I have been undecided with oil prices and the oil&gas stocks for sometime. It does not happen often, but I have been uncertain about the short and medium term direction. I believe I have come to terms with it and I am bullish, so will update some of our oil&gas stocks below.

I have been undecided if price weakness is government intervention or recession fears, perhaps both. As far as intervention, it is close to the election so if this is the case it will end soon anyway.

I believe Trump will win the election, although it is a very close race. The polls show Trump or Harris with 1 to 2 point leads in 3 each of 6 swing states. But remember, in the past two elections, polls showed Trump way behind and he did much better. Most polls are designed to favour Democrats.

If Trump wins it will be a big boost for oil&gas stocks, you know his infamous phrase 'drill baby drill'. If he loses, I think all the negativity is already priced in and the oil&gas stocks would not drop any further.

Perhaps the key will be swing voters. NY Times released news on a poll today and keep in mind they are heavily Democrat bias. I read both sides. NY Times did a poll of three swing states — Arizona, Georgia and North Carolina, asking undecided voters, their biggest concern with Trump and Harris.

Trump was easy, concentrated on one thing 35% did not like his personality, next was 8% for honesty. With Harris, it was more wide spread with 17% personality, 15% ideology, 13% economy and 10% each for honesty and lack of experience. The way I read this, undecided voters just don't like Trump's personality but have numerous issues with Harris. To me that seems to favour Trump. We could assume that the 17% that don't like the personality of Harris probably don't like Trump either. Given Harris's numerous other issues, they will probably lean towards Trump. Just my guess and anything could happen. Trump's biggest challenge could be staying alive until the election and being sworn in, if he wins.

While Biden enjoyed a commanding 33-point advantage over Trump among Hispanic voters in 2020, Harris's lead has dwindled to just 17 points, according to an ABC News/Ipsos poll. This represents a dramatic 16-point drop in Democratic support among this crucial demographic..

With 36.2 million Hispanics eligible to vote in 2024, up from 32.3 million in 2020, this growing electorate poses a serious problem for Harris.

I expect Democrats to do a lot of ballot harvesting and will be a big factor with mail in ballots. We all know all the problems with mail in ballots. For sure there is a lot of uncertainty about the election and with huge legal teams on both sides. It could be weeks before results are settled. I don't think markets are going to like this and another reason I am bearish on general equities.

On the fundamentals, they favour oil. US oil inventories are at multi year lows and seem to keep dropping. I see nothing in the media and analysts about the huge appetite war machines have for oil. And the war machines seem to be going into higher gear. It sounds like Israel is preparing for an invasion of Lebanon and I believe it is only a matter of time before the middle east is an official regional war.

What would the US do then? An Arab oil embargo on the US is still not out of the question.

Things are going poorly for Ukraine. "Russian forces have begun storming the eastern Ukrainian town of Vuhledar, a stronghold that has resisted Russian attack since the beginning of the 2022 war, according to Russian war bloggers and state media," Reuters writes. Meanwhile Zelensky is in the U.S pleading for help. He has been attacking Trump and JD Vance in American media. Perhaps this is part of appeasing the Biden administration for more support?

Whatever oil prices do, the stocks are very cheap.

Permian Resources - - NYSE: PR - - Recent Price $13.75

Entry Price - $9.23 - - - - - Opinion - buy

PR announced a strong second quarter 2024 financial and operational results in mid August. And revised 2024 guidance.

Recent Financial and Operational Highlights

Reported crude oil and total average production of 152.9 MBbls/d and 338.8 MBoe/d during the quarter

Decreased controllable cash costs by 8% quarter-over-quarter to $7.45 per Boe, driven primarily by lower LOE

Reduced second quarter D&C costs per foot by ~13% compared to 2023, driven by operational efficiencies

Announced cash capital expenditures of $516 million and adjusted free cash flow1 of $332 million ($0.43 per adjusted basic share)

Reported total return of capital of $193 million, or $0.25 per share, including $0.06 per share base dividend, $0.15 per share variable dividend and $30 million in share repurchases

Continued to drive shareholder value through accretive acquisitions:

Closed previously announced Eddy County bolt-on

Announced $817.5 million acquisition from Occidental, adding ~29,500 net acres and ~15,000 Boe/d directly offset existing operations

Increased mid-point of full year standalone oil and total production guidance by ~1.5% to 152 MBbls/d and 325 MBoe/d, driven primarily by continued strong operational performance

For the second quarter, Permian Resources generated net cash provided by operating activities of $938 million, adjusted operating cash flow1 of $849 million ($1.10 per adjusted basic share).

Permian increased its 2024 standalone oil and total production targets by approximately 1.5% to 151-153 MBbls/d and 320-330 MBoe/d, respectively, based on the mid-point of guidance.

There base dividend is $0.06 per quarter and they added a $0.15 variable dividend for the quarter for at $0.21 total. On September 3rd they announced increasing their base dividend fro $0.06 to $0.15 which is $0.60 on an annual basis. This equates to a 4.4% yield and that could be higher with the variable dividend component.

Marketwatch reports the stock at 1.16 times book value and trading at a mere 2.39 times cash flow.

The chart looks good, bouncing off the strong support level twice. We need to see a close above $15 to break the down trend channel, for a higher high and a new up leg.

Call options are pretty cheap. We can go out to April 2026 and buy the $14 Calls for about $1.40. I will add these to the Selection List.

APA Corporation, NY:APA - - - - Recent Price - $22.86

Entry Price $30.92 - - - - - - Opinion - buy

We own this stock when they acquired Callon Petroleum on our list.

July 31, APA reported net income attributable to common stock of $541 million, or $1.46 per diluted share. When adjusted for items that impact the comparability of results, APA’s second-quarter earnings were $434 million, or $1.17 per diluted share. Net cash provided by operating activities was $877 million, and adjusted EBITDAX was $1.6 billion.

Marketwatch shows the stock at 4.1 times book value and 3.5 times cash flow. The stock also has a nice dividend yield of 4.2%.

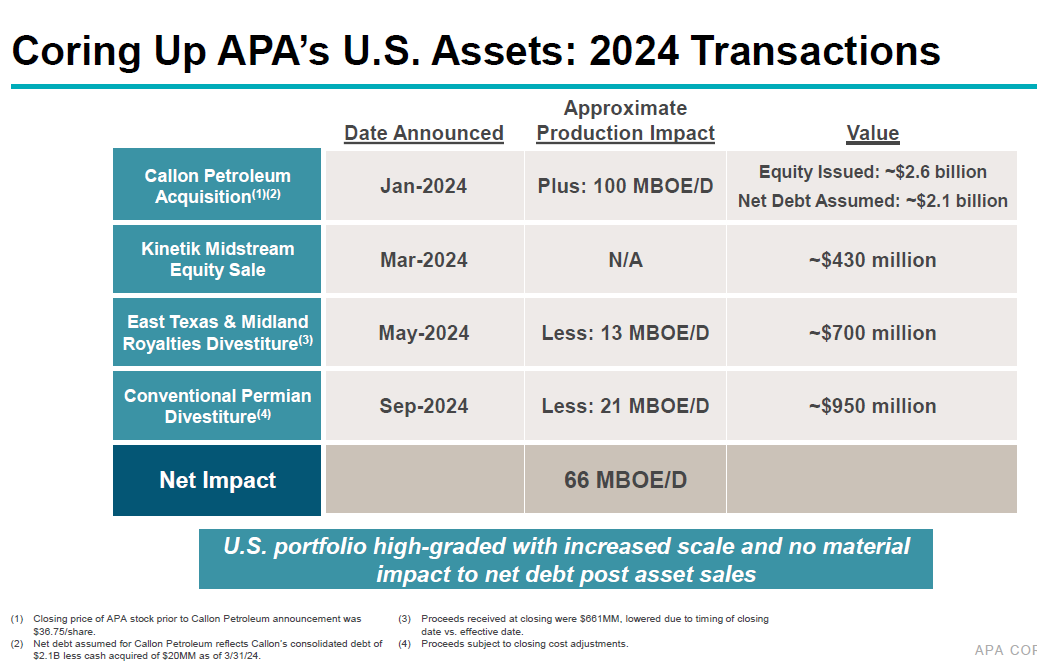

APA has significantly high-graded its U.S. portfolio in 2024 with >$2.0 billion of non-core asset sales. Recently-announced $950 million sale of conventional Permian assets is a transformative step. I am going to highlight two slides from one of their presentations. The first one summarizes their 2024 transactions and impacts.

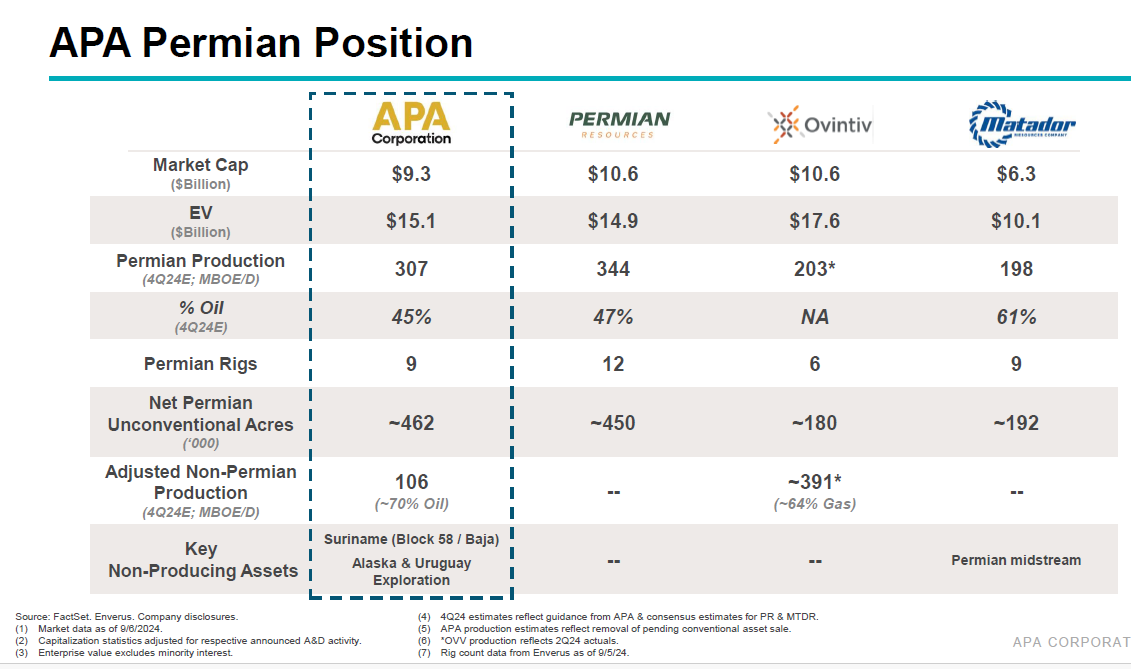

I am showing this next slide because it compares to our other oil stock Permian. The two are quite similar so I will probably sell APA when it recovers.

Right now buyers of the stock can collect a nice 4.2% yield while waiting for the stock to recover. There recent transactions to sort of high grade their assets should mean a safe dividend and perhaps and increase.

The stock has not been this cheap since December 2022 and has given back all it's gains. I show a 2 year chart here. The stock is putting in a double bottom around $23.80. It did drop to $23 one day earlier in the month but bounced back up and closed at $23.60, so today is close enough for a double bottom.

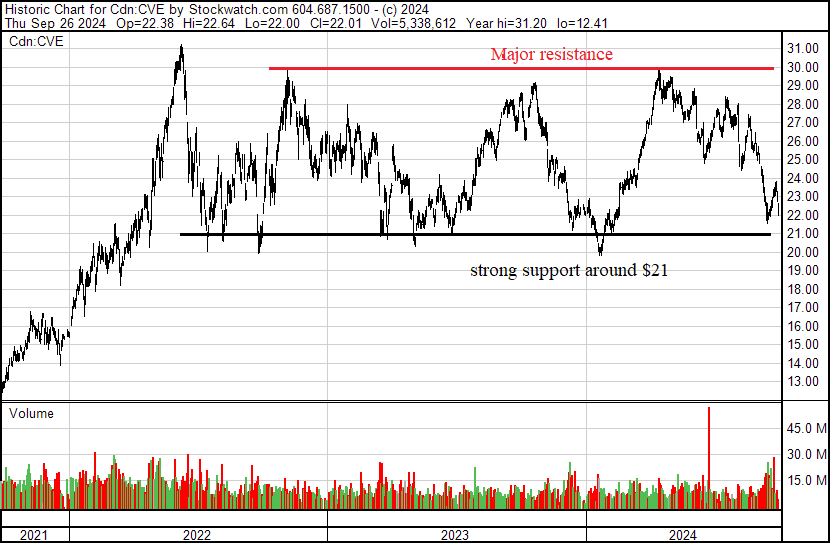

Cenovus Energy - - TSX/NY: CVE - - - Recent Price – C$22.05

Entry Price - $23.53 - - - - - Opinion - buy

Cenovus is on my Millennium Index

Aug 1st, CVE reported strong operational performance across its portfolio in the second quarter of 2024, with solid production from its upstream assets and improved crude throughput at the company’s U.S. refineries, which operated at an overall utilization rate of 93%. Net debt was $4.26 billion at June 30, 2024, and in July the company achieved its net debt target of $4.0 billion. As a result, beginning in the third quarter, Cenovus will begin returning 100% of excess free funds flow (EFFF) to shareholders, as per the company’s shareholder returns framework.

“With the achievement of this significant financial milestone, we are now in a position to substantially increase our shareholder returns,” said Jon McKenzie, Cenovus President & Chief Executive Officer. “We will continue our focus on safely delivering profitable and predictable operations, while progressing our growth projects to further improve the resiliency of the company.”

Recent highlights

Achieved net debt target of $4.0 billion in July, immediately shifting to returning 100% excess free funds flow to shareholders.

As a result of strong first half performance, increased the midpoint of Upstream production guidance to 797,500 barrels of oil equivalent per day (BOE/d)1 and the midpoint of Downstream throughput guidance to 655,000 barrels per day (bbls/d). Capital investment range is unchanged.

The Narrows Lake tie-back pipeline to Christina Lake is expected to achieve mechanical completion by the end of the year, and remains on schedule to deliver first oil mid-2025.

At Sunrise, the company began steaming two well pads which will be brought on production in the third and fourth quarters of this year.

Achieved significant milestones on the West White Rose project as the concrete gravity structure reached its final height and topsides were structurally completed.

Safely completed the largest turnaround in the Lloydminster Upgrader’s history, with the facility now returned to full operations.

Currently the stock is yielding about 3.3% and this does not include variable dividends. Now that they achieved their debt reduction goal, the dividends should increase. Marketwatch reports the stock at 1.47 book value and 5.7 times cash flow. Given expected increase in shareholder returns and the price on the stock chart, it is a good buy here.

The stock has been range bound for 2 1/2 years and a good buy at the bottom the range. If the stock cannot crack $30 on the next attempt, I will probably suggest a sell.

Today's economic news was basically flat and boring

The National Association of Realtors (NAR) said on Thursday its Pending Home Sales Index, based on signed contracts, rose 0.6% last month to 70.6 from July's 70.2, which was the lowest reading since the series started in 2001. Economists polled by Reuters had forecast contracts, which become sales after a month or two, would rise 1.0%.

Applications for US unemployment benefits fell to a four-month low, remaining muted despite a recent slowdown in hiring.

Initial claims decreased by 4,000 to 218,000 in the week ended Sept. 21, according to Labor Department data released Thursday. The median forecast in a Bloomberg survey of economists called for 223,000 applications.

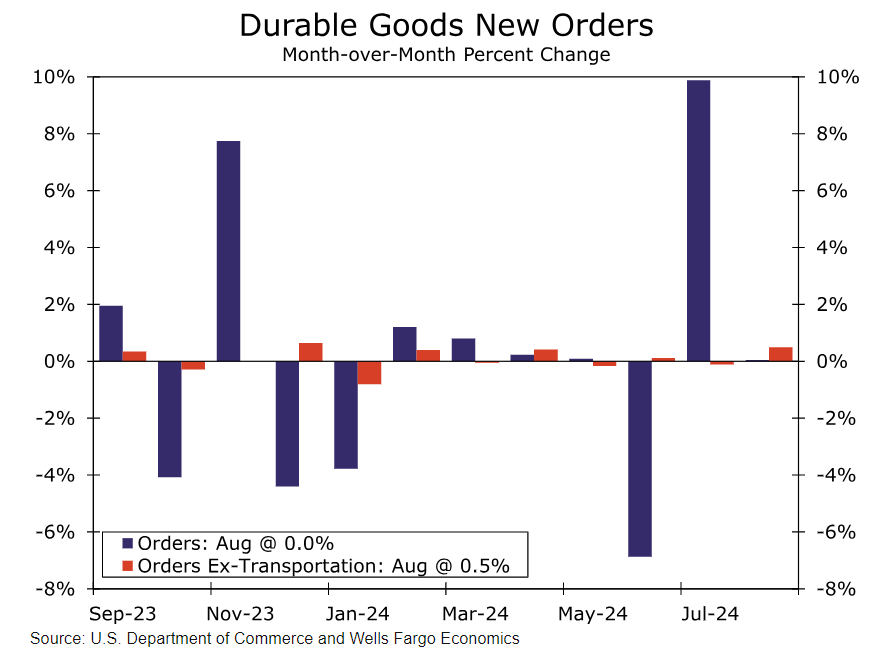

August with durable goods orders were technically positive, but essentially flat. Excluding transport categories, durables orders had their best month of the year.

Setting aside the volatile transportation categories, durable goods orders rose 0.5%, enough to call August the biggest monthly gain of the year in terms of ex-transportation orders. Looking at the chart, if you even out the July pop and May plunge, new orders have been about flat all year.

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.