Along with markets, oil and base metals have corrected on the recession fears. However, they all have their own dynamics. Lets start with oil. Since coming off the 2022 highs around $120, it has been range bound the last 2 years, mostly between $70 and $90.

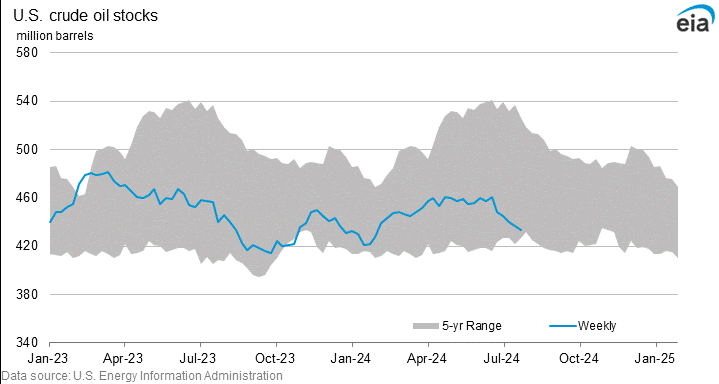

Slowing China demand and recession fears way on the negative side while US falling inventories and potential Middle East escalation way on the bullish side. It has been a tug of war. The EIA just released inventories and hour or so ago and they are getting lower than shown below in last weeks chart, dropping another 3.73 million bbl. EIA crude inventories fell more than expected to a 6-month low.

Aug 7 (Reuters) - China's daily crude oil imports in July fell to their lowest since September 2022, Reuters records of customs data show, as weak processing margins and low fuel demand curbed operations at state-run and independent refineries. Imports fell nearly 12% from the previous month and were 3% below the year-ago amount, according to Reuters' records of customs figures.

So far recession fears in the US are just that as demand is still growing, but China has definitely slowed imports. How long can US demand last is a good question?

Consumer spending remains strong as a mountain of credit card debt piles up. According to the Federal Reserve Bank of New York, credit card debt reached $1.14T in Q2, up 5.8% from a year earlier, or about $6,500 per person. It has soared since 2022 as many consumers swipe away to counter their dwindling purchasing power from the high inflation rate. I doubt this debt increase can continue another year.

For the bullish case, I believe a Middle East escalation is soon in the cards. US inventory levels could recover but we are still in the hurricane season. Vortexa reported Monday that crude oil stored on tankers that have been stationary for at least seven days fell by -31% w/w to 56.66 million bbl in the week ended August 2, the lowest in more than four years. And the other bullish factor is the chart, or price action. The market has bounced off a possible double bottom with a bullish engulfing green candle stick (now more engulfing with the EIA news). In the middle of the trading range, the $78 area acts as resistance and support. I expect a bounce back to there in the short term.

Most of our oil&gas stocks have been strong but correcting the last few days and doing better today.

Bitcoin and Gold

I often hear comparisons of Bitcoin to Gold. As I said before there is no comparison, they are completely different other than the only comparison is they are both unique financial instruments. Bitcoin investors like to think it is a safe haven asset and can be a store of wealth long term. The reality is Bitcoin has only been around a short while and unproven as safe or a store of wealth. The recent market swoon proves it is basically a speculative bubble.

S&P dropped about -6% Friday to Monday lows and the Nasdaq over -8%

Gold served it's usual role as a safe haven, closing at a new high last Friday but falling from about $2500 Friday to a low of around $2400 Monday, but closing at $2444. The drop to the low was far less than markets at around -4%. The gold market is very liquid and with market plunges like this, many investors sell their gold and gold stocks to make margin calls and/or offset losses and raise liquidity.

However, Bitcoin was a disaster. It fell Friday Aug 2nd from around 64k to about 50k on Monday Aug 5th almost down -22%.

Perhaps Bitcoin compares somewhat to the first speculation in Gold in the 1970s. Gold ran from about $120B valuation to worth around $3.6 trillion in 1980 up 3,000%. The crypto market went up from about $36 billion in 2017 to a bit over $2 trillion similar as Bitcoin $2,000 to $70,000, up 3,400%.

Copper (has the PhD in economics)

The copper price has been hit pretty hard in July but is now down around the $4 support area. Most of the down side action is over, but we could go a bit lower before a bounce back up. Capstone Copper has corrected, we got stopped out while our junior copper explorers are mixed.

Capstone Copper - - - - TSX:CS - - - - - Recent Price – C$8.10

Entry Price - $5.90 - - - - - - Opinion – stopped out at $8.90

The company is doing well with Q2 results out last week. Consolidated H1 2024 copper production of 83,058 tonnes achieved guidance of 80,000 to 90,000 tonnes. Consolidated copper production for Q2 2024 was 40,937 tonnes at C1 cash costs of $2.84/lb, which consisted of 15,994 tonnes at Pinto Valley, 10,070 tonnes at Mantos Blancos, 8,721 tonnes at Mantoverde, and 6,152 tonnes at Cozamin.

Net income attributable to shareholders of $29.3 million, or $0.04 per share for Q2 2024 compared to net loss attributable to shareholders of $36.5 million, or $(0.05) per share for Q2 2023, primarily due to the higher realized copper price of $4.54/lb compared to $3.76/lb (prior to unrealized provisional pricing adjustments) and the inclusion of a $53.9 million provision related to the Minto obligation in Q2 2023.

However we got stopped out in late July with a good gain. I will watch a level to buy back in. Since a lot of new subscribers, here is how I use a stop/loss. If market maker see a lot of stop loss orders at a particular price, often they will move the stock to trigger these orders. I prefer a mental stop/loss. If the stock closes below our stop loss, I see the next day if the stock rebounds above the stop in morning trading, if not we sell.

Zonte Metals - - - - - TSXV:ZON - - - - - - Recent Price - $0.085

Entry Price - $0.09 - - - - - - - - Opinion – buy

Zonte has finished drilling at the K6 target on Cross Hills with 5 holes and finishing up the core logging and will send to the lab. Probably late September, early October for results, so this gives us time to buy ahead of those results.

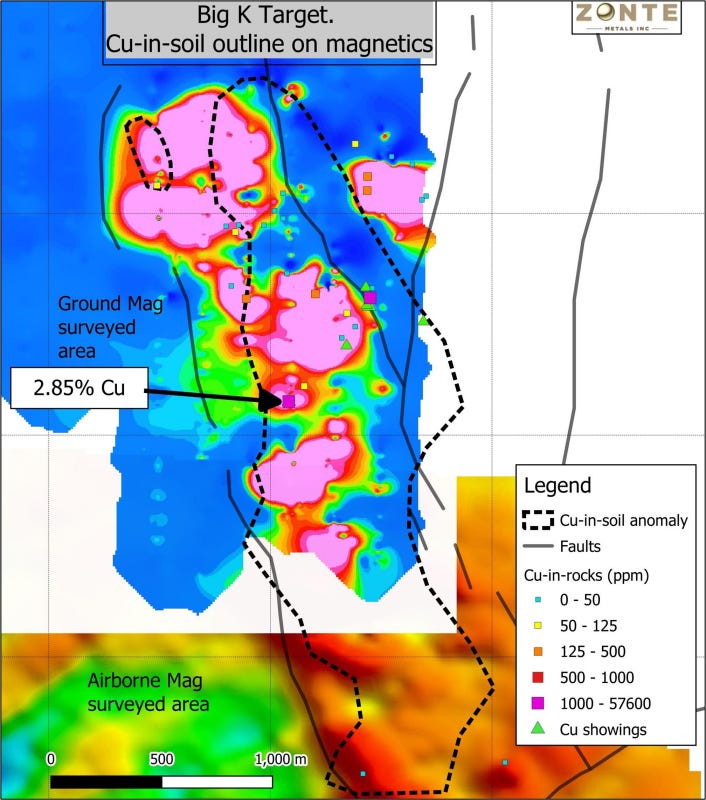

More important in the news is ZON completed more soil sampling adjacent to and south of the previously discovered Big K target and has extended the copper-in-soil anomaly to over 3km. The Big K target was previously identified from coincident magnetic and gravity anomalies, with bedrock copper mineralization and a copper-in-soil anomaly, sitting in a structural corridor. The additional soil sampling to the south of the Big K target has identified an extension of the original copper-in-soil anomaly, now measuring 3,300m in length and up to 650m in width. This extended length also coincides with a magnetic anomaly. Further exploration, including a gravity survey, prospecting and mapping, will be required for this new extension.

Previously, the Company identified copper mineralization in several locations on the northern half of the Big K target. In one grab sample, chalcocite veining in a granite capping unit returned 2.82% Cu, 10.0 g/t Ag and 0.17% U3O8 (see April 3, 2018 press release). The nature of the mineralization may suggest fluid remobilization from depth and into the overlying granite. A map of the Big K target and a picture of the chalcocite vein can be viewed below and on the Cross Hills webpage.

Midnight Sun - - - - - TSXV:MMA - - - - - - Recent Price - $0.48

Entry Price - $0.27 - - - - - Opinion – hold, buy below $0.40

MMA has been our best performing copper stock of late but got hit in the last couple days with the market sell off. On the chart, there is support around $0.40 and I would be a buyer on any dip below that. It is still in the up trend channel (blue lines) so maybe the correction is done.

Giant Mining - - - - - - CSE:BFG - - - - - - Recent Price $0.60

Entry Price - $0.80 - - - - - - - Opinion - buy

Today, BFG announced they completed hole MHB-30 to a depth of 800 feet (244 metres). MHB-30 is the first hole of the diamond core drilling program planned for the Majuba Hill porphyry copper deposit in Pershing county, Nevada.

A downhole survey confirmed that MHB-30 maintained the planned 230-degree azimuth and minus-70-degree inclination. BFG has commenced drilling hole MHB-31. The core was transported to Woods Process Services LLC for sawing and processing before being sent to ALS Global Services in Elko, Nev., for comprehensive laboratory analysis.

David Greenway, CEO, commented: "We are excited to announce the completion of hole MHB-30, the first in our 2024 core drilling program at Majuba Hill. This achievement marks a significant milestone in our exploration efforts. The data obtained from this drilling will be crucial in improving our understanding of the deposit's potential and shaping our future exploration strategies."

Like Zonte, BFG results will probably be around late September so give us some time to buy ahead of this.

Yesterday, I had the wrong chart of the S&P 500, it was from last Friday. I wanted to highlight the importance of the 5,000 area and the level of a bear market.

Paid Advertisers at playstocks

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.