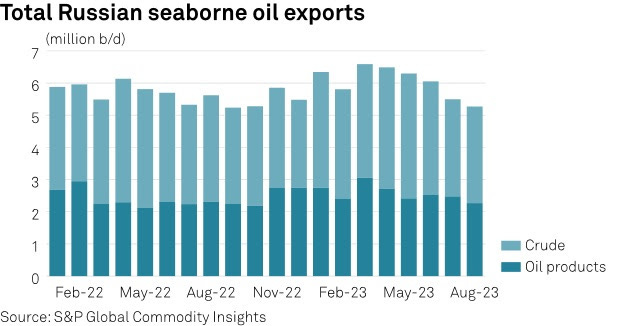

It is easy to see in this next chart that sanctions had little or no effect on Russia oil exports. However with cuts and strong domestic demand in the summer that kept volumes available for external markets capped. Russian seaborne crude and product exports fell to their lowest since September 2022.

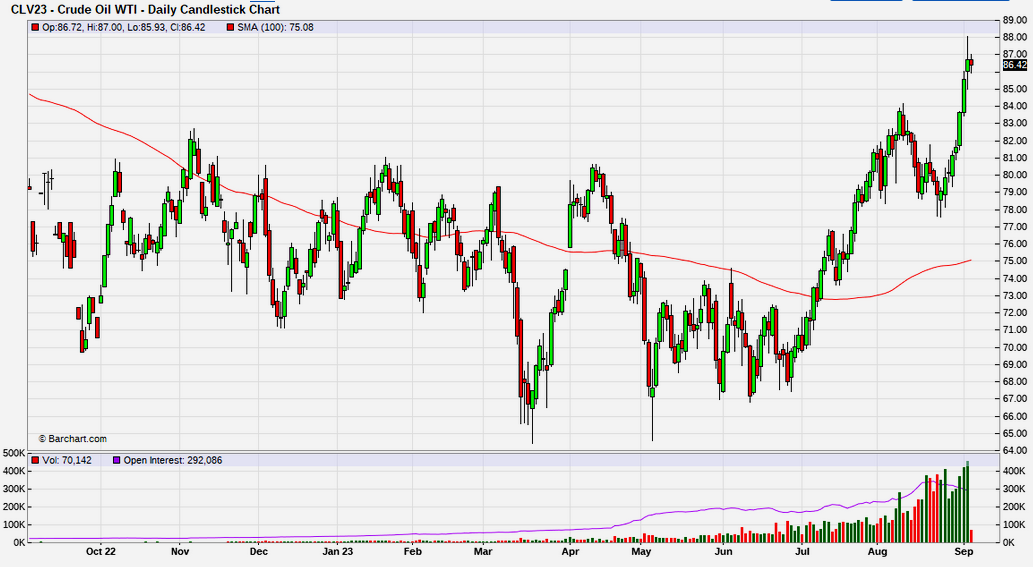

I pointed out a number of times that oil bottomed around $68 and we now have our 1st and 2nd bullish move in over a year. The rally up from the $68 level to the $84 level in August is about +25% so we have a new bull market. The number of US oil rigs operating has continued to fall and the big oil producers, Saudi Arabia and United Arab Emirates have joined BRICs, that is bullish and a clear signal where they will align their interests. I wanted to see oil stay above $80 and support did hold in the $79 to $80 area and this week we see a break to new highs. I expect this move could send oil to the $94/95 area. Can you say hello to inflation again!

Near term, a threat of a hurricane in the gulf producing area could spike prices, that last one was a miss that hit Florida. Natural Gas prices are still weak but it looks like a June bottom is in. Gas prices generally rise in the September to January time frame, ahead of and during the winter season. Last year we had an unusual warm winter in Europe and North America. Who knows what this year brings, but the odds say it won't be as warm as last winter. Hurricanes and cold weather is all up to Mother Nature and nobody can predict with much accuracy.

I have been predicting a return of higher inflation with an end of the favourable YoY comparison of energy prices. This is really going to confuse markets and cause some turmoil. The U.S. national average price of a gallon of regular gasoline now stands at US$3.811 a gallon, according to data from AAA, marking the highest seasonal level since 2012.

On top of that, low diesel inventories are stoking shortage fears. Low US distillate inventories could result in heating oil prices witnessing price shocks this winter. The stocks of diesel and heating oil, according to Reuters remain 15% below five-year average rates, at 118 million barrels or 31 days of supply.

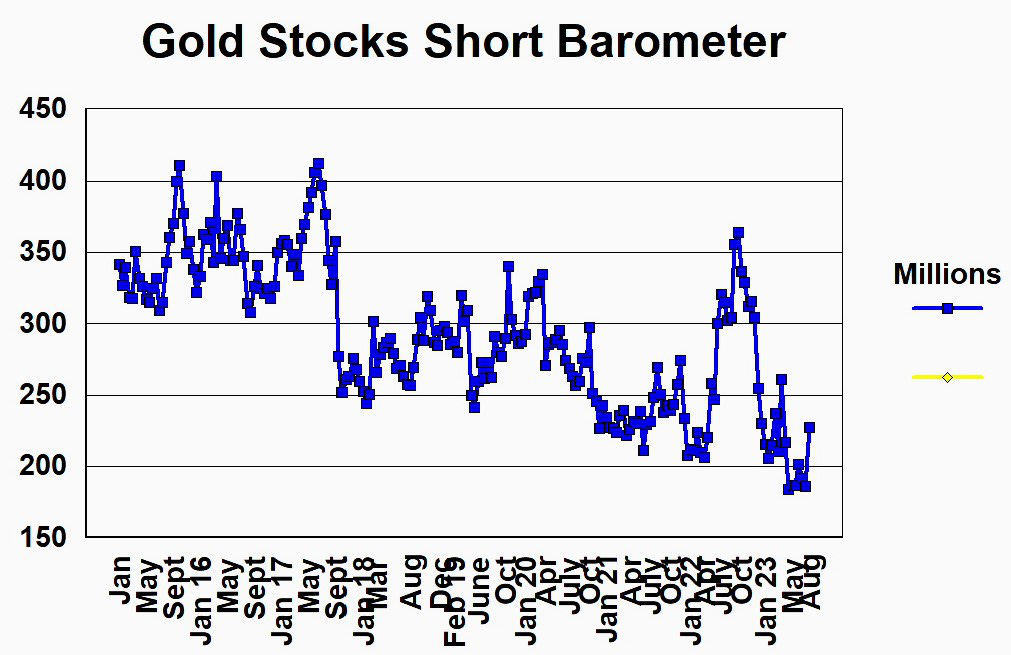

We have a decent rally in gold off what I belief is an August bottom ending a 4 month correction. I went into more detail in my August 17 Bear Trap newsletter and my August 26th newsletter. If you did not read these you can use these links. Gold often does well in this environment. Another encouraging sign is that the shorts on the gold stocks went to the lowest level ever (since I have been tracking in 2015), this summer. This might be a signal that smart money and hedge funds see a gold stock rally coming?

Argonaut Gold - - - - TSX:AR - - - - -OTC:ARNGF - - - - Recent Price $0.68

Entry Price - $0.39 - - - - - - - - - Opinion – buy

There was a bump up in the August 15th short reports and this was mostly Argonaut gold (ARNGF) with 26 million shorts piling on the US side. The stock has rallied from C$0.58 August 15 to C$0.72 last week. Maybe this was short covering. Volume has not been any higher, perhaps the short position was a reporting error? Does not make much sense for a sudden jump in short positions, I highly anticipate the August 31 short report.

In my opinion, Argonaut is the last gold stock you would want to short, it has been one on the best performers in August and made new highs. The stock did not make a clear break out and has pulled back a little from last weeks high, but a break out is coming. This chart is of last week.

They reported Q2 results on August 11, and it only included 3,295 ounces form the Magino mine which is projected to come into commercial production in the current 3rd quarter.

Revenues of $83.1-million was 25 per cent lower than $111.4-million from the second quarter of 2022, due to lower planned production from the company's three Mexican mines, partially offset by higher production from Florida Canyon, and includes $100,000 of initial ounces sold from the Magino mine. Gross profit of $15.5-million was $4.3-million lower than $19.8-million from the second quarter of 2022, due to lower revenues from planned lower production.

Recall that Argonaut sold some producing assets to raise cash for Magino construction. The stock got punished badly because the market was hammering gold stocks that were growing because of rising construction costs. This is all water under the bridge now and we shareholders should reap huge rewards going forward.

Here are the CEO comments in the Q2 report – my bolding “Argonaut delivered solid financial and operational results for the quarter, generating strong cash flows to help fund the completion of our newest mine, Magino. During the quarter, the Magino mill began ramping up, putting the mine on track for commercial production in the third quarter. We believe Magino could be one of the largest and lowest-cost gold mines in Canada. To that end, during the third quarter, while commissioning the Magino mill, we are commencing a reserve development drilling program intended to increase reserves in combination with engineering studies to increase mill throughput. " stated Richard Young, president and chief executive officer of Argonaut Gold.

Now to the other top performer in energy

Earthstone - - - - - NY:ESTE - - - - - - - Recent Price - $21.06

Entry Price - $13.34 - - - - - - - - Opinion – hold, take PR shares

The stock has been moving up since the buyout by Permian Resources Corp. (NYSE: PR) and better oil prices. The companies entered into a definitive agreement under which Permian Resources will acquire Earthstone in an all-stock transaction valued at approximately $4.5 billion, inclusive of Earthstone’s net debt. Under the terms of the transaction, each share of Earthstone common stock will be exchanged for a fixed ratio of 1.446 shares of Permian Resources common stock. The transaction strengthens Permian Resources’ position as a leading Delaware Basin independent E&P with over 400,000 Permian net acres, pro forma production of approximately 300,000 Boe/d and an enhanced free cash flow profile to increase returns to shareholders.

I believe we should take the Permian Resources stock. Both companies were under valued like most in the sector, and Earthstone more so. However, a bigger under valued company should still give us lots of upside.

And saving the bad news last. It is still early days in a more bullish energy market and gold has not proven yet that is has bottomed out from it's May correction. A lot of our gold and energy stocks are still depressed, but improving. However, I think a lot of upside is on the way.

The juniors are always a big laggard and they get hit worse in the bad market we have witnessed since May. The dog days of August often prove to be bottoms if there is a correction or bear market underway. The juniors as measured by the TSX Venture market are down over -40% from the 2021, 1,000 high. They have been going sideways since last September with another down move in August. The most telling thing on the chart is that volume since May has dropped to further historic lows, under 20 million shares most days. Very low volumes are strong signs of a bottom.

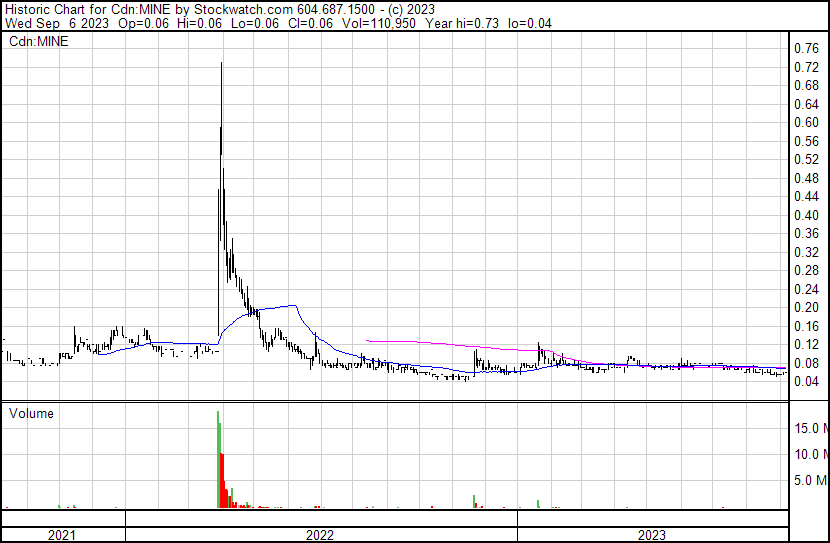

Inomin Mines - - - - - - TSXV:MINE - - - - - - - - Recent Price - $0.055

Entry Price - $0.08 =- - - - - - - - - - - Opinion – buy up to $0.10

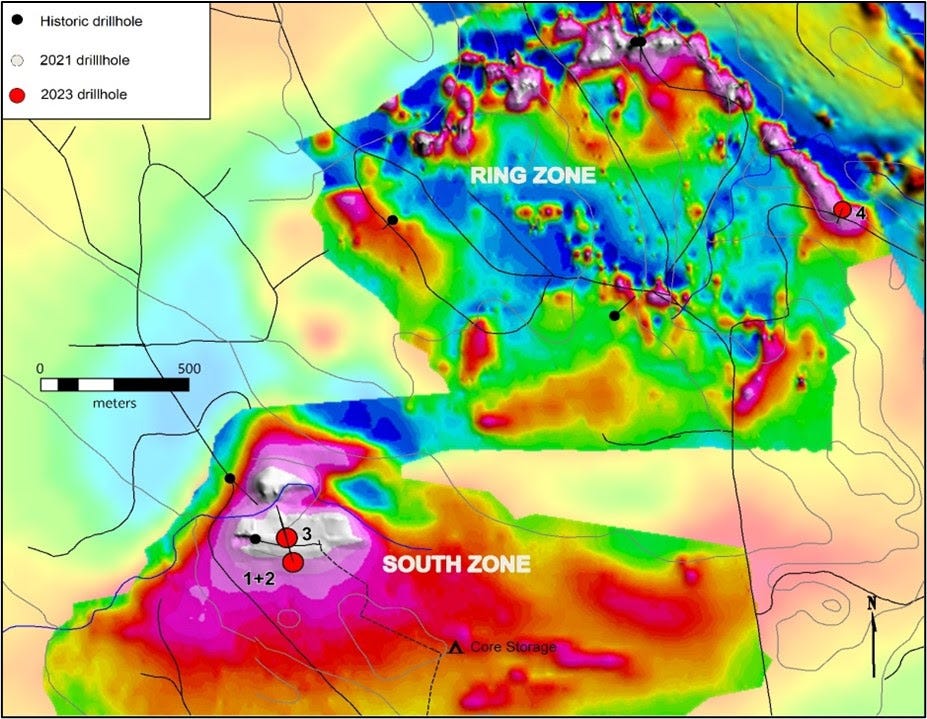

Today, MINE released some great drill results of a new discovery in a new zone, called the South Zone of the Beaver-Lynx critical minerals project. Drilling intersected high-grade magnesium plus nickel and chromium over long intersections. Drill-holes B23-01 and B23-02 were drilled in a fan pattern.

Drilling hit 23% magnesium with 0.19% nickel over 169.2 metres in B23-01,

And 21% magnesium with 0.17% nickel over 146.6 metres in B23-02.

Holes B23-01 and B23-02 are the first-ever holes drilled by the Company in the South Zone.

The South Zone is a 500 x 500 metre strongly magnetic zone as defined by ground magnetics. Drilling confirmed mineralization occurs in two parallel shallow dipping serpentinized bodies with an estimated true thickness of 160 metres. The mineralization appears to be increasing in thickness toward the north.

From the news release, “Our initial drilling in the South Zone has generated additional outstanding results at Beaver,” says Inomin President, John Gomez. “South Zone drilling was designed to test a prominent mag target located 2 – 4 kilometres south of the Spur and North Zones where our maiden discovery hit long intervals of mineralization. To date, five high magnetic zones hosting significant mineralization have been identified at Beaver. Remarkably, high-grade magnesium, sulphide nickel and other metals, including gold, have also been discovered in moderately magnetic areas, specifically the North Bear Creek Zone. Beaver’s exceptional drill results demonstrate the property’s excellent potential for multiple, bulk-tonnage, critical mineral deposits. We look forward to reporting analytical results for the balance of the summer drilling program as results become available.”

The stock soared to $0.70 last March on similar grade magnesium hits, but I doubt we will see that kind of move with a junior bear market the worse in over 20 years. That said, juniors with discoveries can buck the trend. I don't know how it will trade on this news and there are still more drill results to come. Regardless any stock you can buy under $0.10 is cheap.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.