Oil Slammed for nice CPI Print or just Adjust It Away?

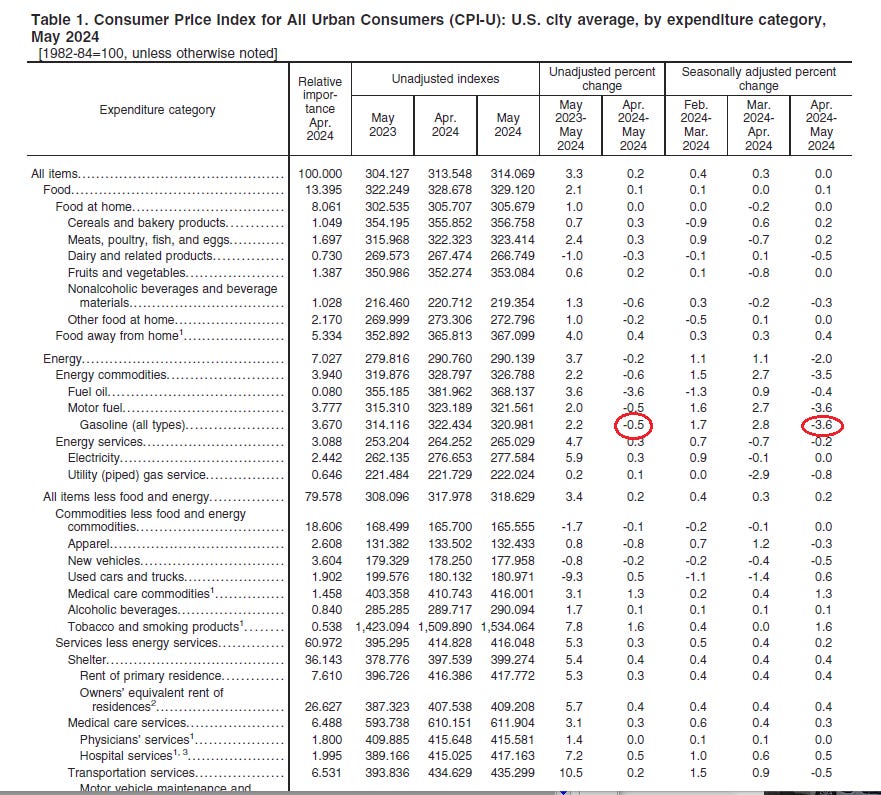

The US CPI number for May came in flat at 0% on a seasonally adjusted basis. Over the last 12 months, the all items index increased 3.3 percent before seasonal adjustment.

More than offsetting a decline in gasoline, the index for shelter rose in May, up 0.4 percent for the fourth consecutive month. The index for food increased 0.1 percent in May. The food away from home index rose 0.4 percent over the month, while the food at home index was unchanged. The energy index fell 2.0 percent over the month, led by a 3.6-percent decrease in the gasoline index. The index for all items less food and energy rose 0.2 percent in May

I commented that oil broke down technically on the chart in late May or was it just intervention to get a better CPI number or make a seasonal adjustment more credible? I have been swayed to the bearish side on oil with this break down, but because oil prices rebounded as quick as they fell, it looks suspicious, like a market intervention. I will be watching trading carefully for some kind of confirmation of a possible new bear trend in the short term. There is ample supply in the oil market at this time, but we still have war uncertainty and into the 2024 hurricane season.

I have been commenting that inflation will rise this summer because energy prices will be compared to low prices last summer. Even with the take down in late May, oil prices are still way above last May, yet the government reports that energy prices fell in the latest CPI report. Lets looks at gasoline that apparently had a huge drop.

On the chart of future prices we can see that gasoline prices averaged around the same this May from last May, about $2.50. And prices are down from April.

However, the government uses price indexes in various urban centres. And to make the numbers what they want, the government uses their magic called 'seasonally adjusted'. Lets look at the actual government data.

Note gasoline that I highlighted with red circles. It dropped -0.5% but with seasonal adjustment it dropped a way larger -3.6%. No other items in the CPI had much of a seasonal adjustment, just the motor fuels/gasoline. Without this adjustment the CPI number would have come in at 0.2% or 0.3%. Simply a BS adjustment by the masters of economic data.

The amount of market interventions and manipulation of government data has gone to whole new levels of BS. The last job numbers report was very badly manipulated too, so to show a strong jobs market and economy.

The government wants to paint a narrative of a strong economy with falling inflation and lower interest rates to come. After the election, I expect more of the real ugliness to show it's face.

Fed Chairman Powell even hints at manipulated job numbers. Note around the 1.40 minute mark in his answer to a Bloomberg reporter question “ there's an argument that they are a bit over stated”.

Why would he ever mention this? These job numbers being reported are becoming so bogus, that Powell had to say something to show he might still be somewhat credible.

I am back on Twitter or what is now X. You can follow me there, just go to this link https://x.com/Ron_playstocks

On X, Snowden said it nicely

You hear in the mainstream all the time that the Fed's objective is to maintain low inflation and full employment. This is just a smoke screen for what their real objective is. And that is to maintain, increase money flow and investment into US assets, stocks, bonds, treasuries, you know, buy US debt. That is why you always see the biggest reaction from the Fed when the stock market craters. And why they have to paint a narrative of being great managers of monetary policy to keep confidence in markets.

So far they have manged to gradually move the narrative from 'transitory' to 'higher for longer'. The last step is to move to 'higher forever', well until the stock market craters. Even so, higher interest rates will be required to attract $$ to maintain the massive government debts and spending. They used the Covid plandemic to go on a wild spending binge and simply can't get off of it. Like a drug addict!